Happy Monday!

As COP30 gets underway, we’re widening the lens on globalization to explore how climate, capital, and collaboration are redrawing the global energy map. Sightline’s new report, Globalization in Climate Tech (in partnership with HSBC), launches tomorrow, Tuesday, November 11. Join our webinar for a closer look at the data and trends behind this shift. 👉 Sign up here.

In this issue, we’re focused on the EU’s new 2040 emissions plans, launched ahead of COP30. (Tomorrow, when our Globalization in Climate Tech report goes live, we’ll have even more insights on how the transition is taking shape worldwide in the coming days and weeks.)

In deals, $954 for battery storage across 3 deals, $700m for rare earth across two deals, and $347m for sustainable construction.

In other news, on the signature UN emissions report, the EU’s low-carbon fuel plan, and electricity affordability on US Election Day.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

From Green Deal to gray area

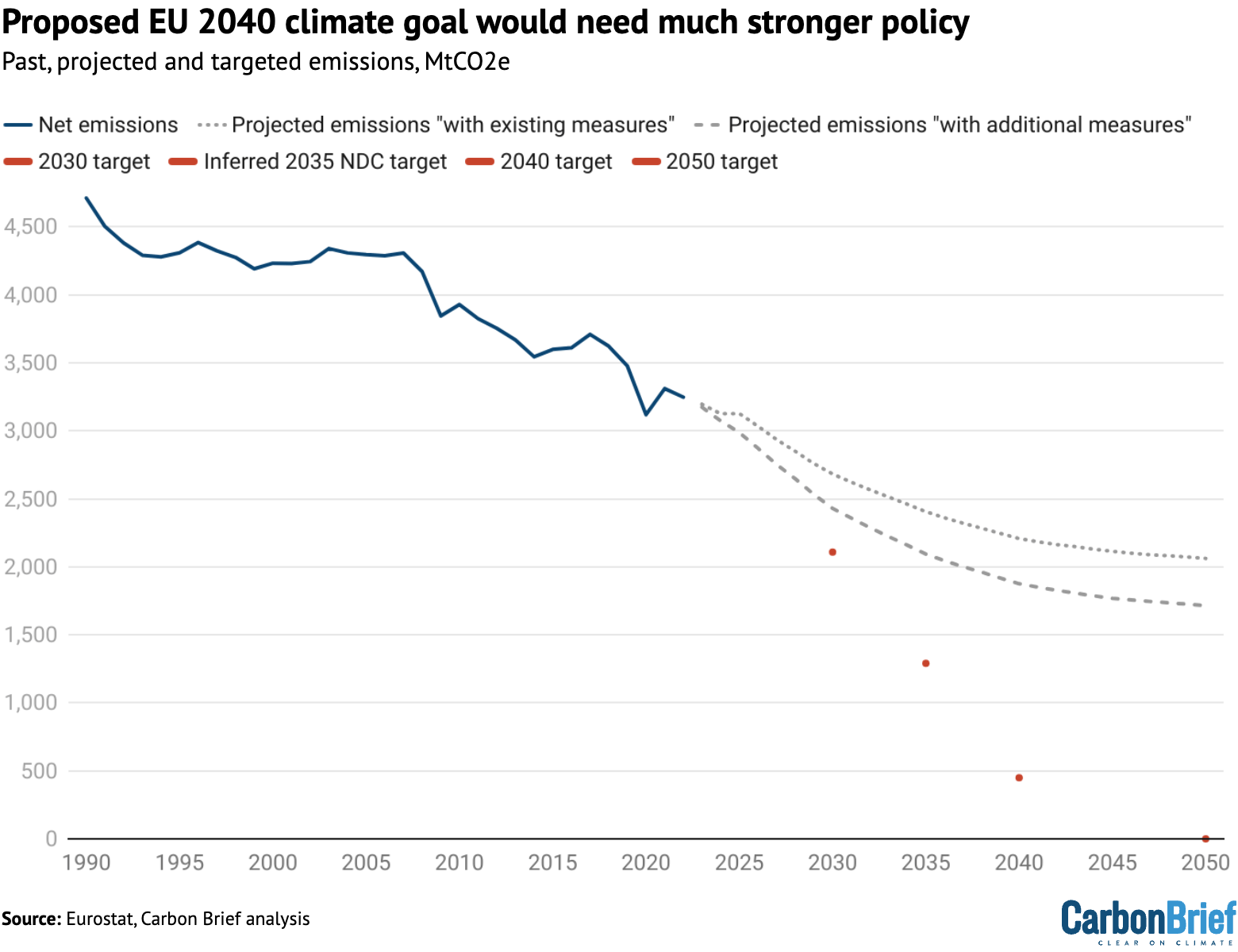

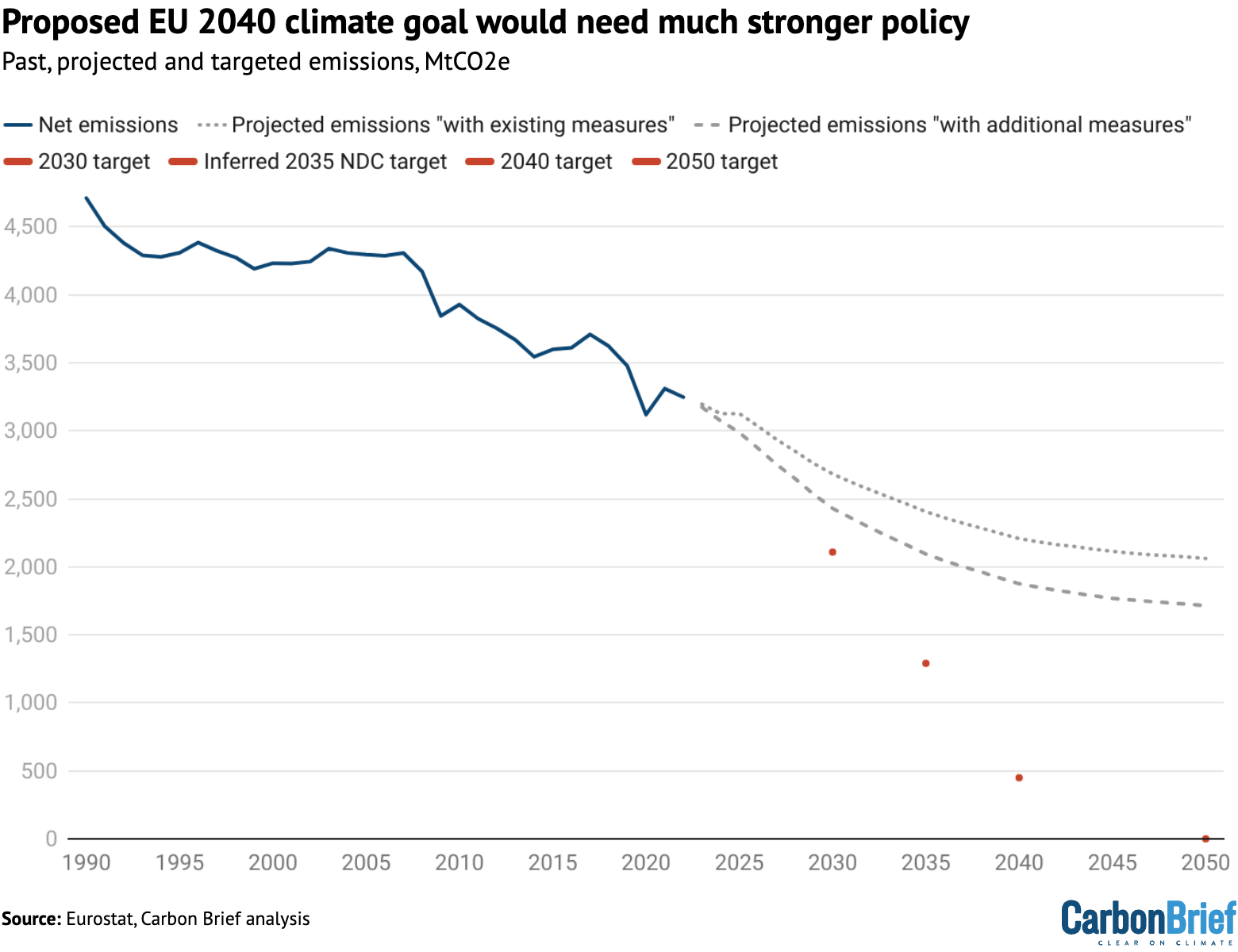

As COP30 opens in Brazil, the EU is arriving with a new and more flexible climate plan. European ministers last week approved a 90% emissions-cut target for 2040 versus 1990 levels, but built in enough wiggle room to soften it to 85% (and potentially even lower). With the US stepping back, pressure shifts to Europe, now caught between green goals and growth anxieties.

What happened

In the lead-up to COP30, the UN asked governments to submit updated 2035 climate plans under the Paris Agreement. The EU slid its proposal just in under the wire last week, after months of negotiation and a tense all-day session among environment ministers on Tuesday.

The plan doubled down on its 2035 nationally determined contribution (NDC) to reduce emissions by 66.25-72.5% from 1990 levels, and also affirmed its headline goal to cut emissions 90% by 2040 from 1990 levels. But the 2040 plan builds in new “flexibilities” aimed at shielding industry and preserving competitiveness:

- Offsets: Countries can use “high-quality international carbon credits” for up to 5% of 1990 emissions, effectively lowering required domestic cuts to 85%. A pilot phase could run from 2031–2035, with possible expansion after 2036. (Credits must qualify under the UN’s Article 6.)

- Carbon removals: From 2030, “domestic permanent removals,” such as DACCS and BECCS projects storing CO2 within the EU, can offset hard-to-abate emissions under the EU ETS.

- ETS2 delay: The carbon market for buildings and road transport will launch in 2028, one year later than planned.

- Cross-sector flexibility and reviews: Member states can shift emissions cuts among sectors to stay cost-efficient. The plan will be reviewed every two years to adjust targets based on energy prices, technology costs, and industrial competitiveness.

This plan is the EU’s bridge between its legally binding 55% cut by 2030 and net-zero goal by 2050. But critics fear the new flexibilities leave it off-track, as the proposal now heads to the European Parliament, where lawmakers will vote on the final law. (The committee is also voting on potential amendments to sustainability disclosure statutes, CSRD and CSDDD, this week.)

Why it matters

The last-minute deal means the EU won’t show up to COP30 empty-handed, but it’s not offering the leadership the climate community hoped for. With the US skipping a federal COP delegation and pushing back on EU disclosure rules like CSRD and CSDDD, many hoped Brussels would carry the mantle of climate ambition.

Instead, the new 2040 plan reflects a pragmatic turn: offsets, review clauses, and delayed carbon pricing all point to competitiveness taking priority over climate purity. Letting countries use carbon credits to meet their national targets, though controversial, aligns with what corporates already do under SBTi-aligned net-zero pledges.

That balance reflects Europe’s political mood. The bloc is split between its climate goals and a push to reindustrialize amid high energy prices and populist pressure. Poland, Slovakia, and Hungary opposed the 2040 target, warning it would hit heavy industry, but could not block it.

That tension mirrors a global one. COP30 host President Lula da Silva has branded this the “COP of truth.” His dual agenda, cracking down on deforestation while expanding oil production, reflects the same dilemma facing Europe: how to fund a green transition when capital is scarce and politics are fragile.

Those trade-offs could ripple through the market:

🟢 Winners

- Carbon markets & MRV tech: Offsets are back in play. Letting up to 10% of EU reductions come from foreign credits reopens a multibillion-euro demand channel for verified carbon offsets, plus MRV software, satellite verification, and registries ensuring integrity across voluntary and compliance markets.

- ESG & data infrastructure: Streamlining CSRD and CSDDD rules cools the old compliance boom but clears room for smarter tools. A new wave of AI-driven disclosure and audit tech could emerge, focused on investor-grade transparency instead of regulatory checklists.

- Adaptation & resilience: COP30’s focus on closing the $284–339bn annual adaptation-finance gap could channel capital into water systems, ag-tech, and climate-risk analytics, especially as developing nations press for the $300bn-per-year climate finance floor promised in last year’s Baku-to-Belém roadmap. Platforms that quantify adaptation outcomes for financiers could benefit.

🟡 Toss-ups

- Industrial decarbonization & energy tech: Heavy industry remains under the main ETS and CBAM regime. Steel, cement, and aluminum still face tightening caps and the phase-out of free allowances, keeping a price signal in place. But the weaker overall ambition softens the policy momentum behind new buildout, possibly slowing investment in hydrogen, CCUS, and industrial retrofits that depend on long-term carbon price clarity. Still, grid, storage, and renewables integration stay afloat through national programs.

🔴 Losers

- Climate credibility? Europe keeps its seat at the climate leadership table, but with less leverage. The optics next to Brazil’s COP agenda, the “oil-plus-forest” model, using fossil revenues to bankroll renewables, aren’t great, as climate impacts accelerate around the world, especially in the Global South.

Key takeaways

- Offsets return as a market and credibility test. Allowing up to 10% of cuts through foreign carbon credits revitalizes carbon markets that have been lagging. But offsets can turn policy into accounting and bring up old integrity debates: who verifies what, and whether buying cuts abroad counts as progress at home.

- Markets move faster than policy. As policy ambition softens, capital is already shifting toward what’s bankable: mature renewables, cost-effective grid infrastructure, AI-driven software plays. Climate action isn’t driven by regulation alone anymore.

- Climate ambition meets economic reality. The EU’s 2040 deal keeps Europe in the game, just playing defense. A 90% goal with 85% execution captures a wider shift among governments: energy security first, climate second.

Want to learn more about the state of climate tech in the EU? Stay tuned for our upcoming Globalization in Climate Tech Report and webinar, featuring fresh data on investment flows, policy trends, emerging innovation hubs, and more.

Deals of the Week (11/3-11/10)

Late-Stage / Growth

⚡ Goldi Solar, a Surat, India-based solar PV module manufacturer, raised $161m in Growth funding from Havells India, Ambit Global Private Client, Godwitt Construction, Karmav Real Estate Holdings, NSFO Ventures, and other investors.

⚡ Infravision, an Austin, TX-based drone-enabled power line upgrade provider, raised $91m in Series B funding from GIC, Activate Capital Partners, Energy Impact Partners, and Hitachi Ventures.

🛵 Upway, a Gennevilliers, France-based e-bike refurbisher, raised $60m in Series C funding from A.P. Moller Holding, Galvanize Climate Solutions, Ora Global, and Sequoia Capital.

🥩 The EVERY Company, a Daly City, CA-based fermentation-based alt-protein developer, raised $55m in Series D funding from McWin Capital Partners, Grosvenor Food & AgTech, Main Sequence Ventures, SOSV, TO VC and other investors.

⚡ Berkeley Energy Commercial Industrial Solutions (BECIS), a Singapore-based distributed energy solutions provider, raised $45m in Growth funding from KLP Norfund Investments and Siemens Financial Services.

🌾 Source.ag, an Amsterdam, Netherlands-based AI greenhouse developer, raised $17m in Series B funding from Astanor Ventures, Enza Zaden, and Harvest House.

🐄 nextProtein, a Paris, France-based insect-based animal feed producer, raised $16m in Series B funding from Swen Capital Partners, British International Investment (BII), Mirova, and RAISE Impact.

Early-Stage

🧪 Synonym Biotechnologies, a Queens, NY-based biomanufacturing scale-up and facility matchmaking platform, raised $20m in Series A funding from GS Futures.

🚢 Hullbot, a Sydney, Australia-based autonomous ship hull cleaning service provider, raised $16m in Series A funding from Regeneration.vc, Artesian VC, Bandera Capital, Climate Tech Partners, Impact Ventures, and other investors.

🚗 Tsuyo, a New Delhi, India‑based EV powertrain manufacturer, raised $5 m in Seed funding from Avaana Capital

🔋 Flux XII, a Madison, WI‑based flowbattery developer, raised $4m in Seed funding from Grantham Foundation, Desai Ventures, Wisconsin Alumni Research Foundation (WARF), and gener8tor.

💧 Mimbly, a Göteborg, Sweden‑based water-saving laundry solutions developer, raised $4 m in Series A funding from Almi Invest GreenTech, Electrolux Professional Group, and Länsförsäkringar.

♻️ DREV, a Göteborg, Sweden‑based industrial battery materials recycler, raised $3 m in Seed funding from Almi Invest GreenTech, Battle Born Ventures, Butterfly Ventures, and SEB.

⚡ Sawa Energy, a Kigali, Rwanda‑based solar‑and‑energy‑storage‑solutions developer, raised $3m in Seed funding from EDFI ElectriFI.

☀️ Struck, an Amsterdam, Netherlands‑based AI‑powered construction compliance software, raised $2m in Seed funding from Value Factory Ventures and Antler.

☀️ Cambridge Photon Technology, a Cambridge, OH‑based developer of advanced materials for solar panel efficiency, raised $2m in Seed funding from Cambridge Enterprise Ventures, Innovate UK, Providence Investment Company, Spectrum Impact, and Tybourne Capital Management.

Other

⚒️ Vulcan Elements, a Durham, NC-based rare earth magnets manufacturer, raised $620m in Debt funding from US Department of Defense (DoD).

🔋 Baltic Storage Platform, a Kuressaare, Estonia-based high-performance battery storage operator, raised $496m in PF Debt funding from Edmond de Rothschild Asset Management, European Bank for Reconstruction and Development, and Nordic Investment Bank (NIB).

🔋 Akaysha Energy, a Melbourne, Australia-based battery energy storage systems developer, raised $298m in PF Debt funding from BNP Paribas, CIBC, Commonwealth Bank of Australia, ING Group, MUFG Bank, Mizuho Bank, SMBC Venture Capital, and Société Générale.

🧱 Molins, a Sant Vicenç dels Horts, Spain-based sustainable construction solutions provider, raised $347m in Debt funding from CaixaBank, BBVA, Banco Sabadell, Banco Santander Smart Fund, HSBC, and Intesa Sanpaolo Bank Romania.

🔋 Plus Power, a San Francisco, CA-based battery energy storage system developer, raised $160m in PF Tax Equity funding from Morgan Stanley for two projects.

⚡ Enlight Renewable Energy, a Tel Aviv, Israel-based renewable energy developer, raised $150m in PF Tax Equity funding from Wells Fargo.

💨 Frontier Infrastructure Holdings, a Dallas, TX-based carbon management infrastructure developer, raised $130m in Debt funding from Kennedy Lewis Investment Management.

🌳 Holmen, a Norrköping, Sweden-based forest-based renewable products producer, raised $115m in Debt funding from European Investment Bank (EIB).

🔋 ReElement Technologies, a Fishers, IN-based recycler of rare earths and battery metals, raised $80m in Debt funding from US Department of Defense (DoD).

⚡ LanzaTech, a Skokie, IL-based syngas/biogas carbon recycler, raised $46m in Grant funding from the European Union.

Exits

🏠 Tectus, a Munich, Germany‑based industrial roofing and rooftop solar company, was acquired by Dach Energiezukunft (DEZ) for an undisclosed amount.

🌾 GWE Biogas, a Driffield, England‑based food‑waste‑to‑biogas and electricity producer, was acquired by EDL Energy for an undisclosed amount.

♻️ Geo Impex, a Tbilisi, Georgia‑based global e‑waste export and processing service provider, was acquired by ConnectM Technology Solutions for an undisclosed amount.

🏭 ElectraTherm, a Flowery Branch, CA‑based waste‑heat‑recovery technology provider, was acquired by BITZER for an undisclosed amount.

🔋 Amperics, a Livermore, KY‑based emergency‑battery‑charger manufacturer, was acquired by ConnectM Technology Solutions for an undisclosed amount.

New Funds

💰 Rubio Impact Ventures, an Amsterdam, Netherlands‑based impact venture firm, raised $80m in commitments for Rubio Fund III, targeting 30 companies focused on scalable solutions in climate, circularity, education and well‑being.

💰 Tikehau Capital, a Paris, France‑based alternative asset manager, announced $603m for its close of Regenerative Agriculture Strategy fund, targeting sustainable food systems and soil health.

This is a sample of the deals available for Sightline Climate clients. Can’t get enough deals?

In the News

Newly released UNEP Emissions Gap Report 2025 shows global warming projections this century are 2.3–2.5°C if NDCs are fully implemented, but under current policies, warming is higher at 2.8°C. Both predictions are lower than last year’s estimates of 2.6–2.8°C and 3.1°C, respectively, with new climate pledges accounting for the reduction. To meet Paris Agreement goals, annual emissions must fall 35–55% below 2019 levels by 2035, but only one-third of countries have submitted new climate plans, and some major emitters, like Russia and Turkey, have pledged less ambitious cuts than their current policies would already achieve.

With electricity affordability back in the national spotlight, Election Day delivered a clear message: energy policy is once again pocketbook politics. Democrats used affordability as a campaign anchor, promising to hold the line on utility bills and present climate action as cost control (power prices also swung California’s early-2000s recall of Governor Gray Davis, who was replaced by Arnold Schwarzenegger). Last week, in New Jersey, Mikie Sherrill’s decisive win reflected that shift. In New York City, mayor-elect Zohran Mamdani built his platform around the idea that climate goals quietly align with everyday savings via school retrofits, affordable housing, and free public transit. In Illinois, lawmakers passed the Clean and Reliable Grid Affordability Act, focused on large-scale short-duration battery storage and grid modernization to rein in rising power costs.

The European Commission has unveiled the Sustainable Transport Investment Plan to accelerate the adoption of renewable and low-carbon fuels in aviation and waterborne transport, aiming to produce 20m tonnes of sustainable fuels by 2035, requiring an estimated $115 bn in investments. In the short term, the plan will mobilize at least $3.35 bn through measures including $2.31 bn from InvestEU, $345m for hydrogen production via the European Hydrogen Bank, and $1.1bn for synthetic aviation and maritime fuel projects under the Innovation Fund and eSAF pilot initiatives.

The $23bn Simandou iron ore project in Guinea, backed by Rio Tinto, China’s Chalco, and Singapore’s Winning Consortium, is set to become Africa’s largest mine, with first shipments to China expected this year. A new 600km railway will carry up to 60m tons of ore annually, about 5% of global output. Simandou is set to strengthen China’s control over the metals (like iron ore) and infrastructure driving the energy transition.

Orsted has put development of its Hornsea 4 offshore wind project back on track after selling a 50% stake in the under-construction Hornsea 3 project for $6.5bn, following a $9.4bn rights issue. With a total project cost of $13bn for a 2.9 GW system, the project sits at the higher end of typical offshore wind costs, but Orsted expects returns of roughly £90–100/MW annually, above its £78.27/MW Contract for Difference (CfD) rate, in a positive signal for the sector.

Pop-up

Tyler Norris’ NYT op-ed on data center flexibility, and the data center pilot project trying it.

And Arushi Sharma Frank’s similar proposal for Texas for data centers to be good grid citizens.

But Ohio says no to data centers – officially.

Free electricity down unda’, thanks to a solar boom.

Shoot for the stars: Google aims to beam AI into orbit, and turning waste to watts as it goes carbon-negative in Brazil.

MBARI’s new underwater tech shows ocean carbon storage in real time.

Mazda’s new concept car inhales its own exhaust!

Could solar farms be an unlikely savior of bumblebees?

Sharks don’t just swim in schools – they follow equations, too.

Opportunities & Events

📅 Everything you need to know about Bridge Rounds: Join Enduring Planet & Friends for a candid, founder-focused discussion on what investors actually want to see in a Bridge, happening over Zoom on Thursday, November 20th, 1:00–2:30 PM EDT.

📅 Climate Happy Hour: Join Women and Climate at their happy hour in Houston, TX on Thursday, November 13, 6:00 PM – 8:00 PM CST for a chance to make new friends and chat about all topics climate.

Jobs

Principal co-entrepreneur @Visionaries Club

Strategy & Finance @Arbor

Regional Reporter @Grist

DevOps Engineer @Inspiration Mobility

Analyst Investment Operations @Blue Earth Capital

Analyst Marketing & Client Support @Blue Earth Capital

Enterprise Account Executive @Pano AI

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!