Disseminated on behalf of Sierra Madre Gold & Silver Ltd.

Mexico has long been one of the world’s top silver producers. For centuries, its mining regions—Zacatecas, Durango, and the Sierra Madre belt—have supplied much of the world’s silver. But after decades of underinvestment and falling output from older mines, the country’s silver production has started to slow.

That is now changing. Modern mining companies are reinvigorating Mexico’s silver belt. They bring in new capital, use better technology, and follow stricter environmental standards. Among these companies, Sierra Madre Gold & Silver Ltd. (TSXV: SM | OTCQX: SMDRF) stands out. The plan to restart and expand the La Guitarra Mine in the Temascaltepec district is a big step forward for Mexico’s precious metals industry.

The Comeback of La Guitarra

The La Guitarra Mine has a long history of production, dating back to colonial times. It produced gold and silver for different owners. Most recently, it was owned by First Majestic Silver. Now, it has restarted commercial production as of January 1, 2025, after a period of care and maintenance.

Sierra Madre acquired the mine in 2023 with a clear strategy: bring it back into production and expand its capacity. The mine has a processing plant that handles 500 tonnes a day. It also has a permitted underground operation. Nearby, there are roads, power, and water infrastructure.

With a strong technical team and fresh funding of C$19.5 million, Sierra Madre is preparing for an expansion. The company aims to boost production to 1,500 tonnes per day by 2027. This will increase up to three times and help keep costs low through smart mine design and local partnerships.

Why Mexico’s Silver Revival Matters

Mexico continues to hold the world’s largest silver reserves. It accounted for about 23-25% of global silver output in 2024, producing about 5,800–6,300 tonnes of silver that year. Rising industrial demand is fueling a new focus on production growth.

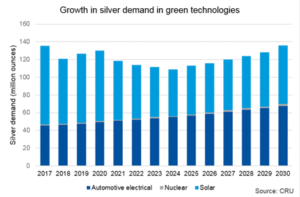

Silver is no longer just a jewelry or investment metal; it’s essential for clean energy. Each solar panel uses about 20 grams of silver, and electric vehicles (EVs) require up to 50 grams. As the solar and EV industries expand, analysts project that global silver demand will exceed 1.2 billion ounces per year by 2030.

This shift opens new chances for producers in stable, mining-friendly places like Mexico. Mexico is attracting new exploration and investment. Its skilled workforce, supportive rules, and modern infrastructure help. This reaffirms Mexico’s role as the world’s silver leader.

Sierra Madre is part of that national revival. Its work at La Guitarra, and exploration at Tepic shows how new companies are turning dormant assets into growth engines for the next decade.

A Project with Built-In Advantages

La Guitarra offers more than history – it has the right foundations that allow for a fast restart. The processing plant, tailings facility, and underground access are ready. This setup saved years of development time.

The mine is also in a favorable location. Situated in Mexico State, it is close to highways and power lines and only a few hours from Mexico City. This proximity reduces logistics costs and makes it easier to hire skilled workers.

Sierra Madre’s leadership team combines local mining experience with strong capital markets knowledge. This balance allows the company to move efficiently from project restart to expansion. La Guitarra is one of Mexico’s top silver-gold mines. It has high-grade veins, clear exploration targets, and permits.

Strengthening Mexico’s Mining Economy

The completed La Guitarra restart is part of a broader trend of economic renewal in Mexico’s mining regions. The country’s mining sector directly employs more than 400,000 people and supports over 2.5 million indirect jobs. The sector’s importance extends beyond jobs. Mining represents nearly 2.5% of Mexico’s GDP and generates billions in export revenue.

New projects like Sierra Madre’s La Guitarra are helping sustain rural economies by creating stable, long-term employment. The La Guitarra project has created hundreds of jobs when it restarted. Sierra Madre has also invested in training and local infrastructure for the community.

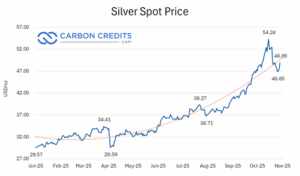

Silver prices are stabilizing around US$48–49 per ounce in late October 2025, having reached an all-time high of $54.24 per ounce on October 16, followed by a swift correction that saw prices dip to the mid-$46 range before rebounding.

Notably, in just 10 weeks from July 31 to the peak, silver surged by nearly 48%, climbing from $36.71 to $54.24 per ounce – a rapid and exceptional rally. This sustained period of around the $50 mark through October is good news for mid-tier producers like Sierra Madre.

They can boost value for shareholders and help local economies, capitalizing on strong price levels and renewed market optimism driven by silver’s resilience after the correction.

Operating with Responsibility

Sierra Madre is also part of a new generation of miners that prioritize environmental and social responsibility. The company is updating its waste and water systems to meet modern standards. They want to use less water and reclaim tailings more efficiently.

Environmental protection is crucial in silver-gold mining areas, where it’s key to balance economic chances with sustainability. Sierra Madre focuses on open communication with the community, clear permitting, and strong ESG practices. This approach meets the needs of local stakeholders and global investors.

The company’s management stressed that modernization at La Guitarra is both about increasing production and doing it responsibly. This commitment to responsible mining strengthens Sierra Madre’s credibility as it seeks to attract long-term partners and institutional investors.

Why La Guitarra Leads the Silver Belt Revival

What makes La Guitarra central to Mexico’s silver revival is its combination of history, infrastructure, and timing. The mine already had everything needed to move quickly back into production, supported by rising demand and favorable silver prices.

Few projects in Mexico are as close to immediate output growth as La Guitarra. The company’s 2025–2027 plan provides a clear growth path: expand capacity, restart exploration, and use cash flow to advance its other assets. This positions Sierra Madre as one of the few junior companies capable of near-term revenue growth in a tightening silver market.

Meanwhile, exploration at the nearby Tepic project could add more resources to support long-term growth. Together, these assets form a strong portfolio with both production and discovery potential.

Looking Ahead

Mexico’s silver belt is reawakening, and Sierra Madre Gold & Silver is at the heart of that revival. The La Guitarra Mine represents more than a completed restart with an expansion and exploration planned – it’s a symbol of how modern technology and responsible operations can breathe new life into historic mining regions.

As global demand for silver continues to rise across industries, from solar panels to electric vehicles, companies like Sierra Madre will play a vital role in meeting that need.

With production restarted, expansion underway, and exploration advancing, Sierra Madre is well positioned to help lead Mexico’s next era of silver success – one built on heritage, innovation, and sustainable growth.

- MUST READ: Silver Prices Surge to 14-Year High in 2025: What’s Sparking this Sustainable Metal Boom?

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Sierra Madre Gold and Silver Ltd. (“Company”) made a one-time payment of $25,000 to provide marketing services for a term of one month. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer, and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that the information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings available on SEDAR+ at www.sedarplus.ca.

The post Reviving Mexico’s Silver Belt: How Sierra Madre’s La Guitarra Mine Is Leading the Comeback appeared first on Carbon Credits.