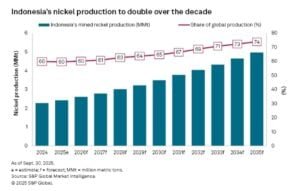

Indonesia has slashed its national nickel mining quota by 120 million tons for 2025. The country’s permitted production will drop from 272 million tons in 2024 to just 150 million tons. As the world’s top nickel producer, responsible for over 56% of global mined nickel, Indonesia’s move immediately shakes global supply chains. The policy also affects carbon markets tied to battery and industrial metals.

The Ministry of Energy and Mineral Resources says the reduction aims to preserve long-term resources and promote environmentally sustainable processing. But the decision carries wider consequences for downstream industries, international buyers, and global nickel pricing.

Why Indonesia Cut the Nickel Quota

Officials cited multiple reasons. First, the government wants to prevent over-extraction and protect strategic reserves. Second, it aims to shift from raw ore exports to higher-value products like nickel matte and Mixed Hydroxide Precipitate (MHP). These processed materials bring more revenue and support the booming electric vehicle (EV) battery sector.

Environmental concerns also played a role. Authorities want stricter compliance with ecological rules to limit habitat loss, water contamination, and other mining impacts. Miners must now meet tighter standards, or their quotas may be reduced further. Mining plan approvals, previously multi-year, are now reviewed annually, increasing regulatory oversight.

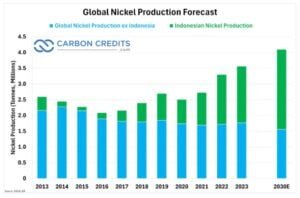

Historically, Indonesia’s quota ranged from 200 to 272 million tons. The 44% reduction in 2025 is unprecedented. However, S&P Global noted that, “Indonesia is still projected to more than double its production over the next decade to an estimated 4.97 MMt by 2035.“

Analysts expect it will address oversupply issues that kept nickel prices in the $14,000–$16,000 per metric ton range this year.

Global Nickel Supply Chain Faces Shock

Indonesia’s decision reverberates worldwide. As the “swing producer,” any production change rapidly affects global inventories and prices. Early 2025 saw a temporary price slump from oversupply, but the quota cut is likely to tighten markets and trigger a price rebound.

Macquarie Group Indonesia’s reduction could cut global supply by 35%. This translates to over a third of global supply lost in a single year. Market analyst Adrian Gardner warns that temporary mine closures may occur if prices stay near or below production costs.

Disruption to EV Supply Chains

Winners and Losers of Indonesia’s Policy

Indonesia anticipates benefits at home. The shift toward processed nickel will attract investment and create domestic jobs. BloombergNEF estimates that local nickel processing and battery plant investments could exceed $15 billion over the next three years.

Export-focused miners face challenges. Smaller operators may see revenue drops, layoffs, and operational hurdles, especially in Sulawesi and Halmahera. Environmental groups have welcomed the move cautiously, urging strict enforcement to ensure promised ecological gains.

International buyers, particularly in China and the West, face tighter competition. China is expected to consume over 63% of primary nickel in 2025. EV and stainless steel manufacturers must secure supply while navigating price volatility.

Implications for Carbon Markets

Nickel’s supply changes have knock-on effects for carbon markets. Green nickel—produced under higher environmental standards—is becoming a key differentiator. Indonesia’s policy encourages cleaner processing methods, which could generate higher-quality carbon credits.

Western companies sourcing “clean nickel” for low-carbon steel and EV batteries may see costs rise. At the same time, the move may attract investment into green mining technology, supporting carbon offset programs.

Supply bottlenecks could increase the price of both nickel and associated carbon credits. Traders and intermediaries may find opportunities in a market that links commodity supply and decarbonization goals.

Nickel Price Volatility and Market Adaptation

The nickel market is already sensitive. Over 20% of global producers operate at a loss at prevailing prices near $15,000 per ton. Cutting a third of global supply may push prices higher and incentivize new investments.

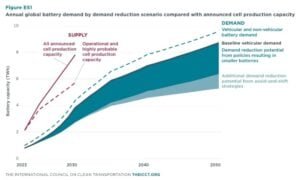

Fundamentals remain complex. Stainless steel production in China rose 12% in early 2025, while battery nickel consumption grew 10–15%. However, total battery demand is still below earlier expectations. Analysts like Mark Selby at Canada Nickel Corp note that Western projects for sustainable nickel are accelerating, especially in Canada, Australia, and Brazil.

This quota cut serves as a wake-up call. Some industrial parks in Indonesia have already reduced external nickel ore forecasts by nearly 30% to adjust to supply constraints.

Will the Market Adapt?

Nickel prices fluctuated through 2025 but stabilized around $15,000 per ton by Q3. The International Nickel Study Group predicts global supply of 27.2 million metric tons versus demand of 27.3 million metric tons—a near balance after years of surplus.

Several factors heighten market risk. About a quarter of global supply operates at or below cash costs, risking mine closures. Chinese stockpiling surged 30% year-over-year, tightening markets further. Meanwhile, demand for EV batteries and stainless steel continues to grow, intensifying competition.

Western governments are investing in alternative sources. North America and Australia are seeing new mines and financing models. Battery makers increasingly prioritize sustainable nickel, adding complexity but promoting lower-carbon supply chains.

Analysts predict global battery-grade nickel demand could double by 2030. If Indonesia’s reduced output persists, competition for raw materials and carbon credits will intensify. Geopolitical and supply chain risks are likely to rise.

Indonesia’s Strategic Pivot and Global Ripple Effects

Indonesia’s decision is more than a domestic policy—it reflects the challenges of critical minerals in the energy transition era. By limiting raw ore output and emphasizing processed nickel, the country is reshaping markets, investments, and carbon credit dynamics.

The reduction affects boardrooms, factories, and carbon markets worldwide. Companies must adapt, governments must secure alternative sources, and investors must anticipate volatility. In a market increasingly linked to decarbonization, Indonesia’s nickel policy highlights the global stakes of sustainable mining and energy transition strategies.

The post Nickel Supply Shock: Indonesia’s 120M Ton Cut and Its Ripple on Carbon Markets appeared first on Carbon Credits.