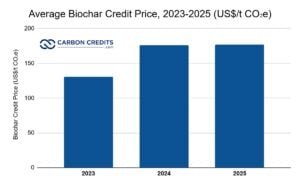

In late 2025, the market for carbon credits based on biochar, a carbon removal method, is showing stable prices. However, behind the calm surface, many players say sentiment is weakening, which comes from fewer retirements, lower demand, and a tight supply.

A recent report by S&P Global found that in October 2025, U.S. biochar credits for delivery in 2025 stayed at around $150 per tonne of CO₂e. Credits for next year’s delivery were about $148 per tonne. This is slightly lower due to less buying activity and hopes for more supply.

Still, the drop in retirements signals weaker demand. Tech-based carbon removal retirements slipped to just 3,327 metric tons (mt) in October, down sharply from 57,417 mt in September. So, while prices held steady for now, the weak market mood raises questions about how the biochar credit market may perform in the coming months.

However, reports from the largest open data platform on the durable CDR market, CDR.fyi paint a different picture of annual biochar contracted volume, purchases, delivered, and retired.

Turning Waste Into Value: How Biochar Works

Biochar comes from heating organic waste, such as agricultural leftovers. This happens in a low-oxygen process known as pyrolysis. Doing this locks in carbon and converts plant waste into a stable, carbon-rich material. That carbon can be stored for decades or centuries.

Biochar removes carbon instead of just avoiding emissions. So, its credits fall under the “carbon dioxide removal (CDR)” category. Over the last few years, buyers in the voluntary carbon market have shown growing interest in CDR credits.

Some traditional “emissions-avoidance” credits are criticized. They often lack permanence and strong verification.

Biochar has a co-benefit: it can boost soil health, water retention, and agricultural yields when added to soil. However, these benefits come after its main role in carbon removal.

Biochar is appealing because it’s relatively affordable compared to pricier carbon removal methods, like direct air capture. It also offers two benefits: removing carbon and improving soil health.

Supply Chains and Demand: The Fragile Balance

Recent data by CDR.fyi points to a mixed and fragile state for the biochar carbon credit market. The key findings include:

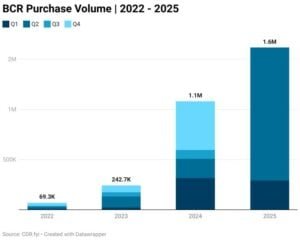

- A 2025 market snapshot from CDR.fyi shows that from 2022 to mid-2025, around 3.04 million tonnes (Mt) of biochar carbon removal (BCR) credits were contracted. Roughly 1.6 Mt of that was purchased in the first half of 2025 alone.

- Deliveries and retirements of BCR credits have also increased. By the end of Q2 2025, around 302,000 tonnes had been retired. That’s about double the amount from previous years.

-

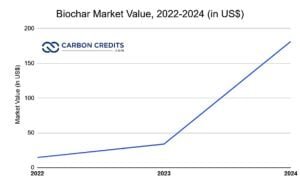

The biochar market also saw strong yearly growth, especially from 2023 to 2024, with a 435% increase.

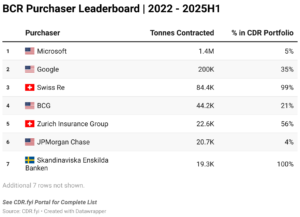

- Despite this, the number of active buyers remains low. A few big companies, like Microsoft, Google, and JPMorgan Chase, make most of the purchases.

On the supply side, biochar credits remain constrained. Many projects face delays in certification or in building out production capacity. Recent data shows that some biochar projects are still validating or just issuing their first credits. This limits the credits available for immediate delivery or sale.

High demand from big buyers, limited supply, and delays in new projects explain why prices remain strong. Yet, it also exposes the fragility of the market: if even a few big buyers step back, or if supply improves markedly, prices could shift.

Diversifying Revenue and Expanding Buyers

Faced with weak sentiment and supply constraints, many biochar developers are rethinking their strategies. Some are trying to expand the market beyond a few large corporations.

A broker in the S&P Global report said there’s a rising push to reach “smaller buyers.” This includes small companies and possibly individuals. This could help broaden demand, reduce concentration risk, and create a more stable base for biochar credits.

Meanwhile, developers are seeking diversified revenue streams. Many are now focusing on the actual biochar product instead of just selling carbon credits. They sell it as soil amendments, bio-fertilizers, and for other uses. This strategy can boost the “bankability” of projects. This makes them more appealing to investors. It also cuts down on reliance on the unstable credit market.

Long-term purchase agreements (offtake deals) are also becoming more common. For buyers seeking certainty, signing multi-year contracts with biochar producers ensures a steady supply.

It may also provide price advantages compared to unpredictable spot markets. That can be a win–win: producers get steady funding, buyers get a reliable supply.

These measures only partly tackle the bigger problem. The supply is still small and fragmented compared to the high demand from companies wanting to offset emissions on a large scale.

What Forecasts Say: Growth is possible, but big challenges remain

Industry analysts are cautiously optimistic about the long-term prospects of biochar carbon credits. Stratistics MRC predicts that the global biochar carbon credit market may rise from about $304.1 million in 2025 to nearly $1,847.3 million by 2032. That implies a compound annual growth rate of about 29.4%.

In another estimate, the biochar market can reach over $3 billion by 2034. That’s a more conservative projection, at a 13.5% annual growth rate.

Other forecasts, such as MSCI Carbon Markets, say demand for biochar credits might rise a lot in the next decade. This rise is fueled by corporate net-zero goals and a greater focus on lasting carbon removal.

Still, several major hurdles stand in the way of scalable growth, such as:

- Supply chain bottlenecks: Many biochar projects remain small or underfunded; building larger plants requires capital and time. Delays in certification, pyrolysis equipment supply, and feedstock sourcing continue to slow expansion.

- Market concentration: A small number of buyers still dominate demand. This means that changes in their demand — or shifts in corporate climate strategies — could strongly affect the whole market.

- Competition and price pressure: If supply grows faster than demand in the medium term, credit prices might come under pressure. Some models even anticipate short-term price compression before a rebound.

- Policy and integration challenges: Many analysts believe that biochar needs more than just voluntary credits to grow. It may need integration into compliance markets, support from government policies, or large public funding.

Implications for Buyers, Producers, and the Climate

For buyers, whether big firms or small businesses, biochar credits are a great way to offset emissions. They are durable and often more credible than traditional offsets. Plus, they can improve soil health and offer other benefits. But buyers should be aware: the current supply-demand mismatch and limited buyer base introduce risk.

For producers, biochar remains a difficult but possibly rewarding business. Diversified income streams and long-term agreements may help stabilize revenue.

For the climate, biochar represents one of the more promising carbon removal tools available today. If done carefully and combined with larger climate actions, it could help remove and store a lot of CO₂.

A Fragile but Promising Path Forward

The biochar carbon credit market in late 2025 is at a delicate balance. Prices remain steady, thanks largely to tight supply and committed offtake deals. But weaker retirements and shrinking buyer activity hint at deeper structural challenges.

Still, signs of adaptation show promise for biochar. New buyers are emerging, business models are diversifying, and long-term contracts are forming. These changes suggest many believe biochar can grow beyond a niche solution. If the industry can fix supply bottlenecks and broaden demand beyond a few big companies, biochar could be a strong part of global carbon removal.

The post Biochar Carbon Credits in 2025: Stable Prices Amid Weakening Demand appeared first on Carbon Credits.