Tesla (NASDAQ:TSLA) is reportedly in advanced talks with Samsung SDI for a $2.1 billion battery deal. This shows Tesla’s push for long-term access to cutting-edge battery technology. The deal will likely focus on cylindrical battery cells. It could boost Tesla’s supply chain as the company increases electric vehicle (EV) and energy storage production.

If finalized, the agreement would make Samsung SDI one of Tesla’s key suppliers alongside Panasonic and LG Energy Solution. Samsung batteries might power the EV maker’s new models and energy storage systems, such as the Powerwall and Megapack.

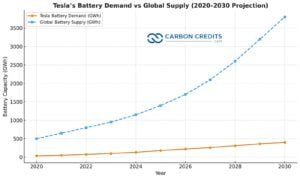

Tesla’s battery demand continues to rise with expanding production at Gigafactories in the U.S., Germany, and China. The company delivered over 1.8 million vehicles in 2024. With the new mass market compact EV coming, battery demand for Tesla may hit 400 GWh each year by 2030.

Why Tesla Needs More Battery Suppliers

Battery supply is the cornerstone of Tesla’s growth. The company’s 4680 cell production is moving more slowly than expected. This limits its ability to meet internal demand fully. As a result, Tesla continues to rely on external suppliers to meet its EV and storage targets.

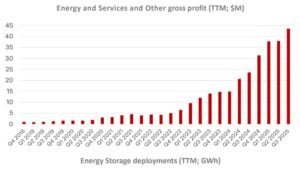

The chart shows the EV giant’s most recent storage deployments. It reached almost 45 GW in the third quarter of 2025.

Samsung SDI supplies cylindrical cells to BMW and Rivian. The company is also expanding its manufacturing in South Korea, the U.S., and Europe. Tesla can partner with Samsung to diversify its sourcing. This way, it can access high-energy-density, nickel-rich batteries. These batteries improve driving range and performance.

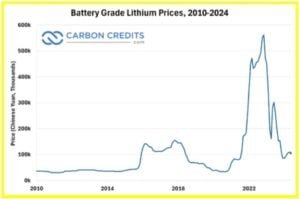

This deal would also help Tesla reduce its exposure to raw material price swings. Battery-grade lithium and nickel prices fell by over 40% in 2024. However, volatility is still high because global demand for energy storage is rising fast.

The Global Battery Boom: A Trillion-Dollar Charge

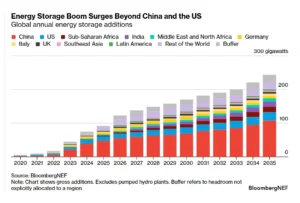

The global battery market is expanding at a record pace. According to BloombergNEF, annual battery demand could exceed 4,500 GWh by 2035, compared to around 950 GWh in 2024. Electric vehicles account for most of this growth, with stationary storage and grid applications contributing an increasing share.

China remains the largest producer, led by CATL and BYD, which together control over 50% of global battery supply. However, competition from South Korea and Japan is growing. Companies like Samsung SDI and Panasonic are investing billions in new factories in the U.S. and Europe.

The U.S. Inflation Reduction Act (IRA) has been a key driver of this shift. It provides tax credits for batteries and EVs made locally. This encourages foreign suppliers to set up production in North America. Samsung SDI is already building new facilities in Indiana and Tennessee, both of which could supply Tesla in the future.

Innovation at Full Voltage: From 4680 to Solid-State

The Tesla–Samsung deal aligns with broader trends in battery chemistry. Samsung SDI is working on high-nickel NCA and NCM cells. They are also looking at solid-state batteries. These batteries could offer better safety and higher energy density.

Tesla has focused heavily on innovation through its 4680 cells, designed to lower costs by 50% per kWh and improve vehicle range. However, scaling production has been challenging. By combining internal development with supplier deals, Tesla is able to stay flexible as battery technologies evolve.

Meanwhile, global research is exploring alternatives like lithium iron phosphate (LFP) for cost savings. It’s also looking into solid-state batteries for better performance in the future.

Analysts predict that commercial solid-state cells will enter mass production between 2028 and 2030. This timing matches Tesla’s future model plans.

The Broader Battery Market: Growth and Challenges

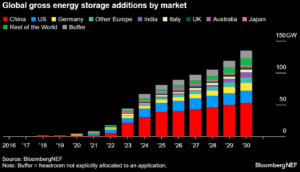

Battery storage has become central to the global clean energy transition. The International Energy Agency (IEA) says that installed battery capacity could jump from about 20 GW in 2020 to over 1,200 GW by 2030 in net-zero scenarios.

BloombergNEF expects 2025 to add 92 GW of new grid-scale storage. This shows how quickly the sector is growing. By 2030, global investment in batteries—across EVs, homes, and the grid—could exceed $1 trillion cumulatively.

Still, the industry faces several headwinds. Supply chain risks for critical minerals like lithium, nickel, and cobalt remain high. Recycling capacity also lags behind growing demand. Governments and automakers are now working to create closed-loop supply chains to recover metals and reduce environmental impacts.

In this landscape, Tesla’s influence remains large. The company’s early push for vertical integration—mining, refining, cell production, and energy storage—has set the pace for other automakers and battery firms.

Tesla’s Expanding Battery Network and Market Influence

Tesla’s collaboration with Samsung SDI is one of many major supply deals the company has formed in recent years. It has strong partnerships with Panasonic for 2170 cells and CATL for LFP batteries. These are used in Model 3 and Model Y vehicles in China.

In 2024, Tesla signed new deals with LG Energy Solution. These agreements provide more high-nickel cells. This supports Tesla’s expanding Megapack energy storage production in California.

Tesla’s global footprint in energy storage has also expanded sharply. The company’s Energy Generation and Storage division reported a 60% increase in deployment in 2024 than the previous year.

And as seen in the first chart above, it skyrocketed to over 40 GW in Q3 2025. Its Megapack systems are now used by utilities in the U.S., U.K., and Australia to stabilize power grids and support renewable integration.

Beyond its partnerships, Tesla plays a defining role in shaping global battery trends. Tesla’s Gigafactory in Nevada led the way in large-scale lithium-ion production. Meanwhile, the Texas and Berlin plants are placing Tesla at the heart of EV battery innovation in the West.

Tesla has driven scale, standardization, and efficiency. This helped make batteries cheaper for everyone. Pack prices dropped from about $1,100 per kWh in 2010 to under $140 in 2024, says BNEF.

As more nations set targets for carbon neutrality by 2050, battery demand will continue to surge. Tesla’s push to secure long-term supply through deals like the one with Samsung SDI ensures it remains a dominant force in this transformation.

The company’s reach goes beyond cars. It also impacts energy infrastructure, manufacturing systems, and the global clean energy economy.

Outlook: Securing Supply, Scaling Sustainability

If the $2.1 billion deal with Samsung SDI moves forward, Tesla will strengthen its supply resilience and technological edge. The agreement shows a bigger industry trend: Automakers are forming key partnerships because demand for EVs and storage batteries is rising fast.

Global energy storage capacity is expected to grow tenfold by the end of the decade. With battery innovation speeding up, Tesla’s strategy of multi-sourcing and co-developing advanced chemistries could be key to maintaining its leadership.

Whether through partnerships, in-house innovation, or scaling renewable energy integration, Tesla continues to help define the direction of the global battery industry.

The post Tesla (TSLA Stock) Sparks $2.1B Samsung Battery Deal as Global EV Demand Charges Ahead appeared first on Carbon Credits.