The 30th United Nations Climate Change Conference (COP30) opened yesterday in Belém, Brazil. From the start, the message was clear: climate change is happening now, and solutions must follow. Nearly 200 countries gathered to turn promises into results. The formal agenda was adopted quickly, which signals a move away from long debates and toward implementation.

President Lula remarked during the summit’s opening:

“We are moving in the right direction, but at the wrong speed…This COP must be remembered as the COP of Action — a conference that turns commitments into results. It is time to integrate climate, economy, and development, creating jobs, reducing inequalities, and strengthening trust among nations.”

Adaptation and Resilience: Real Stories, Real Need

On the first day, adaptation and resilience took center stage. Many communities around the world are already dealing with floods, heat waves, droughts, and storms. At COP30, developing nations stressed they can’t wait for future help. They need infrastructure, early warning systems, and solid support now.

For example, Brazil is using the summit to elevate adaptation as an investor-ready field. A report shows that every dollar spent on resilience can produce up to four dollars in benefits.

The summit’s agenda includes projects such as climate-smart agriculture, restoring mangroves, and strengthening infrastructure. These are not just ideas—they are proven “best buys” in food, water, health, nature, and infrastructure.

RAIZ is a global program aimed at restoring degraded farmland. It also helps strengthen agriculture in vulnerable areas. The aim is to turn land that once produced little into productive, climate-resilient farmland. Such a project tackles food security, livelihoods, and climate risk all at once.

These stories show that adaptation is urgent. The challenge will be making sure the promised funds arrive and that they reach the people and communities who need them most.

Innovation and Technology: Tools for Change

Technology and innovation were also prominent on Day 1. Countries and organizations discussed digital platforms, AI tools, satellite monitoring, and data systems. They aim to measure and track climate action better.

During a showcase at COP30, an agricultural innovation package was launched to help millions of farmers. The package includes an open-source AI model to support farmers in vulnerable regions. This shows how technology can empower local communities—not just big cities or corporations.

These tools matter for carbon credit markets, too. Accurate tracking, measurement, and verification of emissions reductions depend on strong data systems. For companies and project developers in carbon markets, good tech means more confidence that credits represent real change.

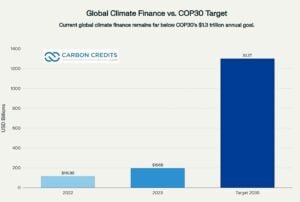

The $1.3 Trillion Question: Who Pays for Climate Action?

Financing remains one of the biggest obstacles. On this first day, many developing nations made it clear: they need more money to adapt and reduce emissions. But the structure of responsibilities came into the spotlight as well.

Major emitters such as the United States, China, and India sent lower‐level representation to COP30. These three countries together account for nearly half of global emissions. Fewer resources mean climate finance might weigh more on other areas, especially Europe and vulnerable nations.

Before COP30, Brazil and finance ministers suggested a plan. This roadmap aims to boost global climate finance to about US$1.3 trillion each year. This is a huge sum compared to current flows. It aims to mobilize grants, private capital, bank reform, and new financing models. The question now is: will the money show up at scale and quickly?

For the carbon markets and ESG community, finance connects directly to credibility. Without enough money for adaptation projects, carbon credit systems, and technology, strong markets may not succeed.

Carbon Markets Under Pressure: A Vital Story

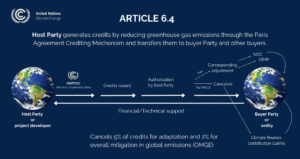

A central thread for ESG and carbon market watchers at COP30 is the state of the carbon crediting mechanism under the Paris Agreement (Article 6.4). This mechanism allows projects to generate credits for verified emissions reductions, which countries or companies can use. But the system faces headwinds.

Here are the key facts:

- The Supervisory Body reported a funding shortfall of around US$13 million this year.

- Rules on the following are in place—but the supply pipeline remains uncertain.

- Baseline: What was the starting point?

- Additionality: Did the project occur because of the credit?

- Leakage: Did emissions just shift elsewhere?

- Permanence: Will the reduction last?)

- Because major emitters have not fully committed to using such credits yet, demand and clarity are still developing.

In Brazil’s home terrain, big tech and carbon credit developers are already active. For example, a Brazilian startup working on reforestation is supplying credits to major tech firms. Buyers are willing to pay higher prices for what they believe are higher-quality credits. But they warn that there are still many projects of ambiguous quality.

For companies using carbon credits as part of their ESG strategy, these issues matter. If credit supply is slow or credibility is questioned, companies may find fewer, higher-cost options. Investors and project developers will watch for who steps in to fill the funding gap, how supply scales, and whether credible markets emerge.

Missing Voices, Shifting Power

Day 1 also highlighted a significant challenge: participation gaps. When countries responsible for large shares of global emissions send lower-level delegations, it raises questions about global cooperation and the scale of the response.

For example, the U.S., China, and India—the biggest three—sent less senior representation to COP30. Observers say this leaves a leadership vacuum and puts more burden on others to carry the financing, negotiation, and implementation load. One commentator said COP30 may risk becoming “a global ATM” for climate finance if coordination doesn’t improve.

For carbon markets, the risk is fragmentation. If different regions adopt different rules, or if major emitters operate outside emerging frameworks, companies may face divergent standards, higher costs, or regulatory risks.

A unified market helps lower transaction costs, boosts liquidity, and builds trust. Day 1 showed that building that unity is still a work in progress.

What to Watch in the Days Ahead

As COP30 unfolds, several signals will matter for ESG, carbon markets, and climate action:

- Will there be concrete pledges to fill the funding gap for the Article 6.4 mechanism? Will donors and countries commit more funds so credit supply can scale?

- Will major emitters increase their engagement, or remain at arm’s length? The level of their participation will shape both cooperation and market confidence.

- Will adaptation finance be connected with market-based solutions (for example, nature-based carbon credits, forest protection, regenerative agriculture)? A good sign would be projects where adaptation, resilience, and mitigation align.

- Will new platforms or coalitions for linked carbon markets emerge? For example, proposals from Brazil talk about connecting national carbon systems into a global “Open Coalition for Carbon Market Integration.” If that gains traction, it could boost market scale.

- Will technology and data systems be scaled across developing countries so they can participate in carbon markets, track progress, and report credibly? Without that, the markets remain narrow and less credible.

Day 1 of COP30 in Belém brought strong signals. The world is shifting from talk toward implementation. Adaptation, resilience, technology, finance, and carbon markets all featured prominently.

Yet, the challenges remain. Participation gaps, funding shortfalls, market uncertainty, and divergent standards all pose risks. For ESG professionals, project developers, and investors, the message is clear: the summit’s value will be judged by whether systems, markets, and finance begin to deliver, not just whether pledges are made.

COP30 may mark a turning point, but it will succeed only if what is announced today becomes action tomorrow.

The post COP30 Begins with a Call for Delivery, with Carbon Credit Rules Taking Shape appeared first on Carbon Credits.