Canada’s climate journey is entering a more uncertain phase. Emissions are trending lower, investments continue to flow, and clean technologies remain in play. Yet momentum is clearly weakening. That is the central message of Climate Action 2026: Retreat, Reset or Renew, the third annual report from the RBC Climate Action Institute.

The report paints a nuanced picture. Progress has not stopped. But it has slowed. Policy reversals, economic pressures, and shifting public priorities are weighing on climate ambition at a time when speed matters most.

Canada now faces a defining question: retreat from climate action, reset its approach, or renew its commitment with a sharper focus.

Emissions Are Falling, but Not Fast Enough

Canada’s total greenhouse gas emissions are projected to be 7% lower in 2025 than in 2019, according to RBC’s estimates. That marks real progress, especially after years of volatility during and after the pandemic.

However, this pace remains well short of what Canada needs to hit its longer-term targets. The country has committed to reducing emissions by 40% to 45% below 2005 levels by 2030 and by 45% to 50% by 2035. Current trends suggest those goals will be difficult to reach without stronger policy signals.

Several sectors have reduced emissions intensity:

- Electricity: down 27%

- Buildings: down 19%

- Oil and gas: down 19%

These gains reflect cleaner power generation, improved efficiency, and gradual technology upgrades. Still, absolute emissions reductions remain modest, especially in sectors tied to economic growth and population expansion.

Climate Action Barometer Hits a Turning Point

For the first time since its launch, the Climate Action Barometer declined. This index tracks climate-related activity across policy, capital flows, business action, and consumer behavior.

The drop was broad-based. No single sector drove the decline. Instead, multiple pressures hit at once.

Key factors include:

- The removal of the consumer carbon tax

- The rollback of electric vehicle incentives

- Economic uncertainty and rising trade tensions

- Alberta’s restrictions on new renewable energy projects

Together, these shifts weakened confidence. Businesses delayed or canceled projects. Consumers pulled back on major clean-energy purchases. Climate policy slipped down the priority list for governments focused on affordability and job creation.

While climate action remains above pre-2019 levels, the trendline has clearly flattened.

Capital Flows Hold Steady, but Growth Has Stalled

Climate investment in Canada has leveled off at around $20 billion per year. That figure has barely moved in recent years.

Public funding remains a stabilizing force. Nearly $100 billion in incentives for clean technology and climate programs is already budgeted for deployment through 2035 by Ottawa and the largest provincial governments.

However, private capital is showing signs of caution. Investment declined compared to 2024, driven largely by cooling sentiment toward early-stage climate technologies. Policy uncertainty has amplified investor risk concerns, especially in capital-intensive sectors like renewables and clean manufacturing.

Some bright spots remain. Wind projects on Canada’s East Coast have supported investment flows, even as renewable development slowed elsewhere.

Carbon Pricing Changes Ease Pressure

The federal government eliminated the consumer carbon tax in April 2025, refocusing carbon pricing solely on industrial emitters. The change had a limited impact on national emissions coverage, as only around three percent of agricultural emissions were subject to consumer pricing.

For farmers, the move delivered meaningful financial relief. Many agricultural operations rely on propane to dry grain or heat livestock facilities. Few cost-effective, lower-carbon alternatives exist in rural regions, making the tax a direct burden on operating costs. Removing it eased pressure without significantly weakening the overall emissions policy.

Still, the decision lowered Canada’s climate policy score and sent mixed signals to investors and businesses evaluating long-term decarbonization strategies.

EV Slowdown Signals Shifting Consumer Priorities

Consumer behavior has become a significant hindrance to climate momentum. Electric vehicle adoption slowed sharply in 2025. EVs accounted for just eight percent of total vehicle sales in the first half of the year, down from twelve percent during the same period in 2024. Passenger EVs now make up only about four percent of Canada’s total vehicle stock.

Higher interest rates, the removal of purchase incentives, and uncertainty around future mandates all contributed to the pullback.

- The federal government also delayed the Electric Vehicle Availability Standard, which was set to require EVs to represent 20% of new vehicle sales by 2026. That pause further weakened confidence across the market.

At the same time, not all clean technologies lost ground. Heat pump adoption edged higher, supported by new efficiency funding, particularly in Ontario. The province’s $10.9 billion commitment to energy efficiency programs could support further uptake, even as other consumer-facing climate actions slow.

Public priorities have also shifted. Only about a quarter of Canadians now identify climate change as a top national issue. Cost of living pressures, healthcare access, and economic stability dominate public concerns, reshaping how households weigh climate-related decisions.

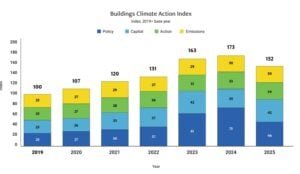

Buildings Sector Becomes the New Battleground

The RBC Institute’s 2026 “Idea of the Year” focuses squarely on Canada’s buildings sector, which has quietly become one of the country’s most challenging emissions sources. Emissions from buildings rose 15% between 1990 and 2023 and now represent a larger share of national emissions than heavy industry.

Today, buildings account for roughly 18% of Canada’s greenhouse gas emissions when electricity-related emissions are included. Progress remains slow. Emissions from the sector are projected to fall by just one percent in 2025, a pace that leaves Canada far from its net-zero target for buildings by 2050.

New construction adds to the risk. If projects continue to follow prevailing building codes, emissions could rise by an additional 18 million tonnes over time, locking in higher emissions for decades.

Responsible Buildings Pact Points to a Reset

Against this backdrop, the Responsible Buildings Pact offers a potential reset. Launched in 2024 under the Climate Smart Buildings Alliance, the initiative aims to accelerate the adoption of low-carbon designs and materials across the construction sector.

The pact focuses on scaling the use of mass timber and low-carbon concrete, steel, and aluminum. These materials can significantly reduce embodied carbon in new buildings while strengthening domestic supply chains. The approach is particularly timely as Canadian producers face constraints from U.S. trade tariffs, limiting access to lower-emissions materials.

If widely adopted, the pact could transform how Canada builds homes, offices, and infrastructure. By embedding emissions reductions into construction decisions today, the sector could deliver long-term climate gains while supporting industrial competitiveness.

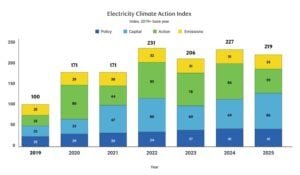

Electricity Progress Slows After Early Success

Canada’s electricity sector remains one of its strongest climate performers. Emissions have fallen an estimated 60% since 2005, surpassing Paris Agreement targets. Coal phase-outs continue to drive reductions, with more than six terawatt-hours of coal power expected to be removed from the grid this year.

Still, progress slowed in 2025. Uncertainty surrounding Alberta’s renewable energy policies led to the cancellation of 11 gigawatts of planned capacity, roughly half of the province’s existing generation. At the same time, natural gas use rose sharply, offsetting some of the emissions gains from coal retirements.

Canada now faces a dual challenge: doubling electricity capacity while fully decarbonizing it by 2050. Estimates suggest the required investment could exceed $1 trillion, underscoring the scale of the task ahead.

Climate Action at a Defining Moment

The RBC report makes one point clear. Canada has not abandoned climate action, but it has lost momentum. Emissions are lower, capital remains available, and technology continues to advance. Yet policy clarity has weakened, consumer confidence has faded, and investment growth has stalled.

With just 25 years left to reach net zero, the choices made now will shape Canada’s emissions trajectory for decades. Renewed coordination between governments, businesses, and consumers will be essential, along with policies that balance economic realities without sacrificing long-term climate goals.

Canada still has time to reset and renew. What it cannot afford is continued drift.

- ALSO READ: Canada to Launch Sustainable Investment Taxonomy in 2026 to Guide Green and Transition Finance

The post Canada’s Climate Momentum Slows in 2026 Despite 7% Emissions Drop, RBC Report Finds appeared first on Carbon Credits.