Disseminated on behalf of West Red Lake Gold Mines Ltd.

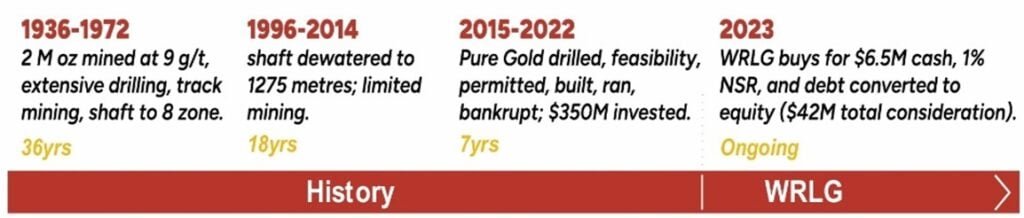

In early 2023, when gold hovered around US$1,970 per ounce and market momentum was weak, most investors played it safe. But West Red Lake Gold Mines Inc. (WRLG) didn’t. Instead, they took a bold, contrarian bet by acquiring the Madsen Mine—a once-prominent gold producer in Ontario’s Red Lake district—for C$6.5 million in cash, 40.73 million WRLG shares, a 1% Net Smelter Return (NSR) royalty, and deferred consideration payments of US$6.8 million.

Contrarian Call Pays Off: Reviving Madsen Mine

The mine had collapsed under its previous owner, Pure Gold Mining, due to a flawed resource model and undercapitalized execution. Despite over C$350 million invested by Pure Gold over seven years, the mine produced disappointing results and eventually went bankrupt. Most investors ran from the wreckage.

However, WRLG could foresee the potential of this mine. Madsen had produced over 2 million ounces of gold historically. It sat on high-grade mineralization in one of the world’s richest gold belts. The mine was fully permitted, had most of the required infrastructure in place, and needed the right team to fix past mistakes.

Expertise at Work: Fixing What Others Couldn’t

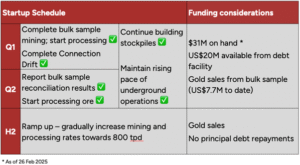

From mid-2023 to mid-2025, WRLG has done the grind to turn things around. They raised $140 million in tough markets. It was no easy feat, but gold-experienced investors understood the value of WRLG’s deep technical know-how. That know-how showed through in a clear plan for Madsen: rebuild trust, improve the resource model, add some key pieces of missing infrastructure, and prepare Madsen for a clean restart.

Key steps included:

- An intensive program of definition drilling to tighten spacing from ~20 meters to ~7 meters, to inform an accurate and high-resolution model of the gold deposit.

- Building a mine plan to optimize efficient mine design and mining optionality, two requirements for successful mining

- Completing critical infrastructure to support efficient operations, like the 1,448-meter Connection Drift—a major underground haulage route that was completed on time in March 2025 – and the 114-person on-site camp.

- Validating the entire approach via a bulk sample test, pulling 15,000 tonnes from six stopes in three parts of the resource to show that actual tonnes, grade, and contained gold on mining aligns very closely with WRLG’s modelled predictions.

WRLG has a strong backup from top mining investment firms like Sprott Lending, Van Eck Funds, and Accilent Capital and renowned mining legend Frank Giustra. Together, they’ve backed the company’s aggressive but carefully executed transformation.

Shane Williams, President and CEO of WRLG said,

“West Red Lake Gold has worked intensely over the last 16 months to greatly improve our knowledge of the orebody and de-risk the project with the objective of executing a successful restart of the Madsen Mine, and this PFS is the culmination of that effort. This initial reserve mine plan only taps well defined and tightly drilled parts of the deposit relatively close to existing workings and still generates robust margins based on a production rate of approximately 70,000 oz. per year that generate almost $400 million in post-tax free cash flow over a 7-year mine life.”

Execution Meets Opportunity: All Set for Production in 2025

Because of all this diligent planning and relentless effort, WRLG restarted the mine on time in late May and will ramp up gold production at the Madsen Mine through the second half of 2025. Achieving a purchase-to-production turnaround in just two years is rare in the mining world. This short timeline speaks volumes about WRLG’s pace and precision.

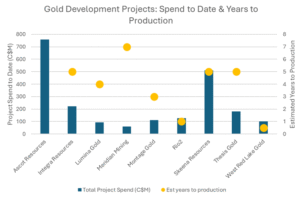

In January 2025, the company released a pre-feasibility mine plan showing strong free cash flow potential. And that’s before even factoring in upside from ongoing exploration. Since acquiring the mine, WRLG has invested CAD$140 million. Add to that the CAD$350 million spent by the previous owner and compare it to WRLG’s current valuation and position on the edge of gold production, and you get an undervalued project with significant built-in advantages.

Most importantly, WRLG is gearing up for production just as the gold market is exploding. Gold prices have hit all-time highs, recently trading above CAD$4,150 per ounce. The second quarter of 2025 set a record for average gold prices, and investors are now moving into gold equities, pushing valuations higher across the board.

WRLG is standing out for the right reasons. It’s a near-term producer sitting on a permitted, high-grade deposit in one of the world’s most proven gold districts. The infrastructure is in place, the plan is clear, and the timeline is short.

Smart, Bold, and Ready to Shine

West Red Lake Gold didn’t just pick up a bargain. They saw a failed operation and knew exactly what needed fixing. With vision, technical know-how, and rigorous follow-through, the company has turned a broken asset into a rare opportunity.

They moved in when others backed off and demonstrated with a successful bulk sample that their strategy works. Now, they’re ready to produce gold just as the market is red hot. This perfect mix of timing, talent, and hard work makes WRLG one of the most exciting gold stories unfolding today.

It’s best defined in their words,

“We are visionaries who acted on a coming market, pushed hard to unlock the value in a hated asset, and are now poised to be a rare and desirable new gold mine as gold trades through all-time highs and keeps climbing”.

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice. West Red Lake Gold Mines Ltd. made a one-time payment of $30,000 to provide marketing services for a term of 1 month. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options in the companies mentioned. This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. This does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to the plans and timing for the potential production of mining operations at the Madsen Mine, the potential (including the amount of tonnes and grades of material from the bulk sample program) of the Madsen Mine; the benefits of test mining; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended December 31, 2024, and the Company’s annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Please read our Full RISKS and DISCLOSURE here.

The post Buying Low, Building Smart: WRLG’s High-Stakes Gold Play Pays Off appeared first on Carbon Credits.