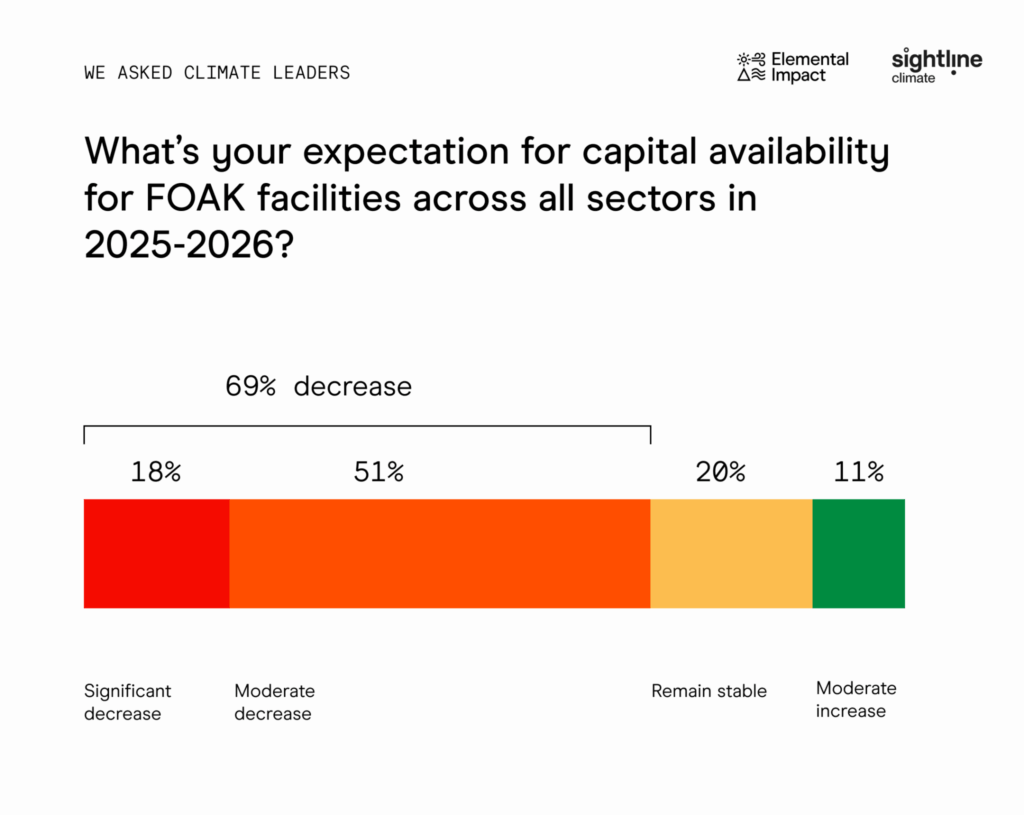

The data is in: First-of-a-Kind (FOAK) projects remain the hardest hurdle in scaling innovative technologies across sectors like energy, industry, and agriculture, and 69% of respondents expect FOAK capital availability to shrink further through 2026.

We recently partnered with CTVC by Sightline Climate to survey investors, founders, and startups, beginning our polling at Elemental Interactive during San Francisco Climate Week. Our ~100 responses represent an initial pulse check from a diverse group—primarily VC/early-stage investors (45%), founders/startups (16%), and private equity/growth investors (10%), along with corporate, impact, infrastructure, and philanthropic investors—providing a snapshot of current market sentiment.

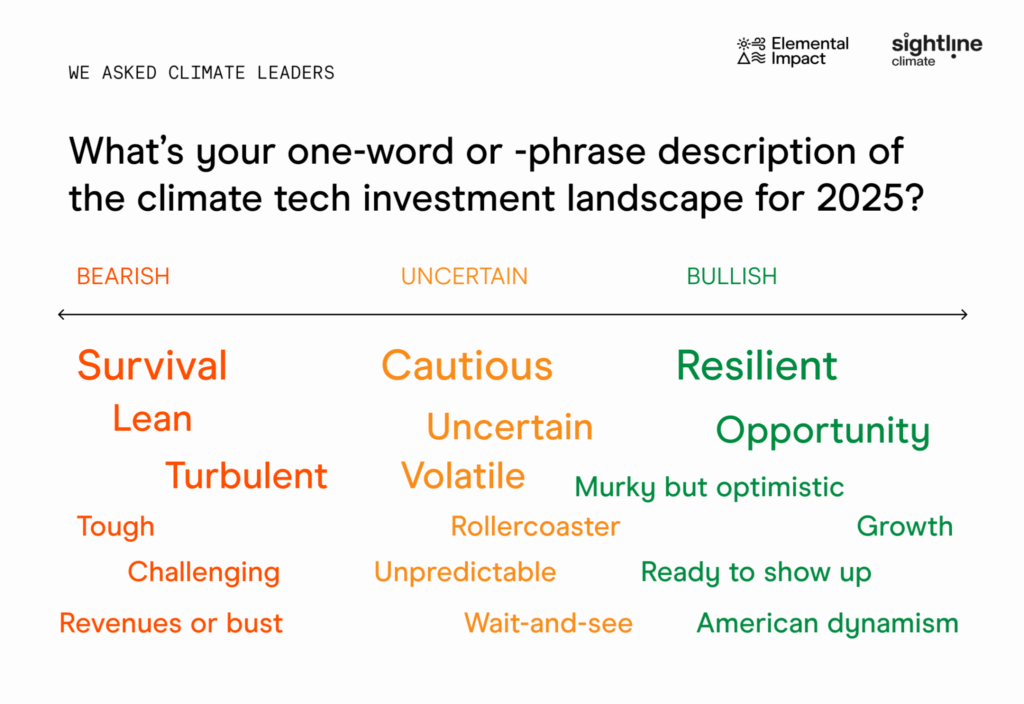

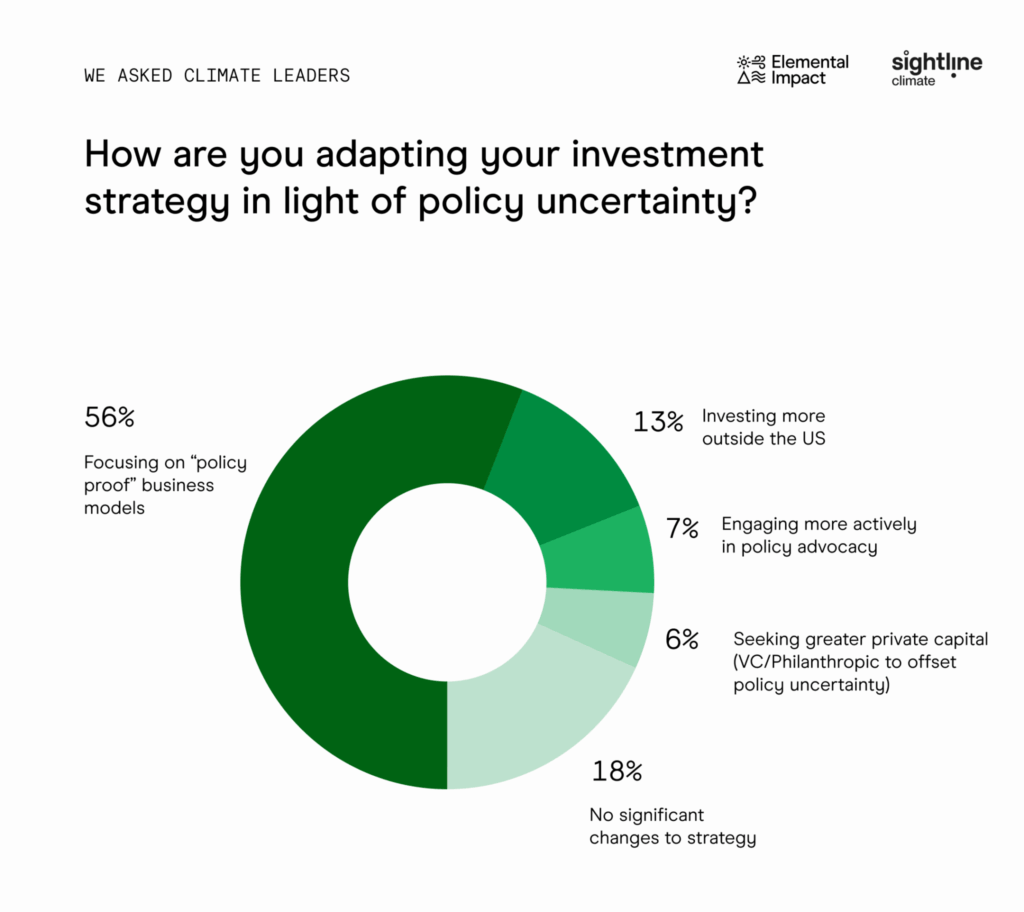

Results show that the uncertain macro environment is driving different adaptation strategies and pivots across the ecosystem. More than half of all investors are focusing on “policy-proof” business models like waste heat recovery and energy efficiency retrofits, and 56% cite high interest rates, sticky inflation, and geopolitical risk, for dialing back on investing.

Let’s dig in!

What we’re seeing—and what respondents said

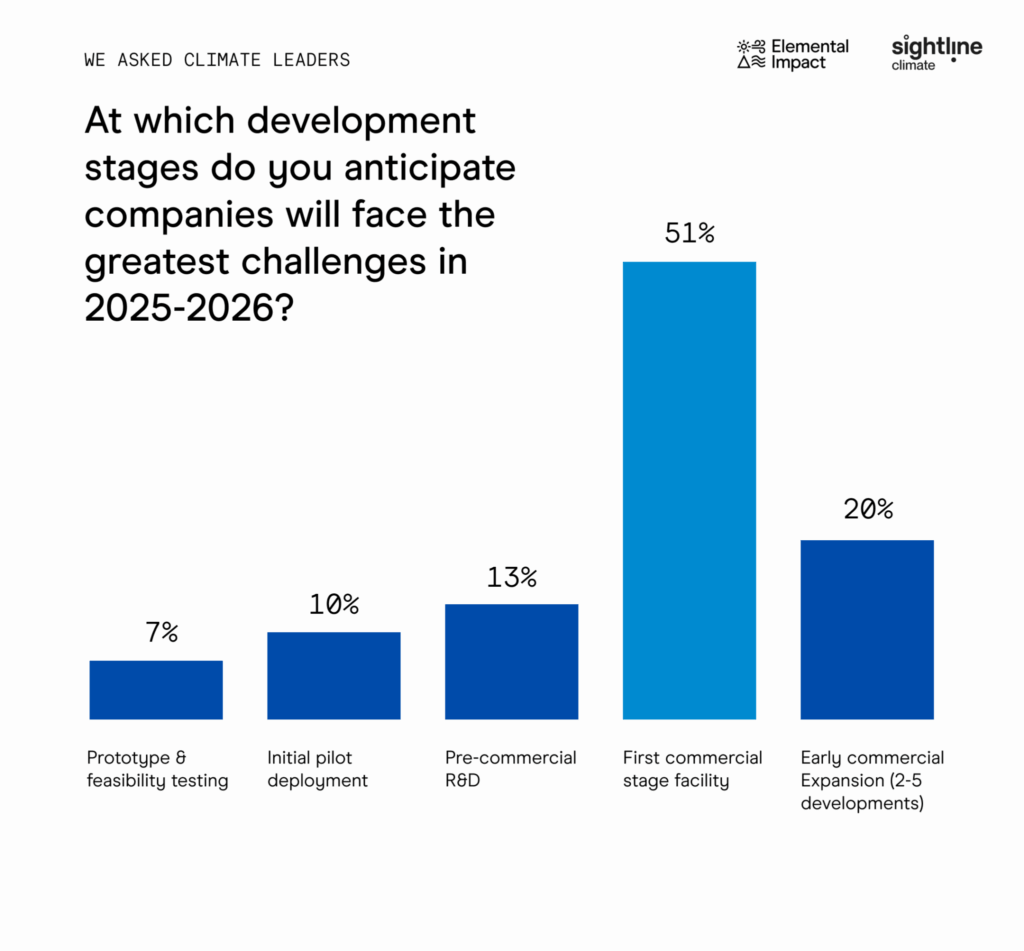

1. The Market’s Consensus: FOAK is the Bottleneck. Our portfolio of FOAK projects reinforces the fact that success requires all facets of project development—technology validation, regulatory approvals, revenue contracts, insurance, and capital commitment—to be addressed at once. We’ve witnessed how this challenge manifests across multiple dimensions. Our portfolio companies report that 89% of project delays stem from external coordination failures, not internal execution problems. The broader market highlights the challenges—more than half (51%) of investors point to first commercial-stage facilities as the toughest development stage to finance through 2026.

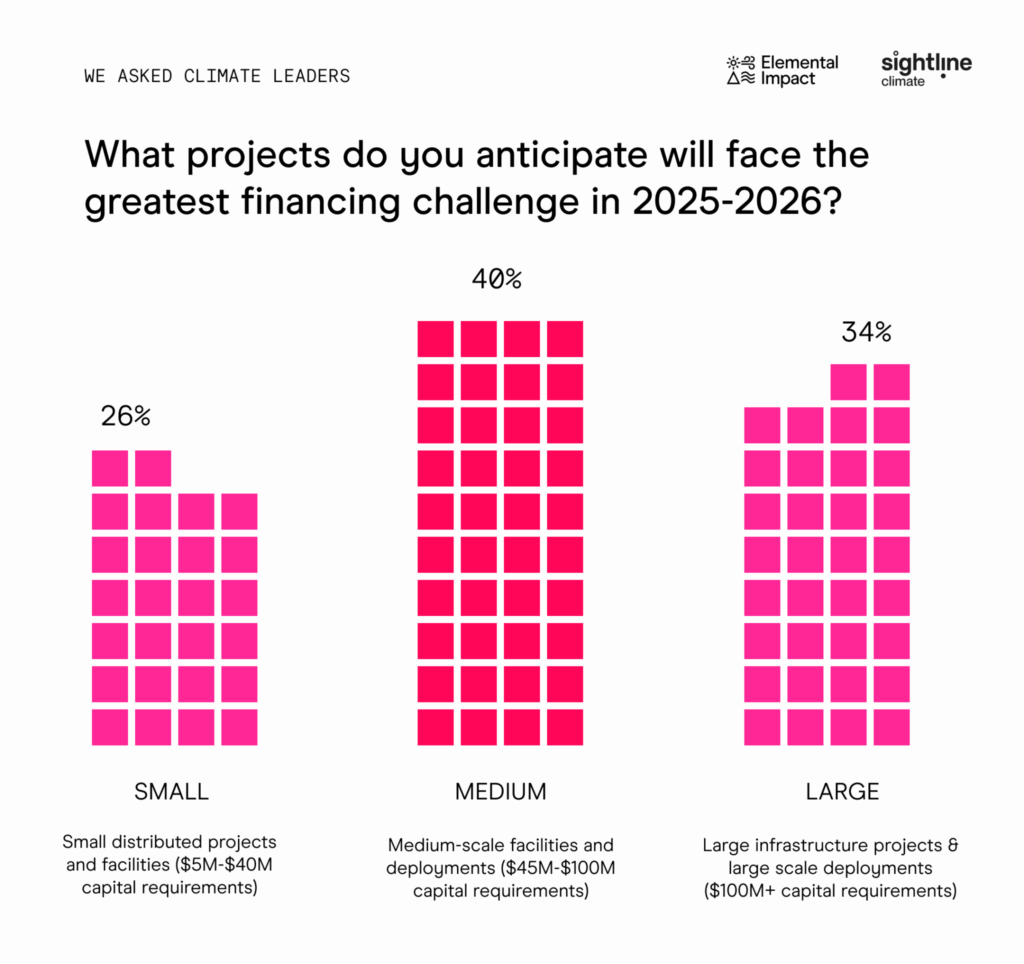

2. The Universal Challenge in Scaling Projects. Our survey asked respondents: “Which projects do you anticipate will face the greatest financing challenge in 2025-2026?” When choosing among three project scales, 40% of respondents identified medium-scale facilities ($40-100M) as facing the greatest financing difficulties, while 34% pointed to large infrastructure projects ($100M+) and 26% cited small distributed projects ($5-40M). This concentration around the medium-scale range reveals where respondents think the financing gap hits hardest, suggesting this is where targeted capital could address the most pressing need.

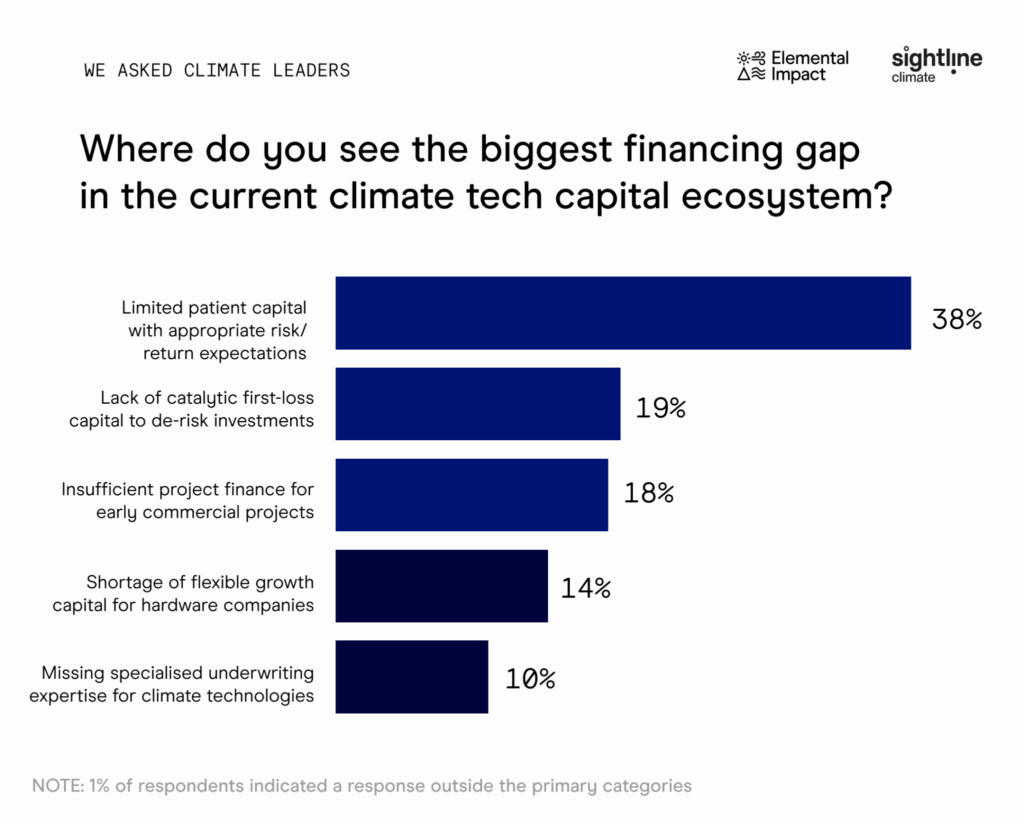

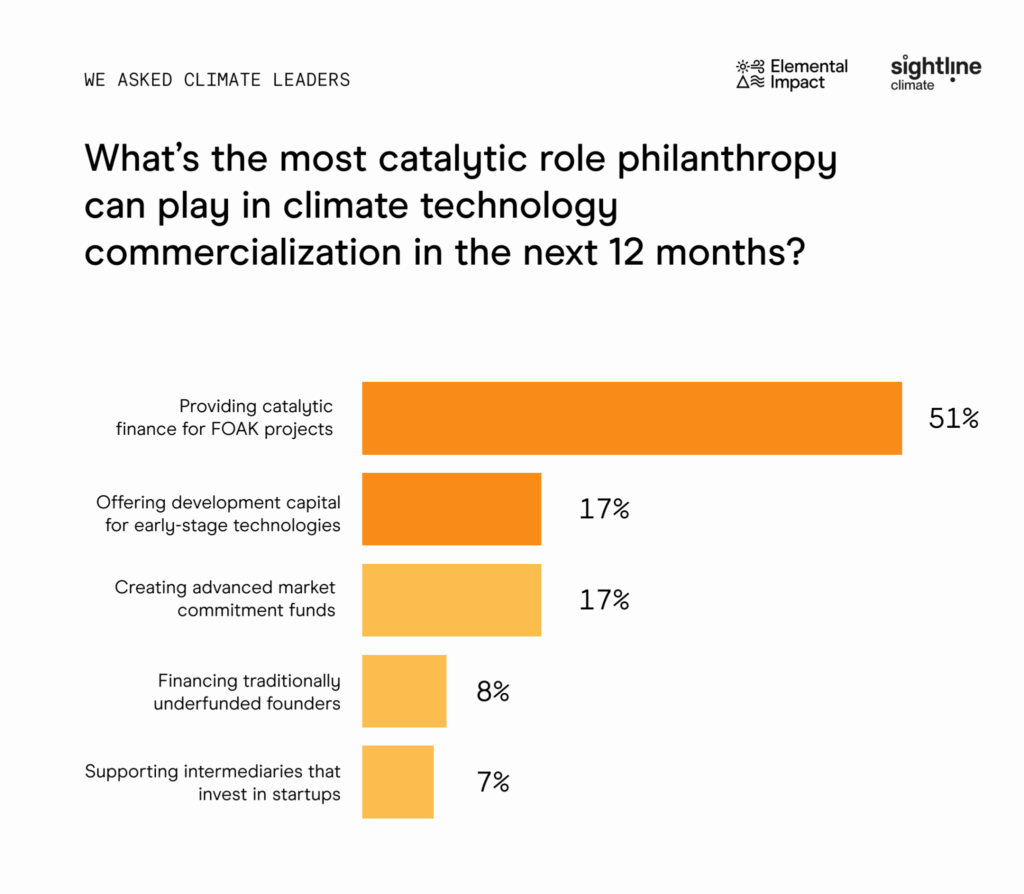

3. The Biggest Financing Gaps, and the Opportunity. Climate tech financing gaps stem from the limited availability of sufficiently patient capital with appropriate risk/return expectations (38%), the lack of catalytic first-loss capital to de-risk investments (19%), and insufficient project finance for early commercial projects (18%). In this moment, investors are looking to philanthropy to play a pivotal role in bridging these gaps. The majority of respondents want philanthropy to either significantly expand engagement or focus on leveraging private capital—revealing investors see philanthropy as uniquely positioned to bridge financing gaps.

4. Philanthropy’s Highest-Impact Play. The survey reveals a clear point of view for philanthropy’s role: 68% of investors now think philanthropy should directly invest in these hard-to-finance areas. This kind of direct project funding would mark a distinct shift in the way philanthropy has typically played in climate. With hundreds of companies ready to scale, small strategic investments at the right stage can create massive leverage—something we’ve validated across 150+ projects, including 14 FOAK facilities. Take Nitricity as a recent example: our $2M catalytic investment helped unlock $7.5M in follow-on equity, venture debt, grants and strategic investment for their fertilizer plant located near farms in California. FOAK represents a critical bottleneck where philanthropic dollars have outsized impact, catalyzing the infrastructure buildout these solutions need to scale.

What our catalytic capital has accelerated across the portfolio: Our strategic investments consistently demonstrate this multiplier effect, with early-stage capital unlocking significantly larger funding rounds and enabling companies to cross critical scaling thresholds. It’s clear that investors are hopeful about the role of philanthropy, noting that targeted philanthropic investment at the FOAK stage creates the proof points and momentum needed to attract institutional capital and move technologies from promising pilots to commercial reality.

Looking ahead

Given the current uncertainty and challenging market we’re all operating in right now, we must innovate and find solutions together to ensure that this vintage of companies that are nailing their product-market-fit don’t atrophy and struggle, just to start over again in four years. Each investor type brings different strengths, but success requires blended approaches and coordination in helping companies bridge to bankability.

Read the full market sentiment analysis

The post 69% Say FOAK Capital is Shrinking—Here’s What That Means appeared first on Elemental Impact.