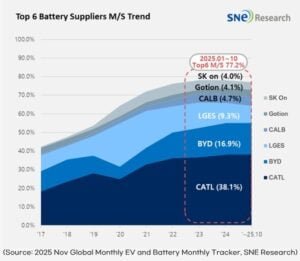

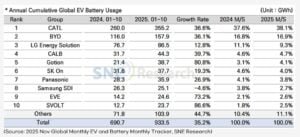

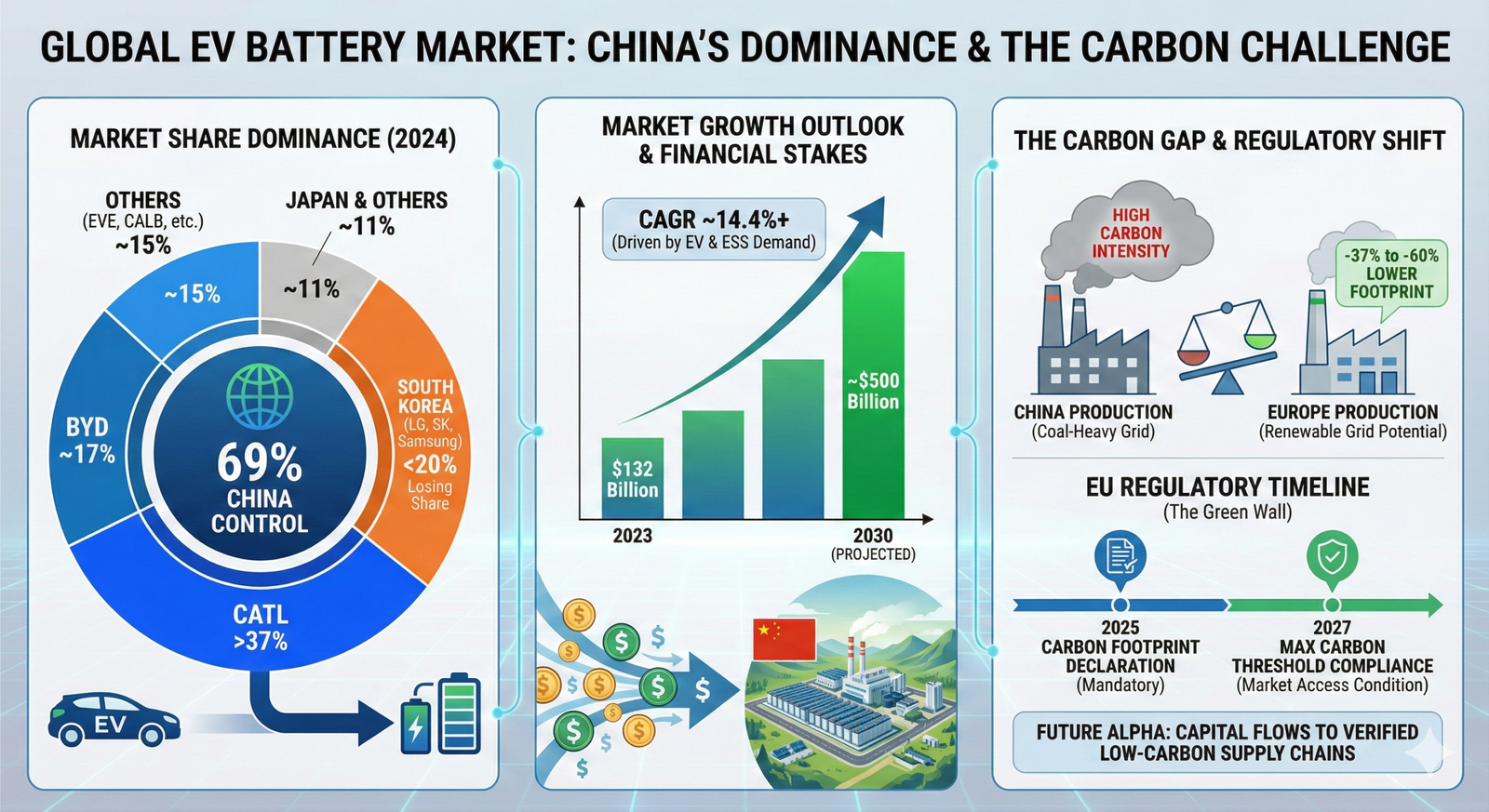

China strengthened its dominance in the global electric vehicle battery landscape in 2025. Fresh data from SNE Research showed that six major Chinese battery manufacturers controlled 68.9% of all EV battery installations worldwide from January to October 2025. Their combined installed capacity hit 644.4 GWh during the period, almost three percentage points higher than last year. This rise confirmed China’s firm leadership in a market that continues to grow quickly despite uneven EV sales trends across regions.

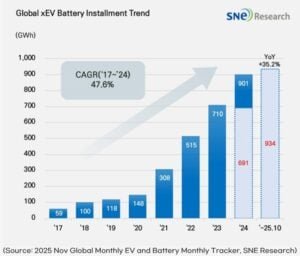

During the same period, worldwide EV battery installations reached 933.5 GWh, marking a 35.2% year-over-year increase compared to 690.7 GWh in 2024. The surge was driven by stronger adoption of battery-powered vehicles across categories, including pure EVs, plug-in hybrids, and hybrid models. Even with policy uncertainty in Europe and inflationary pressure in the U.S., global demand for high-quality battery packs remained strong.

CATL Extends Its Lead While BYD Accelerates Overseas

CATL maintained its dominant position and continued to widen the gap with its competitors. Between January and October, CATL installed 355.2 GWh of batteries, claiming 38.1% of the global market. This share was slightly higher than its 37.6% share a year ago. The company posted a 36.6% annual increase in installed capacity, supported by broad adoption across both domestic and international automakers.

The battery giant powered Chinese brands like Zeekr, AITO, Li Auto, and Xiaomi, while also serving global giants such as Tesla, BMW, Mercedes-Benz, and Volkswagen. This combination gave CATL unmatched scale and brand presence across segments.

Meanwhile, BYD ranked second with 157.9 GWh installed and a 16.9% market share. Its performance reflected both strong Chinese sales and a sharp rise in overseas momentum.

In November alone, BYD sold more than 130,000 vehicles outside China, nearly four times higher than the previous year. This rapid expansion helped push BYD’s battery usage in Europe to 11.2 GWh in the January–October period, a remarkable 216% year-over-year increase.

Its batteries power both its pure electric and plug-in hybrid models, and its vertical integration keeps production costs low and efficiency high.

Other Chinese players also solidified their positions in the top tier:

- CALB: 44.3 GWh (4.7%)

- Gotion High-Tech: 38.7 GWh (4.1%)

- EVE Energy: 24.6 GWh (2.6%)

- SVOLT: 23.7 GWh (2.5%)

Collectively, China’s six leading battery suppliers now shape global supply, technology standards, and pricing power, creating challenges for competitors in Korea, Japan, and Europe.

Korean and Japanese Companies Lose Ground

While Chinese companies gained momentum, South Korean and Japanese suppliers faced growing pressure. Their combined market share fell as Chinese manufacturers expanded scale, lowered costs, and strengthened ties with global automakers.

- LG Energy Solution Holds On but Faces Tesla Slowdown

LG Energy Solution stayed in third place globally with 86.5 GWh and a 9.3% market share. Its installed battery volume grew 12.8% from last year, but market share fell from 11.1%. The main reason was slower Tesla sales for models using LG batteries. Tesla’s move toward LFP batteries and using multiple suppliers cut LG’s Tesla-related battery usage by 14.5%.

However, it still gained from strong global sales of Kia’s EV3 and steady demand for GM’s Ultium-based models like the Chevrolet Equinox, Blazer, and Silverado EV in North America. These helped, but not enough to fully protect LG’s global share.

- SK On Sees Mixed Results

SK On installed 37.7 GWh, capturing 4% of the global market. Its batteries power Hyundai models like the Ioniq 5 and EV6, and Volkswagen’s ID.4 and ID.7. Sales of Ford’s F-150 Lightning were slower, but demand for the Explorer EV helped SK On. Overall, Ford-related battery usage rose 18.1%.

- Samsung SDI Faces Rivian Shift

Samsung SDI posted 25.1 GWh and a 2.7% market share, down from last year. Rivian switched some models to Gotion’s LFP batteries, reducing SDI’s share. Rivian’s overall slowdown also hurt. Positive sales from BMW and Audi helped offset some losses. Models like the BMW i4, i5, i7, and iX, along with Audi’s Q6 e-Tron, kept European demand steady.

Together, LGES, SK On, and Samsung SDI held 16% of the global market, down 3.5 percentage points from last year.

- Panasonic Works to Diversify

Panasonic ranked seventh with 35.9 GWh and a 3.8% market share. The company focused on reducing reliance on Tesla and growing in North America. Efficiency upgrades at its Kansas and Nevada factories, along with work on next-generation 4680 and 2170 cells, helped stabilize costs. Panasonic also expanded talks with North American automakers to diversify its customers.

Regional Strategy Becomes the New Competitive Driver

By late 2025, growth remained strong, but the global competitive landscape grew more complicated. Each major region pursued a different policy direction, forcing battery makers to adjust both technology and supply chain strategies.

North America: Automakers increasingly secured long-term procurement deals to manage battery costs and reduce supply risks. Local production and the U.S. Inflation Reduction Act (IRA) compliance drove rapid investment in domestic supply chains.

Europe: European automakers accelerated efforts to reduce their reliance on imported Asian batteries. As a result, local pack assembly, localized mineral sourcing, and near-shoring became top priorities to comply with EU rules and reduce geopolitical exposure.

Asia: Asian suppliers focused on product differentiation through high-energy-density chemistries, fast-charging cells, long-life platforms, and intelligent battery-management systems. They also expanded partnerships with global OEMs to extend their market reach.

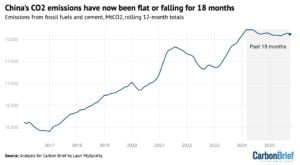

EV Boom Helps Flatten China’s Carbon Emissions

The global EV battery industry is shifting from simply scaling up production to focusing on regional strategies and flexible supply chains. Companies that quickly adapt to new policies, create market-specific products, and strengthen local supply chains are gaining a clear edge.

This shift is playing a significant role in reducing China’s emissions and advancing a cleaner energy future. According to a recent CarbonBrief report, China’s carbon dioxide (CO2) emissions have stabilized over the past 18 months, from March 2024 through the third quarter of 2025.

This marks a notable change for the world’s largest emitter, as strong growth in renewable energy and EVs begins to offset emissions from heavy industry.

The report also highlighted that transport fuel emissions fell by 5% year-on-year in the third quarter of 2025, as more drivers switched from gasoline and diesel vehicles to EVs.

All in all, China enters this next phase with overwhelming scale and strong global partnerships. Still, rising regionalization means that long-term leadership will depend on the ability to operate diverse portfolios—not just on dominating global market share.

The post China Now Controls 69% of the Global EV Battery Market as CATL and BYD Surge in 2025 appeared first on Carbon Credits.