The world approaches COP30 in Belém, Brazil, and attention is on how countries will fund their climate commitments from the Paris Agreement. COP29’s Baku to Belém Roadmap aims for 1.3 trillion in climate finance. This goal is now the key challenge for global cooperation.

This editorial looks at how the new roadmap, Brazil’s Amazon summit, and growing carbon credit markets could change climate funding. These factors may help the world convert climate promises into actual capital.

COP29’s $1.3T Goal Sets the Stage for COP30

COP29 in Baku set a bold goal for climate finance. The aim is to boost funding for developing countries to at least $1.3 trillion annually by 2035.

The New Collective Quantified Goal (NCQG) and the “Baku to Belém Roadmap to 1.3T”, while not a binding report, prepare the world for COP30 in Belém, Brazil.

The roadmap was not intended to be a formal agreement under the UN climate negotiations. Instead, the two COP presidencies took the initiative to design a plan for expanding climate finance.

The Belém summit will see if political will, financial reform, and private capital can work together to meet this challenge. As stated in the roadmap:

“Scaling up climate finance has become a matter of necessity, not merely an enabler of ambition, as responding to climate change demands urgency, not incrementalism. The Roadmap is designed to serve as a basis and a force to accelerate implementation, transforming climate finance into a decisive instrument for securing a livable and just future.”

The Roadmap organizes actions into five “Rs”:

- Replenishing: Grants and concessional finance.

- Rebalancing: Debt and fiscal space.

- Rechanneling: Mobilizing private capital and lowering capital costs.

- Revamping: Capacity and coordination.

- Reshaping: Systems and structures for fair flows.

Reaching 1.3T needs public funding and private innovation. They must work together to change how global finance addresses climate priorities.

The Race to Close the Climate Finance Gap

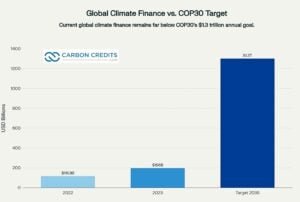

The gap between what’s available and what’s needed remains vast. In 2023, international climate finance for developing economies reached about $196 billion, based on Climate Policy Initiative (CPI) data. This amount is less than one-sixth of what is needed by 2035 for global climate finance.

OECD data shows that developed countries gave $115.9 billion in 2022. This met the old $100 billion target, but it highlights how much bigger the new goal is.

In 2024, global losses from climate-related disasters reached $320 billion. At the same time, many vulnerable nations face rising debt and interest payments, limiting their fiscal space. The math is clear: without big changes to the financial system and better teamwork, climate finance will stay far behind climate risk.

Brazil’s COP30: A Symbol for Global Climate Justice

Hosting COP30 in Belém, Brazil, places the Amazon — one of the planet’s largest carbon sinks — at the center of global diplomacy. Brazil’s presidency seeks to close the gap between rich and poor nations. It focuses on equity, adaptation, and resilience finance.

The Baku to Belém Roadmap highlights that concessional and grant-based resources should focus on the most vulnerable countries. This includes Least Developed Countries (LDCs) and Small Island Developing States (SIDS).

For Brazil, this is a chance to showcase how protecting rainforests and empowering Indigenous communities can align with financial support. This approach leads to clear climate benefits.

Can Carbon Markets Help Unlock the $1.3 Trillion?

Carbon markets, both compliance and voluntary, are positioned to play a growing role in achieving the 1.3T aspiration. COP29 improved rules under Article 6 of the Paris Agreement. This helps clarify how international carbon trading works. This clarity could unlock cross-border credit transfers and boost investor confidence.

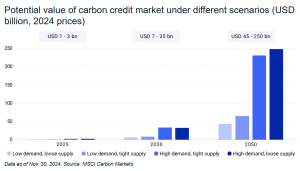

The voluntary carbon market (VCM), meanwhile, continues to evolve toward higher standards of transparency and integrity. Market trackers say the VCM was worth $2 billion in 2024. It could grow five times by 2030 if credibility and regulation improve.

Demand is increasing for high-quality nature-based and tech-driven credits. This is especially true for carbon credits that align with the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCMI).

However, scaling carbon markets must come with safeguards. Without strong integrity standards, carbon finance risks eroding trust rather than building it. COP30 is a chance to make sure carbon credit mechanisms support, not replace, concessional and adaptation finance.

Fixing the Financial Architecture: Debt, MDBs, and Risk Reduction

Many developing countries face a debt crisis that constrains their ability to fund climate projects. In 2023, external debt servicing in these economies hit $1.7 trillion. Many countries now pay more in interest than they do on health or education.

The Roadmap’s “Rebalancing” pillar encourages debt-for-climate swaps. It also supports climate-resilient debt clauses and wider fiscal reforms. These efforts aim to free up resources for sustainable investment.

Multilateral development banks (MDBs) are central to this effort. The Roadmap Toward Better, Bigger, and More Effective MDBs urges reforms. These reforms should boost lending capacity by optimizing balance sheets and recognizing callable capital.

If MDBs boost annual climate lending to around $390 billion by 2030, they could lower financing costs. This would benefit clean energy, adaptation, and just transitions in emerging markets.

What COP30 Needs to Deliver in Belém

To make the 1.3T goal credible, COP30 has to turn ambition into measurable actions:

- Clear replenishment schedules for the Green Climate Fund, Adaptation Fund, and Loss and Damage Fund.

- Time-bound MDB reform commitments, ensuring faster disbursement and lower borrowing costs.

- Robust global standards for carbon markets, ensuring high-integrity credits that benefit local communities.

- Debt relief and fiscal instruments that release capital for climate resilience and clean energy investments.

Each of these outcomes is politically difficult, but technically achievable. The test is whether governments, banks, and private investors can work together. They need to join forces, not act alone, to speed up climate action on a large scale.

Turning Climate Finance Into Climate Action

The Baku to Belém Roadmap, though not binding, is a technical manual for turning pledges into measurable flows. It recognizes that climate action needs more than just public funds or donations. Private investment, carbon markets, and multilateral reform must all work together.

For carbon credit developers, investors, and policymakers, the coming year offers a pivotal moment. COP30 can connect policy goals with financial action. It can reshape how global capital helps us reach a net-zero, climate-resilient future.

Belém is not only another stop on the UN climate calendar. It could also show that climate finance can finally meet the scale of the climate challenge.

- FURTHER READING: Key Takeaways from Bonn’s Climate Talks Ahead of COP30

The post From Baku to Belém: Can COP30 Deliver the $1.3 Trillion Climate Finance Pledge? appeared first on Carbon Credits.