Vale Base Metals (VBM) and Glencore Canada took a major step toward expanding North America’s copper supply. The two companies signed an agreement to study a new brownfield copper project in the Sudbury Basin, one of Canada’s most important mining regions. The plan focuses on using Glencore’s Nickel Rim South Mine infrastructure to safely and efficiently reach underground copper deposits owned by both companies.

Shaun Usmar, CEO of Vale Base Metals, further explained the project. He noted,

“Opportunities to partner and unlock synergistic value between neighbouring miners in the Sudbury Basin have been pursued for decades, without meaningful success. I’m grateful for the commitment shown by both Glencore and our VBM team for coming together to finally unlock this historic opportunity by demonstrating a new collaborative way of working.

“The contemplated partnership paves the way to extract valuable copper-rich orebodies for our respective operations that would otherwise be lost to both companies. The proposed 50-50 joint venture aims to leverage Glencore’s unused infrastructure to access orebodies on both our properties. This will benefit our respective companies, our local communities in and around Sudbury, and it has the potential to produce nearer-term critical minerals from this prolific brownfield project for the Canadian economy. My hope is it will be a catalyst to unearth further synergies in the region.”

A Project That Unlocks Untapped Resources

The agreement allows both companies to examine how they can mine their adjacent copper deposits through Glencore’s current mine shaft. Instead of building a new shaft from scratch, they intend to deepen and extend the existing one. This approach reduces environmental impacts, shortens construction timelines, and avoids the major capital expenses associated with greenfield developments.

The partners estimate the project will deliver about 880,000 metric tons of copper over 21 years. The total investment is expected to fall between $1.6 billion and $2 billion USD. Given the strong demand for copper and the tight supply, the timing of this plan aligns well with the current market.

At Glencore’s Capital Markets Day presentation, held on Wednesday, 3 December 2025, in the UK, CEO Gary Nagle commented:

“Since our last Capital Markets Day in 2022, we have made significant progress on de-risking our exceptional portfolio of copper projects. These projects are mostly brownfield and expected to be highly capital efficient. We have a clear pathway for our base copper business to exceed 1 million tonnes of annual production by the end of 2028, with a target to produce c. 1.6 million tonnes by 2035, which would make Glencore one of the largest copper producers in the world. We have already taken key steps on this journey, including the submission of our Argentinian RIGI applications in August and our decision to restart the Alumbrera copper/gold operation in Argentina which we are announcing today.”

Sudbury’s Rich Mix of Critical Minerals

Since the Sudbury Basin contains a mix of valuable minerals, the project would also produce nickel, cobalt, platinum group metals (PGMs), gold, and other critical materials. These metals are important for batteries, renewable power systems, and global clean-energy supply chains.

The companies plan to begin detailed engineering work in 2026. This phase will include environmental assessments, community consultations, and technical design studies. A final investment decision is set for the first half of 2027.

If approved, the new operation would not only unlock ore that could have remained untouched but also support long-term planning for both companies’ Canadian mining portfolios.

Notably, Vale’s broad global network of operations gives it significant experience in complex underground mining. And that strengthens the Sudbury partnership.

Sustainable Mining Gains Ground Through Brownfield Strategy

The partners’ decision to build on existing infrastructure reduces the environmental footprint of the project. Brownfield developments generally require fewer land disturbances, lower water use, and smaller construction areas than brand-new mines. This approach fits well with growing expectations for sustainable mining practices in Canada and worldwide.

Economically, the project could create high-quality jobs in Sudbury and support local businesses. Because the region has a long history of mining, the community already has a strong workforce, training programs, and service ecosystem that can support new developments.

The initiative also supports Canada’s Critical Minerals Strategy, which aims to secure domestic supplies of materials needed for clean energy technologies. Copper, nickel, and cobalt are at the heart of that effort.

Canada and the U.S. Expand Their Copper Capacity

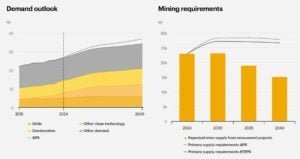

Copper is becoming even more important as renewable energy, electric vehicles, and power grid upgrades expand worldwide. The metal is also vital for semiconductor manufacturing and military equipment. Significantly, Canada already holds strong copper resources, especially in Ontario, and continues to grow as a major contributor to global supply.

Additionally, a more stable domestic supply reduces reliance on foreign mineral supply chains for both Canada and the U.S.

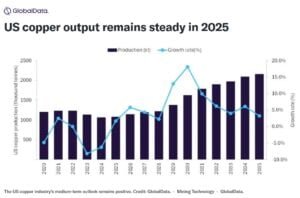

Meanwhile, the United States is also preparing for major growth. U.S. copper production is projected to reach 1,077 kilotonnes in 2025, an increase of nearly 2% from the previous year. By 2030, new large-scale projects could push the U.S. into the global top five copper-producing nations. By 2035, output may more than double to over 2 million tonnes per year.

Copper Prices Stay Strong in 2025

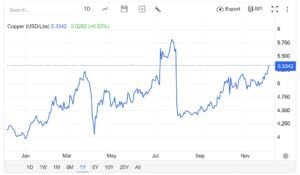

As per Trading Economics, Copper prices rose above $5.20 per pound, reaching a four-month high. The increase followed a record peak on the London Metal Exchange due to lower output in Chile, planned Chinese smelter cuts, and a weaker U.S. dollar.

Since late August, copper has climbed about 13% on the LME amid supply shortages. Traders also boosted shipments to the U.S. to take advantage of high Comex prices, while uncertainty over future tariffs added extra market pressure.

Because of this price environment, the Vale-Glencore collaboration appears especially timely. High prices offer a strong economic case for unlocking new supply from brownfield sites like Sudbury and supporting long-term market stability.

Unlocking Copper to Power a Cleaner Future

Overall, the planned Sudbury project reflects a shift in mining strategy as companies look for smarter, lower-impact ways to increase critical mineral supply. By using existing assets, Vale and Glencore can reach valuable copper deposits faster, reduce costs, and strengthen North America’s mineral independence.

As demand rises for clean energy technologies and electrification, projects like this will play a major role in supporting economic growth, energy security, and the global transition to a low-carbon future.

If the joint venture moves forward after the 2027 investment decision, the Vale-Glencore partnership could become one of the most important copper developments in Canada—helping power everything from EVs to renewable grids for years to come.

The post Vale–Glencore Sudbury Venture Aims to Unlock 880,000-Ton Copper Volume for North America appeared first on Carbon Credits.