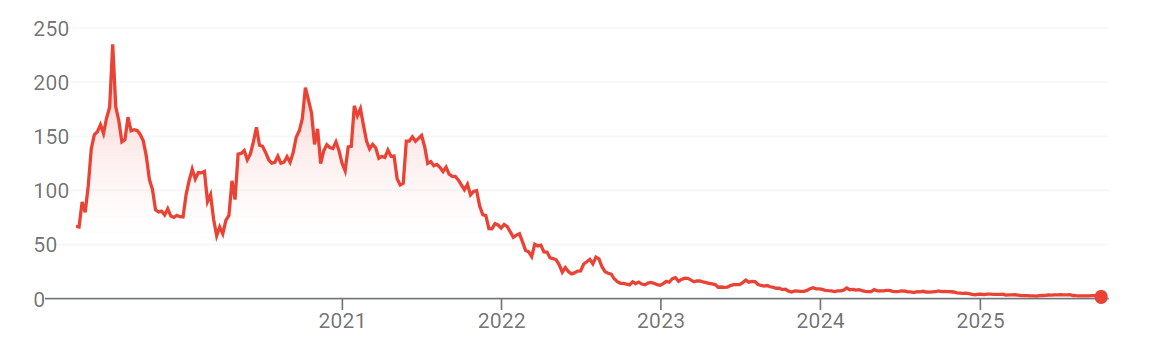

Beyond Meat stock fell to a record low on Monday after the firm moved to restructure its debt, aiming to cut leverage and buy time for a turnaround.

The loss-making firm has debts of $1.2 billion thanks to an offering of convertible notes made in March 2021 that will mature in 2027. The convertible notes, issued at a time when enthusiasm for alt protein was at its peak, were a cheap form of capital as they paid 0% interest in return for giving investors the option to convert the notes into shares were the stock price to go up.

But with the stock now trading far below the conversion price, conversion is unlikely, meaning Beyond Meat would be on the hook to repay the notes in cash at maturity (over $1bn) in 2027—something it will be unable to do, barring a miraculous turnaround.

If Beyond Meat can’t afford to pay noteholders, it will be in default.

The company’s new proposal offers to exchange these zero-interest notes for a package of new notes paying 7% interest (or 9.5% if paid in kind) that mature in 2030, plus shares of Beyond Meat stock.

According to the filing, 47% of existing noteholders have already agreed to the swap, which involves up to $203 million of new bonds due in 2030 and 326 million shares of common stock—an issuance that would significantly dilute current shareholders’ stakes.

The exchange offer is contingent on a minimum participation of 85% of the aggregate principal amount.

By converting part of its debt into equity and extending repayment obligations to 2030, Beyond Meat would ease its debt burden and buy more time to turn the business around, said CEO Ethan Brown. “The Exchange Offer is intended to significantly reduce leverage and extend maturity, two outcomes that meaningfully support our long-term vision of being the global plant protein company.”

The exchange offer and related consent solicitation (whereby current note holders agree to amend the provisions in the original convertible note agreement) closes on October 28.

‘The company is in a horrible spot no matter how you look at it’

One alt protein investor told AgFunderNews: “If this were a growing company with good sales, good EBITDA, and a bright future in a temporarily bad situation then as an investor I might be able to swallow it.

“But the reality is the company is in a horrible spot no matter how you look at it… declining sales, no EBITDA, shrinking market share. There is nothing positive going on at this company that I am aware of; it has been bad for a long, long time.”

He added: “When you go the market to ask your investors to swap into longer dated debt at 7% interest and shares of the company—which ostensibly is worth zero—it is a tough pill to swallow. And they need to get 85% of current holders to agree to swap; that is no small task. There is no value in their offer.

“They may get the 85% of current converts to agree, only so they can collect 7%, but the story is written and the equity has no value. It’s hard to see how they turn it around at this stage; the company has a negative net worth, declining sales, and no strategy to get out of the hole.”

Slowing the rate of cash burn

Beyond Meat, which posted a 19.6% year-over-year (YoY) decrease in net sales to $75 million in the second quarter, blamed “ongoing softness” in the plant-based meat category, with especially weak results in the US retail channel.

“We are responding by accelerating our transformation activities, including more rapidly and aggressively reducing our operating expenses to fit anticipated near term revenues; prioritizing increased distribution of our core product lines; and investing in margin expansion initiatives across these core products,” said CEO Ethan Brown.

The firm has also brought in corporate restructuring expert John Boken from consultancy AlixPartners as interim chief transformation officer.

“The reason that I wanted him [Boken] to come on as interim manager of the business is to really drive two major outcomes,” Brown explained in the Q2 earnings call. “One is to get the operational footprint into the current revenue environment… in a way that doesn’t break things. And then the second is around margin. I wanted someone like John to… make sure that we can become EBITDA positive within the second half of next year.”

Part of the work involves “exiting certain product lines and reconfiguring others,” he added: “We are super focused on slowing the rate of cash burn… Bringing in John, I think, is a symbol of the level of urgency and seriousness that we’re placing on ensuring that we are able to drive out cost from the business as quickly as we can.”

The post Debt deal buys Beyond Meat time, but there’s ‘no strategy to get out of the hole,’ says alt protein investor appeared first on AgFunderNews.