After a challenging year, the global nuclear industry is preparing for a meaningful rebound in 2026. New reactor startups, plant restarts, and strong policy backing are reversing the slowdown seen in 2025. At the same time, rising electricity demand from artificial intelligence and data centers is giving nuclear energy a renewed role as a stable, carbon-free power source.

According to BloombergNEF, global nuclear capacity is expected to grow again next year after shrinking in 2025. While long construction timelines and high costs remain hurdles, governments and major corporations are once again looking to nuclear to meet long-term energy needs.

A Weak 2025 Sets the Stage for Recovery

The nuclear sector struggled in 2025. Only two reactors entered service through November, while seven were permanently shut down. As a result, global nuclear capacity declined by around 1.1 gigawatts, marking one of the industry’s weakest years in recent memory.

However, this downturn appears short-lived. BloombergNEF expects about 15 reactors to come online in 2026, adding close to 12 gigawatts of new capacity. This shift reflects years of planning finally materializing, along with growing political and commercial support for nuclear power.

More importantly, the rebound signals confidence that nuclear can play a larger role in energy security and decarbonization, especially as electricity demand accelerates.

The Palisades Restart Marks a Historic Moment

One of the most symbolic developments in the U.S. is the planned restart of the Palisades nuclear plant in Michigan. If successful, it would become the first nuclear facility in the country to return to service after entering decommissioning.

Owned by Holtec International, Palisades is targeting an early 2026 restart. The project has received $1.52 billion in federal loan support and officially transitioned back to operational status in August. Once fully operational, the plant is licensed to run through at least 2031. Holtec also plans to apply for a 20-year license extension in early 2026.

This restart reflects a broader shift in U.S. nuclear policy. Instead of allowing aging plants to shut down, policymakers are increasingly focused on extending reactor lifetimes, upgrading existing facilities, and bringing retired plants back online where possible.

Data Centers Drive New Energy Choices

At the same time, the rapid expansion of AI and cloud computing is reshaping power markets. In 2025, major technology companies signed several U.S. deals for gas-fired power, alongside clean energy contracts, as they raced to secure fast and reliable electricity supplies.

Big Tech firms have long been leaders in renewable energy procurement. However, the urgency to expand computing capacity has pushed them to also consider gas-fired and nuclear power. Speed, reliability, and 24/7 availability have become critical factors.

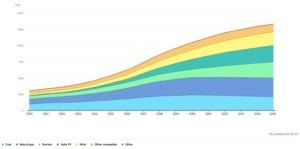

According to the International Energy Agency, gas-fired power plants are currently the largest source of electricity for U.S. data centers. This is expected to continue in the near term, as renewable projects face grid connection delays and policy bottlenecks. Still, the IEA expects clean power, including nuclear, to play a larger role after 2030 as installed capacity grows.

U.S. Policy Accelerates Nuclear and SMR Deployment

U.S. government policy is now closely aligned with this shift. The Trump Administration has emphasized “energy dominance” and reliable power to support AI leadership. The Department of Energy is working to remove barriers to co-locating data centers with new generation sources, including nuclear plants on federal land.

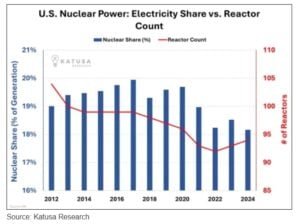

Recent executive orders aim to increase US nuclear energy capacity from 100GW to 400GW by 2050. It also aims to add 5 gigawatts of additional capacity by upgrading existing nuclear reactors and to have 10 newly designed large reactors under construction by 2030.

As part of this push, the DOE recently selected the Tennessee Valley Authority and Holtec as the first recipients of $400 million each in cost-shared funding to advance early deployments of advanced light-water small modular reactors.

Officials say these projects will help deliver new nuclear generation in the early 2030s, strengthen domestic supply chains, and support a broader nuclear renaissance. In addition, retired coal plant sites across the U.S. could host up to 174 gigawatts of new nuclear capacity, offering faster development timelines and existing grid connections.

Modest Growth Expected Through the Decade

Looking ahead, the U.S. nuclear industry expects gradual but steady growth. BloombergNEF estimates around 7% net growth, or roughly 7 gigawatts, by the end of the decade. This will primarily result from plant restarts, power upgrades, and license extensions for reactors that are set to expire before 2035.

Earlier frameworks under the Biden administration targeted as much as 200 gigawatts of new nuclear capacity by 2050. These ambitions are now being accelerated by stronger political support and rising demand from AI-driven infrastructure.

Still, challenges remain. Large-scale nuclear projects take years to build and face complex regulatory processes. As a result, small modular reactors and life-extension projects are expected to play a larger role in the near to medium term.

- MUST READ: Project Matador: America’s $90B Nuclear Power Solution for AI, Semiconductors, and Data Centers

China Continues to Lead Global Expansion

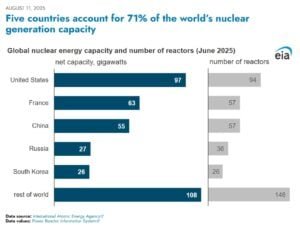

While the U.S. focuses on restarts and SMRs, China remains the world’s most active nuclear builder. The country has approved 10 new nuclear generating units with a total investment of about $27 billion. These projects expand five existing plants and rely entirely on domestic technologies.

Investment in nuclear engineering and construction reached a record 146.9 billion yuan last year. By the end of 2024, China had 57 reactors in operation with nearly 60 gigawatts of installed capacity.

China is forecast to become the world’s largest nuclear power market by 2030, overtaking both the U.S. and France. Nuclear power currently supplies about 5% of China’s electricity, and this share is expected to double to 10% by 2040.

Notably, China’s Linglong One small modular reactor is scheduled to begin commercial operations in the first half of 2026. This would make it the world’s first commercial onshore SMR, further strengthening China’s leadership.

Nuclear Finds New Purpose in an AI-Driven World

Globally, about half of all reactors under construction are located in China. At the same time, technology giants such as Microsoft, Google, Amazon, and Meta are signing nuclear power agreements or investing directly in reactor development. Goldman Sachs estimates that data center electricity demand could rise by 160% by 2030.

Despite lingering risks, the combination of climate goals, grid constraints, and surging AI demand is reshaping the role of nuclear energy. While large reactors remain slow to build, nuclear energy is increasingly seen as one of the few scalable, low-carbon options capable of delivering reliable power around the clock.

Sources of global electricity generation for data centres, Base Case, 2020-2035

As a result, 2026 may mark the beginning of a new chapter for the nuclear industry—one driven not just by decarbonization, but by the growing need for dependable energy in a data-hungry global economy.

The post 2026: The Year Nuclear Power Reclaims Relevance With 15 Reactors, AI Demand, and China’s Expansion appeared first on Carbon Credits.