ExxonMobil Corporation (XOM) is reinforcing its role as a dependable choice for income-focused investors, while also increasing its investments in digital and AI technology. It raised its quarterly dividend by 4%, from $0.99 to $1.03 per share.

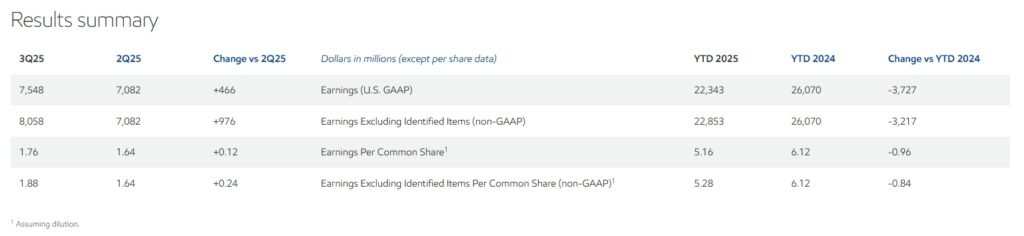

The increase came after Exxon released its third-quarter 2025 results. The company reported $7.5 billion in profit, or $1.76 per share. It generated $14.8 billion in operating cash flow and $6.3 billion in free cash flow. In the quarter, Exxon returned $9.4 billion to shareholders through dividends and stock buybacks. For the full year, the company expects to buy back about $20 billion worth of its own shares.

A Strong Quarter with Strategic Progress

Year-to-date earnings came in at $22.3 billion, compared to $26.1 billion during the same period in the prior year. Lower crude realizations, weaker chemical margins, and higher operating costs weighed on the results. However, production growth in Guyana and the Permian Basin, alongside structural cost reductions, helped offset some of the decline.

Management emphasized that eight out of ten major project startups planned for 2025 have already been completed, with the remaining two on track.

The company also advanced several long-term strategic initiatives, including:

- Acquiring additional Permian acreage to secure a future low-cost oil supply.

- Expanding into the carbon materials market, supplying inputs for next-generation batteries and manufacturing.

- Increasing computing and data infrastructure to support AI-driven operations.

Executives maintain confidence in meeting — and potentially exceeding — medium-term production targets. Partnerships in high-value fields such as the Upper Zakum reservoir continue to provide scaled output and stable cash flow.

Still, analysts caution that short-term volatility in oil prices could pressure margins. Additionally, large-scale project execution remains a key risk to maintaining momentum.

Energy Products Earnings Rise

AI Moves to the Center of Exxon’s Operating Model

Beyond production growth, Exxon is leaning heavily into artificial intelligence and digital automation as a lever for efficiency and long-term competitiveness.

The company invests around $1.8 billion annually in information and digital systems, with an R&D budget near $1 billion. These investments target:

- Faster seismic data interpretation

- Autonomous and optimized drilling operations

- Predictive equipment maintenance to prevent downtime

- Supply chain and logistics automation

- Refinery process optimization for energy and emissions reduction

Executives estimate that AI-enabled workflows and process standardization could unlock more than $15 billion in structural cost savings by 2027. These savings are designed to self-fund further innovation, accelerating a cycle of operational efficiency.

A major part of this strategy involves simplifying Exxon’s historically complex IT architecture. Leadership has stated that reducing system variation is essential for scaling AI applications consistently across global assets.

For investors, this approach signals a move beyond traditional upstream growth toward a more data-driven industrial model — one designed to function efficiently across volatile commodity cycles.

Exxon’s Net-Zero Plans and the Path to 2050

Exxon continues to position itself for a lower-emission future, but progress remains tied to policy development and technology maturity.

The company has committed to pursuing net-zero emissions in its operated assets by 2050. It plans to invest up to $30 billion in lower-emissions initiatives between 2025 and 2030. These include:

- Achieving net-zero Scope 1 and 2 emissions in its Permian unconventional operations.

- Expanding methane detection programs through satellite and ground-based monitoring.

- Eliminating routine flaring in upstream operations, consistent with the World Bank Zero Routine Flaring initiative.

- Deploying carbon capture and storage (CCS), hydrogen, and lower-carbon fuels.

- Electrifying equipment and integrating cleaner energy sources in operational sites.

- Improving operational efficiency through upgraded maintenance and design practices.

Exxon states that its investments in CCS, hydrogen, biofuels, and lithium could reduce third-party emissions by more than 50 million metric tons annually by 2030. To put that into perspective, that is roughly equal to the annual electricity-related emissions of nearly 10 million U.S. homes.

Even so, company leadership acknowledges that achieving global net-zero goals requires supportive government policy and large-scale energy system transformation. Current global progress falls short of what is needed to stay on a net-zero pathway.

In the news recently, Exxon is challenging California’s climate laws, claiming they violate free speech and impose costly, hard-to-verify reporting. The rules require full emissions disclosure, including Scope 3, and climate-related financial risks.

A win for Exxon could slow similar laws nationwide, while a win for California could set a new standard for corporate climate accountability.

- KNOW MORE: Oil Giants Under Fire: ExxonMobil Fights Climate Laws as TotalEnergies Found Guilty of Greenwashing

Near-Term XOM Stock Outlook

The company continues to prioritize shareholder returns through dividends and buybacks, supported by steady output from high-margin assets. At the same time, Exxon is transforming its operations through AI and automation in ways that could reshape its cost structure for decades.

- MUST READ: ExxonMobil’s (XOM Stock) Wild Ride: Gas Discovery, $14M Pollution Fine, and Carbon Storage Push

The post ExxonMobil (XOM) Q3 Earnings Beat: Will AI and Innovation Secure Dividends in a Climate-Conscious Era appeared first on Carbon Credits.