Standard Chartered has taken a major step in sustainable finance. The UK-based multinational bank issued its first-ever green bond, raising €1 billion to fund climate-focused projects. These projects will span Asia, Africa, and the Middle East, regions where financing gaps remain severe.

Although this is the bank’s fifth sustainable finance issuance, it is the first issued only as a green bond. This shift signals a stronger focus on climate-driven investments. It also shows that Standard Chartered plans to remain active in the sustainable debt market.

The press release also highlighted that investor interest was strong. The bond was nearly four times oversubscribed, with demand exceeding €3.9 billion. This response highlights growing confidence in green finance when projects are clear and credible.

Dan Hodge, Group Treasurer, Standard Chartered, said:

“Investor demand was strong for this issuance with orderbooks peaking at over EUR 3.9bn. Investors in our Sustainable Finance offering continue to enjoy the benefit of facing a UK-regulated Bank counterparty, while the impact delivered through our products and in this case, through our first Green Bond, takes place in many of the most dynamic and high-growth developing markets.”

Why Sustainable Finance Matters More Than Ever

The timing of this bond is critical. Standard Chartered’s 2024 Sustainable Finance Impact Report noted that only five years are left to achieve the UN Sustainable Development Goals, and global progress remains slow. Out of 139 measurable SDG targets, only 18% are on track to be met by 2030. Meanwhile, 17% show limited progress, and 18% have moved backward since 2015.

At the same time, global investment has weakened. Foreign direct investment fell again in 2024, and early trends suggest continued pressure in 2025. This decline has hit SDG-linked sectors the hardest.

Investment in infrastructure in developing countries dropped sharply. Renewable energy funding also fell. Water, sanitation, and agrifood systems saw similar declines. As these trends continue, the financing gap for emerging economies keeps widening.

Thus, without urgent action, this shortfall could reach USD 6.4 trillion by 2030. Therefore, banks and investors must act faster to redirect capital toward sustainable growth.

How Standard Chartered’s Green Bond Makes a Real Impact

The €1 billion raised will support projects aligned with Standard Chartered’s Sustainability Bond Framework. This framework has received a Second Party Opinion from Sustainalytics, which adds credibility and transparency.

The bank will use the funds to finance renewable energy, green buildings, and circular economy solutions. In addition, the bond will support climate-resilient infrastructure, energy efficiency upgrades, and sustainable water and natural resource projects.

Importantly, these investments address both sides of the climate challenge. They reduce emissions while also helping communities adapt to climate risks. As a result, the projects aim to deliver long-term environmental and economic benefits.

Significantly, the bank’s green financing is already making a difference. The Impact Report, green assets supported projects that reduced emissions and strengthened climate resilience.

Standard Chartered’s Sustainable Finance Asset Portfolio

Flood-Resilient Infrastructure in Ghana

In Ghana, the bank financed the design and supply of 89 rapid-response emergency bridges. These bridges serve flood-prone regions across the country. During extreme weather events, they restore access to roads and essential services.

As a result, rural communities gain faster access to healthcare, education, and jobs. These projects also reduce long-term damage from floods, which are becoming more frequent.

Supporting India’s Shift to Clean Transport

The bank has also played a role in India’s clean mobility transition. Through a USD 15.2 million green loan, Standard Chartered supported GreenCell Mobility in deploying 150 electric buses in Surat, Gujarat.

This project marked a first for India. It became the country’s first project-finance green loan in the e-mobility sector. Over the ten-year loan period, the buses are expected to avoid nearly 99,500 tonnes of CO₂ equivalent.

Beyond emissions cuts, the buses reduce fuel costs and eliminate pollution from diesel and gas. At the same time, they improve public transport quality. Passengers benefit from quieter, cleaner, and more reliable travel.

Expanding Solar Power in Türkiye

In Türkiye, Standard Chartered supported one of the country’s largest renewable energy projects. A EUR 249 million green loan, backed by export credit agencies, helped Kalyon Enerji develop Türkiye’s second-largest solar power plant.

Once completed, the project will generate enough electricity for over 80,000 households each year. It will also account for about 11% of the country’s total solar generation.

As a result, Türkiye will reduce fossil fuel use while strengthening energy security. This project shows how large-scale green finance can drive national energy transitions.

The Scale of Standard Chartered’s Green Portfolio

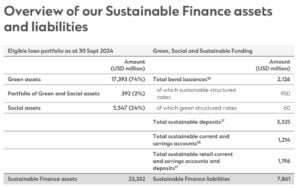

Standard Chartered’s sustainable finance activity continues to grow. As of September 2024, the bank reported USD 23.3 billion in sustainable finance assets. Around 78% of these assets are located in Asia, Africa, and the Middle East.

Within this pool, USD 17.4 billion qualifies as green assets. These funds support more than 350 green projects across multiple sectors.

Collectively, from January 2021 to September 2024, the bank mobilized USD 121 billion in sustainable finance. This progress moves it closer to its USD 300 billion target by 2030.

Clear and Measurable Climate Benefits

The environmental impact of this financing is measurable. By September 2024, 74% of the bank’s sustainable finance lending supported green projects. These investments helped avoid 4.06 million tonnes of CO₂ emissions during the reporting period. This figure represents a 34% increase from the previous year.

To put this in context,

- The avoided emissions are equivalent to removing 9.5 million barrels of oil from use.

- They also match emissions from 3.7 million economy-class round-trip flights between London and Singapore.

Salman Ansari, Global Head, Capital Markets, Standard Chartered, said:

“SCPLC navigated what transpired to be the busiest ever day in EUR IG credit markets to price its debut Green offering, having previously issued in Social and Sustainable format. The EUR 1 bn-sized offering landed flat to the Issuer’s secondary curve – credit to the strength of our credit and the investor interest in our sustainability story.”

Standard Chartered’s first green bond sends a clear message. Demand shows that investors are ready to support climate action when projects are transparent and impactful.

As climate risks rise and funding gaps widen, such initiatives will become essential. By focusing on emerging markets and real outcomes, Standard Chartered is positioning green finance as a core part of long-term growth and climate strategy.

The post How Standard Chartered’s €1 Billion Green Bond Is Scaling Climate Finance in Emerging Markets appeared first on Carbon Credits.