BMW widened its lead over Mercedes-Benz in the global electric vehicle market in 2025, selling more than 2.5 times as many fully electric cars as its longtime German rival. The growing gap highlights not only BMW’s strong execution but also the mounting pressure on Mercedes-Benz to reset its EV strategy amid weak demand and regional headwinds.

While both automakers faced a challenging macro environment, their electric vehicle performance moved in sharply different directions. BMW accelerated, especially in Europe. Mercedes, by contrast, lost momentum in key markets such as China and North America, forcing difficult product and portfolio decisions.

BMW’s EV Strategy Delivers Scale and Stability

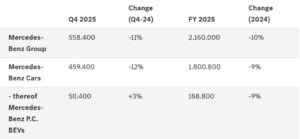

BMW ended 2025 with 442,072 fully electric vehicle deliveries, including more than 105,000 electric Minis, marking a 3.6% increase from the previous year. Over the same period, Mercedes delivered 168,800 battery-electric vehicles, a 9% year-on-year decline. The contrast underscored BMW’s growing dominance in the premium EV segment.

More broadly, the BMW Group delivered 2.46 million vehicles across all powertrains in 2025, slightly higher than the previous year.

- Electrified vehicles—including plug-in hybrids—reached 642,087 units, up 8.3%, and accounted for 26% of total group sales. This balance between combustion engines, hybrids, and EVs continued to shield BMW from abrupt demand swings.

BMW executives described electrified models as the company’s strongest growth driver. Demand proved especially resilient in Europe, where supportive regulations, charging infrastructure, and consumer incentives remained relatively stable compared to other regions.

Jochen Goller, member of the Board of Management of BMW AG, responsible for Customer, Brands, Sales, said,

“In 2025, in a challenging environment, the BMW Group sold more vehicles than in the previous year. Our electrified vehicles were in particularly high demand. Europe reported especially strong growth, with battery-electric vehicles accounting for about a quarter of total sales, and BEVs and PHEVs combined reaching a share of over 40% across the region. We remain fully on track to meet our EU CO₂ fleet target for 2025.

Europe Anchors BMW’s Electric Momentum

Europe emerged as the backbone of BMW’s electric success in 2025. Fully electric deliveries surged 28.2% across the region, with battery-electric vehicles representing roughly one-quarter of BMW’s total European sales. When plug-in hybrids are included, electrified vehicles exceeded 40% of sales in several major markets.

This performance also helped BMW stay on track to meet its EU fleet CO₂ targets, a growing priority as emissions rules tighten further later this decade. The company’s ability to scale EV sales without sacrificing profitability reinforced confidence in its multi-powertrain strategy.

Meanwhile, BMW’s British subsidiary Mini reached a notable milestone. The brand delivered its 100,000th fully electric Mini, and more than one in three Minis sold in 2025 featured a battery-electric drivetrain. This success demonstrated that smaller, urban-focused EVs continue to resonate strongly with European buyers.

Warning Signs Emerge in the U.S. Market

Despite strong annual results, BMW’s fourth-quarter performance revealed emerging challenges. Global EV deliveries fell 10.5% year over year in the final quarter, reflecting broader softness in consumer demand.

The United States stood out as a weak spot. BMW’s BEV sales in the U.S. plunged 45.5% in Q4, falling to just 7,557 vehicles. For the full year, U.S. electric deliveries dropped 16.7%, underscoring the impact of high interest rates, uneven incentives, and lingering infrastructure concerns.

Even so, BMW’s diversified geographic exposure helped offset U.S. weakness. Strong European demand and early interest in upcoming models provided confidence heading into 2026.

Neue Klasse Signals BMW’s Next Growth Phase

BMW’s outlook received an additional boost from early demand for its upcoming Neue Klasse platform. The first modern model under this architecture, the electric iX3, generated strong initial orders across Europe.

In fact, customer reservations already cover nearly all of BMW’s planned European production for the model in 2026. The Neue Klasse platform is central to BMW’s long-term strategy, combining new battery technology, improved efficiency, and a software-first vehicle architecture.

By 2027, BMW expects to launch or update more than 40 models across various drive options, reinforcing its belief that flexibility—not a single-technology bet—offers the safest path through an uncertain transition.

In this context, Goller further noted,

“Especially in Europe, 2026 will be marked by the NEUE KLASSE. At the same time, we will be introducing several new models this year, such as the BMW X5, BMW 3 Series, and BMW 7 Series. In total, the BMW Group will launch more than 40 new and revised vehicles with various drive options by 2027.”

Mercedes Faces Structural EV Headwinds

Mercedes-Benz entered 2025 under pressure, and conditions worsened as the year progressed. Global car sales fell 8% in the first nine months, with particularly sharp declines in China (-27%) and North America (-17%). Trade tensions and tariffs further complicated the picture.

The car maker delivered 168,800 BEVs, down 9%. Mercedes achieved higher total electrified sales, including plug-in hybrids (PHEVs), at 368,600 units, flat year-over-year.

In the United States, Mercedes paused orders for its EQS and EQE sedans and SUVs mid-year, citing unfavorable market conditions. As per reports, customer feedback highlighted design concerns and price sensitivity, particularly as competitors introduced newer platforms and faster charging capabilities.

As a result, Mercedes decided to phase out the EQE sedan and SUV by 2026, only four years after launch. The move marked a rare admission that parts of its first-generation EV strategy failed to connect with buyers.

Mercedes Bets on a Reset, Not a Retreat

Rather than scaling back electrification, Mercedes is attempting a reset. The company plans an aggressive product offensive, with 18 new or refreshed models in 2026 alone and 25 new models globally over three years.

However, Merc’s electric CLA boosted demand. It’s a new 800-volt EV architecture, starting with the upcoming electric CLA and GLC. Mercedes claims the new CLA can add up to 325 kilometers of range in just 10 minutes, with charging speeds reaching 320 kW. The company hopes these improvements will directly address earlier criticisms around charging and efficiency.

CEO Ola Källenius has described the coming period as the most intense launch cycle in Mercedes’ history. Still, execution risks remain high, particularly as competition intensifies and EV demand growth moderates in some markets.

Sustainability Becomes a Competitive Divider

Beyond sales volumes, sustainability strategies increasingly shape long-term competitiveness. BMW continues to position electrification as the biggest lever for emissions reductions while maintaining optionality across technologies, including hydrogen and efficient combustion engines.

The company aims to cut CO₂e emissions across its value chain by 90% by 2050, using 2019 as a baseline. Interim targets include a 40 million-ton reduction by 2030 and a 60 million-ton reductionby 2035. BMW has already mandated renewable energy use across its battery supply chain and sourcing contracts, including Tier-n suppliers.

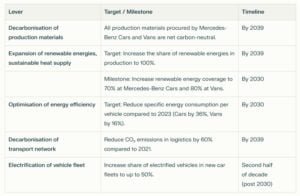

Mercedes, meanwhile, is pursuing its “Ambition 2039” plan, targeting a net carbon-neutral new vehicle fleet across the full lifecycle. The company plans to reduce CO₂ emissions per passenger car by up to 50% within the next decade, while increasing renewable energy use in production to 100% by 2039.

Both automakers recognize that as EV adoption rises, emissions reductions must increasingly come from manufacturing and supply chains, not just vehicle usage.

The Gap Widens, but the Race Continues

By the end of 2025, BMW had clearly established itself as the premium EV leader among Germany’s luxury brands. Its combination of steady electrification, regional balance, and early success with next-generation platforms set it apart.

Mercedes, however, is not conceding the race. Its upcoming models and platform overhaul could still narrow the gap, especially if global EV demand rebounds. For now, though, BMW’s lead remains firmly intact—and the pressure on Stuttgart continues to build.

- READ MORE: Global EV Trends: Growth, Challenges, and the Future of Electric Mobility • Carbon Credits

The post BMW Outpaces Mercedes 2.5x in EV Sales, Proving Electrification Is the Emissions Lever appeared first on Carbon Credits.