Cities drive the world’s economy. They also drive most of its emissions. Urban areas account for more than 70% of global greenhouse gases, but a new roadmap says they can flip the script. Instead of being the biggest source of pollution, cities can become powerful climate solutions—functioning as carbon sink cities that actively remove more CO₂ than they emit.

The “Pathways to Carbon Sink Cities: Implementation Guide 2025,” released by the City CDR Initiative, lays out a practical plan to make that future real. The guide moves beyond vision statements and academic modeling. Instead, it focuses on implementation—how cities can integrate carbon removal directly into planning, infrastructure, finance, governance, and everyday urban life.

Rethinking Cities as Carbon Removers, Not Just Emitters

The core idea is simple but transformational. Cities no longer need to think only about reducing emissions. They can remove carbon at scale using:

- Direct air capture systems on rooftops and public buildings

- Enhanced rock weathering in streets and construction materials

- Biomass strategies like biochar and algae systems

- Nature-based sinks like urban forests, wetlands, and green roofs

This is the third report in a broader effort. Earlier editions mapped the vision and identified capability gaps. This new guide delivers the operational blueprint.

Crucially, the report stresses that urban carbon removal does more than fight climate change. It supports adaptation, improves air quality, boosts public health, enhances biodiversity, and strengthens city resilience. As global carbon markets tighten, the report argues that cities investing in CDR today stand to benefit economically tomorrow.

Deployment Pathways: From Pilots to Gigaton-Scale Removal

Urban spaces may feel crowded, but the guide shows there is significant hidden potential. It highlights city-ready CDR pathways already close to commercial viability.

Engineered systems include modular DAC units that can integrate into rooftops, transport hubs, and energy facilities. Enhanced weathering can be embedded into pavements and parks. Meanwhile, biological approaches like algae bioreactors in wastewater plants and perennial biomass in vertical farms deliver added sustainability value.

The report outlines a realistic growth curve:

- Pilot Phase: Start with low-risk, low-cost installations in public spaces.

- Expansion Phase: Incentivize private sector adoption through tax benefits and carbon revenue.

- Integration Phase: Embed CDR directly into zoning, building codes, and infrastructure plans.

Beyond climate impact, many of these systems deliver co-benefits. DAC installations can help cool buildings. Urban forests improve mental health, reduce heat, and clean local air. These benefits strengthen community support and political momentum.

- READ MORE: Verra Issues First CCP-Labeled IFM Credits Under VM0045: A New Era for Forest Carbon Accounting

Governance: The Hardest Challenge—and the Biggest Enabler

Technology alone will not build carbon sink cities. Governance determines success.

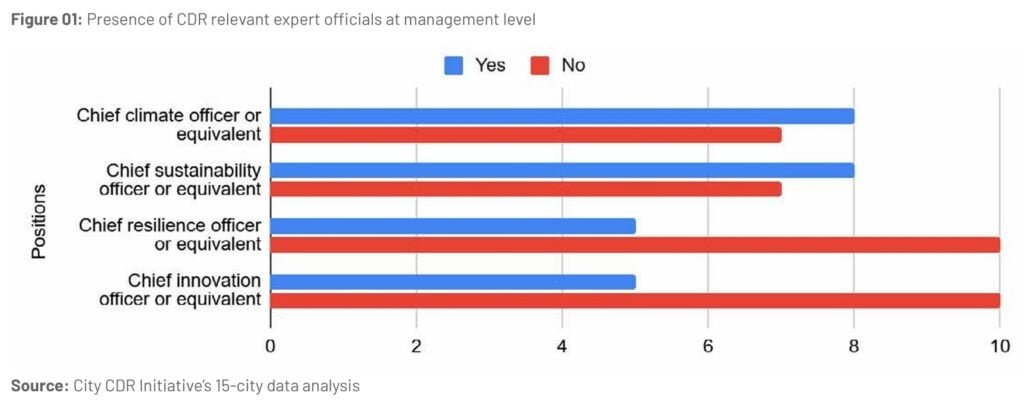

The guide calls for multi-stakeholder coalitions, bringing together governments, utilities, real estate players, financial institutions, and local communities. It introduces a “City CDR Readiness Assessment” to help municipalities evaluate infrastructure suitability and regulatory gaps.

Key policy tools include:

- CDR quotas built into building codes

- Dedicated CDR funds using green bonds, grants, and carbon revenues

- Digital MRV platforms using satellites, IoT sensors, and AI

- Bulk procurement programs to reduce cost for smaller businesses

Case studies across 20 cities show that shared energy service contracts and pooled procurement dramatically accelerate uptake, especially for small and mid-sized companies.

Urban Carbon Credits: Turning City CDR into a Market Opportunity

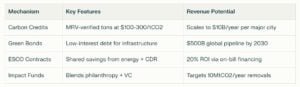

Urban CDR is more than a climate goal—it is quickly becoming a strong market opportunity. The guide explains that city-based carbon credits could earn premium prices because they are easier to verify, offer long-term permanence, and deliver real community benefits. Instead of depending on one funding source, cities can use several routes.

These include Article 6–aligned international crediting, blended finance supported by public funds and impact investors, performance-based contracts that pay only for verified removals, and large public-private partnerships like those already taking shape in Shanghai.

Investors Eye Urban CDR

Investors are paying attention. Rising compliance demand, a recovering voluntary market, and supportive policies such as the U.S. Inflation Reduction Act and EU frameworks are helping build confidence. Early projections suggest scalable pilots could deliver returns of 15% to 25%, turning CDR into both a climate solution and an attractive investment space.

With President Trump’s administration pushing energy dominance while IRA-backed incentives remain influential, U.S. cities could become major DAC hubs. At the same time, Asia’s mega-cities hold a strategic advantage thanks to strong industrial ecosystems and access to mineral supply chains, positioning them as powerful players in the next wave of urban carbon removal.

A Realistic Roadmap to 2040 Net-Sink Cities

The report lays out a three-phase roadmap:

- Phase 1 (2025–2027):

Cities prepare infrastructure, build workforces, and launch 10–20 pilots each. - Phase 2 (2028–2035):

Policy mandates drive scale. Cities target removal equal to 1–5% of their emissions annually. - Phase 3 (by 2040):

Urban CDR integrates fully with AI-enabled management, pushing cities into net-sink status.

Challenges remain. Land scarcity is real. Costs are uneven. But hybrid solutions—like DAC plus solar installations along highways—and equity funds for low-income communities help balance deployment.

Shanghai’s Qingpu New Town offers a glimpse of what’s possible. A study of its central business district showed that under a high-quality development pathway, emissions peak by 2028 and fall by over 47% by 2040. With integrated scenario planning, green buildings, smart mobility, storage, and urban sinks, its model can guide global replication.

The Investment Signal: Cities as the Next Frontier of Carbon Markets

Analysis suggests the CDR market, currently valued at approximately $2 billion, is projected to expand to $50 billion by 2030 and potentially exceed $250 billion by 2035. Compliance buyers, corporate climate commitments, and rapid urbanization would power it.

Risks exist—such as technology maturity, policy swings, and MRV complexity—but diversified deployment spreads exposure and strengthens resilience.

For ESG investors, infrastructure planners, and climate strategists, carbon sink cities are more than a climate concept. They represent a new class of climate asset—where sustainability, resilience, and financial returns align.

Cities built the modern world. Now they may be the ones that help save it.

The post From Emissions to Removal: Why Carbon Sink Cities Are the Next ESG Frontier appeared first on Carbon Credits.