[Disclosure: AgFunderNews’ parent company is AgFunder.]

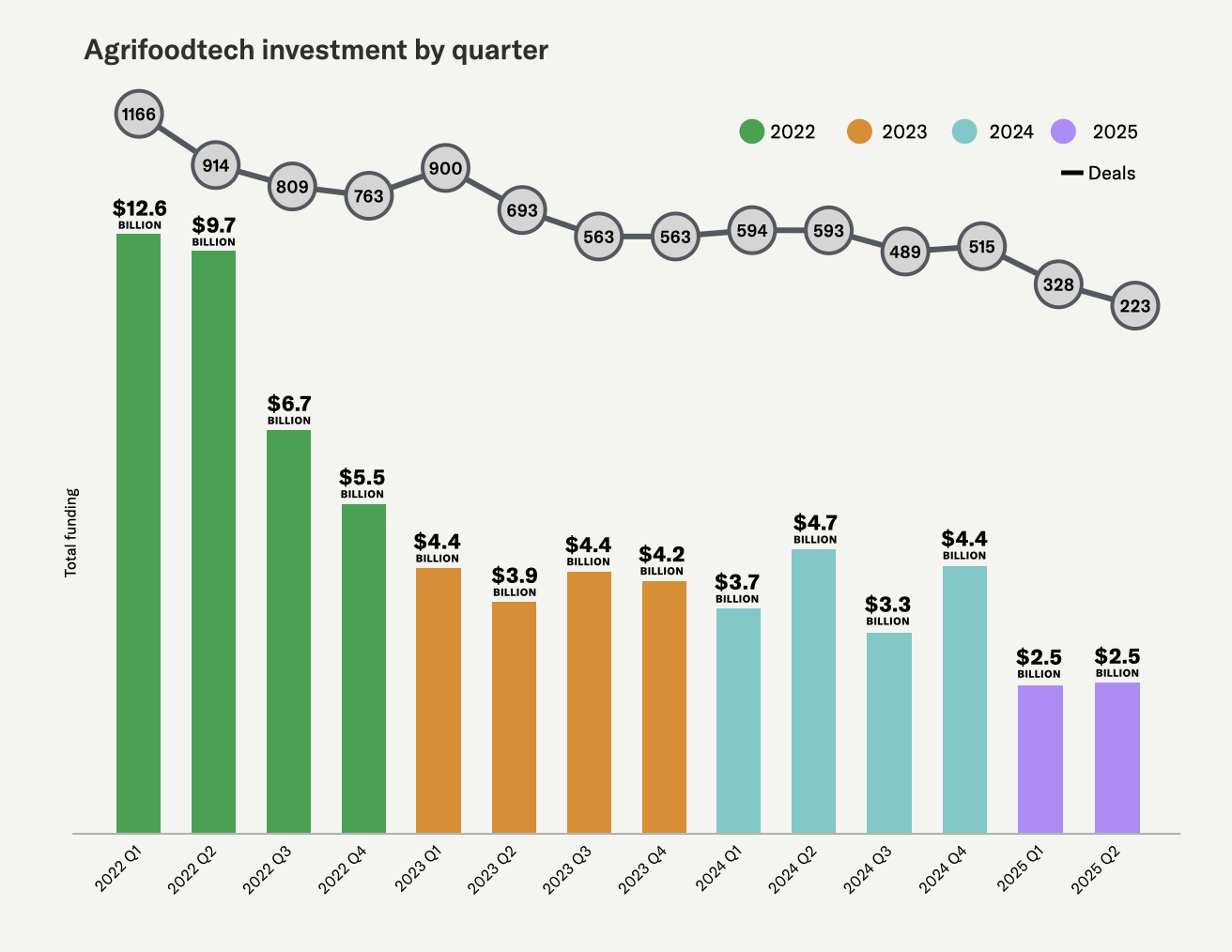

Agrifoodtech VC funding’s bottom would appear to have a trap door.

Last year’s numbers showed a break in the ongoing free fall for investment to the sector, but not a full stop. In the first half of this year, VC funding to the space has continued to decline.

Agrifoodtech startups raised $5.1 billion in H12025 over 551 deals compared to $8.1 billion across 1,187 deals in H12024, according to preliminary* data from AgFunder.

To put this in context, this is the lowest H1 total for agrifoodtech funding since 2015, when startups raised $3.6 million across 518 deals in what was then a very nascent space.

Over the last decade, investment climbed, reaching $5.5 million in 2016 before hitting double digits during the pandemic years of 2020–2021. Even casual observers of the space have witnessed the decline that came after.

Investors will ‘stay selective’ in 2025

“For about eight years, from 2013-2021, we saw the gentrification of many sectors including foodtech and agtech, attracting the biggest funds and driving up valuations,” explains AgFunder founding partner Rob LeClerc. “We’re now seeing VC flight out of everything not AI.”

Globally, AI startups raised more than $100 billion in 2024, accounting for nearly one third of all venture capital funding that year. Agrifoodtech is not unique when it comes to losing capital to AI, with industries from cleantech to gaming taking the hit as well.

An uncertain trade environment, geopolitical conflicts and tensions, and continued economic instability have also contributed to tough funding environments across industries.

And as LeClerc points out, “There’s also the capex nature of the [agrifoodtech] sector which has fallen out of favor for everything outside of defense and robotics.”

Because of these factors, founders would do well to gain a deep understanding of regional dynamics, says Darren Leong, a principle at Clay Capital.

“Across Europe and Asia, we are seeing categories that faced headwinds in one market gain meaningful traction in another. The turbulence of recent years has produced more resilient and disciplined founders, better equipped to navigate complexity and close the gap between technical validation and commercial scale. While total funding is likely to remain below prior peaks, we believe 2025 will reward those who can scale with focus, adapt to local conditions, and deliver measurable outcomes rather than just novel ideas.”

Leong and other investors expect agrifoodtech investment to stay selective throughout the rest of 2025.

This has led to the emergence of founders that are “more focused and strategic,” according to Leong.

“Many are building leaner teams, prioritizing capital efficiency, and concentrating on one or two core products that meet clear market needs, scale effectively, and provide a credible path to profitability. Instead of expanding too quickly across geographies or verticals, these founders are emphasizing depth before breadth, proving themselves in initial markets through both top line growth and operational resilience.”

Mark Kahn, managing partner at India-based VC Omnivore, also said funders will stay selective in 2025, “with capital leaning toward models that clearly drive efficiency and scale.”

“We’re seeing strong momentum in agri-fintech and full-stack CDMO businesses, and there’s a growing confidence in breakthrough areas such as sustainable materials and agrifood life sciences,” he noted.

Antony Yousefian, a parter at TheFirstThirty VC, said that life science and biology experts are now replacing generalist venture capitalists in agrifoodtech. An increased focus on human health outcomes is also gaining attention from new stakeholders, he said.

“The wider restructuring [of agrifoodtech] is mostly complete, with generalists having exited and vertical farming, alternative proteins, and now carbon startups also capitulating. Many declare that ‘VC doesn’t work in agrifoodtech.’ These are typical bottom signals, indicating real opportunities. You will see an accelerating investment environment now, and this is why we are accelerating investments too.”

Where is the money going?

A couple large deals drove Midstream Technologies to the top of the list of investment categories in H12025.

UK-based Magnavale, which operates a cold-storage network for the food industry, raised more than $600 million in a single round, while packaging and bottler producer Diesco Industries raised $165 million.

The category’s next-largest round was a $50 million B raise for Israeli food intelligence platform Tastewise.

Ag biotech, the top-funded category in H12024, dropped to fourth place in H12025. Thus far, US-based seed design company Inari has landed the category’s only nine-figure round, with the remainder of recorded rounds all under $30 million.

Farm Robotics, Mechanization & Equipment was the fifth-best-funded category—despite overall investment to it clocking in below previous years: In H12025, the category raised $313.8 million compared to $398 million in H12024 and $505 million in H12023.

Innovative Food, which raised $828 million in H12024, dropped to just $250 million in H12025.

Investment to Novel Farming Systems continued its years-long decline, dropping from $336 million in H12024 to $144 million in H12025.

*H12025 numbers are preliminary and likely don’t account for all agrifoodtech funding activity in the first and second quarters.

The post Agrifoodtech VC funding drops again, but ‘these are typical bottom signals, indicating real opportunities’ appeared first on AgFunderNews.