Finland recalls a typical Nordic scenario. Picture a robust ecosystem of government-backed initiatives that foster startup creation and provide crucial funding to complement and support private VC investments. Public institutions offer accessible grants, and large corporations are actively investing in national innovation, directly or via foundations. One example is the $10.6m government grant recently bagged by Solar Foods.

Such an approach has been a common strategy in the Netherlands and Denmark, which have become recognized European hubs of tech innovation.

Can Finland join this “Nordic innovators” club? It has certainly done well recently. The year 2024 and the beginning of 2025 have seen an impressive amount of funding channeled to its agrifoodtech sector, with a strong focus on food production and food innovation.

Situated at the northern periphery of Europe, with a population of less than 6 million people, in 2024 Finland raised $390 million in agrifoodtech venture capital across 19 deals, according to AgFunder data. This figure placed Finland in 8th place in the global ranking for the year, ahead of Japan, Canada, Brazil, Spain, and Israel.

Finland’s territory is large, yet according to a 2022 World Bank estimate, around 10% of it is occupied by lakes and water while 73.7% is covered by forests, and large parts of the country remain blanketed with snow for most of the year. This results in only around 7.5% of the Finnish land mass, less than 23,000 square kilometers, being allocated to agriculture. Despite this, the country has shown a remarkable interest in agrifood startups.

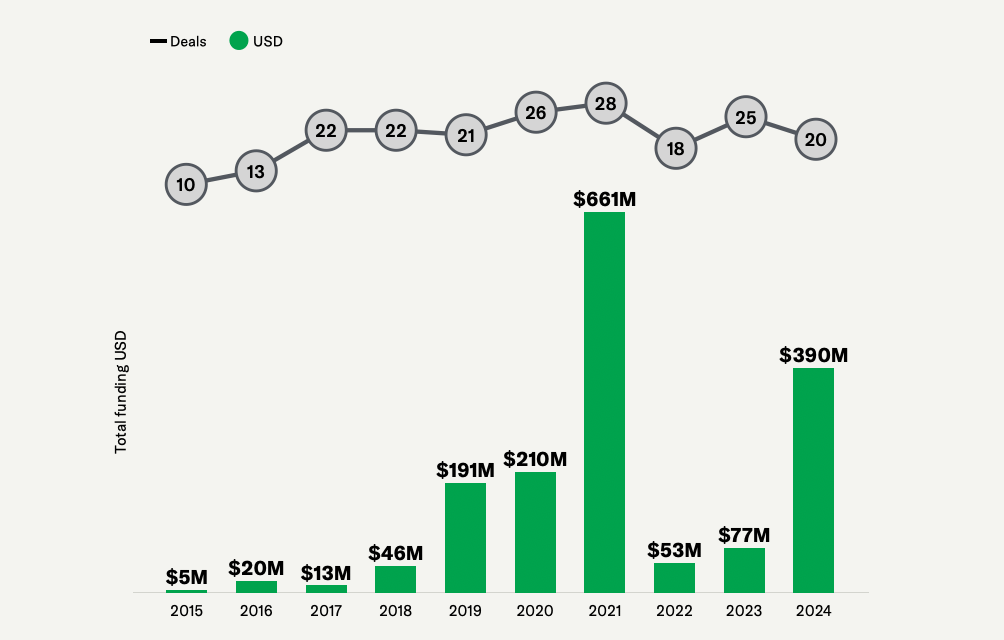

10 years of investment in Finnish agrifoodtech

A look at agrifoodtech VC funding over the last 10 years makes it clear that 2024 was an exceptional year, although a megadeal for aquaculture startup Finnforel accounted for a sizable chunk ($259.8 million) of the $390 million raised.

Yet we can observe a clear growth trend. Investments were increasing during the pre-covid period, peaked in 2021 with $661 million across 28 deals, dropped in 2022 when a credit crunch hit the industry, resumed growth in 2023, and overtook pre-covid levels in 2024.

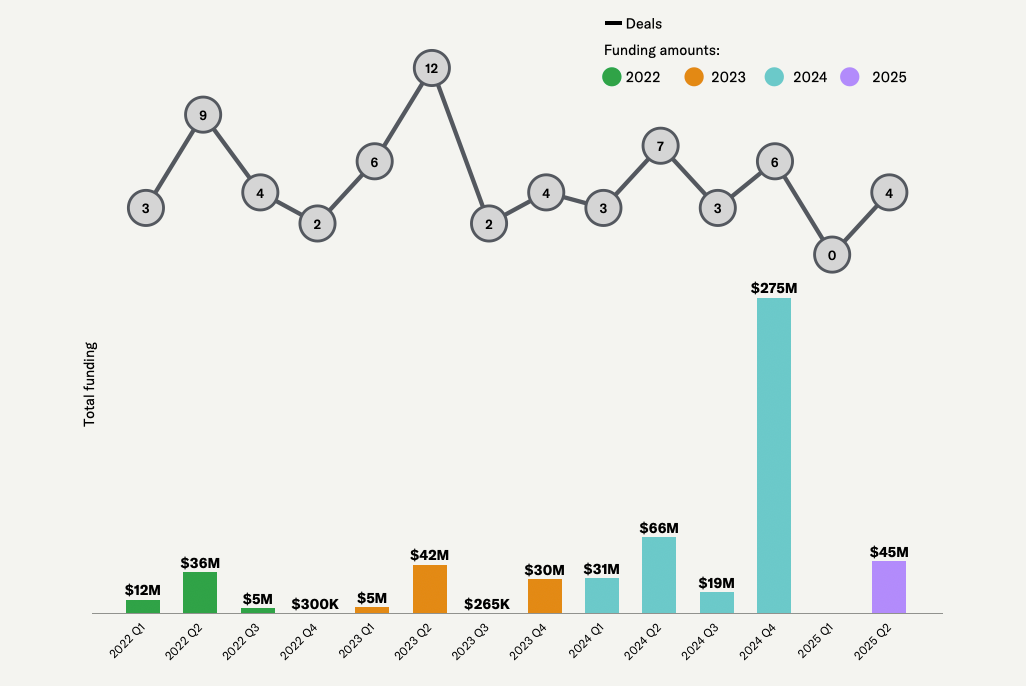

Investment by quarter

Looking at the most recent data, while there were no deals in agrifoodtech in the first quarter of 2025, startups in the space have already attracted $45 million in Q2.

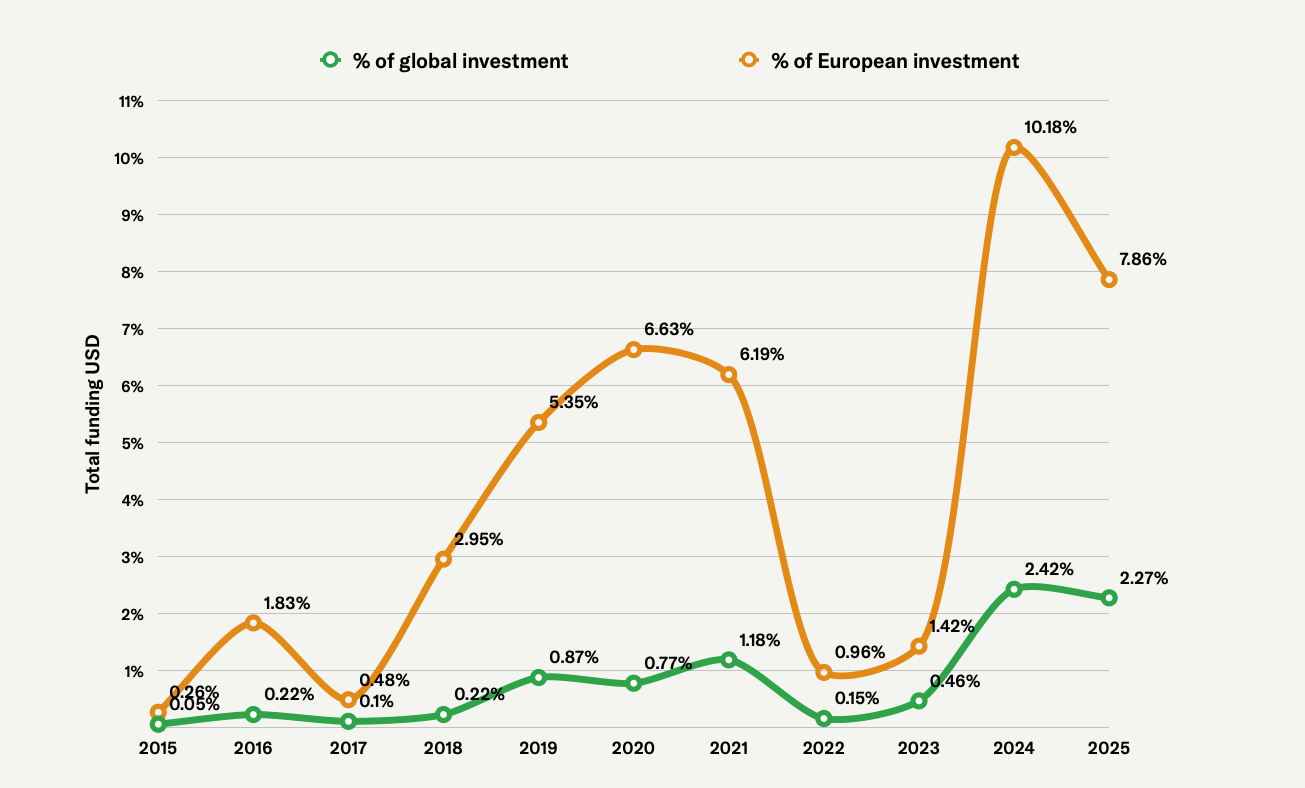

Finland’s share of global investment and share of European investment

Finland’s role inside the global and European agrifoodtech scenario seems to be on the rise.

Its share of European investment has been steadily growing from 2017 to 2020, when it reached 6.63%. While its share briefly dropped during the post covid credit crunch, it jumped to over 10% in 2024, thanks mainly to Finnforel’s round, and presently sits at 7.86%, well above pre-covid levels.

On a global scale, Finland has steadily gained share since 2018, with a temporary drop in 2022 and 2023. However, it has risen again to achieve a 2.42% share of global agrifoodtech funding in 2024 and is hovering at 2.27% in 2025.

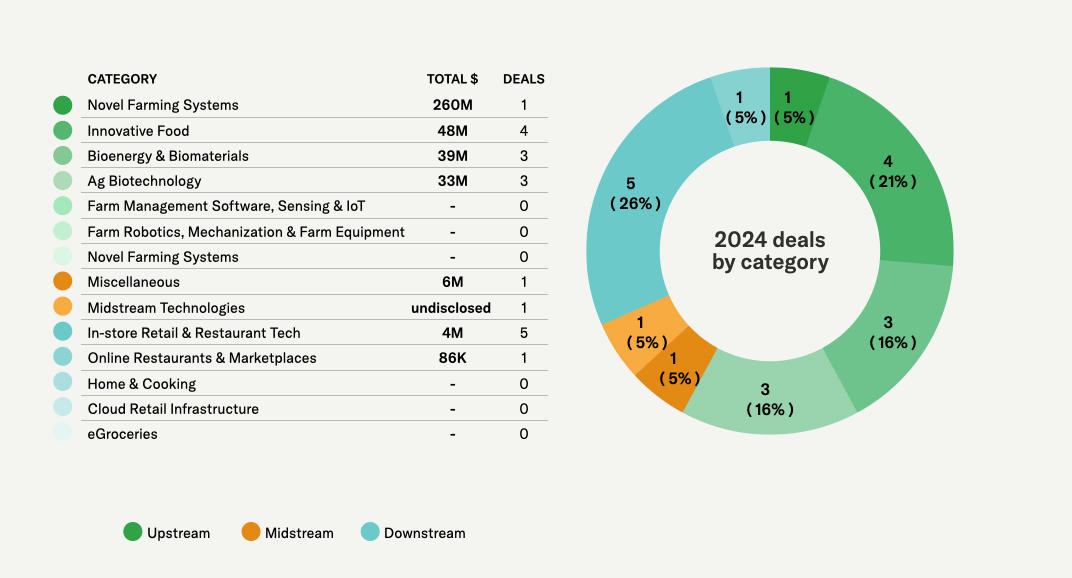

Breakdown by category

2024 agrifoodtech funding in Finland by category 2024

While AgFunder’s downstream category Online Restaurants & Marketplaces captured almost 50% of all funding in Finland across the last 10 years, 2024 has been a year dominated by categories in the upstream supply chain.

The largest category – Novel Farming Systems – attracted $260 million, or 66.6% of all funding in the country for the year. However, this all came from a single deal: Finnforel’s mega-round. Second came Innovative Food, attracting $48 million across four deals, accounting for 12.4% of all funding.

Bioenergy & Biomaterials achieved a 10.1% share thanks to three deals worth $39 million, while Ag Biotechnology accounted for 8.4%, bringing in $33 million across three deals.

The category with the highest deal count for 2024 was downstream: In-store Retail & Restaurant Tech, with five deals, despite accounting for just 1.1% of all agrifoodtech funding raised in the country in the year.

Finland is focusing most of its agrifoodtech investment on food and feed production, in its different aspects, from innovative foods and alternative proteins (Onego Bio, Solar Foods, Enifer, Volare), to novel farming (Finnforel), food delivery (Wolt), food recycling (Ductor), and food manufacturing (Foodiq).

Biomaterials manufacturing is another sector that seems to be gaining interest, with companies such as Infinited Fiber Company and Fiberdom.

Stage analysis

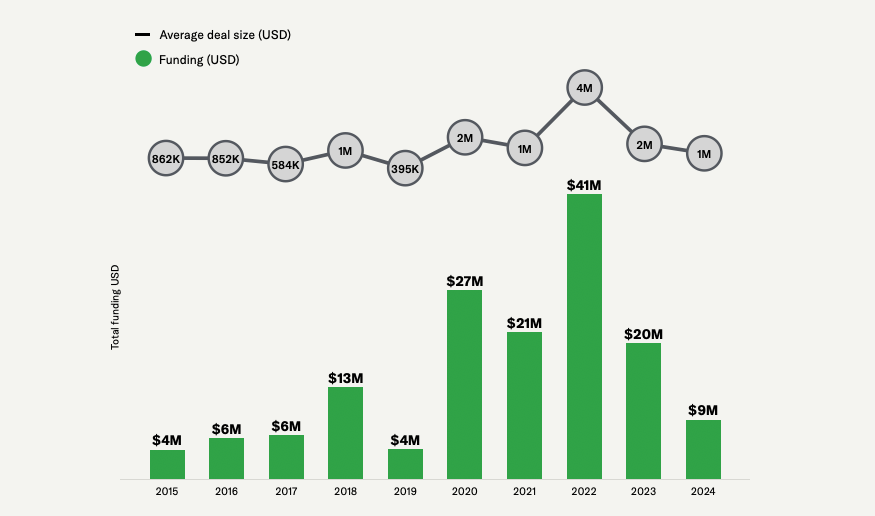

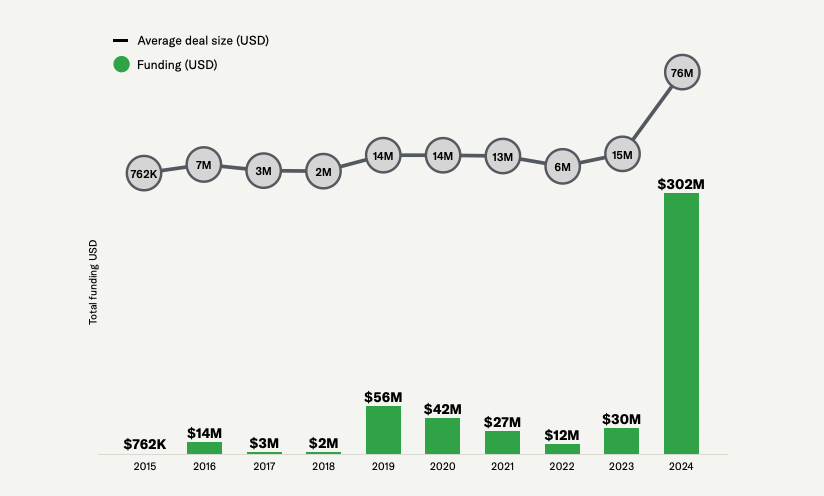

Seed stage agrifoodtech funding in Finland, 2015-2024

Seed funding in Finland has been declining during the last three years, both in terms of total funding and average deal size.

Most of the growth has been coming from Series A and B rounds. Debt financing has grown too, while C, D and late stages rounds have been sparse.

A stage agrifoodtech funding in Finland 2015-2024

Top 5 funded startups 2024/2025

Finnforel, currently operating two recirculating aquaculture system (RAS) facilities in Finland with a total production volume of 3,000 tons of rainbow trout per year, raised $259.8 million via a Series A round in October 2024. That is the second largest amount ever raised by a Finnish agrifoodtech startup, behind the $530 million late round raised by Wolt in 2021.

Onego Bio, a foodtech startup producing animal-free egg-white protein through precision fermentation, raised $45.3 million in two rounds in 2024: a $30 million A round in February, followed by a $15.3 million B round in July.

Volare, an insect ag startup, raised $35.8 million, via a $29 million debt round closed last week (May 27, 2025), and a $6.8 million A round raised in October 2024. The company upcycles industrial food waste into sustainable protein, oil and fertilizer ingredients.

Infinited Fiber Company is a biomaterials startup recycling cellulose-rich raw materials such as cotton-rich textile waste, used cardboard, or wheat or rice straw into high-quality textile fibers with the look and feel of cotton. It raised a $29.5 million B round in March 2024.

Enifer, a biomass fermentation company using upcycled agrifood industry byproducts to fuel mycoprotein production, raised $25.9 million in May 2024 composed of a $16.2 million B round and $9.7 million in debt financing.

Further reading:

Nordic Foodtech VC announces first close of second fund at $45m: ‘We’re not hunting for unicorns’

Enifer partners with ethanol giant FS for mycoprotein production in Brazil

🎥 Onego Bio eyes Wisconsin site for chicken-free egg production, files GRAS notice

The post Data Dive: Can Finland sustain 2024 funding levels and become a true food innovation hub? appeared first on AgFunderNews.