Despite widespread anxiety about climate change and food security, the world’s farmers pumped out massive volumes of grain in 2025.

On Dec. 9, the U.S. Department of Agriculture (USDA) pegged 2025 global grain output (wheat, corn, sorghum, oats, barley, rye and rice) at 2,954 million tonnes, up 3.5 per cent from the previous marketing year.

That’s a new record high, up an impressive 8.5 per cent from five years ago.

Although chatter in commercial and social media forewarns that this planet may soon be unable to feed its rising population, big crops in recent years prove that the world is currently not running out of food — or the capacity to produce food.

Rising production is being achieved primarily through better yields, not the cultivation of more farmland.

A recent report from the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO) indicated that 80 to 85 per cent of grain-production increases are due to yield improvements.

This increased supply is not evenly distributed around the globe. Shortages do exist, primarily in areas enduring war and despotic authoritarian regimes. Unlike grains, the beef, fruit and vegetable sectors are not seeing similar advances in output. However, crop farmers continue to do a masterful job of feeding the world.

One result of this is that world food commodity prices fell for a third consecutive month in November. A global price index monitored by the FAO was down 1.2 per cent from October, 2.1 per cent below November 2024 and almost 22 per cent below the March 2022 peak reached after the start of the war in Ukraine.

What does this mean for 2026?

Plentiful supplies will keep a lid on corn and wheat prices the coming year, providing a buffer against crop problems. They won’t necessarily keep prices from rising but will limit price gains. Don’t expect runaway bull markets for grains in 2026.

Crypto crunch

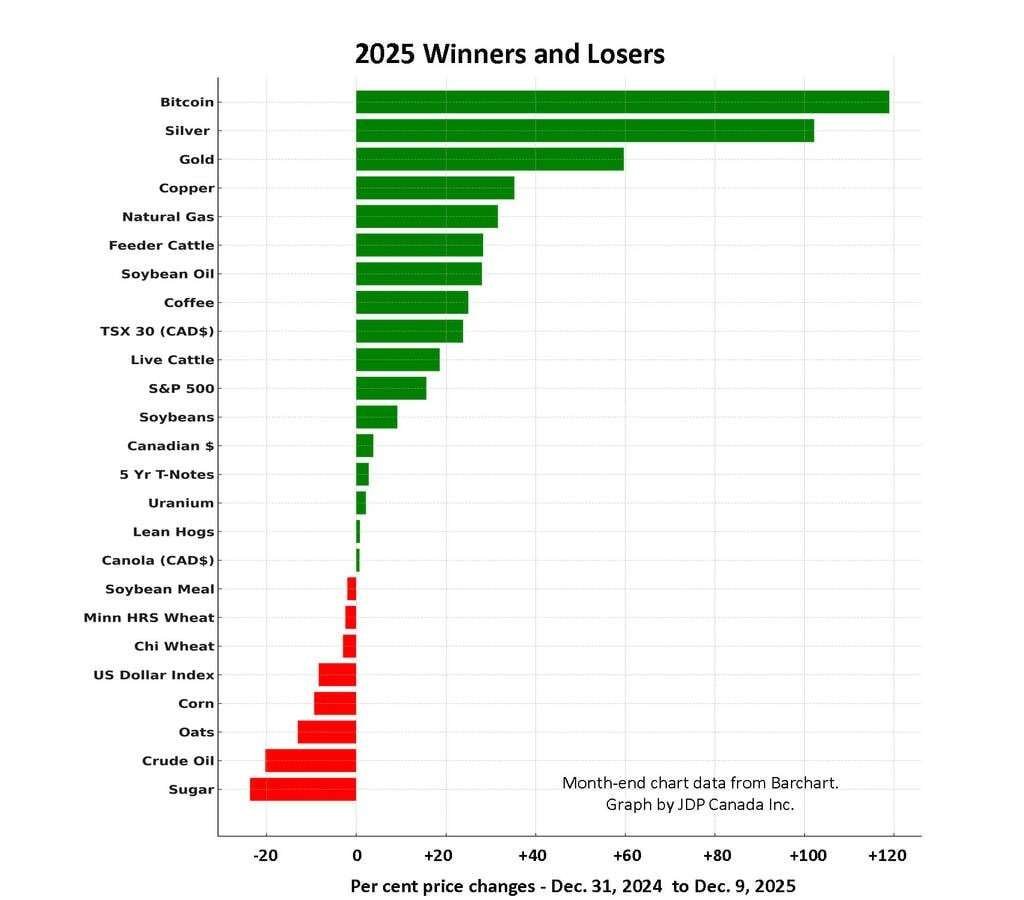

Reviewing the 2025 market landscape, it was a big year for Bitcoin but a bubble burst for most cryptos.

In late 2022, one Bitcoin was worth less than US$20,000. In August and September of 2025, it soared briefly above $120,000. At press time, it stands at about $92,200.

After a wild year and despite the hard break since late summer, it’s still nearly double its year-ago value. Impressive, as most other cryptocurrencies crashed this fall.

One coin, known as the “Useless Ethereum Token,” attracted big money before falling to zero.

Cryptocurrencies sponsored by U.S. president Donald Trump and his family crashed, including the $Melania coin, as well as American Bitcoin Corp., founded by one of Trump’s sons. They join a long list of crypto casualties. It’s no wonder, considering that cryptocurrencies have no intrinsic value.

Metals glittered most brightly

Barring an unforeseen downturn, silver will notch the biggest gain in the commodity world in 2025, popping up about 102 per cent from Dec. 31, 2024. Gold is not far behind. Copper started high and is still high. Metals investors may be in excellent cheer this holiday season.

The TSX also did well, buoyed by the metal companies included in its index and helped by big bank stocks.

Live cattle and feeder cattle started the year high and rose even higher, up 28 and 19 per cent respectively. It took two full decades for prices to reach levels which finally reward cow-calf operators for their tenacity. Beef producers have waited a very long time for this.

Consumers aren’t so happy. But at current high-flying levels, it’s likely that the bulk of the meat price explosion is behind us.

Lean hogs are up just marginally on the year and may play catch-up to cattle in the year ahead. The spread between these two markets set a record the past year and a narrowing is highly likely.

Crop markets calm and bright … and not so bright

Oilseeds (soybeans and canola) are approaching year-end with advances of varying degrees. Soybean oil has been far stronger than soybean meal. Odds are meal will be a stronger player than oil in 2026.

The canola supply in Canada is heavy after a record-yielding crop. Looking ahead, much will depend on our ongoing trade friction with China.

Wheat is down but, as our previous reports have suggested, this sector is probably grinding slowly through a major cycle-low. It’s surprising corn isn’t lower than it is, considering the USDA is pegging U.S. production at over 16.75 billion bu., compared with just 14.9 billion last year.

Energy markets were mixed. Natural gas is preparing to leave the year in positive territory but is still low-priced by the standards of the past 15 years. This is still a low-level market.

The Canadian dollar had a quiet, low-level year, spending most of its time around 68 to 72 cents U.S. Don’t bet heavily on the Canuck staying depressed for all of 2026. Currencies have been known to make key turns with the flip of the calendar.

Concluding thoughts

Markets tend to change places. Often the best performers of one year will slip to the lower end of the spectrum the next year.

The 2025 winners, most of which are now high-priced, will likely not lead an upward charge in 2026. Keep an eye on today’s bottom-dwellers for impending action.

Happy market-watching in 2026.

The post Big production year provided big market moves appeared first on Farmtario.