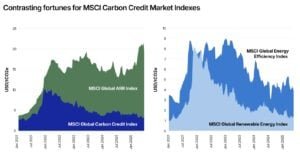

Carbon credit prices jumped to new 2025 highs this week, sparking intense market activity and a wave of interest from companies and investors racing toward net-zero goals. Fresh data from MSCI showed that high-rated credits traded at more than 300% above lower-rated ones in May.

Meanwhile, the MSCI Global ARR Index—which tracks afforestation, reforestation, and revegetation projects—climbed to a record $21.3 per ton in June. These trends reveal a clear shift: buyers now want transparent, verified, and high-impact credits.

As competition heats up, major players and new platforms are doubling down on quality. Because of this, buyers must choose trusted exchanges that offer verified, high-integrity carbon credits. Below, we break down why prices are rising, what trends are driving demand, and where buyers can find reliable credits in today’s fast-changing market.

Why Carbon Credit Prices Are Climbing in 2025

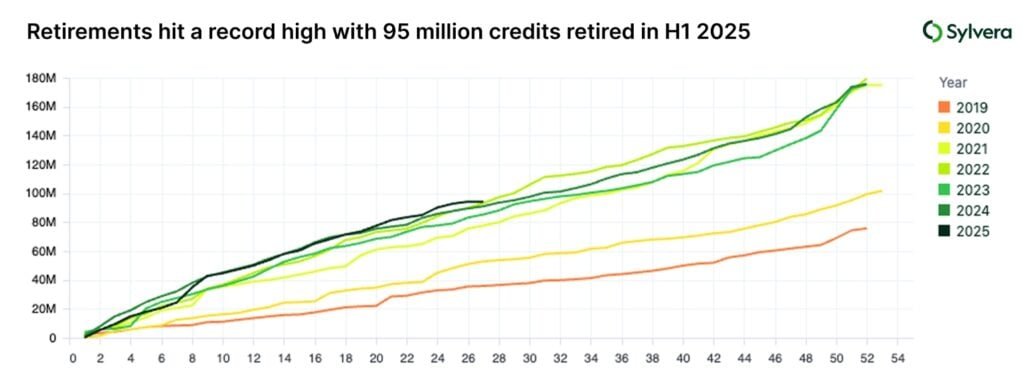

The 2025 carbon market looks very different from previous years. More than 95 million credits were retired in the first half of the year alone, according to Sylvera. This was the highest six-month total ever recorded. The surge reflects stronger climate action from governments and companies facing stricter rules.

Prices show the same direction. Carbon credits today cost 1.9 times more than in 2018. Demand for high-quality offsets hit new highs, while the supply of credible, recent credits remains tight.

Premium Credits and Removals Capture Big Margins

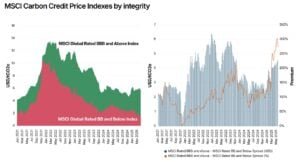

High-rated credits led the price jump. In 2025, “investment-grade” credits—rated BBB or higher—averaged $14.80 per ton. Lower-rated credits averaged just $3.50. Buyers also paid more for newer credits. According to Ecosystem Marketplace, premiums for credits issued in the past five years reached 217%, up from 53% in 2023.

Carbon removal credits, such as reforestation or direct air capture, gained even more momentum. These credits now trade at a massive 381% premium over traditional reduction credits.

Although prices still vary—sometimes by 11% between credits from the same project—buyers show rising confidence. New standards, such as the ICVCM’s Core Carbon Principles and updated regulations, are making integrity a priority.

Why High-Quality Carbon Credits Are in Such High Demand

Demand for trustworthy credits keeps rising due to tighter rules, corporate pressure, and growing public scrutiny. Programs like CORSIA, the global aviation offsetting system, now require stricter eligibility. In the first half of 2025, more than one-third of all new credits issued were potentially eligible for CORSIA Phase 1, depending on Article 6 approvals.

The Science-Based Targets initiative (SBTi) also pushed companies to use only high-integrity carbon removals for net-zero claims. As a result, businesses are moving away from cheap, low-quality credits. Instead, they are paying more for offsets that deliver proven climate and community benefits.

Technology-based removal credits—such as direct air capture—saw some of the highest prices in the market, often above $1,000 per ton. Nature-based credits remained important but typically traded between $7 and $24 per ton. This widening gap shows how buyers value durability and innovation.

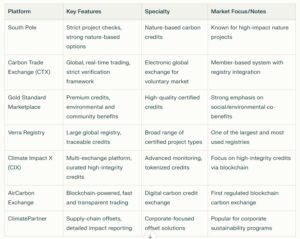

The Top 7 Platforms to Buy Verified Carbon Credits in 2025

Because transparency matters more than ever, selecting the right exchange is essential. Here are seven reliable platforms offering verified carbon credits in 2025:

All these platforms work with leading standards bodies like Verra, Gold Standard, and the American Carbon Registry to ensure strong credibility.

- ALSO CHECK OUT: Top 3 Carbon Credit Companies Driving Climate Impact in 2025

How New Standards and Market Forces Are Reshaping 2025 Prices

Integrity-focused reforms, new technologies, and shifting buyer behavior continue to reshape the carbon market. According to the World Bank, new standards have led to fresh price swings—especially for high-quality nature-based credits. Issuances hit record highs, too.

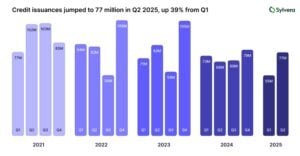

- Sylvera reported that 77 million credits were issued in Q2 2025, up 39% from Q1 and 14% from Q2 2024. Yet retirements grew even faster, keeping pressure on supply.

Old vintage credits are quickly falling out of favor. Companies now want recent, high-quality offsets that meet new regulatory and investor expectations. As a result, BBB-rated credits and other premium assets are setting the tone for market pricing.

Some older credits still trade below $1 per ton, but high-integrity projects now define the market’s direction and future values.

What the Latest Data Says About Growth and the Road Ahead

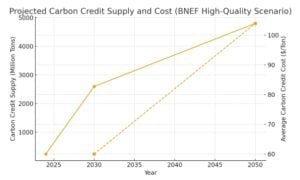

The numbers reveal a market growing fast and evolving even faster. BloombergNEF’s High Quality scenario shows potential supply rising from 243 million tons in 2024 to 2.6 billion tons by 2030, and possibly 4.8 billion tons by 2050. Even with rising supply, prices are expected to climb.

- BNEF forecasts an average of $60 per ton by 2030, increasing to $104 per ton by 2050 as demand for removals outpaces reduction credits.

Notably, Direct air capture will play a major role. By 2050, BNEF expects it to supply 21% of all carbon credits, helping push average prices above $100.

Market structure is also shifting. Bilateral (over-the-counter) deals have exploded—growing 27-fold since 2022—as buyers want tailored, audited solutions. Compliance markets, like those in Singapore and California, continue to raise prices through strong tax and allowance policies.

The Bottom Line for 2025 and Beyond

The carbon market is moving toward a future defined by quality, transparency, and impact. Demand is rising fast, regulations are tightening, and buyers are paying more for verified, high-integrity credits.

In this new environment, the best opportunities will favor informed buyers—those who act early, choose reputable platforms, and prioritize integrity over volume. The road to net zero increasingly depends on credible, premium carbon credits that deliver real climate results.

- FURTHER READING: Carbon Credits Supply to Skyrocket 35x by 2050 – But at What Price?

The post Carbon Credit Prices Hit New 2025 Highs: 7 Safe Platforms Every Buyer Should Know appeared first on Carbon Credits.