Artificial intelligence (AI) is reshaping technology and energy systems worldwide. As AI grows, it increases the need for powerful hardware, which also puts stress on electricity grids. Two major trends illustrate this change: the fast-growing data center GPU market and rising global power demand to support AI and digital infrastructure. These trends have implications for technology companies, power operators, governments, and energy planners.

GPU Gold Rush: AI Chips Are the New Power Plants

The data center graphics processing unit (GPU) market is expanding quickly due to AI demand. GPUs are specialized chips that speed up AI training and inference tasks. Today’s AI models require thousands of GPU cores working in parallel to process data.

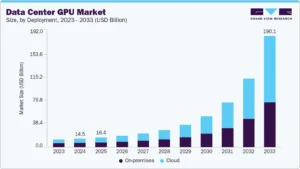

In 2024, the global data center GPU market was estimated at about $14.48 billion. Analysts expect this market to grow rapidly in the coming decade.

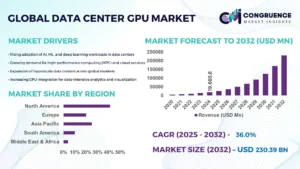

One forecast suggests it may hit around $155.2 billion by 2032, about 30.6% increase from 2024. This growth is driven mainly by AI, machine learning, and other high-performance computing workloads.

Other market research supports rapid growth but shows variation in future values depending on methodology. A different long-term forecast shows that the data center GPU market might grow from about $21.6 billion in 2025 to $265.5 billion by 2035. This means an annual growth rate of 28.5%.

These projections show a clear global trend. Demand for GPU-based data center hardware will triple or more in the next decade. This growth comes as AI services spread across various industries.

Hyperscale cloud platforms, enterprises, and government agencies are among the major buyers driving this demand. AI tools, like generative AI and large language models, are booming. This keeps GPU-based computing central to future digital growth.

Watts Up: How AI Drives Global Power Demand

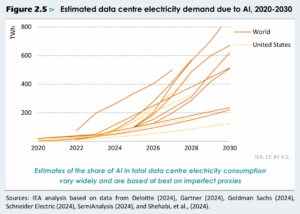

Global electricity demand is set to rise sharply over the next decade. A recent UN report says demand will rise by over 10,000 terawatt-hours by 2035. This increase is roughly equal to the total electricity consumption of all advanced economies today. Rapid growth in artificial intelligence and digital infrastructure is a major driver of this trend.

Data centers play a central role in this surge. The International Energy Agency (IEA) estimates that data centers consumed ~415 TWh globally in 2024 (1.5% of total electricity). That’s up from ~240 TWh in 2023—a growth of around 73% driven by AI rollout.

This growth shows the quick rollout of AI systems. They depend on power-hungry GPUs and high-density computing gear.

The IEA predicts that by 2030, data centers will make up over 20% of electricity demand growth in advanced economies. In countries with large AI and cloud computing hubs, data centers are becoming one of the fastest-growing sources of new power demand. This shift pressures grids. It also increases the need for new power generation, grid upgrades, and low-carbon sources.

Power demand growth from data centers will also change how grids operate in key economies. In the United States, data centers are projected to account for nearly half of all growth in power demand through 2030. In other advanced economies, data centers could drive more than 20% of electricity demand growth.

Beyond simple demand growth, the global power system must plan for future capacity needs to meet rising consumption. Reports indicate that by 2035, global electricity demand could grow by around 30% compared with today.

AI-driven demand is a central factor behind this increase, along with electrification in transport, industry, and buildings. Renewables, nuclear, and cleaner energy sources will have to expand to meet this growth while reducing emissions.

Regional Hotspots: Who’s Feeling the Grid Strain?

Growth in GPU markets and power demand varies by region. North America leads the data center GPU market, with a large share of sales and installed capacity. This success comes from cloud providers and hyperscale platforms.

Europe and Asia have high demand. Asia-Pacific is growing quickly because of investments in digital services and computing infrastructure.

On the energy side, grids in some regions face more strain than others. Advanced economies with many AI data centers, like the U.S., parts of Europe, and China, must balance current power needs with the fast growth of data center loads. Emerging markets might find it hard to keep up with industrialization and digital growth if they don’t invest in their grid.

Renewable energy plays a growing role in addressing power demands from digital infrastructure. By 2024, renewable energy had grown significantly around the world.

Solar and wind power made up a large part of the new installations. In 2023, solar capacity grew by over 32%. Also, global installed renewable power capacity surpassed 4,400 gigawatts. This expansion helps meet part of the rising demand from data centers and other sectors.

GPUs, Power, and Infrastructure Converge

The growth of AI is changing how investors and companies view computing hardware. GPUs are no longer seen as short-term technology tools. Many investors now treat them as long-term physical infrastructure, similar to power plants or transport assets.

A survey by KPMG and Nuway Capital looked at 120 investors in 10 global markets. It found that almost 80% believe generative AI is the main reason to invest in GPU capacity.

Over 70% of high-net-worth investors see GPUs as a better investment than blockchain and quantum computing. Many also ranked GPUs above renewable energy. This shift reflects stable demand, physical limits, and long asset lifetimes.

Power availability has become a critical constraint. As GPU-dense data centers expand, electricity supply now shapes where and how fast AI infrastructure can grow. In response, major technology firms are securing long-term power sources that can deliver large volumes of reliable, low-carbon electricity, such as nuclear.

Several companies are turning to nuclear energy. Meta has announced deals with Vistra, TerraPower, and Oklo to secure up to 6.6 gigawatts of nuclear capacity by 2035. Microsoft made a 20-year deal with Constellation Energy to restart the Three Mile Island nuclear plant. This effort is backed by a $1 billion loan from the U.S. government.

Amazon also has deals for 1.9 gigawatts of nuclear power from the Susquehanna plant. They also have agreements for small modular reactor projects. Google has signed a deal with Kairos Power for energy from multiple small modular reactors, with up to 500 megawatts expected by 2035.

Nuclear to the Rescue: Powering AI 24/7

Industry leaders now describe this link between AI and nuclear power as structural. At a recent International Atomic Energy Agency meeting, officials noted that nuclear energy provides several key benefits. It has low emissions, supplies power around the clock, offers high power density, and is scalable. This makes it a great fit for AI needs.

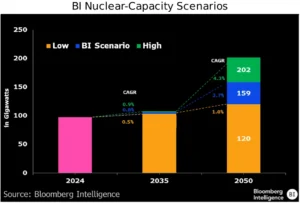

Globally, 71 nuclear reactors are under construction, adding to 441 operating units, with 10 planned in the United States. Bloomberg Intelligence predicts that U.S. nuclear capacity may grow by 63% by 2050. Most of this increase will happen after 2035, as small modular reactors become commercially viable.

At the same time, supply limits are reinforcing the infrastructure view of GPUs. Constraints in chip manufacturing, power access, land, and grid connections are tightening. Hyperscalers are responding with massive spending.

Major cloud companies are expected to spend over $600 billion on capital expenditures in 2026, a 36% increase from 2025, according to analysts. About $450 billion of that will go to AI infrastructure. NVIDIA leads the market, taking nearly 90% of AI accelerator spending. In early 2025, it reported $35.6 billion in quarterly data center revenue.

Together, these trends show a clear shift. The future of AI will depend not just on software, but on access to GPUs, data centers, and reliable power. For investors, utilities, and policymakers, AI is now an infrastructure challenge as much as a digital one.

- READ MORE: AI Drives a Transformative Wave in Global Data Centers – and Energy Is the Real Bottleneck

The post AI Demand to Drive $600B From the Big Five for GPU and Data Center Boom by 2026 appeared first on Carbon Credits.