Copper prices have risen due to market uncertainty, trade policies, and supply changes. Recently, copper jumped by more than 5% after U.S. President Donald Trump hinted at a 25% tariff on copper imports. This caused a rush in the market as traders tried to adjust prices and secure copper before tariffs took effect.

U.S. Tariffs Shake the Market: The Great Copper Rush

Trump’s comments on tariffs have caused a stir in the copper market. In a speech to Congress, he suggested that a 25% tariff on imported copper might already be in place. This shocked traders, as the market expected lower tariffs or a longer timeline.

Following this news, Comex copper prices soared, reaching nearly 12% higher than London Metal Exchange (LME) prices. This price gap led to a global scramble for copper that could be shipped to the U.S. before tariffs are enforced. U.S. manufacturers have also been stocking up to avoid paying extra costs in the future.

Copper Inventories and Supply Constraints

Apart from tariffs, copper inventories have played a major role in price movements. Recently, copper stockpiles in China and overseas markets have dropped.

In China, inventories fell by 9,000 metric tons in early March. In the U.S., both Comex and LME copper inventories declined, showing strong demand for the metal.

Copper ore supply has also tightened. A major copper producer, Indonesia, recently changed its mining regulations, impacting exports. This has added to concerns about future copper availability. Additionally, mining companies are struggling with declining ore grades, leading to lower copper output.

To address these shortages, companies are investing in new mining projects. For example, mining giant BHP is expanding operations in Botswana, Africa, in an effort to meet rising demand. However, opening new mines takes years, meaning supply issues are unlikely to be resolved quickly.

- RELATED: Trump’s Tariffs and Climate Rollbacks: How 2025 is Shaking Copper Markets and Clean Energy Goals

Why Copper Prices Matter and What Affects Them

Copper is a key material in construction, electronics, and renewable energy. The rising demand for electric vehicles (EVs) and green energy projects has made copper even more valuable. Experts predict that in 2025, global demand for copper will grow by about 2.9%.

Higher copper prices can make products more expensive. For example, the cost of electrical wiring, batteries, and even home construction may rise if copper stays expensive. Many industries rely on stable copper prices to keep production costs low.

The U.S. dollar also influences copper prices. Recently, the dollar index dropped to 103.6, making copper more expensive for international buyers. This, combined with uncertainty about U.S. economic growth, has contributed to market volatility.

China, the world’s largest copper consumer, is also playing a role. A positive economic outlook in China has supported copper demand. Lower inventories and increased construction projects have further pushed up prices.

Additionally, China’s government is investing heavily in infrastructure and clean energy, further increasing the need for copper.

The Role of Green Energy in Copper Demand

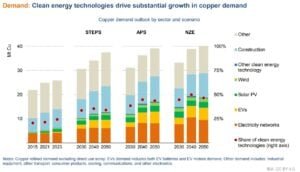

One of the biggest drivers of copper demand is the green energy sector. Copper is used in solar panels, wind turbines, and electric vehicle batteries. As countries push for more renewable energy, demand for copper is expected to keep growing.

For example, the International Energy Agency (IEA) predicts that demand for copper from renewable energy projects will double by 2030. This will put even more pressure on copper supplies, potentially leading to further price increases.

According to IEA data, global refined copper demand could grow from 26 million tonnes in 2023 to around 40 million tonnes by 2050 in the Net Zero Emissions (NZE) scenario.

- In 2023, renewables and EVs accounted for about 25% of global refined copper demand. By 2030, this share could rise to about 45% in an accelerated NZE scenario. EV-related copper demand could increase more than twelvefold, from 2% of global demand in 2023 to 12-13% by 2050.

However, the IEA warns of a significant supply gap after 2025. Mining output may struggle to keep up with demand.

By 2030, there could be a 4.5 million-tonne deficit in primary copper supply under the NZE scenario. This highlights the need for increased investment in mining and recycling.

Future Outlook: Will Copper Prices Keep Rising?

Experts are divided on what comes next. J.P. Morgan predicts that the global copper supply deficit will grow, pushing prices even higher. The bank expects copper to reach an average price of $11,000 per metric ton by 2026.

The bank also expects China’s copper demand growth to slow from 4% last year to 2.5% this year, posing a key risk to market tightening.

The International Copper Study Group (ICSG) reported a 22,000 metric ton deficit in December, down from 124,000 metric tons in November. Citi has anticipated a 25% tariff on copper imports by late 2025 under Trump’s executive order.

Meanwhile, ANZ suggests that if the U.S. fully implements its 25% tariff, copper prices will climb further as trade flows shift.

Some analysts believe copper prices could rise by more than 75% in the next 2 years. However, if the U.S. economy slows down, copper demand could weaken. Investors are watching key economic indicators, such as job reports and inflation data, to understand where the market is headed.

Last year, copper faced a supply shortage, and demand is expected to rise even more with the growth of EVs, where copper plays a crucial role.

BHP forecasts a 70% increase in global copper demand, surpassing 50 million tonnes per year by 2050. The copper market could expand at an average annual rate of 2%, driven by the shift to clean energy and advanced technology.

A mix of political, economic, and supply factors is driving copper prices. The potential for a 25% U.S. tariff has already shaken the market, while declining inventories and strong demand continue to support higher prices.

As global trade shifts and supply chains adjust, copper remains a key material to watch in the coming months.

The post Copper Crunch! How Trump’s Tariffs and Supply Shocks Drive Prices Up appeared first on Carbon Credits.