United States Antimony Corporation (NYSE American: UAMY), also called USAC, is quietly bringing antimony mining back to the U.S. The company recently announced that it has started buying land and mining claims near its old smelter in Thompson Falls, Montana. This move could help reduce America’s heavy dependence on foreign sources of antimony.

As global supplies tighten and prices rise, USAC’s return to domestic mining could play a big role in securing this critical mineral, especially since antimony is used in everything from solar panels and batteries to missiles and ammunition.

United States Antimony Corporation (USAC) Restarts Antimony Mining in Montana

Since the start of 2025, USAC has been acquiring mining rights and land close to its antimony smelter in Sanders County, Montana. This site has been home to the company’s smelting operations for decades. In the 1970s, USAC’s earlier leadership had mined antimony from underground veins in the same area.

Mr. Gary C. Evans, Chairman and CEO of USAC, explained elaborately by saying,

“The U.S. Government is continuing to get actively involved in securing North American supply chains of critical minerals, especially antimony. This is due to China’s dominance and embargos initiated last year. Market rules do not apply to national security and China does not play fairly in the global free marketplace as we outlined in our Form 8-K dated June 27, 2025. Governments around the world are finally beginning to understand the need to secure their own supply chains, specifically for critical minerals. There continues to exist a worldwide shortage of this critical material necessary for our Department of Defense.

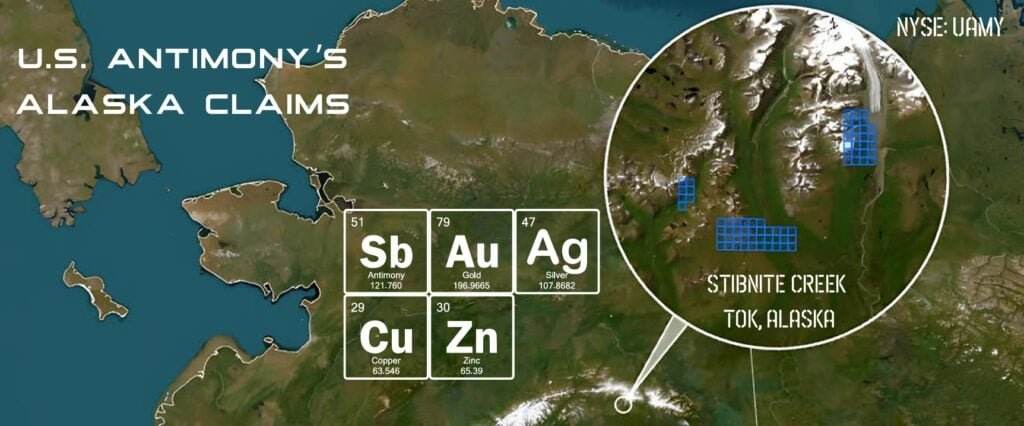

The significant price increase experienced for worldwide supplies of antimony ore have made this decision to reopen our existing antimony mine adjacent to our smelting operations an easy one. With these mining claims combined with our over 35,000 plus acres of new mining claims located in Alaska, we are the first company to restart mining operations in the United States going back decades. Additionally, we are the first fully integrated antimony company in the world having our own antimony supply and controlling both our own midstream and downstream operations.”

Now, after reviewing old records, maps, and site visits, the company found signs of at least three antimony-rich vein systems. These areas could once again support mining. USAC owns around 24 acres of land and has mining rights to about 1,200 acres in total.

The company plans to restart operations on five acres of patented land, where it’s already allowed to mine under Montana’s Small Miners Exclusion Statement (SMES). A second SMES is expected soon. USAC is also filing for exploration permits with the Montana Department of Environmental Quality and the U.S. Forest Service.

This is a big step toward bringing American antimony mining back online right next to the only operating antimony smelter in the U.S.

Why This Montana Smelter Matters

The Thompson Falls smelter is the only antimony smelter still running in the United States. This gives USAC a big advantage. While other companies must import processed antimony, USAC can mine and refine the metal in one place.

The smelter can produce:

- 15 million pounds of antimony oxide per year, or

- 5 million pounds of pure antimony metal per year

Antimony oxide is used to make flame-resistant products, such as plastics, paper, rubber, textiles, coatings and paints, fluorescent lights, etc.

USAC also produces antimony trisulfide, used in military gear and ammunition, and processes precious metals and zeolite at its facilities in Mexico and the U.S.

Alaska and Canada Add More Strength

US Antimony is also expanding outside Montana. In Alaska, the company holds over 35,000 acres of mining claims. These sites could feed more ore into the Montana smelter and help USAC grow its production capacity.

On June 27, 2025, the company completed a deal to buy the Fostung Properties in Ontario, Canada. This site is rich in tungsten, another important mineral used in military and industrial tools. The property is about 70 kilometers from Sudbury and covers 50 mining claims across 1,114 hectares.

The deal cost only $5 million. The sellers kept a small 0.5% royalty, meaning they earn a bit if minerals are sold. This move helps USAC grow into other critical mineral markets while staying in safe, stable regions like Canada.

What’s Causing the Global Antimony Shortage?

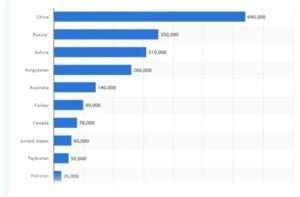

The company notes that right now, the global antimony supply is facing serious problems. For years, China and Russia have controlled most of the world’s antimony. In fact:

- Over 60% of global antimony ore comes from China and Russia

- China made over 70% of processed antimony (ATO) up until 2022

Countries with the largest reserves of antimony worldwide as of 2023 (in metric tons)

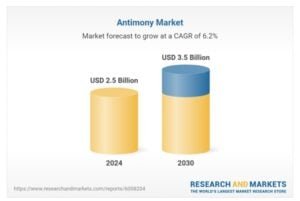

However, things are changing. In the first half of 2024, China’s exports of antimony dropped by 45%. This is because more of it is being used in the nation to make solar panels, which are in high demand. Also:

- Chinese ore quality is getting worse

- New environmental rules make it harder to mine

- China, despite producing the most antimony, is now a net importer of antimony concentrates

Other countries have very little processing capacity. This makes it difficult for buyers to find reliable, non-Chinese sources of antimony.

Antimony Is a Critical Mineral for the U.S.

The U.S. government has called antimony a critical mineral, especially because of its military uses. Antimony is used in:

- Ammunition and explosives

- Infrared-guided missiles

- Night-vision gear

- Nuclear weapons

- Fire-resistant materials

- Batteries and solar panels

Without it, both the defense and clean energy industries could suffer. That’s why the Department of Defense (DoD) and the Department of Energy (DOE) are pushing for more U.S. production.

Trump Speeds Up Mine Permits

To support this effort, the Federal Permitting Improvement Steering Council announced on April 18 that it will fast-track permits for 10 major U.S. mining projects. Antimony projects were among them.

One of those projects is the Stibnite Gold Project by Perpetua Resources, which has large antimony reserves. The project is now on the Federal Permitting Dashboard, which helps speed up reviews, improve coordination, and make the process more transparent.

The further boosts America’s strategy to boost local mining, especially for minerals needed in defense and clean energy.

Investors Pay Attention as United States Antimony Corporation Stock (UAMY) Rises

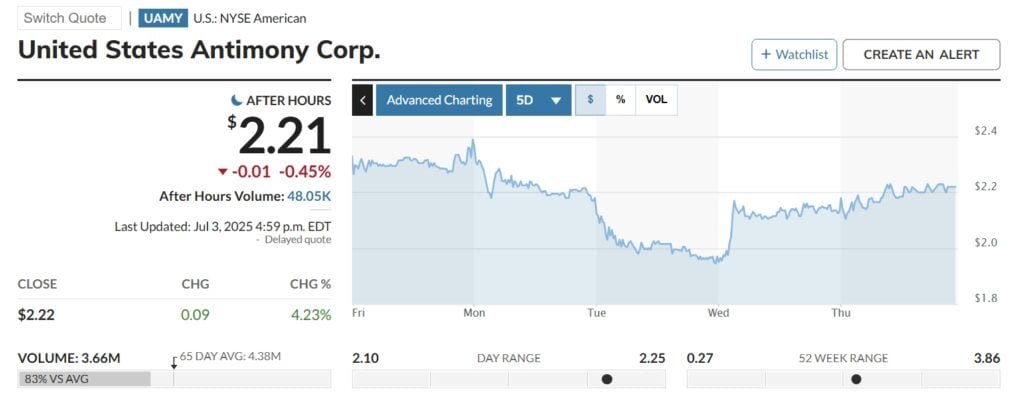

Following USAC’s announcements and expansion news, investors reacted. On July 3, 2025, the company’s stock rose 4%, and its market cap reached $258.5 million.

Investors see strong potential in domestic antimony production, particularly as global supply shrinks and demand rises. USAC’s low-cost expansion strategy and access to key land and smelting facilities make it an attractive bet in the growing critical minerals market.

With strong assets in Montana, Alaska, and Canada, the company can become a key supplier of antimony and tungsten in North America. The company is rebuilding its operations at a time when global supply chains are weak and prices are rising.

By bringing mining back to Montana, feeding its smelter with local ore, and expanding into new critical minerals, United States Antimony Corporation is helping rebuild America’s mineral independence.

- FURTHER READING: Unlocking the Power of Critical Minerals with US DOE’s $45 Million Investment: A Focus on Antimony

The post United States Antimony Corporation (NYSE: UAMY) Ramps Up Domestic Mining to Strengthen America’s Supply Chain appeared first on Carbon Credits.