The global race for advanced computer chips is heating up. Countries are competing to lead in semiconductors, which are the core of computers, smartphones, and artificial intelligence (AI) systems.

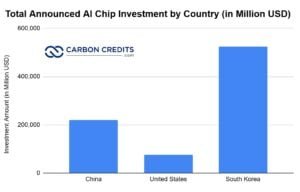

Recently, China proposed a $70 billion plan to support its chip industry. At the same time, South Korea unveiled a $518 billion strategy to expand its semiconductor sector and challenge global leaders like the U.S. and Taiwan. Both plans show how governments are investing heavily to secure technology and economic power in the AI era.

China Plans a Big Chip Industry Support Package

China is considering a major incentive package for its chip industry. The package could be worth up to $70 billion. This would make it one of the largest government efforts to support semiconductor production in the world.

Chinese officials are still discussing the details. The exact amount and the final plan have not been finalized. The proposal would include subsidies, financial support, and other incentives for companies that design and make chips.

The goal of this plan is to strengthen China’s domestic chip manufacturing. China wants to rely less on foreign technology, especially in advanced chip design and production. Officials see semiconductors as key technology for future growth, national security, and AI development.

This proposed spending builds on earlier government efforts to support semiconductor firms. China operates the China Integrated Circuit Industry Investment Fund, or “Big Fund III,” a $47.5 billion equity investment vehicle. This fund has invested tens of billions in local chipmakers.

The possible plan joins a broader global trend. Countries are using public money to support chip production and AI‑related technology. This is happening amid rising global competition between China, the United States, and other advanced economies.

The announcement comes as U.S. policy on chip exports changes. On December 8, President Donald Trump approved the sale of Nvidia’s H200 chips to China. The deal includes a revenue-sharing plan, with 25 % of sales going to the U.S. government.

What China’s Incentive Package Could Do

If China moves forward with the $70 billion package, it would signal a major step in its industrial strategy. The incentives could help Chinese companies:

- Expand domestic chip production capacity.

- Invest in equipment and manufacturing facilities.

- Attract investment in chip design and research.

Officials hope the incentives will reduce China’s reliance on imported chips and advanced tools that are controlled by other countries. This includes sophisticated systems for manufacturing cutting‑edge chips. President Xi Jinping aims for 70% self-sufficiency by 2025.

However, Chinese technology is still behind some global leaders in certain areas, even if the country has invested over $150 billion since 2014. For example, producing the most advanced logic chips remains a challenge domestically. China has relied on imports or foreign partnerships to access some high‑end tools and designs.

South Korea’s Ambitious Long‑Term Chip Strategy

Around the same time, South Korea unveiled a very large plan to strengthen its semiconductor sector. Seoul announced a proposal to invest about 700 trillion won, which is roughly $518 billion, in its chip industry.

The South Korean plan focuses on chips for AI and other advanced technologies. It aims to expand beyond memory chips, where the country is already strong, into areas like logic chips and AI processors.

South Korea’s semiconductor plan includes targeted R&D and sub-investments to drive innovation. It has allocated:

- 126.8 billion won for AI-specialized semiconductor development by 2030,

- 260.1 billion won for compound semiconductors by 2031,

- 360.6 billion won for advanced packaging technologies by 2031, and

- 216 billion won for next-gen memory technologies by 2032.

These focused investments aim to strengthen South Korea’s capabilities in cutting-edge chip technologies and support the country’s push into AI and system semiconductors.

The government also wants to strengthen cooperation between chip designers and manufacturers. It aims to create more companies that design chips (fabless firms) as well as expand production capacity.

South Korea’s plan is part of a long‑term vision through 2047. Officials say this effort is meant to position the country as a global leader in the AI era.

South Korea’s Strategic Focus on AI and the Supply Chain

South Korea’s chip strategy highlights the importance of artificial intelligence and advanced semiconductor technologies. Its plan aims to:

- Expand technological capabilities in AI‑related chips.

- Strengthen the full supply chain for semiconductors.

- Build industrial clusters that combine production, research, and infrastructure.

The Korean government sees this as both an economic and strategic priority. Officials say that better chips and AI could boost the nation’s global competitiveness in the coming decades.

Why Chips Are the Heart of the AI Era

Advanced chips are essential for many technologies. They power smartphones, computers, data centers, vehicles, and most importantly, artificial intelligence systems. Many governments now see semiconductor leadership as vital for economic and national security.

China and South Korea are acting as the global chip race intensifies. Other major players include the United States, Taiwan, Japan, and the European Union. Each has its own strategies to promote chip design, advanced manufacturing, and supply chain security.

The United States passed the CHIPS and Science Act. This law gives subsidies and tax incentives to chip companies in the U.S. It authorizes roughly $52.7 billion for semiconductor manufacturing, research, and workforce support. It also has an additional $24 billion in tax credits to encourage domestic chip production.

This funding supports advanced semiconductor facilities and R&D, including AI-relevant technologies. It also aims to boost domestic production and cut reliance on foreign suppliers.

Taiwan leads in advanced chip manufacturing. It excels in logic chips and advanced process nodes. South Korea is strong in memory chips, which are also critical for many high‑performance computing applications. China is still catching up in production technology. However, it is pushing for faster progress with state support.

Chips, Energy Use, and Emissions

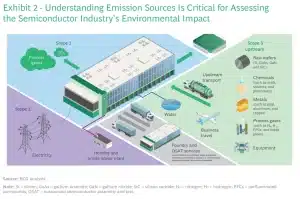

Making advanced chips uses a lot of energy. Factories run large machines and maintain clean air, which consumes huge electricity. A single semiconductor plant can use as much energy as a small town and about 10 million gallons of ultra‑pure water daily.

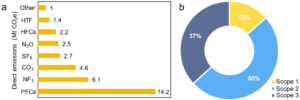

Globally, the semiconductor industry accounted for roughly 0.5 % of electricity use in 2022, with 70 % of emissions coming from energy consumption. In East Asia, AI chip production caused emissions to jump sharply.

- Taiwan’s emissions grew from 41,200 to 185,700 tonnes of CO₂ in one year, while South Korea’s rose from 58,000 to 135,900 tonnes.

Most emissions come from electricity (Scope 2) and gases used in production, which can trap heat more strongly than CO₂.

Chipmakers are acting to reduce energy use. Some report up to 44 % lower peak power use, and many aim for 20–30 % energy cuts or 100 % renewable electricity by 2040. Balancing growth with climate goals is now a key challenge for the global chip industry.

The Global Semiconductor Race is On

Both China and South Korea are responding to global pressures and opportunities. Advanced chips are key to technologies like AI, quantum computing, autonomous vehicles, and smart devices.

Many countries are investing heavily in semiconductor research and manufacturing. This includes public funding, tax incentives, and partnerships with private companies. Governments also work to protect intellectual property, secure supply chains, and attract skilled workers.

Some initiatives encourage international cooperation. For example, alliances and trade agreements seek to strengthen supply chains and reduce risks from political or economic tension.

- READ MORE: TSMC Posts Record Q3 2025 Earnings as AI Chip Demand Soars 39% and Sustainability Strengthens

The post Global AI Chip Race Heats Up: China’s $70B Plan and South Korea’s $518B AI Strategy appeared first on Carbon Credits.