Trump Trade Shake-Up: Which Countries Are Winning Vs. Losing?

Key Takeaways

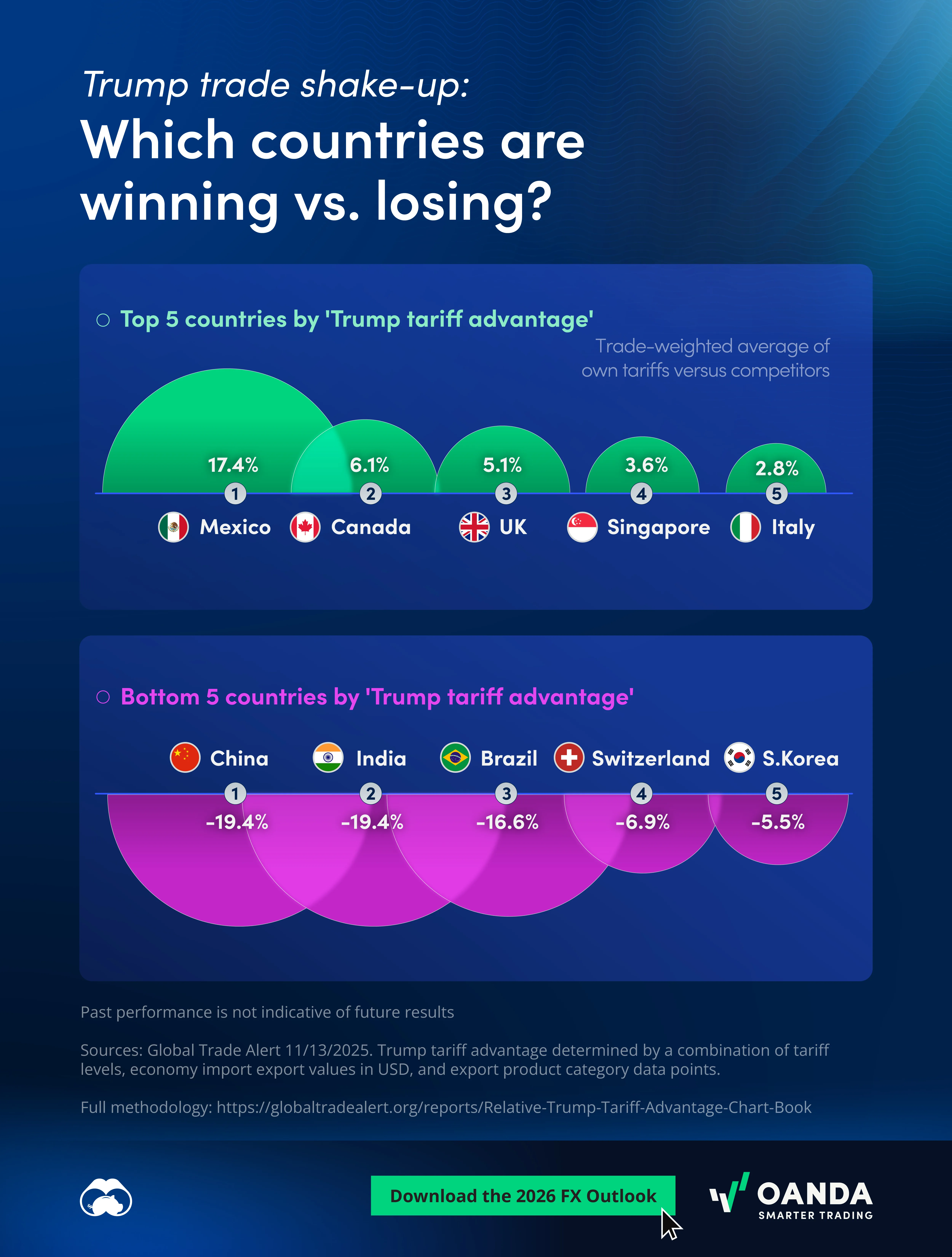

- Shifts in U.S. trade policy under President Trump are creating a more uneven playing field for global exporters.

- Mexico (+17.4%), Canada (+6.1%), and the UK (+5.1%) have emerged with clear relative advantages.

- By contrast, China (-19.4%), India (-19.4%), and Brazil (-16.6%) have faced significantly greater headwinds.

As U.S. trade policy shifts under President Trump, global exporters are facing a more uneven competitive landscape. This visualization, created in partnership with OANDA, explores which countries are winning versus losing in this period of economic uncertainty.

How Trump’s Trade Policies Are Reshaping Export Competitiveness

Changes to tariffs and trade agreements mean countries are no longer operating under the same conditions when accessing the U.S. market. This visual compares countries based on their tariff exposure relative to key competitors, highlighting which exporters are gaining an advantage and which are falling behind as commerce dynamics evolve.

After a volatile start to 2025, several countries now stand out as relative winners. Mexico and Canada benefit from geographic proximity and established trade frameworks, while the UK, Singapore, and Italy have also emerged with more favorable tariff positioning.

| Country | Relative Advantage (%) |

|---|---|

Mexico Mexico |

17.4 |

Canada Canada |

6.1 |

UK UK |

5.1 |

Singapore Singapore |

3.6 |

Italy Italy |

5.1 |

For exporters in these countries, improved access to the U.S. market is often associated with the potential for stronger trade volumes and firmer demand. These shifting dynamics create an environment that has historically supported capital flows and acted as a tailwind for respective currencies.

Where Trade Headwinds Are Building

On the other side of the ledger, a group of major exporters is facing growing disadvantages. China continues to contend with elevated tariffs and ongoing trade tensions, while India and Brazil face higher relative exposure compared to peers. Switzerland and South Korea also appear less favorably positioned, potentially weighing on export competitiveness.

| Country | Relative Disadvantage (%) |

|---|---|

China China |

-19.4 |

India India |

-19.4 |

Brazil Brazil |

-16.6 |

Switzerland Switzerland |

-6.9 |

South Korea South Korea |

-5.5 |

For these economies, higher commerce barriers represent a significant challenge that can weigh on export growth and corporate earnings. In the current landscape, these factors are being monitored for their potential to increase pressure on foreign exchange markets.

What to Watch Next

For traders and investors, these divergences highlight the evolving conditions within the global marketplace, as trade policy remains a key driver of capital and currency flows.

Note: Past performance is not indicative of future results.

-

Markets3 days ago

Markets3 days agoWhat Happens to the USD When the Fed Cuts Rates?

Will Fed easing in 2026 pressure the USD, or will global rate shifts rewrite the usual pattern?

-

Money12 months ago

Money12 months agoMajor Currency Performance by Region in 2024

For each of the world’s seven major regions, what is the most-traded currency and how did it perform versus the U.S. dollar in 2024?

-

Money1 year ago

Money1 year agoWhich Assets Are Most Correlated to the USD?

Building a well-balanced, diversified portfolio involves including assets with varying correlations. The USD, with its weak or negative correlations to other assets, can be a valuable…

-

Markets1 year ago

Markets1 year agoRanked: The Ten Most Traded Currencies with the U.S. Dollar

The U.S. dollar is used in 88% of FX trading transactions. Which currencies are most commonly on the other side of the exchange?

-

Markets1 year ago

Markets1 year agoRanked: The Top Performing Major Currencies (2014-2023)

Which major currencies have performed best on the foreign exchange market over the last decade?

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “Trump Trade Shake-Up: Which Countries Are Winning Vs. Losing?”;

var disqus_url = “https://www.visualcapitalist.com/sp/oan04-trump-trade-shake-up-which-countries-are-winning-vs-losing/”;

var disqus_identifier = “visualcapitalist.disqus.com-192837”;