China’s electric vehicle scene stayed red-hot in November 2025, but the results weren’t the same for everyone. BYD hit its strongest sales month of the year, even as profits and quality concerns weighed it down. Xiaomi, the fast-rising tech newcomer, kept delivering strong numbers too, but not strong enough to satisfy investors.

Together, the two companies offered a clear snapshot of where China’s fast-growing EV market is heading — and what customers want next.

BYD Scores Biggest Month of 2025 — Despite Profit Squeeze

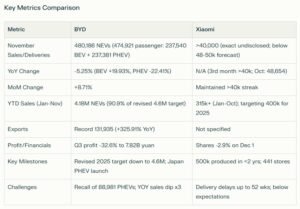

BYD once again proved why it leads the global EV market. The company sold 480,186 new energy vehicles in November, its highest monthly total this year. But the celebration came with a twist. Sales still dipped 5.25% year-over-year, marking BYD’s third straight month of falling annual sales.

Still, things looked better compared to October. BYD managed an 8.71% month-over-month boost, suggesting the company still has plenty of momentum.

But the most interesting part? The gap between BYD’s battery models.

-

Battery electric vehicles (BEVs) jumped 19.93% year-over-year to 237,540 units.

-

Plug-in hybrids (PHEVs) tumbled 22.41% to 237,381 units.

This shift says a lot about Chinese car buyers. They’re moving toward full EVs and leaving hybrids behind as technology improves and charging networks grow.

Even with the strong sales, BYD felt the financial pressure. Its third-quarter profit dropped 32.6% to 7.82 billion yuan ($1.1 billion). That’s the second quarter in a row that profits slipped.

Because of these setbacks, BYD trimmed its 2025 sales target from 5.5 million to 4.6 million vehicles. Still, with 4.18 million units already sold, the company has already hit 90.9% of its updated goal.

Surprisingly, BYD’s (BYDDY stock) Hong Kong shares still finished December 1 up 1.18%, showing that investors haven’t lost faith in the company’s global strategy.

Exports Save the Day as BYD Goes Global

If domestic sales were a bit shaky, BYD’s overseas performance more than made up for it. November exports hit an eye-popping 131,935 units — BYD’s highest export number ever. That’s a 325.91% jump from last year and a 57.25% increase from October.

Simply put, BYD is winning big outside China.

The company is moving fast to build a global footprint. On December 1, BYD launched the Sealion 6 plug-in hybrid SUV in Japan — the country where Toyota has long ruled. Priced from ¥3.982 million ($25,620), the model marks BYD’s first PHEV in Japan and signals that the company is ready to take on its fiercest rivals.

But Recalls Return as Quality Concerns Grow

Not everything went smoothly for BYD in November. China’s safety regulator ordered the recall of 88,981 Qin PLUS DM-i plug-in hybrids built between January 2021 and September 2023. The issue? Battery pack inconsistencies could reduce electric-only range under extreme conditions.

With this recall, BYD has pulled more than 210,000 vehicles off the road in 2025 alone.

The recall involves older cars, but it still adds fuel to worries about BYD’s manufacturing quality. Even so, the company’s expanding export success helped soften the blow.

Xiaomi Cruises Past 40,000 Deliveries — But Investors Wanted More

Xiaomi, China’s fast-growing EV challenger, stayed above the 40,000-unit mark in November for a third straight month. The company didn’t reveal exact numbers, keeping to its habit of letting third-party reports handle that. But one thing was clear: analysts expected more.

Citi projected 48,000–50,000 deliveries, so Xiaomi’s number — likely just above 40,000 — disappointed the market. Investors reacted fast, pulling Xiaomi shares down 2.9% on December 1 to HK$39.84.

Still, Xiaomi’s growth story remains one of the most impressive in the EV world.

-

It topped 41,948 deliveries in September as per the China Passenger Car Association (CPCA) data.

-

It smashed records in October with 48,654 units.

-

From January to October, it delivered 315,376 EVs in total.

Despite the slowdown, it’s certainly not bad for a company that entered the car business only 19 months ago.

Celebrates 500,000 Cars Built in Under Two Years

Xiaomi reached a milestone few automakers have achieved so quickly. On November 20, it celebrated its 500,000th EV rolling off the production line. Deliveries only began in April 2024, making the accomplishment even more remarkable.

At the event, CEO Lei Jun lifted the company’s 2025 delivery target to 400,000 vehicles. This was the second upgrade of the year, following earlier hikes from 300,000 to 350,000.

Citi analysts backed the new goal. With Xiaomi delivering around 10,000 vehicles per week, they said the company is well-positioned to hit the 400,000 mark. They reaffirmed their “buy” rating and set a HK$50 price target.

Expands Stores and Speeds Up Deliveries

To keep up with rising demand, Xiaomi opened 17 new stores in November, pushing its total to 441 stores across 131 cities. Its service network is also expanding, with 249 centers now operating in 144 cities.

But success brought a new challenge: long wait times. Some customers faced delays of up to 52 weeks. To fix that, Xiaomi launched an “In-Stock Vehicle Purchase Program” on December 1.

Buyers can now get brand-new cars, official display models, or nearly new vehicles—all with faster delivery, full warranties, and possible discounts if they lock in orders by December 26.

The company’s lineup is also gaining momentum. The YU7 SUV, launched in June, accounted for 69% of Xiaomi’s deliveries in October, with 33,662 units. The model even beat Tesla’s Model Y in domestic sales that month. Meanwhile, the SU7 sedan continues to attract huge interest.

EV Race Tightens as 2025 Winds Down

BYD and Xiaomi both ended November with momentum, but the paths they followed looked very different. BYD leaned on exports to keep growth steady, even as profits fell and recalls returned. Xiaomi kept expanding at lightning speed, but November’s softer numbers reminded investors that rapid growth also brings volatility.

As the EV market becomes more competitive and global, November’s results showed one clear message: China’s biggest EV players are evolving fast — and the race is far from over.

China’s EV Boom Helps Push Emissions Down

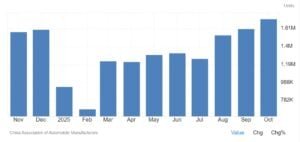

Electric car registrations in China jumped to 1.72 million units in October 2025, up from 1.60 million in September. This marked a new all-time high and showed how quickly the country’s EV market kept growing. For context, China averaged just over 419,000 monthly registrations between 2017 and 2025, with the lowest point recorded in early 2017.

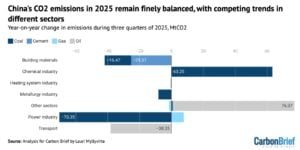

This rapid rise in EV adoption has also played a major role in flattening China’s emissions curve. According to CarbonBrief, transport fuel emissions fell by 5% year-on-year in Q3 2025. More drivers moved away from gasoline and diesel vehicles and shifted toward cleaner electric options.

Moreover, this momentum reflects the strength of China’s electrification policies. The country leads the world in EV production and sales, backed by incentives, improving charging networks, and strong industrial support. As a result, China continued to steer its transport sector toward lower emissions and a cleaner energy future.

The post BYD Breaks Records While Xiaomi Slows: Despite Split Fortunes, They’re Still Driving China’s Emissions Down appeared first on Carbon Credits.