Verde AgriTech, a company based in Brazil, has entered into an exclusive partnership with UNDO Carbon Ltd., a UK-based firm. Under this agreement, they will work together to create carbon removal credits. These credits will come from a process called Enhanced Rock Weathering (ERW), using a special mineral that Verde mines in Brazil.

This deal marks Verde’s first major step into the carbon credit market. Both companies believe their combined strengths can lead to large-scale removal of carbon dioxide (CO₂) from the atmosphere.

What Is Enhanced Rock Weathering (ERW)?

ERW is a method to capture CO₂ using natural minerals. The idea is to spread crushed rock, rich in silicate minerals, over farmland. When rain and soil interact with this rock, a natural chemical reaction pulls CO₂ from the air. Over time, that CO₂ becomes part of new, stable minerals — basically locking it in the ground.

UNDO specializes in this technique. They have developed systems to measure how much carbon is removed. They also know how to verify and package these removals into credits that companies can buy.

- RELATED: Microsoft and UNDO Partner for 15,000 Tons of Carbon Removal Using Enhanced Rock Weathering!

Scaling Carbon Removal Together

The partnership allows Verde to expand beyond fertilizers and minerals by selling carbon removal credits. Verde brings a large supply of glauconitic siltstone, mining operations, field-application capacity across Brazil, and local expertise in soil, agriculture, and mineral processing.

In effect, UNDO gains reliable access to mineral feedstock and a strong local partner, essential for scaling ERW projects. Verde’s facilities can handle, crush, and spread the rock, supported by its logistics and soil sampling experience.

UNDO will handle the measurement, reporting, and verification (MRV) of CO₂ removed from the atmosphere. Their platform uses proprietary (patent‑pending) protocols to ensure the credits are real and permanent.

- Together, they aim to remove hundreds of thousands of tonnes of CO₂, with each tonne of rock capturing 70–120 kilograms depending on conditions.

Verde’s mineral reserves, in the hundreds of millions of tonnes, give the partnership long-term capacity to meet these goals.

The deal also offers a new revenue stream for the agritech company and high-quality credits verified through strict MRV, aligning with standards such as Verra, Gold Standard, and Puro.earth.

Cristiano Veloso, Founder and CEO, Verde, said:

“By combining our glauconitic siltstone products and established operations in Brazil with UNDO’s award-winning expertise in measurement, reporting, and verification, we aim to originate and deliver durable, high-quality carbon removal credits aligned with global best practices, including leading Enhanced Rock Weathering methodologies .”

The warrant system further aligns interests: UNDO benefits only when credits are sold, while Verde shares in future growth. With these combined strengths, the partnership could scale ERW locally and globally, providing credible, durable carbon removal.

Turning CO₂ Into Credible Carbon Credits

Verde and UNDO plan to sell the carbon removal credits to companies that want to offset their emissions. These credits are expected to be durable — meaning the CO₂ will stay locked away for a very long time.

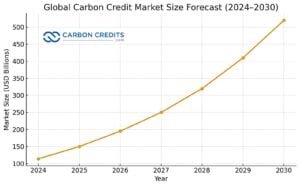

The voluntary carbon market has grown steadily in recent years. Industry estimates show it reached around $2 billion in annual transactions. Projections suggest that it could rise to over $40 billion by 2030 as companies demand more high-quality carbon removal. This growth provides a strong commercial foundation for Verde and UNDO as they prepare to bring ERW credits to market.

Meanwhile, estimates show the global carbon market will rise sharply by 2030.

To align incentives, Verde is granting UNDO up to 1.7 million share purchase warrants. These warrants will vest (or become usable) based on future sales of carbon credits.

Here is how the warrant structure works:

- Initial warrants: 100,000 options, tied to credit sales at a high price per ton of CO₂.

- Additional warrants: 1,000,000, tied to more credit sales at slightly lower prices.

- Success-based warrants: 600,000, tied to further future sales if targets are met.

Verde’s Long Road to Carbon Market Leadership

Verde’s entry into carbon credits is not instant. In 2023, the company announced plans to enter the market. It highlighted the potential of its silicate rock for ERW to capture a lot of CO₂.

Based on its mineral reserves and processing capacity, Verde estimates it can produce up to 300,000 tonnes of carbon removal credits annually. This shows that carbon removal is a long-term strategic focus, not a side project.

To prepare, Verde explored partnerships that could strengthen its expertise in carbon markets. Verde teamed up early with WayCarbon, a well-known carbon project developer. They looked into how Verde’s minerals could help remove carbon and generate revenue.

WayCarbon guided Verde on project design, verification paths, and market demand. This helped Verde grasp what’s needed for high-quality, credible carbon credits.

These steps helped Verde gain experience in science, market trends, and regulations. This groundwork paved the way for bigger deals, like its current partnership with UNDO.

Studies in journals like Nature and PNAS back ERW’s effectiveness. They show that finely crushed silicate rock can capture CO₂ in months to years.

The carbon stays stored in mineral form for tens of thousands to millions of years. This validates Verde’s confidence in its mineral reserves as a tool for long-term climate mitigation.

ERW in Action: Impact on Emissions and Agriculture

This deal is part of a larger trend in the climate field: companies are looking for durable, scalable ways to remove CO₂. Enhanced Rock Weathering is one such method. When done right, it can store carbon for very long periods.

Brazil emits roughly 2.4 to 2.7 billion tonnes of CO₂-equivalent each year, depending on land-use trends. Agriculture accounts for about one-quarter of national emissions. Because ERW is deployed directly on farmland, it offers a pathway to reduce or offset part of this sector’s footprint while improving soil conditions.

Partnerships like this one help make carbon removal more real and credible. They mix scientific innovation (UNDO’s MRV systems) with physical capacity (Verde’s mineral operations). This could attract more buyers who want serious, long-term climate solutions.

However, scaling ERW also comes with challenges. Large-scale rock crushing and distribution can increase operational costs, and long-term monitoring requires specialized scientific methods.

Regulatory clarity for ERW credits is still developing in many markets, and some buyers remain cautious as they compare different carbon removal approaches. These factors may influence how quickly Verde and UNDO can expand their projects.

Blueprint for Scalable, Durable Carbon Removal

Verde AgriTech’s exclusive partnership with UNDO Carbon is a major step for both companies. Verde gains a new source of income. UNDO secures a reliable supply of mineral feedstock for its ERW work. Together, they hope to produce high-quality, durable carbon credits from Brazil.

If they succeed, they could remove hundreds of thousands of tonnes of CO₂ while building a scalable model for future carbon removal. Their partnership could become a blueprint for how mining and climate technology firms work together to fight climate change — not just in Brazil, but around the world.

The post Verde AgriTech and UNDO Carbon Partner to Scale Enhanced Rock Weathering appeared first on Carbon Credits.