See more visuals like this on the Voronoi app.

See more visuals like this on the Voronoi app.

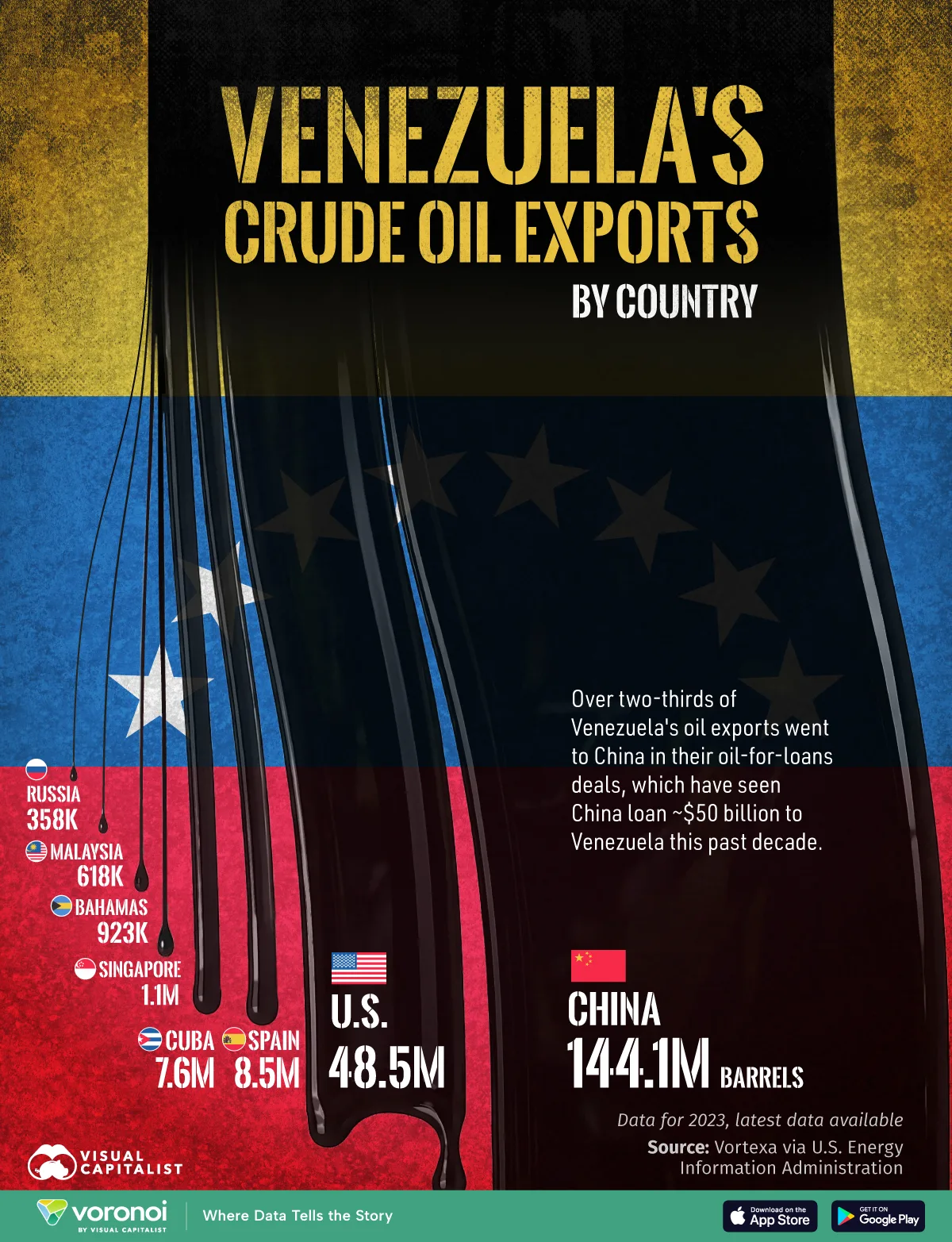

Visualized: Venezuela’s Crude Oil Exports by Country

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Venezuela holds some of the world’s largest oil reserves, but turning that potential into export revenue depends heavily on where its barrels can actually go.

After Nicolás Maduro’s capture by U.S. forces, Venezuela’s oil industry is set to change significantly. But where were Venezuela’s oil exports going previously?

This visualization shows how Venezuela’s crude oil exports were distributed across destination countries in 2023 using data from Vortexa via the U.S. Energy Information Administration.

Where Were Venezuela’s Crude Oil Exports Going?

In 2023, Venezuela exported 211.6 million barrels of crude oil, with more than 90% going to just China and the United States.

The data table below lists each country’s total barrels imported and its share of Venezuela’s exports in 2023:

| Country | Barrels of crude oil exports from Venezuela (2023) | Share |

|---|---|---|

China China |

144,071,000 | 68.1% |

United States United States |

48,467,000 | 22.9% |

Spain Spain |

8,533,000 | 4.0% |

Cuba Cuba |

7,587,000 | 3.6% |

Singapore Singapore |

1,092,000 | 0.5% |

Bahamas Bahamas |

923,000 | 0.4% |

Malaysia Malaysia |

618,000 | 0.3% |

Russia Russia |

358,000 | 0.2% |

China was the dominant destination for Venezuelan crude, importing 144 million barrels in 2023, which represented 68% of all of the South American country’s crude oil exports.

The U.S. was the next largest buyer with 48.5 million barrels imported from Venezuela in 2023, or around 23% of Venezuela’s total crude oil exports that year.

Spain and Cuba were the next two countries with significant amounts of crude oil imports from Venezuela at 8.5 million and 7.6 million barrels, respectively, in 2023.

How China and Venezuela Met Each Other’s Needs

Following the January 2019 U.S. sanctions on PDVSA imposed by the Trump administration—which cut Venezuela’s state oil company off from the U.S. financial system and normal cash sales—a large share of Venezuelan crude exports shifted into oil-for-loans arrangements.

China became the central counterparty, having lent nearly $50 billion over the past decade to Venezuela (now estimated to be $10-$12 billion), receiving crude shipments as debt repayment rather than cash.

While Venezuela’s heavy grade of crude oil is more difficult to refine and yields fewer high-value fuels like gasoline and diesel and more residual products like asphalt, for China this worked out well.

The Asian country’s high asphalt demand is due to its large-scale infrastructure and construction buildouts, and Venezuela’s crude oil offered a cheap supply of necessary resources.

With the U.S. now likely taking control of Venezuela’s oil sector, China will be forced to import more from other trading partners like Russia, Iran, or potentially Canada, which also produces extra-heavy grades of crude oil.

Learn More on the Voronoi App

To learn more about which countries hold significant crude oil reserves besides Venezuela, check out this graphic on Voronoi.