Canada is stepping up in the race for critical minerals. During its G7 Presidency, the country announced a $6.4 billion investment for 26 new projects and partnerships. This aims to strengthen supply chains and reduce reliance on unstable markets.

The announcement took place at the G7 Energy and Environment Ministers’ Meeting in Toronto. It marks a new approach for Canada and its allies to ensure clean energy security, advanced manufacturing, and defense.

Canada’s Critical Minerals Alliance Gains Global Momentum

Central to this initiative is the Critical Minerals Production Alliance. This framework connects G7 nations and industry leaders to speed up mineral projects while maintaining strong environmental and labor standards.

Minister of Energy and Natural Resources Tim Hodgson noted that access to critical minerals—like lithium, graphite, nickel, and rare earth elements—supports cleaner, more resilient economies.

He said,

“Canada is moving quickly to secure the critical minerals that power our clean energy future, advanced manufacturing and national defence. Through the Critical Minerals Production Alliance and the G7 Critical Minerals Action Plan, we are mobilizing capital, forging international partnerships and using every tool at our disposal to build resilient, sustainable and secure supply chains. These investments are foundational to Canada’s sovereignty, competitiveness and leadership in the global economy.”

Unlocking $6.4 Billion for 26 Projects

Canada is introducing 26 new investments, partnerships, and policies. These initiatives aim to speed up the production and processing of critical minerals across the country. They will attract public and private capital to boost domestic mining and processing.

Key highlights include:

-

Offtake agreements with major producers like Nouveau Monde Graphite and Rio Tinto for graphite and scandium.

-

Partnerships with nine allied nations—France, Germany, Italy, Japan, Luxembourg, Norway, the U.S., Australia, and Ukraine—to co-invest and secure offtake deals.

-

A new Roadmap to Promote Standards-Based Markets for Critical Minerals under the G7 Critical Minerals Action Plan (CMAP).

These actions position Canada as a trusted and transparent supplier of responsibly sourced minerals, enhancing investor confidence in long-term, low-risk clean energy supply chains.

Building a Secure and Responsible Future

Canada’s ties with G7 partners focus on resilience. With rising global competition, clear supply chains are crucial for strategic security.

Under the G7 Critical Minerals Action Plan, member countries aim to diversify production, boost innovation, and ensure fair labor and environmental practices. This plan builds on Japan’s Five-Point Plan for Critical Minerals Security (2023) and Italy’s 2024 initiatives. It also expands cooperation with emerging markets and developing economies.

Canada will use the Defence Production Act to stockpile key minerals, enhancing domestic readiness for defense and industrial needs. This stockpile will:

-

Strengthen Canada’s defense supply chains.

-

Protect domestic production from market disruptions.

-

Support NATO’s deterrence and defense strategy.

-

Boost sovereignty in the Arctic region.

This strategy shows that minerals like nickel, copper, and rare earths are vital for EVs, batteries, national defense, clean technologies, and digital infrastructure.

Projects Driving Canada’s Mineral Future

The newly funded projects span Quebec and Ontario, targeting high-demand minerals for EV batteries, semiconductors, and renewable technologies.

Flagship projects include:

- Northern Graphite Corp. – Graphite mine near Montreal, Quebec.

- Nouveau Monde Graphite Inc. – Matawinie graphite project, Quebec.

- Vianode – Synthetic graphite and anode materials facility in St. Thomas, Ontario.

- Torngat Metals Ltd. – Strange Lake rare earth elements project, Quebec.

- Ucore Rare Metals Inc. – Rare earth processing plant in Kingston, Ontario.

- Rio Tinto Group – Scandium production facility in Sorel-Tracy, Quebec.

Additional infrastructure investments in Chibougamau, Kuujjuaq, and Eeyou Istchee James Bay (Quebec) will improve logistics and supply chains for copper, lithium, nickel, and cobalt.

These developments will boost local economies, create jobs, and strengthen G7 supply chain resilience while supporting Canada’s clean energy transition.

Mobilizing Global Capital for Clean Energy Security

G7 partners agree that responsible mining needs immediate, scaled investment to tackle issues like permitting delays and price volatility. The G7 Critical Minerals Action Plan calls for better collaboration among governments, export credit agencies, and development finance institutions (DFIs) to unlock capital and lower investment risks.

This strategy aims to attract private financing for projects meeting high environmental and ethical standards, fostering transparent, market-based systems for mineral trade.

Moreover, the G7 seeks to help emerging market economies build responsible mining industries through better infrastructure, governance, and investment frameworks.

These partnerships will align with global initiatives like the G20 Compact with Africa, ensuring mineral development fosters local value creation and community participation.

Strengthening Canada’s Leadership in a Critical Decade

Furthermore, Canada is preparing for major international events, including the IEA Ministerial Meeting and the PDAC Conference in 2026. These will highlight Canada’s growing role in achieving a clean energy future.

By linking national defense, economic security, and clean energy goals, the Critical Minerals Production Alliance shows how cooperation can counter practices that disrupt mineral trade and threaten global supply stability.

The country’s $9 billion defense investment plan, announced earlier this year, supports this strategy by enhancing domestic capabilities while promoting sustainable development.

Canada Anchors North America’s Critical Minerals Growth

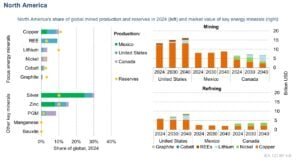

According to the International Energy Agency (IEA), North America holds a major share of the world’s essential mineral reserves. The United States has large deposits of lithium, copper, and rare earth elements. Canada is rich in graphite, lithium, and nickel, while Mexico has strong copper reserves.

Together, these countries play an important role in global mining. The region accounts for about 10% of the world’s copper output and 9% of rare earth production. In 2024, the United States approved its first lithium mine in more than 60 years, marking a big step toward securing a local supply.

By 2040, the IEA expects the value of North America’s energy minerals to grow to around USD 30 billion for mining and USD 14 billion for refining. Mining growth will mainly come from copper in the United States and Mexico, and from lithium and nickel in Canada.

For refining, the region could make up about 4% of the global market, led by copper and lithium refining in the United States and copper and nickel refining in Canada.

A Unified Path Toward Resilient Supply Chains

The G7 stands united against global challenges. Canada’s leadership shows that securing critical minerals goes beyond extraction. It emphasizes trust, transparency, and long-term sustainability.

By promoting responsible mining, mobilizing capital, and ensuring traceable supply chains, Canada and its allies are paving the way for a cleaner, more secure industrial future.

The Critical Minerals Production Alliance demonstrates that countries can work together. By collaborating, they build strong systems that support economic growth, protect the environment, and enhance national security. They also help power future technologies.

The post Canada Leads G7 with $6.4B Critical Minerals Boost to Secure Global Supply Chains appeared first on Carbon Credits.