Microsoft and Alphabet have become the world’s strongest forces behind durable carbon removal. Together, they have funneled more than $10 billion into technologies designed to pull carbon dioxide out of the atmosphere for centuries. Their push marks a major turning point for the carbon removal market, which has struggled for years with high costs, slow progress, and limited buyers.

Today, the two tech giants are putting carbon removal at the center of their climate strategies. Their actions are injecting confidence, capital, and momentum into a sector that many once considered too expensive to scale. As demand for clean energy grows and artificial intelligence drives up electricity use, Microsoft and Alphabet are betting big on solutions that can permanently erase their emissions footprints.

Rising Investments Reset the Market

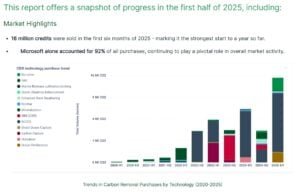

Morningstar’s 2025 analysis shows Microsoft driving about $8 billion in carbon removal commitments, with Alphabet close behind. Their combined spending has pushed global commitments above $10 billion, a sharp rise from the small voluntary market of recent years.

Both companies act as early buyers and long-term partners, giving startups stable funding. Microsoft’s nearly 300,000-tonne deal with Arca Climate Technologies, signed after an 18-month pilot, is now helping the company scale across North America.

Alphabet supports demand through the First Movers Coalition, committing $500 million to advance early carbon-negative technologies and help them progress from pilot scale to gigaton-scale solutions.

MUST READ:

- Microsoft (MSFT Stock) Tops Q2 2025 Record-Breaking Surge in Durable Carbon Removal Credit Purchases

- Google, Meta, and Others Invest $41M in Carbon Removal Credits

Why Big Tech Is Rushing to Remove Carbon

Several forces explain Big Tech’s sudden acceleration. One major factor is the explosive growth of data centers, especially those powering AI. Even with clean electricity purchases, Microsoft’s emissions rose 23% between 2020 and 2025. Its leaders now view durable carbon removal as a necessary “backstop” to meet their 2030 and 2050 climate goals.

Additionally, high-quality carbon removal credits are scarce and expensive. Some early-stage projects still cost more than $600 per tonne. However, Microsoft and Alphabet’s steady buying reassures investors that demand will continue.

Critics say relying on a few wealthy buyers makes the market fragile. Yet, Big Tech lowers risk for startups, funds pilots, and spurs government and investor support—similar to early solar, where large buyers drove scale, innovation, and lower costs.

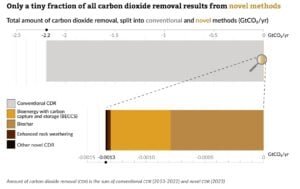

What “Durable” Actually Means

Durability—how long carbon stays locked away—is central to Microsoft’s and Alphabet’s strategies. Microsoft, in particular, has defined strict criteria. The company prefers projects that store carbon for more than 1,000 years, with clear scientific validation. These include:

- Direct air capture

- Mineralization

- Biomass carbon removal and storage

- Certain types of bioenergy with carbon capture

Every proposal goes through lifecycle analysis and third-party review.

In 2025, Microsoft signed a 6.8 million-tonne agreement with AtmosClear, a Louisiana-based carbon capture company. It also committed 3.7 million tonnes to CO2-80, which captures carbon from pulp and paper mills.

These deals signal confidence across a broad portfolio of solutions, ranging from industrial capture to innovative mineralization technologies developed in Canadian and Australian mines.

Alphabet continues to work through the First Movers Coalition to support next-generation carbon removal. At Davos, World Economic Forum President Børge Brende called these companies “the true first movers” that enable disruptive climate technologies to scale.

High Demand Sends Carbon Removal Prices Surging

If price signals matter, then the last two years show how fast demand has risen. Heavy buying from Microsoft, Alphabet, and other firms pushed high-durability credit prices to new highs. Because supply remains tight, these large contracts often go to the same handful of buyers.

While smaller companies struggle with rising prices, the surge does encourage more innovation. Some mid-durability solutions, such as biochar, have seen costs fall as producers scale up to meet larger orders. Yet, the long-term health of the market depends on expanding demand beyond the tech sector.

New Entrants Anchor a Stronger Market

Thanks to Big Tech’s leadership, more corporations are entering the carbon removal market. Salesforce, Amazon, Apple, and major insurers have begun purchasing durable removal credits. Governments—including Singapore, Sweden, and several European nations—are also exploring or funding carbon removal programs.

This widening participation is essential. Diverse buyers create market stability and help avoid over-reliance on a small group of tech companies.

Meanwhile, the voluntary carbon market is undergoing a quality overhaul. Buyers now demand strong verification standards, transparent lifecycle data, and clear durability claims. This shift is raising the bar for every project developer in the space.

One example of a success story is Arca’s partnership with Microsoft. It began with academic research in Canada and evolved into a commercial mineralization project supported by Big Tech funding. The deal shows how early capital can turn scientific ideas into permanent carbon sinks.

Can Today’s Billion-Dollar Investments Deliver Gigaton Removal?

Although current momentum is impressive, the challenge ahead is enormous. Microsoft leaders warn that AI-driven energy demand may continue to outpace emissions reductions. They frame the company’s strategy as “do our best, remove the rest,” acknowledging that cutting emissions alone is no longer enough.

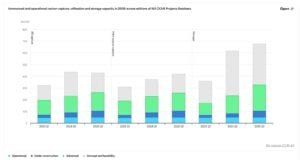

Industry analysts see rapid progress. BloombergNEF and IEA data show permanent carbon removal commitments reached $10 billion in 2025, compared with less than $2 billion just two years earlier. Direct air capture capacity has passed 1.3 million tonnes per year, and the IEA reports a twelvefold jump in mineralization projects since 2022.

By 2030, experts anticipate a demand for durable carbon removal of 40 million tonnes per year. If investments continue, the market could exceed $50 billion by the end of the decade.

Still, big obstacles remain. Costs must fall so that smaller businesses can participate. Additionally, the world will need clearer rules to connect voluntary markets with compliance systems.

Looking Ahead: A Turning Point for Carbon Removal

The next decade will determine whether carbon removal becomes a global climate tool or stays a niche market. Microsoft and Alphabet have pushed the industry to a new level, creating confidence and setting standards. Their investments have sparked competition, inspired more buyers, and accelerated innovation.

If current trends hold, carbon removal could soon become as essential as emissions reduction—and a true foundation of global net-zero strategies.

LATEST:

- Carbon Credit Prices Hit New 2025 Highs: 7 Safe Platforms Every Buyer Should Know

- Carbon Markets in 2025: A New Era of Accountability, Quality, and Transparency

The post Big Tech Firms Microsoft (MSFT) and Alphabet (GOOGL) Lead in Durable Carbon Removal Investments Exceeding $10 Billion appeared first on Carbon Credits.