Korea Zinc is taking a major step to reshape the global critical minerals market. The world’s largest non-ferrous metal smelter will build a state-of-the-art facility in Clarksville, Tennessee, in partnership with the U.S. Department of War and the U.S. Department of Commerce. The project known as the “U.S. Smelter” will require $6.6 billion in capital spending and $7.4 billion in total investment, including financing costs.

Deputy Secretary of War Steve Feinberg.

“President Trump has directed his Administration to prioritize critical minerals as essential to America’s defense and economic security. The Department of War’s conditional investment of $1.4 billion to build the first U.S.-based zinc smelter and critical minerals processing facility since the 1970s reverses 50 years of industrial decline. The new smelter in Tennessee creates 750 American jobs to unlock strategic minerals as a force multiplier across aerospace, defense, electronics, and advanced manufacturing without chokepoints.”

“U.S. Smelter”: A Landmark Project for Supply Chain Security

The project is the largest U.S. metals refining investment in decades, strengthens U.S.–South Korea economic and security ties, and helps the United States reduce reliance on China for materials crucial to electronics, clean energy, and defense.

- The U.S. Department of War will arrange about $2.15 billion with private investors.

- The Department of Commerce will provide $210 million in CHIPS Act funding to support U.S.-based equipment purchases, with JPMorgan helping structure the financing

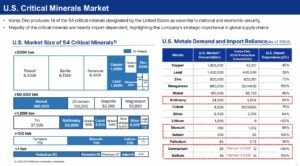

This will be the first zinc refinery built in the U.S. since the 1970s. More importantly, it will operate as an integrated smelter capable of producing 13 non-ferrous metals, most of which the U.S. government classifies as critical minerals.

U.S. officials see the project as a flagship example of how allied nations can work together to secure vulnerable supply chains. As global competition for natural resources intensifies, the facility aims to ensure steady access to materials that underpin modern industry and national security.

Secretary of Commerce Howard Lutnick, highlighted:

“Korea Zinc’s critical minerals project in Tennessee is a transformational deal for America. Our country will now produce, in volume, 13 critical and strategic minerals that are vital to aerospace and defense, semiconductors, AI, quantum computing, autos, industrials, and national security. With our investment in this state-of-the-art project, we are decisively strengthening our national and economic security by producing these critical minerals at scale and thus reducing dependence on foreign nations. Additionally, the United States has preferred access to a portion of Korea Zinc’s expanded production in South Korea.”

Korea Zinc Brings Global Smelting Leadership to the U.S

Korea Zinc plans to deploy personnel and technical expertise from its Onsan Smelter early in the project. This approach aims to ensure smooth commissioning and reduce operational risks.

Onsan’s strength lies in processing complex and low-grade materials, including scrap with high impurity levels. Its integrated zinc-lead-copper system maximizes metal recovery and sets global benchmarks for efficiency.

By transferring this know-how, Korea Zinc expects the U.S. Smelter to rank among the most advanced facilities in the world. For Korea Zinc, the U.S. smelter is more than an expansion. It creates a strategic production base in the world’s largest demand market.

By producing inside the U.S., Korea Zinc can reduce exposure to geopolitical risks, trade restrictions, and logistics disruptions. It can also source scrap and raw materials locally, making its global supply chain more flexible and resilient. The move positions Korea Zinc as a trusted long-term partner in America’s critical minerals ecosystem.

Shareholders Pushback

Despite strong government support, Korea Zinc faces resistance– its largest shareholder alliance, led by MBK Partners and YoongPoong, opposes the U.S.-backed joint venture, arguing it could dilute existing shareholders and cement Chairman Choi Yun-beom’s control. They may even seek a court injunction to block new share issuance.

Markets reacted sharply. Korea Zinc shares initially jumped more than 26% when the project was announced, but later fell by over 13% as opposition surfaced.

What the Tennessee Smelter Will Produce

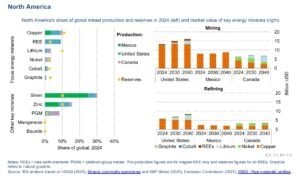

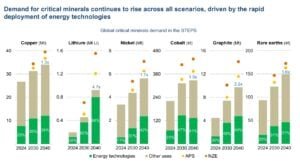

The United States consumes vast volumes of critical minerals, driven by growth in electric vehicles and batteries, semiconductors and AI data centers, aerospace and defense manufacturing, etc.

Once fully operational, the U.S. Smelter will process around 1.1 million tons of raw materials per year and produce 540,000 tons of finished products annually.

The output will include:

- Base metals: zinc, lead, and copper

- Precious metals: gold and silver

- Strategic minerals: antimony, indium, bismuth, tellurium, cadmium, gallium, germanium, and palladium

- Chemical products: sulfuric acid and semiconductor-grade sulfuric acid

Notably, 11 of the 13 metals qualify as critical minerals under the 2025 U.S. Geological Survey list. Some, such as indium and gallium, are currently 100% import-dependent in the United States.

Phased Construction with Operations Starting in 2029

Site preparation will begin in 2026, followed by full construction in 2027. The company expects to start phased commercial operations in 2029, beginning with zinc, lead, and copper production.

The smelter will span 650,000 square meters, modeled after Korea Zinc’s Onsan Smelter in Ulsan, South Korea. Onsan is the world’s largest single-site smelting complex and the backbone of Korea Zinc’s global leadership.

By applying the same advanced technology, process optimization, and digital control systems, the company aims to replicate that success in North America.

Why Clarksville Makes Strategic Sense

Clarksville offers several advantages that make it an ideal location.

First, the site already hosts Nyrstar’s existing zinc smelter, the only zinc refinery currently operating in the United States. Korea Zinc plans to acquire Nyrstar’s U.S. operations, subject to conditions, then dismantle the old facility and replace it with a much larger and more advanced plant.

Second, the region provides strong infrastructure, including stable soil conditions, reliable drainage, and favorable groundwater characteristics. It also offers excellent rail and road connectivity.

Third, Clarksville brings a skilled workforce. The existing smelter has operated for nearly 50 years, and the new project will allow hundreds of experienced workers to transition into the expanded facility.

Finally, electricity costs, one of the largest expenses in smelting, are relatively low in the region. Combined with federal and state incentives, this gives the project a clear cost advantage.

The bigger picture is that the Tennessee project remains a defining moment for Korea Zinc and U.S. industrial policy. For the U.S., it strengthens supply chain independence. For Korea Zinc, it secures long-term growth in a high-demand market.

To end with, Chairman Yun B Choi emphasized,

“With its project in the United States, Korea Zinc will solidify its position as a strategic partner supplying essential minerals for aerospace and defense. This will become a model case of strengthened U.S.-ROK economic security cooperation. Given the current geopolitical climate and strong U.S. support, now is the optimal moment for expansion into the American market.”

The post Big Bet, Bigger Stakes: Korea Zinc’s $7.4 Billion Smelter Reshapes U.S. Critical Minerals Supply appeared first on Carbon Credits.