Happy Monday!

Two of Europe’s most ambitious long-duration energy storage programs just picked winners — and one of the more conventional contenders swept the field. We’re diving into these different emerging LDES techs, their economics, and what this tells us about the future of energy.

In deals, $824m for utility-scale solar and energy storage, $814m for residential solar and heating, and $350m for battery recycling.

In other news, US’ new Russian oil sanctions, a new Australia-US partnership for critical minerals, and the hottest geothermal lease in the Western US yet.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

Lithium-ion: Still the current favorite

To charge up emerging long-duration energy storage (LDES), governments have been rolling out targeted policies — and this past month, two of the most ambitious programs to date wrapped their first rounds. But instead of backing next-gen tech, both the UK and Italy plugged right back into the dominant short-duration incumbent: lithium-ion.

Turns out, the best way to scale long-duration storage in 2025 … might be to use the tech we already have.

What happened

As grids transition to renewables and power demand climbs, long-duration energy storage — systems that can discharge for 8+ hours, well beyond the typical 1–4 hour window — is becoming essential to smooth out intermittent generation and avoid curtailment. In Europe, the push is especially urgent: countries are working to decarbonize faster, replace aging thermal fleets, and cut dependence on Russian gas without sacrificing grid reliability.

Italy and the UK are test cases for this. Earlier this month, Italian transmission system operator Terna announced the results of its first-ever energy stroage auction for 10GWh of capacity, open to battery systems with durations of 2, 4, 6, and 8 hours. The auction was 4x oversubscribed, but all winning bids came from li-ion projects, coming in cost-competitively at an average €12,959/MWh-year ($15,087) — well below the €37,000 ($43,079) cap. Most of the capacity went to larger players like Enel and Eni, with 15-year contracts starting in 2028.

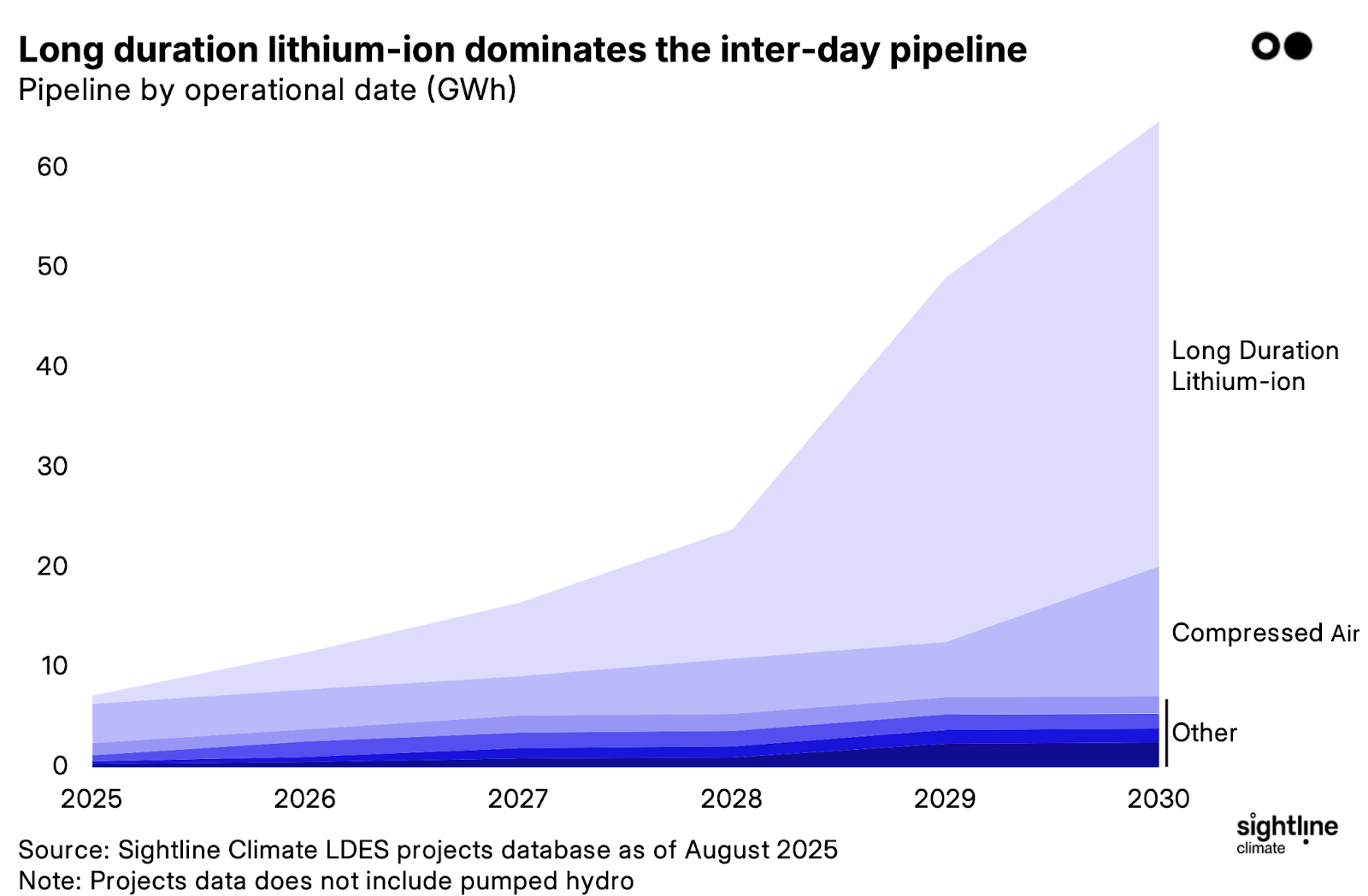

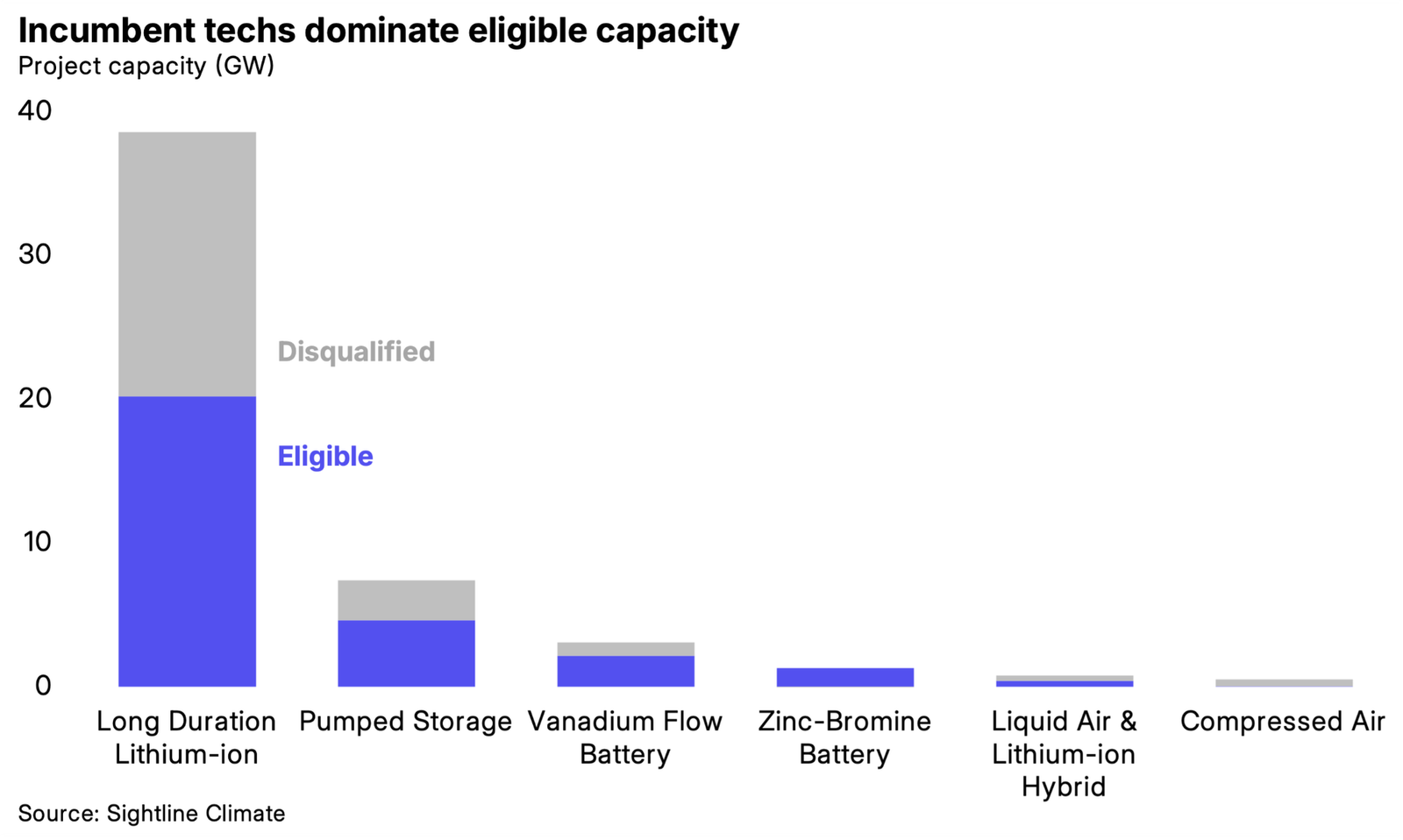

In the UK, Ofgem advanced 77 LDES projects (28.7GW) to the next phase of its new LDES cap-and-floor program, after disqualifying 94 proposals for failing to prove tech readiness or deliverability. The scheme targets 2.7–7.7GW of inter-day storage (projects that discharge for 8+ hours) by 2035, and 70% of this newly eligible capacity is lithium-ion, excluding pumped hydro. A few emerging technologies made the cut — including 3.8GW of vanadium flow and 1.3GW of zinc-bromine — but they remain the exception.

Despite being intended to unlock flexible, inter-day storage, both tenders awarded the bulk of capacity to lithium-ion — the only tech that cleared today’s cost and readiness bar.

Why it matters

These tenders were supposed to be breakout moments for emerging LDES techs. The assumption was that newer technologies like flow, compressed air, or iron-air would step in while lithium-ion would cap out around four hours. (Lithium-ion's high power density makes it the storage technology of choice for ≤4 hours, with decades of R&D and large-scale use in electric vehicles delivering lower costs than anything else.) But instead, Li-ion extended its lead, even at 8+-hour durations it hasn’t historically dominated.

That’s partly because most emerging techs still come with higher capex and opex than incumbent lithium-ion. [Sightline clients can access research briefings here to learn more about the benchmarks behind this analysis.] And Li-ion at any duration continues to benefit from economies of scale, from mature supply chains to established manufacturing pathways. Big players are now actively designing for longer durations: in just the past year, CATL and Quinbrook launched a DC block optimized for 8-hour storage, Hithium began mass-producing 4-hour cells, and LEAD unveiled dry electrode equipment for thick-electrode, long-duration formats.

Ironically, the policies meant to unlock innovation have ended up reinforcing Li-ion’s dominance. Italy offered 15-year fixed contracts, exactly the kind of revenue certainty newer techs need. But only lithium-ion could hit the bankability and pricing targets. In the UK, Ofgem’s eligibility screen knocked out most alternatives before they could even bid.

As we wrote last month in Energy-Storage.News, lithium-ion already accounts for 70% of the 64.7GWh of inter-day LDES projects that are targeting operations by 2030, more than triple the second most deployed tech, compressed air (20%).

Interested in learning more about Sightline’s LDES projects and benchmarking data Talk to our experts here.

Its footprint is expanding, too — beyond balancing renewables to powering data centers and AI infrastructure. Aligned Data Centers announced it is adding a 31MW/62MWh lithium-ion battery from Calibrant Energy to a data center, aiming to fast-track interconnection and skip years of grid delays. Redwood Materials is reusing EV cells to power modular data centers (and the company announced a fresh $350m raise this week). It’s a fast-growing, well-funded use case.

Still, the tech’s scale advantage means supply chain dependency, particularly on China, which dominates cell manufacturing and key materials processing. Even as Li-ion wins on cost and readiness, the geopolitical and resource risks remain.

Key takeaways

- Markets aren’t waiting for a breakthrough. Italy and the UK both built tech-neutral programs to scale long-duration storage, and got exactly what tech-neutrality rewards: low cost, proven delivery. Lithium-ion swept because it’s already bankable, manufacturable, and deployable at scale, from 2- to 8+-hour durations. Developers, lenders, and OEMs are moving forward with what works now, and that’s not necessarily a bad thing.

- Policy alone won’t diversify the tech stack. If governments want earlier-stage innovation beyond just lithium-ion, they’ll need to explicitly design for it, with tailored risk-sharing, lower readiness bars, or carve-outs for newer technologies. But there could be domestic security cases for it: avoiding Chinese supply chains. The UK’s selection criteria does include a “strategic” component designed to ensure tech and geographical diversity among the winning projects, which could give more expensive emerging techs a chance to be selected.

- Batteries as both grid infrastructure and AI infrastructure? The Aligned and Redwood announcements show a new kind of BESS customer emerging: hyperscalers and compute builders with money to spend and no time to wait. If these use cases scale, the storage market could expand to include capacity-as-a-service for high-growth industries.

Deals of the Week (10/20-10/27)

Late-Stage / Growth

🔋 Redwood Materials, a Carson City, NV-based lithium-ion battery recycler, raised $350m in Growth funding from Eclipse and NVentures.

🛵 Spiro, a Nairobi, Kenya-based electric micromobility vehicle fleet operator, raised $100m in Growth funding from African Export-Import Bank.

🌾 Carbon Robotics, a Seattle, WA-based AI and robotic precision weed control equipment maker, raised $20m in Series D funding from Giant Ventures.

🔋 Maxwell+Spark, a Rotterdam, Netherlands-based modular lithium-ion battery systems developer, raised $15m in Series B funding from Klima, Chevron Technology Ventures, Fairtree Elevant Ventures, and Idemitsu Australia.

🛰 WSENSE, a Rome, Italy-based underwater wireless communications developer, raised $12m in Series B funding from Axon Partners Group, CDP Venture Capital, FINCANTIERI, Indico Capital Partners, RunwayFBU, and other investors.

Early-Stage

💨 Arbor Energy, a Los Angeles, CA-based developer of compact power plants using biomass and natural gas, raised $55m in Series A funding from Lowercarbon Capital, Voyager Ventures, Cantos, Gigascale Capital, and Marathon Petroleum.

🥩 MATR Foods, a Copenhagen, Denmark-based fermentation-based alt meat maker, raised $23m in Series A funding from Export and Investment Fund of Denmark and Novo Holdings.

🌱 TRACT, an Amsterdam, Netherlands-based supply chain sustainability insights platform, raised $22m in Series A funding from ICOS Capital Management, Future Food Fund, Invest International, PYMWYMIC, Rabo Investments, and other investors.

🛰 SenseNet, a Vancouver, Canada-based AI and satellite wildfire detection platform, raised $15m in Series A funding from Stormbreaker, B Current Impact Investment, Fusion Fund, Thin Line Capital, Ventures Platform and other investors.

🍎 Mondra, a London, England-based food sustainability analytics platform, raised $13m in Series A funding from AlbionVC, Planet A Ventures, Green Circle Capital, PeakBridge, Ponderosa Ventures, and Swisscom.

🏠 etalytics, a Darmstadt, Germany-based AI-driven HVAC optimization platform, raised $10m in Series A funding from M12, Alstin Capital, BMH Hessen, and ebm-papst.

🌾 Farmworks, a Nairobi, Kenya-based smallholder-focused farm development platform, raised $5m in Seed funding from Marula Square.

🔋 Sizable Energy, a Milan, Italy-based long-duration offshore pumped hydro developer, raised $8m in Seed funding from Playground Global, Eden Ventures, Exa Ventures, Satgana, Unruly Capital, and other investors.

⚡ Milvus Advanced, an Oxford, England-based rare earths nanomaterials developer, raised $7m in Seed funding from Hoxton Ventures, Bluebird Climate, EQT Foundation, LQD VC, Lowercarbon Capital, and other investors.

🚢 Zparq, an Älta, Sweden-based ultracompact electric marine motors developer, raised $7m in Grant funding from Almi Invest GreenTech, EIT InnoEnergy, European Innovation Council, and Santander.

⚡ Dig Energy, a Cambridge, MA-based distributed geothermal energy developer, raised $5m in Seed funding from Avila VC, Azolla Ventures, Baukunst, Conifer Infrastructure Partners, Koa Labs, Mercator Partners, and other investors.

🧱 DMat, a Milan, Italy-based low-carbon concrete manufacturer, raised $5m in Seed funding from Primo Capital, Corbites, Deep Future, PeopleFund, and Safar Partners.

⚡ Pila Energy, a San Francisco, CA-based plug-in home battery company, raised $4m in Seed funding from R7 Partners, Acclimate Ventures, Alumni Ventures, GS Futures, Refactor Capital, Toyota Ventures and other investors.

💨 Hydryx, an Amsterdam, Netherlands-based landfill gas-to-energy developer, raised $3m in Seed funding from Graduate Entrepreneur.

🛰 MarineLabs, a Victoria, Canada-based real-time coastal intelligence developer, raised $3m in Seed funding from BDC Capital and InBC Investment Corp.

💧 HULO, a Leeuwarden, Netherlands-based AI-driven water leak detection software, raised $3m in Seed funding from LUMO Labs, VP Capital, FOM, NEW-TTT fund, Rabobank, and other investors.

⚡ Rightcharge, a London, England-based EV charging platform, raised $3m in Seed funding from Soulmates Ventures, BlackWood Ventures, Purple Ventures, and Unruly Capital.

Other

⚡ Recurrent Energy, an Austin, TX-based solar and energy storage developer, raised $824m in PF Debt funding and PF Tax Equity funding from CoBank, Nord/LB, Mitsubishi UFJ Financial Group, Siemens Financial Services, and Wells Fargo.

⚡ Enpal, a Berlin, Germany-based integrated solar and smart heating provider, raised $814m of PF Debt funding from Bank of America, Barclays, Citi, Crédit Agricole CIB, and M&G Investments.

🔋 Energy Vault, a Westlake Village, CA-based grid-scale energy storage solutions developer, raised $300m in PF Equity funding from Orion Infrastructure Capital.

⚡ Meva Energy, a Backa, Sweden-based waste biomass to renewable gas producer, raised $46m in Debt funding from European Investment Bank.

♻️ Generate Upcycle, a New York City, NY-based organics recycling facility operator, raised $43m in PF Debt funding from Fiera Private Debt and Generate Capital.

⚡ Pure Hydrogen, a North Sydney, Australia-based hydrogen and fuel cell developer, raised $2m in Post-IPO Debt funding from GAM Investments.

New Funds

💰 Mirova, a Paris, France-based sustainable investment manager, raised $1.4b for its Mirova Energy Transition 6 fund from returning investors, focusing on renewable energy, storage, e-mobility, and energy efficiency infrastructure across OECD countries.

This is a sample of deals available for Sightline Climate clients. Can’t get enough deals?

In the News

US sanctions Russian oil majors to pressure Putin into ending the war in Ukraine, sending global oil prices up 5%. The sanctions were imposed on Rosneft and Lukoil, two of Russia’s top oil producers which control over 5% of global output, and disrupted major buyers in China and India. The move signals tightening US pressure on Russia’s fossil fuel revenues as the EU’s latest sanctions banning Russian LNG imports have already dropped 90% since 2022.

Australia and the US signed a $2bn joint critical minerals agreement to counter China’s control over global supply chains and strengthen Western access to rare earths and battery metals. Each government will invest $1bn in mining and processing projects targeting critical mineral deposits worth $53bn. The US Export-Import Bank later announced $2.2bn in additional financing for seven Australian rare earth metal companies.

Geothermal leasing in Nevada hit a new high, with a BLM auction netting $9.44 million in bids across 86 federal land parcels. The record-setting sale, driven by companies like Invenergy, Ormat, and Cordillera, reflects rising investor interest amid repeated successful auctions in the Western US as geothermal gains momentum as a baseload clean energy source, bolstered by policy and market tailwinds.

Though the overall response remains limited, more governments and companies are starting to act on UN alerts about methane leaks. The UN’s International Methane Emissions Observatory reported that responses to its pollution warnings rose from just 1% last year to 12%. Since 2022, the agency has issued over 3,500 alerts to 33 countries, reflecting growing global attention to methane’s role in climate change.

Thailand will begin mandating Sustainable Aviation Fuel use, starting at 1% in 2026 and rising to 8% by 2036, while restructuring road fuels around Gasohols and Biodiesels. The plan includes phasing out certain Gasohols by 2027 and repurposing surplus ethanol for SAF production, and highlights a broader shift to biofuels even in non-EU countries.

Pop-up

The people long for nuclear, but are wary of data centers.

South Korea scraps its clean hydrogen tender, but not for the reasons you think.

If the AI bubble bursts, can SMRs stay afloat?

Constellation Energy has the energy AI needs, at least according to its CEO.

From Bitcoin mining to data centers, Crusoe’s newest venture is space.

A Japanese Karaoke chain is singing praises to solar.

Rhine river flows turn into electricity with Energyfishes.

ASEAN's nuclear commitments might be a $84bn green light for investment.

Load growth may only be “unprecedented” over the last thirty years.

Opportunities & Events

📅 VERGE at Trellis Impact 25: Join us at the premier event for professionals decarbonizing their organizations and supply chains on Oct. 28–30 in San Jose, CA. Make sure to use our partner code TI25SL for 10% off.

📅 Monthly Energy/Enviroment Founder Meetup: Meet other founders and environmental enthusiasts on Thursday, Oct. 30 in San Francisco, CA to talk shop, share ideas and support each other in building solutions in the energy and built environment space.

📅 2025 Wharton Energy & Climate Conference: Join us on November 7 in Philadelphia, to build on the theme, "Fortifying the Future: Advancing Resilience for the Energy Transition," through panels, keynotes, an innovation showcase, and networking with professionals, academics, and students.

Jobs

Senior DevOps Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Software Engineer @Sightline Climate

CEO, Battery Manufacturing @Marble

CTO, Protein Engineering @Marble

Director of Strategic Initiatives @EFI Foundation

Senior Project Manager @Adaptive Water

Investor @Giant Ventures

Finance Business Partner @Siemens Energy Ventures

Project Manager @Siemens Energy Ventures

Commercial Operations Specialist @Hitachi Ventures

Consolidation Analyst @AtkinsRealis

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!