Disseminated on behalf of Surge Battery Metals Inc.

In an unprecedented turn for 2025, the Global X Lithium Battery Tech ETF (LIT) has surged ahead as a standout performer, eclipsing even traditional tech giants like NVIDIA. With lithium increasingly seen as a foundational material driving the clean energy transition, LIT’s year-to-date returns have soared, outpacing NVIDIA and spotlighting the essential role of lithium in global decarbonization efforts. Lithium’s real-world impact is reshaping transportation and energy infrastructure, establishing it as the backbone of electric vehicles (EVs), renewable energy storage, and advanced battery technologies.

Investor priorities are changing. Policy makers, corporate leaders, and major funds are focusing on domestic lithium production, battery innovation, and secure critical mineral supply chains in response to skyrocketing global demand. Electric vehicle adoption and grid-scale energy storage set new records, pushing the lithium value chain into the spotlight and attracting increasing capital from those eyeing long-term sustainability and tech-driven value.

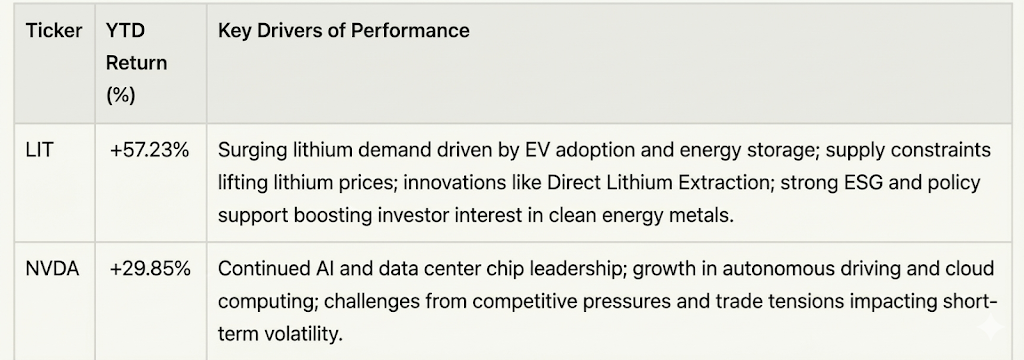

As of December 03, 2025, the Global X Lithium & Battery Tech ETF (LIT) traded near $63, showing +57.23% growth in lithium and battery supply chain sectors since the start of 2025. Nvidia (NVDA) stock traded at around $180, up about 30% year-to-date. This gap reflects rising confidence in lithium as a key material for our energy shift. Unlike tech stocks that focus on digital trends, lithium drives real changes in transport and energy. Investors see lithium as vital for a low-carbon economy.

Performance Comparison: LIT ETF Vs NVDA Stock vs LIT ETF

LIT covers a wide part of the lithium value chain. It includes major miners like Ganfeng Lithium Group, Albemarle, and Lithium America, battery makers like Tesla, CATL, etc., and firms focused on advanced energy storage. Even though lithium demand has soared, lithium ETFs skyrocketed after the White House revealed plans to take a stake in Lithium Americas.

However, the gap between LIT and NVIDIA shows a growing awareness of lithium’s role in clean energy. NVIDIA symbolizes digital progress, while LIT reflects the energy shift driving electrification and clean tech.

Next, we’ll explore LIT’s growth drivers, trends in lithium supply and demand, and investor interest in lithium stocks.

LIT ETF’s Unique Exposure

Global X Lithium & Battery Tech ETF (LIT) tracks the entire lithium value chain. It includes companies in mining, refining, chemical processing, battery cell production, and advanced battery technology. This ETF provides diversified exposure to a fast-growing market, unlike investing in a single company. This variety allows LIT to benefit from both raw material demand and battery innovation, positioning it well for long-term growth.

The fund’s structure offers stability. Individual stocks can be volatile due to earnings reports or regulations. By investing across the supply chain, LIT reduces risk and taps into the electrification trend. This mix of breadth and depth has helped LIT outperform traditional tech leaders in 2025.

A Boom in Lithium Demand

The main driver of LIT’s success is rising lithium demand. Lithium powers lithium-ion batteries found in everything from EVs to home energy systems and grid storage.

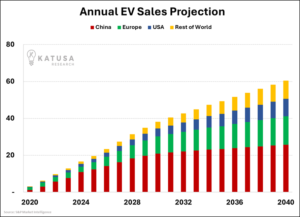

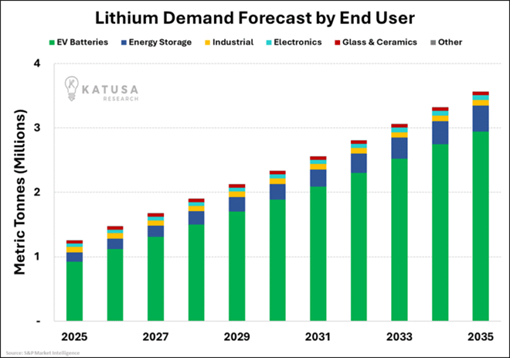

IEA says that global EV sales in 2025 are set to reach around 20 million units, breaking records. Thus, the EV boom is reshaping the lithium market, with electric cars now making up nearly 90% of lithium use worldwide.

This demand surge isn’t just from more vehicles. Battery packs are growing larger for longer ranges and faster charging. Each new EV requires more lithium than older models. Additionally, the rapid growth of stationary energy storage boosts lithium use further.

Grid-scale battery installations exceeded 90 gigawatt-hours (GWh) in 2024, with annual growth rates above 30% expected in the coming years. These batteries store energy from renewable sources and release it during peak demand, making lithium crucial for a renewable future.

The combination of EV adoption and grid storage creates a strong, multi-layered growth story for lithium. Investors increasingly view lithium as a key part of global clean energy infrastructure.

- INTERESTING READ: Every Lithium Stock Just Woke Up From a 3-Year Coma

Lithium Supply Dynamics and Technological Innovation

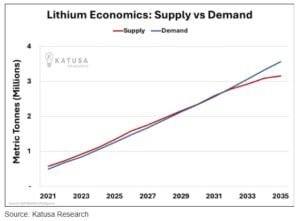

While demand is rising, lithium supply struggles to keep pace. Mining and refining require significant capital, long permits, and strict environmental compliance. Many major lithium deposits are concentrated in specific areas, adding geopolitical risks.

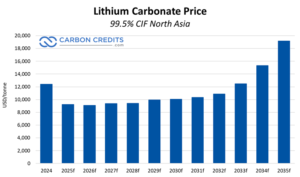

- These supply constraints have kept lithium prices high, with battery-grade lithium carbonate expected to be around $9,250 in 2025.

Emerging technologies are reshaping the supply landscape. Direct Lithium Extraction (DLE) is gaining attention for its efficiency and sustainability. DLE extracts lithium from brine or geothermal sources using less water and causing less land disturbance. Companies using DLE can produce a higher-purity product faster than with traditional methods. For ESG-focused investors, DLE represents a greener way to boost production.

Companies in LIT’s portfolio are adopting these technologies and securing strategic supplies. Lithium Americas, a major holding, recently acquired a 59% stake in the Thacker Pass lithium project in the U.S. through a government initiative. This highlights the importance of domestic lithium sources amid global supply uncertainties.

Market Sentiment and Investment Trends

Investor enthusiasm for lithium stocks and ETFs has surged with global clean energy efforts. Governments are promoting domestic lithium production, supporting EV adoption, and funding battery manufacturing. The U.S., European Union, and China have ambitious plans to secure critical battery materials.

Analysts at Albemarle and other top lithium producers predict that global lithium demand could more than double by 2030, reaching up to 3.7 million tonnes of lithium carbonate equivalent (LCE).

This long-term outlook attracts both retail and institutional investors wanting to join the clean energy transition. LIT offers a liquid, diversified way to tap into this growth without relying on a single company.

The rising focus on lithium aligns with broader trends in sustainable investing. Markets favor assets linked to real decarbonization strategies and infrastructure projects. Lithium, as a backbone for EVs and energy storage, fits this narrative well.

- ALSO READ: Top 3 Pure-Play Battery Stocks to Watch in 2025 and Top 5 Lithium Producers Powering the Battery Market in 2025

Comparing LIT and NVIDIA (NVDA Stock) Performance in 2025

NVDA stock remains a standout performer, driven by its leadership in AI chips, data centers, and autonomous vehicle tech. Analysts see growth potential and have set high price targets for 2025. However, NVIDIA faces challenges like competition from new chipmakers and pricing pressures. While the stock is strong, its growth depends on digital and AI trends rather than energy transformation.

LIT, in contrast, thrives on real shifts in energy and transport systems. While NVIDIA represents the digital revolution, LIT embodies the energy revolution. Lithium’s key role in EVs and storage gives the ETF unique exposure to a megatrend likely to continue. This explains why LIT has outperformed major tech leaders in 2025.

Risks and Challenges

Investing in lithium comes with risks, even with strong prospects. Supply chain delays, regulatory issues, and changes in battery technology can affect demand. These factors may reduce lithium’s role in batteries. Companies in LIT require continuous capital investment to grow, which can impact profits. Price swings in lithium markets can also threaten stability for cautious investors.

Still, strong growth in EV adoption and energy storage, along with supportive policies and tech advances, provides a solid foundation for continued lithium demand.

Lithium as a Strategic Investment Theme

LIT ETF’s 2025 jump shows a broader investment shift. Lithium has evolved from a niche material to a vital part of the clean energy economy. In 2025, LIT is expected to outperform top tech stocks, making it a strong investment opportunity today.

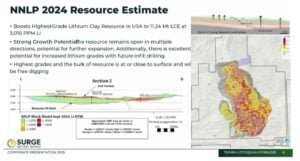

Apart from ETFs, another way to gain exposure to the lithium theme is through Surge Battery Metals (TSXV: NILI | OTCQX: NILIF). The company’s flagship asset, the Nevada North Lithium Project (NNLP) in Elko County, Nevada, hosts the highest-grade lithium clay resource currently reported in the United States.

According to its latest resource estimates, NNLP holds an Inferred Resource of 11.24 million tonnes of lithium carbonate equivalent (LCE) grading 3,010 ppm Li at a 1,250 ppm Li cut-off, according to its latest mineral resource estimate.

This high-grade claystone deposit positions NNLP as a potential future source of domestic lithium for electric vehicles and energy storage, as the Company now advances the project toward Pre-Feasibility, including ongoing economic studies, technical work, and permitting.

This grade makes NNLP the highest-grade lithium clay resource currently reported in the United States.

RELATED:

- Nevada Lithium Hub: Why Surge Battery Metals Holds the Key to U.S. EV Independence

- America’s Lithium Gap: How Surge Battery Metals Could Bridge the Supply Shortfall

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Surge Battery Metals Inc. (“Company”) made a one-time payment of $50,000 to provide marketing services for a term of two months. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

The post Lithium’s Surge: Why Global X Lithium & Battery Tech ETF (LIT) Is Outperforming NVIDIA Stock in 2025 appeared first on Carbon Credits.