Xpansiv has launched a new data series for North America’s Renewable Energy Certificate (REC) markets. This product merges data from Xpansiv’s CBL spot exchange, Xpansiv Connect™ portfolio system, and OTC prices from Evolution Markets.

This combination offers a clearer view of the market. Users can track individual RECs in both spot and forward markets. They can access key details like RPS status, state, price type, vintage, and registry. This helps users better understand REC trends and market movements.

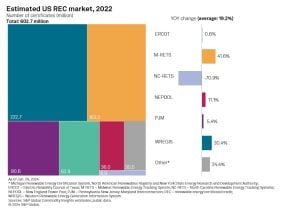

Source: Xpansiv

Source: Xpansiv

Why Renewable Energy Certificates (RECs) Matter in Clean Energy

Renewable Energy Certificates (RECs) track clean energy from sources like wind and solar. Since renewable electricity mixes with other sources on the grid, RECs help verify and claim renewable energy usage. Many businesses use International Renewable Energy Certificates (I-RECs) to meet their sustainability goals and offset carbon emissions.

Technically, “An I-REC is a tradable certificate representing the environmental attributes of one megawatt-hour (MWh) of renewable energy generation. They are recognized by the GHG Protocol, CDP, and RE100 for reporting Scope 2 emission.”

Xpansiv: Enhancing Market Insights with Reliable Data

Nathan Rockliff, Xpansiv’s Chief Strategy Officer, highlighted the importance of this launch. He noted,

“Xpansiv’s new consolidated REC data product harnesses our comprehensive market infrastructure to provide an unmatched, detailed view of the REC markets. This offering is the first of our enterprise-wide initiatives to enhance the utility, integrity, and coverage of environmental commodity data, accelerating the global energy transition and driving real impact.”

The platform offers daily insights into more than 120 REC types across seven ISOs. It includes executed trade data, firm orders from CBL, and indicative prices from Evolution Markets. Historical data dating back to 2019 adds depth and accuracy. With Xpansiv Connect, users can track both spot and forward REC instruments in real-time, improving market visibility.

CBL Overview

Record-Breaking REC Trading Volumes

This launch comes at a time of peak REC trading activity. In 2024, more than three million RECs were exchanged on CBL—an 18% jump from the previous year. January alone saw transactions exceed $27 million, setting a new record.

Xpansiv’s REC data is now available through its API, web platform, and third-party data partners, making it easier than ever for market participants to access critical insights.

EXCLUSIVE:

The CarbonCredits team connected with Xpansiv to explore their REC data product in greater detail. An Xpansiv spokesperson provided valuable insights worth noting.

CC: What makes Xpansiv’s consolidated REC data product a game-changer for market participants?

Xpansiv: We designed the new consolidated data product to bring a new level of robustness and utility to REC data by combining spot and forward market data, with unique instrument identifier reference data. Integrated unique identifiers enable multi-sourced trade, order, and indicative spot and forward prices to be mapped to a single instrument.

With that improvement, RECs can be modeled precisely by spot/forward price, vintage, RPS, registry, and other attributes, which is difficult to do with legacy data formats.

CC: How is Xpansiv leveraging Evolution Markets’ spot and forward prices to enhance REC market insights?

Xpansiv: Spot and forward prices are essential inputs into a REC data series. Sourcing that data from recognized market leader- Evolution Markets ensures that the prices are the product of a rigorous assessment process over a broad range of RECs. Further ensures continuity for the new product’s five-year historical data series.

The new product includes Evolution Markets data as well as firm order and trade prices from the CBL spot exchange.

In 2024, CBL’s REC market traded a total of 3.15 million MWh, an 18% increase. The notional value traded was $158 million, a 41% jump.

Lastly, but importantly, the new data series is built using unique instrument identifiers from the Xpansiv Connect portfolio management system. Xpansiv Connect is integrated with 14 REC and carbon registries and has issued more than a billion instrument identifiers since launch.

The careful consolidation of those three diversified market and reference data sources is what makes the new data product so powerful and useful.

CC: Why are CBL REC trading volumes surging, and what does it mean for the future of renewable energy markets?

Xpansiv: CBL REC volumes are growing because the exchange and its post-trade Xpansiv Connect portfolio management system provide real credit, liquidity, and operational benefits to market participants.

Xpansiv’s CBL spot exchange provides direct access live, firm bids and offers, instant execution, and automated, T+0 settlement, through direct integrations with leading REC registries.

OTC market participants settle trades via the exchange for two primary reasons.

The first is trades can be settled between CBL participants without bilateral trading or credit counterparty agreements.

The second is, as with exchange-matched trades, CBL’s post-trade infrastructure provides automated settlement for OTC trades, speeding settlement cycles and reducing errors and failures.

CC: If the US REC market hits $40 billion by 2033, how will Xpansiv’s data innovation fit into this growth?

Xpansiv: The US REC markets, and, in fact, REC markets globally, are projected to grow sharply from both traditional sectors as well as significant demand to support the proliferation of new data centers being driven by the artificial intelligence boom.

High-integrity markets and reference data are integral parts of successful commodity and financial markets. Our institutional-grade infrastructure is built to enable environmental commodity markets to scale, which we think is essential to attain a timely energy transition.

The new consolidated REC data product is the first of our enterprise-wide initiatives to enhance the utility, integrity, and coverage of environmental commodity data, accelerating the global energy transition and driving real impact.

That goes for established REC and carbon markets, as well as nascent markets in sustainable aviation fuel, or SAF, energy, and recycled plastics, to name a few that we’re working on.

Xpansiv’s Role in the Energy Transition

Xpansiv operates a leading market infrastructure for environmental commodities, including carbon credits and RECs. It also manages registry systems for energy and environmental markets and oversees North America’s largest independent solar renewable energy credit trading platform.

Xpansiv provides advisory and transaction support in carbon, renewable energy, and energy transition markets through its Carbon Financial Services and Evolution Markets divisions. Xpansiv Connect™, its multi-asset environmental portfolio management system, further enhances data transparency, supporting the industry’s push for accountability in sustainability efforts.

Strong Investor Support

Xpansiv’s investor base includes Blackstone Group, Bank of America, Goldman Sachs, Aramco Ventures, Macquarie Group Ltd., S&P Global Ventures, Aware Super, BP Ventures, Commonwealth Bank, and the Australian Clean Energy Finance Corporation.

U.S. Renewable Energy Certificate Market Set to Hit $50 Billion by 2033

The U.S. Renewable Energy Certificate (REC) market is on track for major growth. According to S&P Global, REC generation is expected to rise from over 950 million MWh in 2024 to nearly 2.7 billion MWh by 2033.

Wind and solar will lead the way, with their combined share increasing from 81.7% to 92.5% over this period. The sharp rise in renewable energy output is the key driver behind market growth.

The U.S. REC market is projected to approach $40 billion by 2033 in the base case. However, in an optimistic scenario, it could reach nearly $50 billion—$10 billion higher than the base estimate.

- FURTHER READING: Xpansiv Joins Forces with S&P Global and CME to Supercharge Australia’s Carbon Credit Market

The post Xpansiv Boosts Transparency in North America’s Renewable Energy Certificate Market. EXCLUSIVE Interview Inside appeared first on Carbon Credits.