Gevo, Inc. (NASDAQ: GEVO) delivered a major earnings surprise for the third quarter of 2025, posting results that exceeded Wall Street expectations and highlighted a sharp turnaround in its financial performance.

Record Revenue Growth and Strong Financial Recovery

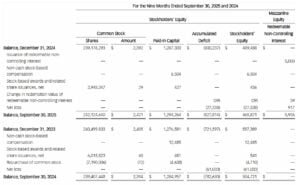

For Q3 2025, Gevo reported revenues of $43.6 million, far above analyst forecasts of $37.03 million, and a dramatic increase from about $2 million during the same period last year. The company’s earnings per share (EPS) came in at a loss of $0.03, beating the expected loss of $0.04.

Most notably, Gevo achieved a positive adjusted EBITDA of $6.7 million, marking its second consecutive quarter of profitability. This was a major improvement compared to a loss of $16.7 million a year ago, reflecting improving operational efficiency and higher cash flow from its facilities.

The company ended the quarter with $108 million in cash, ensuring a strong liquidity position as it continues investing in growth projects.

North Dakota Facility Powers Carbon and Ethanol Gains

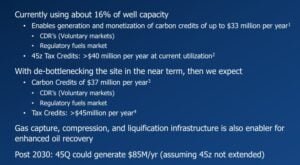

Gevo’s North Dakota operations were the cornerstone of its quarterly success, contributing $12.3 million in operational income. This performance was driven by efficient low-carbon ethanol production, carbon sequestration, and robust sales of clean fuel and voluntary carbon credits.

During the quarter, the site achieved several operational milestones:

- Produced 17 million gallons of low-carbon ethanol

- Generated 46,000 tons of protein and corn oil co-products

- Sequestered 42,000 tons of carbon dioxide

- Produced 92,000 MMBtu of renewable natural gas (RNG)

Gevo’s Carbon Capture and Sequestration (CCS) system has now stored over 560,000 metric tons of CO₂ since its launch in June 2022, making it the world’s first ethanol dry mill to achieve commercial-scale carbon storage.

The company also capitalized on Section 45Z Clean Fuel Production Credits (CFPCs), selling all its remaining 2025 credits worth $30 million, bringing total CFPC sales for the year to $52 million. This reflects Gevo’s ability to monetize carbon-linked incentives effectively.

Carbon Credit Expansion Strengthens Revenue Mix

Gevo is rapidly scaling its carbon revenue streams. In Q3 2025, the company signed a multi-year offtake agreement expected to generate around $26 million in Carbon Dioxide Removal (CDR) credit sales over five years, with the potential to increase volumes.

By the end of 2025, Gevo expects carbon co-product sales to grow to $3–5 million, up from $1 million in Q2. The company projects that long-term annual carbon revenues could exceed $30 million as it optimizes its carbon accounting and trading systems.

Gevo’s carbon credits are certified under the Puro.Earth standard, ensuring over 1,000 years of permanence, among the most durable forms of carbon removal on the market. Its customers include Nasdaq and Biorecro, signaling growing confidence from corporate buyers in Gevo’s durable carbon removal capabilities.

This dual-income approach, combining low-carbon fuel sales with carbon credit monetization, strengthens Gevo’s position in both the voluntary and compliance carbon markets.

Strategic Focus on Sustainable Aviation Fuel (SAF)

Sustainable Aviation Fuel (SAF) is the main pillar of Gevo’s long-term strategy. Through its proprietary Alcohol-to-Jet (ATJ) technology, the company converts renewable ethanol into low-carbon jet fuel, helping airlines decarbonize air travel.

Gevo plans a Final Investment Decision (FID) by mid-2026 for its upcoming ATJ-30 plant, a project designed to scale synthetic SAF production at its North Dakota site. Once completed, the plant could play a central role in meeting the aviation sector’s growing SAF demand.

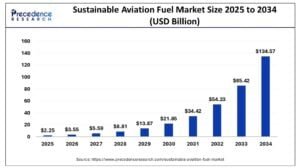

SAF Market Forecast

The global SAF market is expanding rapidly. In 2025, the market was valued at about $2.25 billion but is forecasted to soar to $134.57 billion by 2034, growing at a CAGR of over 57 percent, according to industry estimates. This surge is driven by regulatory mandates, green aviation goals, and policies like the U.S. Inflation Reduction Act and the EU’s ReFuelEU Aviation Initiative.

Gevo’s integrated approach linking SAF production, ethanol output, and carbon monetization aligns perfectly with the industry’s transition toward net-zero aviation. As the company scales ethanol production to 75 million gallons annually, it expects a substantial boost in SAF output and carbon credit revenues.

Carbon Capture and Policy Incentives Drive Future Growth

The company capitalizes on the intersection of clean fuel policy, carbon markets, and technology innovation. By sequestering carbon at its ethanol facilities, the company captures and sells verified carbon credits while also producing renewable fuels that qualify for federal incentives.

With growing policy support and rising carbon prices, Gevo is positioned to benefit from both market-based carbon trading and tax credit monetization. The Section 45Z clean fuel credits, in particular, provide strong financial incentives that enhance the company’s margins and encourage further expansion.

As governments tighten emission standards and airlines commit to net-zero targets by 2050, the demand for SAF and durable carbon credits will continue to rise. Gevo’s technology and operations are built to meet this challenge while maintaining commercial viability.

Investor Confidence and Stock Performance

Following its strong Q3 2025 results, Gevo’s stock rose over 4 percent in after-hours trading, reflecting investor confidence in the company’s growth trajectory. The stock trades around $2.12 per share with a market capitalization of about $513 million.

Investors are increasingly viewing Gevo as a clean-energy growth stock, citing:

- Consistent revenue growth and improving EBITDA margins

- Clear strategic direction toward SAF and carbon capture

- Effective monetization of clean fuel tax credits and carbon offsets

The company’s solid balance sheet, strong policy tailwinds, and successful operational execution position it favorably within the renewable hydrocarbon fuels market.

Gevo’s Role in the Green Aviation Future

The aviation sector targets a 65% reduction in emissions through SAF by 2050. And companies like Gevo will play a critical role in meeting that goal. Its ATJ technology, carbon sequestration systems, and integration with carbon markets make it one of the few clean fuel developers with a fully circular carbon strategy.

Significantly, its North Dakota operations serve as a blueprint for carbon-negative fuel production, proving that decarbonization and profitability can coexist. With expansion plans for 2026 and beyond, the company is well-positioned to scale both its fuel and carbon businesses.

The post Gevo’s Q3 2025 Earnings Fuel Optimism for Its SAF and Carbon Credit Growth Strategy appeared first on Carbon Credits.