What Happens to the USD When the Fed Cuts Rates?

Key Takeaways

- Historically, Fed rate cuts put downward pressure on the U.S. dollar (USD).

- The USD often rises in the first 3 months of a cutting cycle, but weakens over the 6-month, 1-year, and 2-year horizons.

- Other major central banks (including the BoC, BoE, and ECB) have typically cut rates over similar periods.

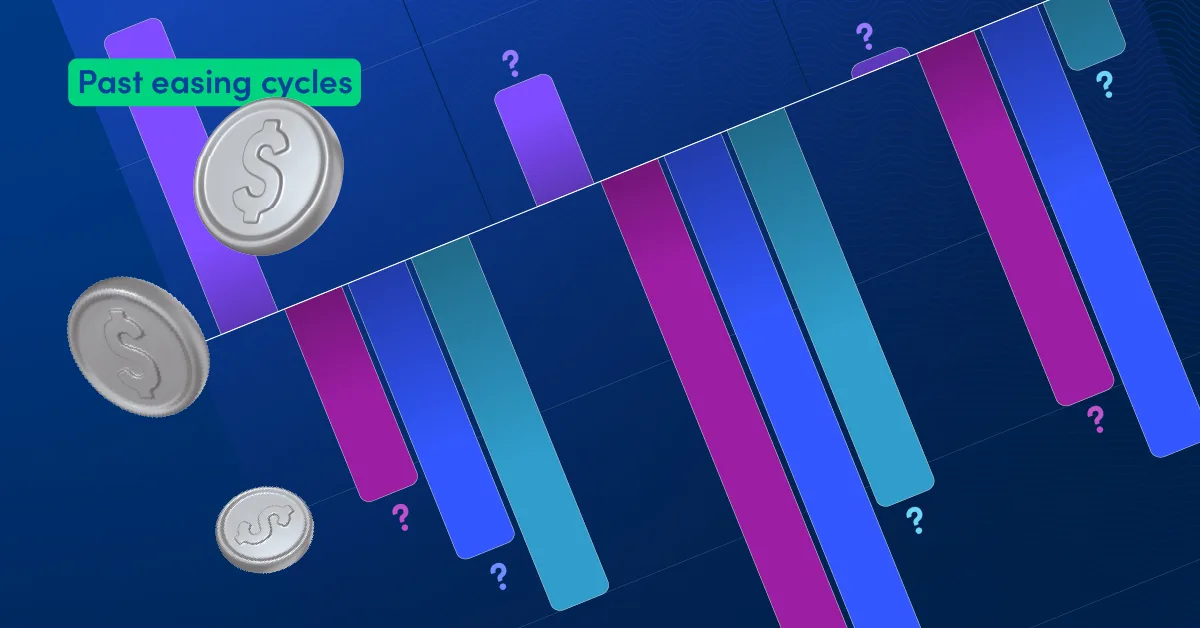

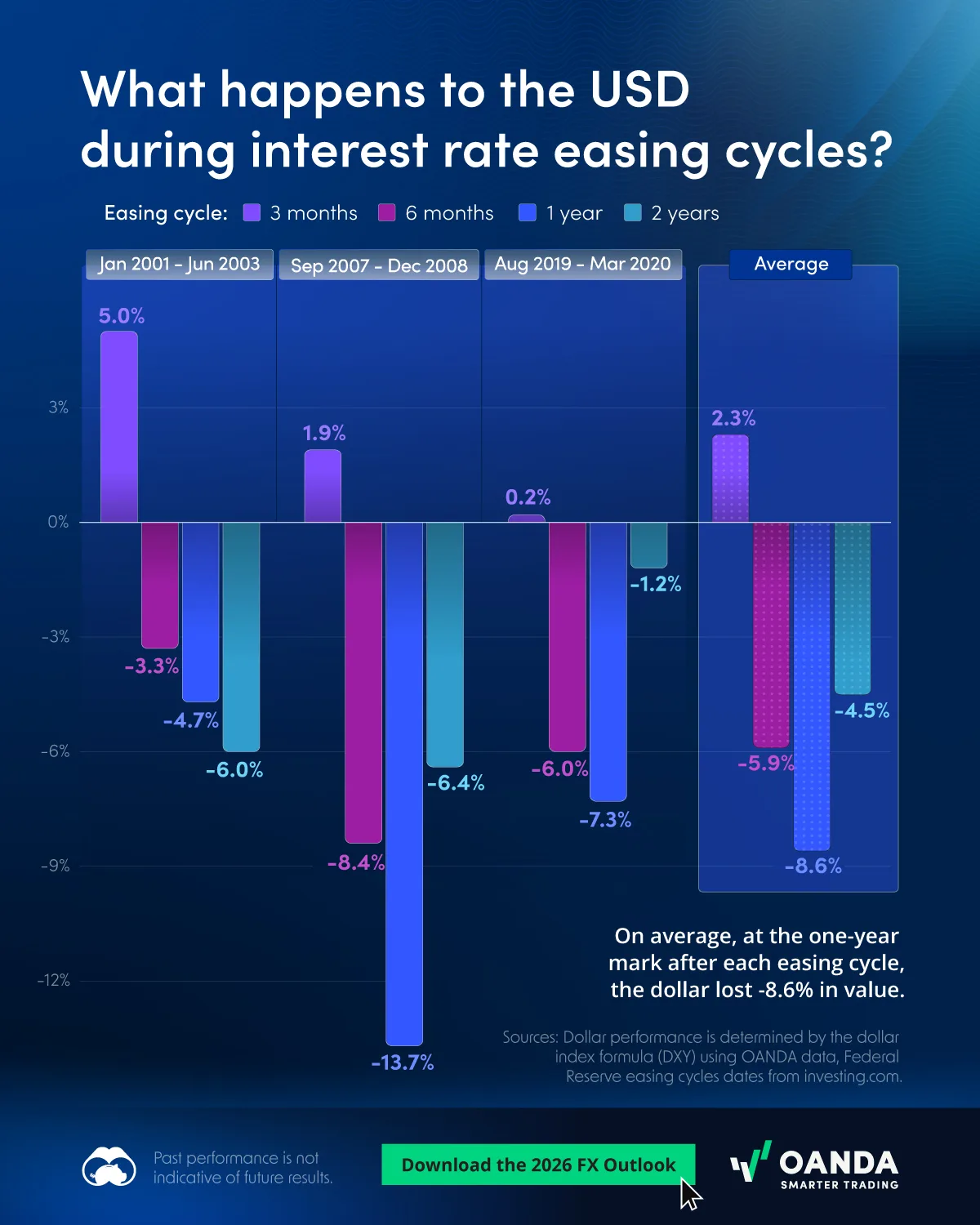

When the Federal Reserve begins cutting interest rates, the U.S. dollar has historically struggled to maintain its strength. This visualization, created in partnership with OANDA, examines how the dollar behaved during the last three major easing cycles.

While the USD may stay stable, or even prove resilient, early on, it has tended to weaken as the cycle progresses. Will greenback performance in 2026 follow suit if the Fed cuts rates further?

How the USD Has Responded to Fed Rate Cuts

Across these cycles, a clear negative relationship emerges between the start of Fed easing and U.S. dollar performance. On average, the dollar has fallen about 6% six months into a rate-cut cycle, dropped nearly 9% after one year, and remained lower even two years after cuts begin.

| USD Performance (%) | ||||

|---|---|---|---|---|

| Rate Cut Cycle | 3 months | 6 months | 1 year | 2 years |

| January 2001-June 2003 | 5.0% | -3.3% | -4.7% | -6.0% |

| September 2007-December 2008 | 1.9% | -8.4% | -13.7% | -6.4% |

| August 2019-March 2020 | 0.2% | -6.0% | -7.3% | -1.2% |

| Average | 2.3% | -5.9% | -8.6% | -4.5% |

The steepest declines occurred during the 2008 Global Financial Crisis, but the pattern holds across all three cycles—showing declines at the 6-month, 1-year, and 2-year marks each time.

The Role of Global Rate Differentials

Importantly, the dollar’s path does not depend on Federal Reserve policy alone. Major easing cycles are often driven by widespread economic stress, prompting other central banks to adjust policy in tandem.

During both the early 2000s slowdown and the 2007–08 financial crisis, the Bank of Canada, Bank of England, and European Central Bank all cut rates alongside the Fed. At the same time, the Bank of Japan kept rates near zero in the early 2000s and later moved into negative territory from 2016 to 2024, highlighting how coordinated global policy shifts can shape currency outcomes.

What This Means Going Forward

As 2026 starts, the key question is whether a new easing cycle will once again pressure the U.S. dollar or whether global rate dynamics will alter the historical playbook.

Learn how to trade smarter in 2026 with OANDA’s free outlook.

Note: Past performance is not indicative of future results.

-

Money12 months ago

Money12 months agoMajor Currency Performance by Region in 2024

For each of the world’s seven major regions, what is the most-traded currency and how did it perform versus the U.S. dollar in 2024?

-

Money1 year ago

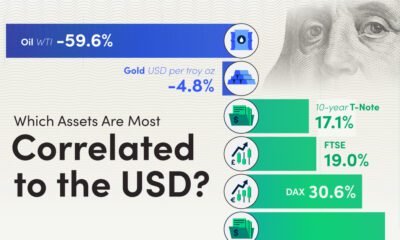

Money1 year agoWhich Assets Are Most Correlated to the USD?

Building a well-balanced, diversified portfolio involves including assets with varying correlations. The USD, with its weak or negative correlations to other assets, can be a valuable…

-

Markets1 year ago

Markets1 year agoRanked: The Ten Most Traded Currencies with the U.S. Dollar

The U.S. dollar is used in 88% of FX trading transactions. Which currencies are most commonly on the other side of the exchange?

-

Markets1 year ago

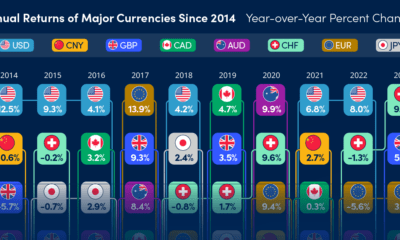

Markets1 year agoRanked: The Top Performing Major Currencies (2014-2023)

Which major currencies have performed best on the foreign exchange market over the last decade?

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “What Happens to the USD When the Fed Cuts Rates?”;

var disqus_url = “https://www.visualcapitalist.com/sp/oan04-what-happens-to-the-usd-when-the-fed-cuts-rates/”;

var disqus_identifier = “visualcapitalist.disqus.com-192751”;