Stellantis Korea recently announced that owners of its electric vehicles (EVs) can convert the mileage they have accumulated into carbon credit rewards. The company, through a carbon credit specialist, Hooxi Partners, will trade these credits and return the money as a reward to vehicle owners. This turns miles driven into a green credit benefit.

The move, the first in Korea, marks a novel incentive. Stellantis Korea doesn’t only offer discounts or rebates. They view driving an EV as building a true carbon reduction “asset.” By turning EV use into carbon credits, the company lets EV owners share in the carbon credit market.

How Stellantis Korea’s Carbon Credits Work

Carbon credits represent cuts in greenhouse gas emissions. Each credit equals one ton of avoided or removed CO₂. Credits often come from renewable energy, reforestation, or reduced industrial emissions.

For EVs, credits exist because they produce little or no tailpipe CO₂. If the electricity used for charging is low-carbon, the emission savings can be measured and turned into credits.

In South Korea, the grid emits between 0.42 and 0.45 kg CO₂ per kWh, according to industry estimates. Industry estimates that every 1,000 km driven by EVs avoids roughly 0.15–0.25 tCO₂e, depending on the energy mix.

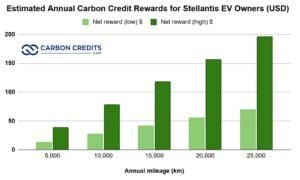

Credits are retroactive for existing mileage via app tracking and can be sold on the Korea Exchange or voluntary markets at ₩30,000–50,000 per tCO₂e ($22–37 USD). Average drivers covering 15,000 km per year could earn 2.25–3.75 credits, equivalent to ₩67,500–187,500 ($50–140 USD), with Stellantis retaining a fee.

The chart above shows the potential carbon credit rewards an EV owner could earn in a year. The program applies to all Stellantis EVs from 2023 onward, including the Peugeot e-208, Fiat 500e, and Jeep Avenger.

This gives EVs two benefits: encouraging cleaner transport and creating a tradable asset for automakers or owners. For companies like Stellantis, carbon credits are becoming part of the business model, as they can earn and sell credits worldwide.

Why The Move Is Significant? The Local Impact

In South Korea, EV adoption has surged. H1 2025 sales jumped 45.7% year-on-year to 74,000 units, giving EVs a 9.2% share of new car sales. August sales hit 18.4% amid subsidies, and full-year projections suggest an 11–20% market share with 407,000 units produced.

Still, many automakers, including Stellantis, struggled. In 2024, Stellantis Korea held less than 1% of the EV market. This year, the company aims to increase sales by about 30% in 2025. They will focus on boosting the Jeep Avenger and Peugeot due to weak EV performance.

This development matters for the East Asian country, aligning with its climate goals.

South Korea’s 2035 Climate Plan

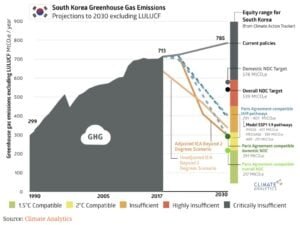

South Korea has approved a climate plan aiming to cut greenhouse gas emissions by 53–61% from 2018 levels. National emissions are expected to fall from 742 million tonnes to 348.9–289.5 million tonnes by 2035.

- The transport sector faces one of the steepest cuts: 60–63%, from 98.8 million tonnes in 2018 to roughly 36.8 million tonnes in 2035. EV adoption is key to meeting this target.

South Korea pledged to join the Powering Past Coal Alliance. This marks its first promise to stop new coal power plants that lack carbon controls. It also plans to phase out existing coal plants gradually.

The carbon credit reward plan brings new value. For buyers, it offers more than just subsidies or discounts. For Stellantis, it might boost EV sales, build brand trust, and meet global demands for carbon accountability.

The program may also attract environmentally conscious buyers by offering a tangible “reward for clean driving.” For Stellantis, it is one way to show its commitment to its net zero goal.

Driving Toward Zero: Stellantis’ Roadmap to a Carbon‑Neutral Future

Stellantis continues to advance its net zero ambitions, with new data showing meaningful progress as of 2024.

By 2024, the company had cut its Scope 1 and 2 greenhouse‑gas emissions by about 39 % relative to its 2021 baseline. At the same time, the share of decarbonized electricity powering its own operations rose to 59 %, up from 45 % in 2021.

On the products front, Stellantis expanded its hybrid‑vehicle offerings in Europe, launching 30 hybrid models in 2024 with more planned through 2026. The company will use efficient hybrid technology. This can cut CO₂ emissions by about 20% compared to traditional combustion engines.

The company is boosting its circular economy efforts. Its hub in Italy marked a year in 2024. In that time, it remanufactured tens of thousands of engines, gearboxes, and batteries. It also reconditioned thousands of vehicles and processed millions of components. These actions support the company’s larger goals for decarbonization and resource reuse.

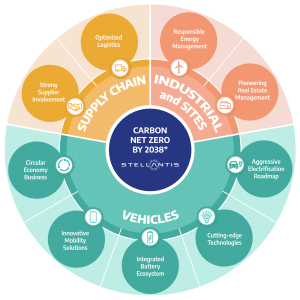

These steps support Stellantis’ Dare Forward 2030 plan. The goal is to achieve carbon net zero by 2038. This will address all scopes while keeping residual emissions low.

Global EV Market Trends and Carbon Credit Strategies

Globally, EV adoption is accelerating. Data for 2024–2025 show strong growth, driven by better batteries, improved charging, lower costs, and tighter decarbonization regulations. For many automakers, shifting from internal combustion engines (ICE) to EVs is now mandatory to meet emissions targets.

Carbon Credits Becoming a Core Business Strategy

Carbon credits are now more than environmental tools; they are a growing revenue source for EV makers. Leapmotor in China supplied over 100,000 credits in 2025 at €20–30 per credit, selling to companies like Stellantis.

Tesla earned over $$2.76 billion from ZEV credits in 2024 alone, selling to GM and Ford. In the EU, automakers bank credits for compliance, with EVs generating 10–20 times more credits than ICE vehicles.

Stellantis Korea’s program follows this model: EV sales combined with carbon credit generation. For companies investing early in electrification and low-carbon energy, credits can provide financial returns beyond traditional car sales. The Korea pilot alone could generate ₩50–100B by 2027.

Policies and Incentives Push EV Adoption — But Credits Add a New Layer

Many countries provide subsidies, tax breaks, or rebates for EV buyers. In South Korea, national and local incentives helped boost EV sales. But subsidies are usually one-time benefits.

Stellantis Korea goes further by tying rewards to actual driving. Mileage now generates financial credit, aligning long-term behavior with emissions reduction and making EVs a smarter investment.

Future Outlook: A New Phase for EV Incentives

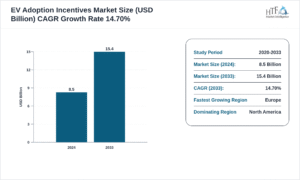

The global EV incentive market — including subsidies, rebates, and credit-based schemes — is forecast to grow at an annual growth of 14.7% from 2024 to 2033. As more carmakers use programs like Stellantis’s, carbon credits might become a key part of EV value. This could support adoption even after subsidies stop.

Governments may increasingly integrate carbon credit systems into EV policies, creating formal global markets. Automakers investing early in electrification, carbon accounting, and clean supply chains will gain a competitive edge.

For consumers, EVs could become cleaner and smarter long-term investments, with mileage translating into measurable financial rewards.

Stellantis Korea’s carbon credit initiative is more than marketing; it signals a new phase for EV incentives. By rewarding actual usage, it aligns consumer behavior with emission reductions while adding financial value. If successful, this model could reshape how automakers, buyers, and regulators view EVs, making clean driving both practical and profitable.

The post Stellantis Korea Turns EV Miles into Cashable Carbon Credits for Owners appeared first on Carbon Credits.