ExxonMobil published its updated 2030 Corporate Plan, which keeps the company’s “dual challenge” approach. The oil giant says it will supply reliable energy while cutting emissions. The update raises lower-emission spending, while also forecasting higher oil and gas production to 2030.

Billions in Motion: ExxonMobil’s Financial and Production Targets

ExxonMobil plans about $20 billion of lower-emission capital between 2025 and 2030. It says the $20 billion targets carbon capture and storage (CCS), hydrogen, and lithium projects.

The company projects ~5.5 million oil-equivalent barrels per day (Moebd) of upstream production by 2030. Exxon also forecasts ~$25 billion of earnings growth and ~$35 billion of cash-flow growth by 2030 versus 2024 on a constant price-and-margin basis.

The oil major gives a range for cash capex. It shows $27–29 billion for 2026 and $28–32 billion annually for 2027–2030. The updated plan highlights about $100 billion in major investments planned for 2026–2030. It notes these projects could bring in around $50 billion in total earnings during that time.

Low-Carbon Plan: $20B for CCS, Hydrogen and Lithium

ExxonMobil describes the $20 billion as focused on three business lines:

- CCS networks and hubs for third parties.

- Hydrogen production and integrated fuels.

- Lithium supply for batteries.

The company says roughly 60% of the $20 billion will support lower-emissions services to third-party customers. It estimates new low-carbon businesses could deliver ~$13 billion of earnings potential by 2040 if markets and policies develop as expected.

Exxon’s updated Corporate 2030 Plan lists current and contracted CCS volumes. The company reports about 9 million tonnes per annum (MTA) of CO₂ capture capacity under contract for its U.S. Gulf Coast network. Key project entries include:

- Linde — Beaumont, TX: ~2.2 MTA CO₂, start-up 2026.

- CF Industries — Donaldsonville, LA: ~2.0 MTA, start-up 2026.

- NG3 (Gillis, LA): ~1.2 MTA, start-up 2026.

- Lake Charles Methanol II: ~1.3 MTA, start-up 2030.

- Nucor — Convent, LA: ~0.8 MTA, start-up 2026.

The plan also highlights a proposed 1.0 GW low-carbon power/data center project paired with ~3.5 MTA capture, with a planned final investment decision in 2026. Exxon calls its Gulf Coast network an “end-to-end CCS system” and says scale depends on permitting and supportive policy.

- SEE MORE: ExxonMobil’s (XOM Stock) Wild Ride: Gas Discovery, $14M Pollution Fine, and Carbon Storage Push

Counting Carbon: How Exxon Tracks Methane and Emissions Cuts

ExxonMobil says it is making measurable progress on emissions. The company reports faster-than-expected cuts in several intensity metrics. It states it has already met key 2030 intensity milestones and now expects to meet its methane-intensity target by 2026, four years early.

The company repeats its long-term net-zero framing for operated assets. Exxon’s plan targets Scope 1 and Scope 2 net-zero for its operated assets by 2050. It also sets a nearer target of net-zero Scope 1 and 2 for its operated Permian assets by 2035.

These commitments focus on emissions the company directly controls. They do not include a Scope 3 net-zero pledge for customer use of sold products. Exxon underscores that these goals depend on technology, markets, and supportive policy.

On operational achievements, Exxon highlights large cuts in routine flaring and improved equipment standards. The new plan states that the company reduced corporate flaring intensity by over 60% from 2016 to 2024.

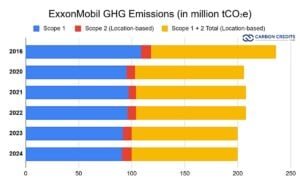

- As shown in the chart below, ExxonMobil’s operated-basis greenhouse gas profile shows a clear decline in Scopes 1 and 2 between the 2016 baseline and 2024.

Also, by 2024, Scope 1 emissions dropped to 91 million metric tons CO₂e. Scope 2 emissions (location-based) reached 9 million metric tons CO₂e. Together, this totals 100 million metric tons CO₂e. This is about a 15% reduction from 2016 based on operations.

For the same period, Exxon’s Scope 1+2 emissions intensity dropped from 27.5 to 22.6 metric tons CO₂e per 100 metric tons produced. This shows they are decarbonizing operations, even as production has changed.

The company also hit other flaring and GHG intensity goals ahead of schedule. These outcomes came from replacing old equipment, tightening operations, and limiting routine venting and flaring.

Exxon lists four categories of near-term reduction actions it is scaling up:

- Methane control: wider deployment of leak-detection and infrared cameras, more frequent inspections, and accelerated repairs.

- Flaring reduction: operational changes and stricter shutdown protocols to cut routine flaring.

- Efficiency and asset management: project design improvements, digital optimization, and selective asset sales or retirements to lower average carbon intensity.

- CCS and low-carbon services: building capture hubs (about 9 MTA of contracted CO₂ capacity on the U.S. Gulf Coast) and contracting capture services for industrial customers.

The plan also names specific technology and program investments. Exxon highlights advanced sensor networks and real-time emissions monitoring. They also focus on expanding data systems to track and verify reductions. It expects these tools to improve measurement accuracy and speed up corrective action.

Limits and caveats appear repeatedly. Exxon links its long-term net-zero goal to several factors. These include market formation, policy incentives like tax credits and carbon pricing, and permitting timelines. The company warns that total emissions and some asset outcomes will change with production levels and energy demand.

In the near term, key metrics to watch include:

-

2026 methane-intensity and flaring disclosures.

-

Volumes of CO₂ captured and stored as Gulf Coast CCS projects launch.

-

The pace of FID and execution for the 1.0 GW / 3.5 MTA low-carbon power and capture project.

These will show whether Exxon’s claimed progress converts into sustained emissions declines.

Fueling the Future: Rising Oil & Gas Output Through 2030

Exxon projects higher hydrocarbon output even as it invests in low-carbon businesses. The plan targets ~5.5 Moebd by 2030. The company expects ~65% of production to come from advantaged assets such as the Permian Basin, Guyana, and select LNG.

Permian growth is a core part of the supply outlook. Exxon expects roughly 2.5 Moebd from the Permian by 2030, up materially from 2024 levels. Guyana’s Stabroek Block is another major growth driver.

Exxon plans multiple new offshore start-ups in Guyana before 2030. The company argues that these barrels deliver lower operational carbon intensity compared with many older fields.

Critics say rising production risks locking in fossil reliance. Environmental groups, including the Sierra Club, called the plan inconsistent with a 1.5°C pathway. Exxon responds that the world will need oil and gas for decades and that its strategy balances supply security with emissions reduction. Reuters reported split investor and market reactions when the plan surfaced.

- MUST READ: Oil Giants Under Fire: ExxonMobil Fights Climate Laws as TotalEnergies Found Guilty of Greenwashing

Investor Radar: Metrics to Track Exxon’s Low-Carbon Rollout

ExxonMobil links the pace of low-carbon roll-out to policy, permitting, and market formation. Key near-term items to watch include:

- Final investment decision and execution of the 1.0 GW / 3.5 MTA project in 2026.

- Gulf Coast CCS volumes will actually be placed into service in 2026–2030.

- Methane-intensity disclosures in 2026 to confirm earlier achievement claims.

Market analysts noted Exxon’s plan targets improved earnings and cash flow through 2030 while retaining tight capital discipline. Some news channels highlighted that the company raised its earnings and cash-flow outlook to 2030 without raising total capital allocation.

The post ExxonMobil’s $20B Low-Carbon Bet in 2030 Plan: Big Emissions Cuts, Bigger Oil Production appeared first on Carbon Credits.