Happy Monday!

This week, we’re unpacking the Trump administration's push to dismantle the EPA’s 2009 “endangerment finding,” the cornerstone of US laws limiting greenhouse gas emissions, with far-reaching implications across autos, power plants, and more.

In deals, $225m for EV charging, $200m for lithium-sulfur batteries, and $171m for renewable energy development.

In other news, new tariff developments, the Fed’s rate decision, and green steel trade.

Plus, we're launching our NYCW 2025 Events Tracker next Monday — your go-to guide for the can’t-miss happenings in climate tech. Hosting a panel, meetup, happy hour, or any other activation? 👉 Submit your event here to be included.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

EPA’s ‘endangerment finding’ faces extinction

Last week, the Trump administration swung a big sledgehammer at a bedrock federal climate rule. EPA administrator Lee Zeldin announced plans to revoke the agency’s 2009 “endangerment finding,” the legal foundation for the EPA’s authority to regulate greenhouse gas emissions. If finalized and upheld in court, the repeal would crack through existing standards for vehicles, power plants, and other major sources of emissions — undoing years of progress while leaving deep fissures of policy uncertainty.

What happened

Whispers of this move have been circulating since the new administration took office in January. Now, it’s official. Zeldin, citing a DOE-backed report from climate-skeptic scientists questioning mainstream warming projections, laid out a plan to rescind EPA’s finding that six GHGs — CO2, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride — endanger public health and welfare.

Without this finding, the EPA loses its Clean Air Act authority to treat greenhouse gases as pollutants, undoing a precedent upheld by the Supreme Court in Massachusetts v. EPA (2007). Zeldin called the proposed repeal “the largest deregulatory action in the history of the United States.” Rescinding the finding would topple a suite of sector-specific rules built on its legal foundation, including:

- Vehicle emissions standards – existing rules covering the nation’s largest source of greenhouse gases were projected to avoid 7bn metric tons of CO2 and save drivers roughly $6K per vehicle over its lifetime.

- Power plant limits – from Obama-era standards on new fossil plants (2015) to Biden’s 2024 guidelines requiring carbon capture retrofits on coal and gas units. Together, these rules were projected to avoid over 600m metric tons of CO2 pollution through 2042 and deliver $85–$100bn in climate benefits, alongside major public health gains.

- Aircraft emissions regulations – finalized in 2021 to align with international CO2 standards but projected to deliver negligible additional reductions because most aircraft already complied. Still, without the endangerment finding, there’s no legal authority to set stronger future aviation GHG rules, leaving only voluntary airline pledges and ICAO guidelines.

Instead, the new EPA makes its case around costs and limited benefits, arguing in its draft Regulatory Impact Analysis that EV adoption is lagging, gasoline and diesel prices are likely to remain low, and US vehicle emissions are too minor a share of global totals to “scientifically” shift climate trends. The agency frames climate regulations — not emissions — as the greater threat to public welfare, claiming they drive up car prices and limit consumer choice. It aims to finalize the repeal by the end of the year, but it will almost certainly be met with lawsuits. Even if the repeal is finalized after a legal battle, a future administration could try to rebuild the rule, which would entail a new scientific review and another multi-year regulatory process.

Why it matters

Sectors will respond to the changes based on their maturity, existing investments in climate technologies, and fear of public pressure on air quality.

More mature industries could largely stay the course. For automakers, the loss of federal standards doesn’t mean a free-for-all. California and 17 other states have tougher tailpipe rules under the Clean Air Act’s Section 177 waiver, although these are also a point of contention with Trump, and international markets, from the EU to Canada to China, are moving faster on vehicle efficiency and zero-emission mandates. But a patchwork of state-level requirements, combined with intense EV competition and softening US consumer demand, makes long-term planning murky and expensive without a consistent national framework.

For power producers, decades of EPA rules have already driven down SO2 and NOX emissions by over 90% between 1990 and 2020. Most existing plants have the infrastructure in place to control these pollutants, but without enforcement, some operators may scale back compliance or maintenance. New builds may choose to forgo scrubbers altogether, though many developers could still install them as a precaution, since the technology is mature and relatively inexpensive. Other pollutant standards might loosen, though, with filterable particulate matter (fPM) limits for coal-fired plants potentially reverting from 0.010 lb/MMBtu to 0.030 lb/MMBtu, and mercury (Hg) limits for lignite-fired plants increasing from 1.2 lb/TBtu to 4.0 lb/TBtu — changes that could erode air quality gains, particularly in communities already burdened by industrial pollution.

For oil and gas, compliance with methane rules in the Inflation Reduction Act has already started, though the OBBB delays enforcement of penalties for 10 years. Big producers already have an incentive to invest in pricier methane measurement, reporting, and verification (MRV) technologies to protect their market access and monetize captured gas, but smaller producers could slow-walk adoption.

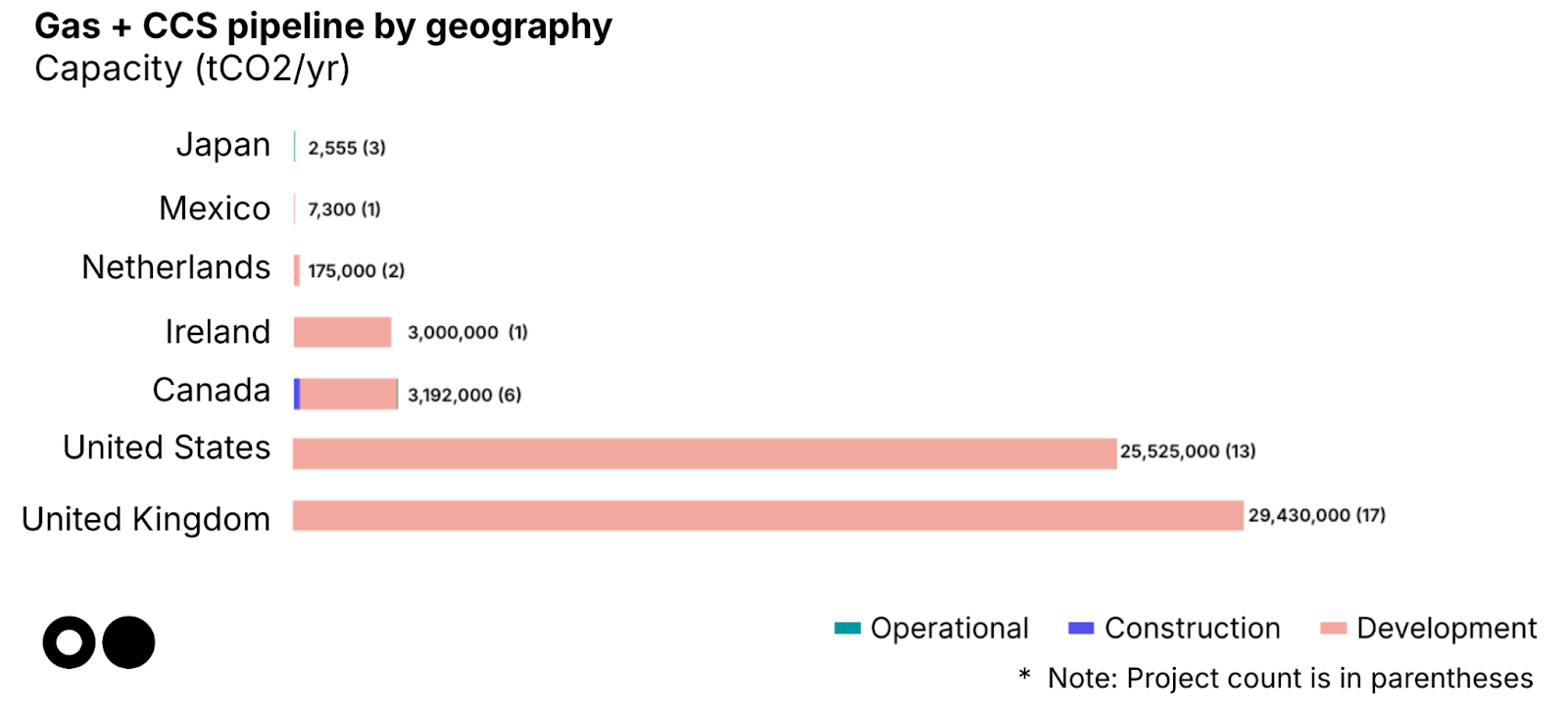

More nascent technologies like gas + CCS retrofits are already a niche play. Deployment has lagged, and much of the announced capacity is only “CCS-ready” — reserving space for future capture equipment without installing it upfront. If mandates return down the line, developers can act on that optionality. Voluntary corporate buyers — hyperscalers like Microsoft or Google with their own net-zero targets — may continue to make this bet, especially given the OBBB’s boost for tax credits.

What’s next

- Lots of legal and policy whiplash. Expect years of uncertainty. Even if the repeal is finalized, lawsuits will almost certainly drag it into the courts, potentially all the way to the Supreme Court.

- Fragmented compliance landscape. With federal authority hollowed out, regulation splinters. States like California want to retain their own vehicle emissions programs, and international markets keep ratcheting up standards for autos, fuels, and methane leakage. Global companies must navigate a patchwork of state, federal, and foreign rules, while domestic-only players risk falling behind in clean technologies.

- Weaker policy pull for next-gen decarb tech. Mature pollution controls (SO2 scrubbers, existing methane mitigation) may continue under voluntary or state-led programs, but emerging solutions — gas + CCS retrofits, advanced methane MRV, industrial carbon capture — lose the prospect of a federal mandate to drive adoption at scale. Without that policy certainty, projects may remain stranded in “CCS-ready” limbo.

Deals of the Week (7/28-8/3)

Late-Stage / Growth

🔋 Lyten, a San Jose, CA-based lithium-sulfur battery manufacturer, raised $200m in Growth funding.

Early-Stage

✈️ AIR, a Haifa, Israel-based eVTOL developer, raised $23m in Series A funding from Entrée Capital.

⚒️ Still Bright, a Newark, NJ-based copper extraction technology developer, raised $19m in Seed funding from Breakthrough Energy Ventures, Material Impact, Azolla Ventures, Fortescue, Impact Science Ventures, and SOSV.

🚢 MobyFly, a Vouvry, Switzerland-based electric hydrofoil ferry developer, raised $13m in Series A funding from Crédit Mutuel Impact.

☀️ Planted Solar, an Oakland, CA-based efficient solar deployment service provider, raised $12m in Series A funding from Piva Capital, Breakthrough Energy Ventures, Khosla Ventures, and Team Builder Ventures.

🍎 FloVision Solutions, a South Bend, IN-based AI-based food production analytics provider, raised $9m in Series A funding from Insight Partners, Rockstart, SOSV, and Serra Ventures.

💧 HydroLeap, a Singapore-based wastewater treatment service provider, raised $5m in Series A funding from Antares Ventures, EDBI, Enterprise Singapore, and Woh Hup.

🏠 Pearl Edison, a Detroit, MI-based home electrification software and contractor services provider, raised $3m in Seed funding from Commonweal Ventures and New System Ventures.

💨 Solidec, a Houston, TX-based modular reactor developer for chemical manufacturing, raised $2m in Pre-seed funding from New Climate Ventures, Collaborative Fund, Echo River Capital, EcoSphere Ventures, Plug and Play Ventures, and other investors.

🚆 Maxi Mobility, a Milan, Italy-based electric taxi mobility service provider, raised $1m in Seed funding from Motor Valley Accelerator, UniCredit Group, Fondazione Modena, and Plug and Play Ventures.

Other

⚡ EVgo, a Los Angeles, CA-based fast EV charging network platform, raised $225m in PF Debt funding from Sumitomo Mitsui Banking Corporation, Bank of Montreal, ING Group, Investec, and Royal Bank of Canada.

⚡ Greenvolt, a Porto, Portugal-based renewable energy developer, raised $171m in PE Expansion funding from Kohlberg Kravis Roberts (KKR).

🛰 EarthDaily Analytics, a Vancouver, Canada-based earth observation data provider, raised $60m in Debt funding from Trinity Capital.

🌬 Cadeler, a Copenhagen, Denmark-based offshore wind services company, raised an undisclosed amount in Debt funding from DNB, KfW, and SpareBank.

⚡ Stargate Hydrogen, a Tallinn, Estonia-based alkaline electrolyzer developer, raised an undisclosed amount in Corporate Strategic funding from Repsol.

💨 Tree.ly, a Dornbirn, Austria-based forestry carbon credits platform, merged with Pina Earth.

🔋 Northvolt, a Stockholm, Sweden-based lithium-ion battery manufacturer, completed an asset sale of an undisclosed amount from Lyten.

Exits

🤝 Chart Industries, a Ball Ground, GA-based specialized energy equipment manufacturer, was acquired by Baker Hughes for $13.6bn.

🧱 Eco Material Technologies, a South Jordan, UT-based sustainable alternative cement producer, was acquired by CRH for $2.1bn.

☀️ OnSight Technology, a Folsom, CA-based autonomous solar inspection robotics developer, was acquired by Nextracker for an undisclosed amount.

🌱 Emitwise, a London, England-based enterprise carbon accounting platform, was acquired by Green Project Technologies for an undisclosed amount.

New Funds

💰 Nuveen Green Capital, a New York City, NY.-based sustainable commercial real estate financing affiliate of Nuveen, raised $785m for CPACE Lending Fund III, with a focus on sustainable commercial real estate finance via C-PACE strategies.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

In the News

Along with an executive order imposing tariffs on imports from 69 countries, Trump announced energy purchase commitments that could reshape fossil fuel demand. The EU pledged $750bn in US energy imports (largely LNG) over three years, and Japan and South Korea pledged $550bn and $100bn respectively, though these amounts exceed projected demand or available supply. This risks diverting capital away from clean energy infrastructure and extending reliance on natural gas.

The Federal Reserve has signaled that it could hold rates steady in September, prolonging high financing costs that make it harder for renewable energy developers to fund new projects and scale deployment. This comes as global renewable energy targets fall far short of the pledge made at COP28 to triple capacity by 2030, with current national plans reaching only 7.4 TW, well below the 11 TW needed. The gap is widest outside the EU, with major emitters like the US lacking updated targets and reversing climate policies.

China will export over 10,000 tons of hydrogen-based green steel to Italy in its first shipment aligned with the EU’s Carbon Border Adjustment Mechanism, accompanied by an Environmental Product Declaration showing a 50% lower carbon footprint than conventional blast furnace steel. The deal highlights a potential pivot in industrial decarbonization strategy: producing low-emissions steel outside the EU, where strict rules and high costs have slowed domestic green steel projects.

Helion has begun construction on its first fusion power plant, Orion, aiming to deliver fusion-based electricity to Microsoft by 2028 under a power purchase agreement. The project passed environmental review and reflects fusion’s shift toward commercialization, with Polaris, Helion’s next prototype, aiming to produce electricity from fusion.

Meanwhile, Dutch startup Ore Energy has connected the world’s first iron-air “rust” battery to a public grid, offering a low-cost, long-duration alternative to lithium batteries by storing energy for over 100 hours using reversible rusting. Massachusetts‑based competitor Form Energy has raised over $1.2bn and is scaling its own 100‑hour iron‑air batteries through multiple commercial installations in the US, as the race for LDES deployment charges ahead.

In nuclear news, NRC Commissioner Annie Caputo has resigned nearly a year early, marking the commission’s second sudden departure amid the Trump administration’s push to expand nuclear energy. The leadership shake-up raises uncertainty around regulatory timelines and concerns over safety and reputation.

The Department of Defense reversed its decision to shut down a long-standing satellite data program crucial for hurricane forecasting and sea ice monitoring, extending public access until at least 2026. This ensures continuity for risk modeling, infrastructure planning, and climate intelligence that rely on these datasets.

Pop-up

China’s nuclear future charges forward with a GW reactor on the horizon.

Hong Kong fuels the first hydrogen-powered charging station.

Painting the planet in pixels, with AI power.

Ammonia ships set sail, fueling the biofuel revolution across ocean waves.

Tsunami trembles shake Pacific coastlines.

Chile leaps to the rescue, saving Darwin’s frog from extinction.

Not so underground – geothermal is rising globally.

Sightline’s data featured in this story on gas power plants and carbon capture.

Opportunities & Events

💡 Pricing AI Software for the Energy Transition & Physical World: Take this survey from EIP about AI x energy novel business models and benchmarks.

📅 Energy + Climate Tech Startup Roundtable: Join TEX-E on Monday, August 4, 5:15 PM – 7:00 PM CDT in Houston, Texas to hear from local energy tech startups Cemvita and Revterra sharing insights on entrepreneurship, the Houston ecosystem, and the future of climate tech, followed by audience Q&A and networking.

📅 Clean Creatives London Happy Hour: Join us on Wednesday, August 6, 6:00 PM – 8:00 PM for a networking event for PR, marketing, and ad professionals committed to climate solutions, hosted by Clean Creatives with Clockwise Marketing and 4Change Marketing.

📅 The Greenhouse Pitch Pod: Join us on Tuesday, August 26, 5:00 PM – 6:00 PM at Grantham Institute for a monthly session for early-stage ClimateTech founders to practice pitching, receive constructive feedback, and gain insights from peers and the Greenhouse team.

Jobs

Senior Software Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Account Executive @Sightline Climate

Senior Program Manager @The Greenlining Institute

Asset Class Specialist @Blue Earth Capital

Associate Director @Energy and Environmental Economics, Inc.

Founding Consumer Product Analysis @Optiwatt

Director of Sustainability @Global Steel Climate Council

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!