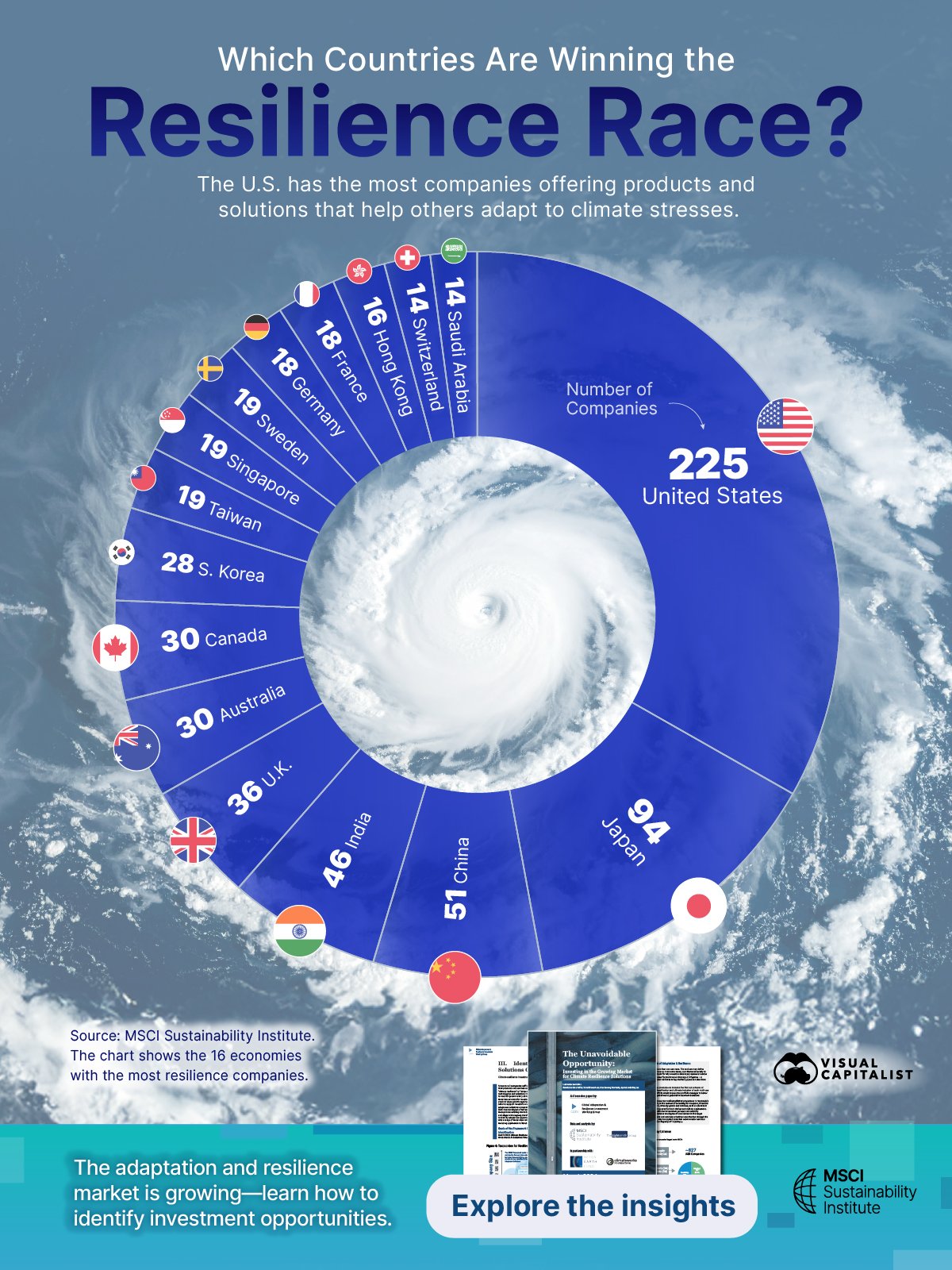

Which Countries Are Winning the Resilience Race?

Key Takeaways

- The U.S. has the most companies offering products and solutions that help others adapt to climate stresses.

- Two-thirds of resilience companies are located in developed markets.

Extreme weather and climate change keep rewriting the playbook for governments and businesses. As risks mount, society is racing to build resilience.

This graphic, in partnership with MSCI, shows which countries have the most companies offering solutions that help others protect themselves against physical climate risks.

What Are Resilience Companies?

In most cases, a company will not self-identify as a climate resilience or adaptation company. Investors can identify these companies if they have a significant business line in a technology, product, or service that prevents or reduces the impact before, during, or after climate stresses.

Here are some examples of climate solutions:

- Early monitoring systems for floods or wildfires

- Vaccines for new diseases

- Water storage technologies

It’s important to note that adaptation and resilience companies are businesses that offer these solutions to third parties. If a company is taking steps to make their own operations more resilient, experts consider this a normal element of risk management.

Resilience Companies by Country

Using this framework, MSCI has identified more than 800 publicly-traded companies that help others adapt and be resilient to climate stresses. This represents about 11% of the public global equity market, as measured by the MSCI ACWI IMI Index.

The U.S. has the largest share of resilience companies.

| Country/Economy | Number of Companies |

|---|---|

United States United States |

225 |

Japan Japan |

94 |

China China |

51 |

India India |

46 |

United Kingdom United Kingdom |

36 |

Australia Australia |

30 |

Canada Canada |

30 |

South Korea South Korea |

28 |

Taiwan Taiwan |

19 |

Singapore Singapore |

19 |

Sweden Sweden |

19 |

Germany Germany |

18 |

France France |

18 |

Hong Kong Hong Kong |

16 |

Switzerland Switzerland |

14 |

Saudi Arabia Saudi Arabia |

14 |

Source: MSCI Sustainability Institute. The chart shows the 16 economies with the most resilience companies.

Overall, two-thirds of these companies are located in developed markets. China and India have the largest representation among developing markets. Why should investors pay attention to these companies?

A Compelling Investment Opportunity

The effects of climate change are widespread and worsening. For instance, billion-dollar weather disasters in America have become more frequent and costly with each passing decade. According to insurers, climate change is the top emerging risk, tied with war.

On top of this, BlackRock has noticed rising demand for resilience solutions. Companies that offer these solutions are poised to benefit from the rising demand, but few easily investable products are available to investors.

Get more details on how to identify these companies and gain targeted exposure with MSCI’s exclusive insights.

-

Investor Education1 week ago

Investor Education1 week agoChina’s Economy vs. Market Cap: A Global Imbalance

China’s economy is a large percentage of global GDP, but the country has a small weight in equity markets—here’s what investors need to know.

-

Investor Education2 months ago

Investor Education2 months agoA New Framework for Personalized Financial Portfolio Alignment

The MSCI Similarity Score compares a client’s financial portfolio to a model portfolio based on risk exposures, allowing for personalization.

-

Green3 months ago

Green3 months agoTracking Emissions: Corporate Concentration and Climate Progress

Just 1% of companies are responsible for the majority of public company emissions. See the progress companies are making to reduce emissions.

-

Technology7 months ago

Technology7 months ago3 Reasons Millennials Are Driving the AI Revolution

Millennials are more likely to accept AI than older generations. What other factors could help them drive the AI revolution?

-

Technology9 months ago

Technology9 months agoThe Fintech Frontier: How Digital Wallets Are Changing Payments

Digital wallets have become the top payment method thanks to their convenience. How can investors track innovation in fintech companies?

-

Healthcare10 months ago

Healthcare10 months agoCharted: Deaths Related to Bacterial Infection vs. Research Efforts

Globally, nearly 14% of deaths are related to a bacterial infection—but research isn’t keeping up with the need for new treatments.

-

Healthcare10 months ago

Healthcare10 months agoVisualizing the Rise of Antibiotic Resistance

Antibiotic resistance has nearly tripled in the last two decades, meaning treatments may no longer work for some bacterial infections.

-

Technology1 year ago

Technology1 year agoCharting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

-

Investor Education1 year ago

Investor Education1 year agoHow MSCI Builds Thematic Indexes: A Step-by-Step Guide

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

-

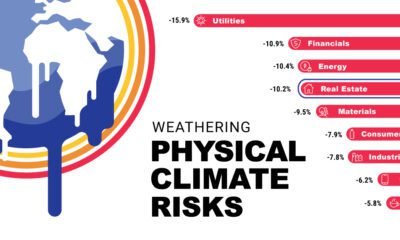

Markets2 years ago

Markets2 years agoWeathering Physical Climate Risks: A Guide for Financial Professionals

Physical hazards like fires pose climate risks for companies, due to the added costs of asset damage and business interruption.

-

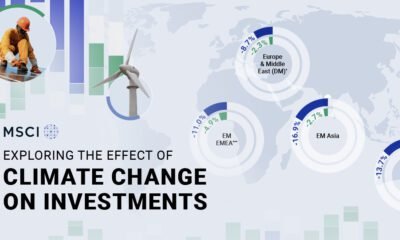

Green2 years ago

Green2 years agoVisualized: What Are the Climate Risks in a Portfolio?

This infographic shows the effects of climate change on investments, and how climate risks may affect a portfolio’s value.

-

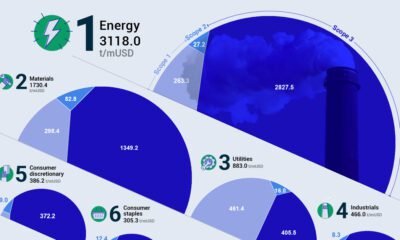

Green2 years ago

Green2 years agoVisualized: An Investor’s Carbon Footprint, by Sector

Which sectors are the largest contributors to emissions? From energy to tech, this graphic shows carbon emissions by sector in 2023.

-

Investor Education2 years ago

Investor Education2 years agoWhich Climate Metrics Suit Your Investment Goals Best?

When selecting climate metrics, it is important to consider your purpose, the applicability and acceptability of the climate strategy, and the availability of historical data.

-

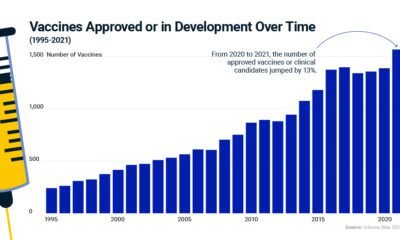

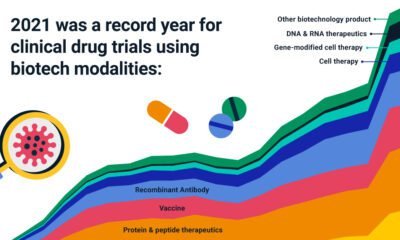

Healthcare2 years ago

Healthcare2 years agoInnovation in Virology: Vaccines and Antivirals

Vaccine development has grown six-fold since 1995. Learn how virology, the study of viruses, is driving innovation in the healthcare industry.

-

Misc2 years ago

Misc2 years agoInfographic: Investment Opportunities in Biotech

Capture the investment opportunities in biotech with the MSCI Life Sciences Indexes, which target areas like virology and oncology.

-

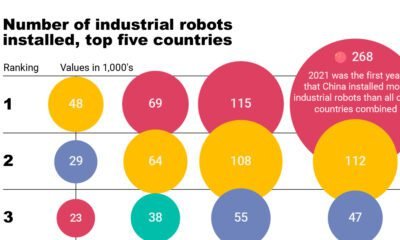

Technology2 years ago

Technology2 years agoIndustrial Automation: Who Leads the Robot Race?

This graphic from MSCI shows the pace of industrial automation across leading countries like China and the U.S.

-

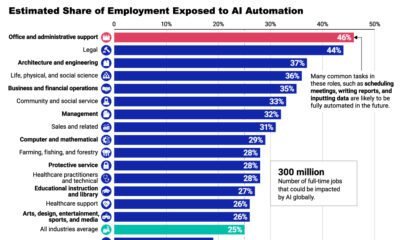

Technology2 years ago

Technology2 years agoRanking Industries by Their Potential for AI Automation

AI automation is expected to impact some industries more than others. See the latest projections in this infographic.

-

Markets2 years ago

Markets2 years agoHow Institutional Investors Can Approach Digital Assets

Digital assets are gaining popularity due to their return potential and decentralized nature. How can institutional investors get exposure?

-

Technology2 years ago

Technology2 years agoClassifying Digital Assets With a New Framework: Datonomy

How can investors get clarity on the thousands of digital assets available? A new structure classifies digital assets by their use cases.