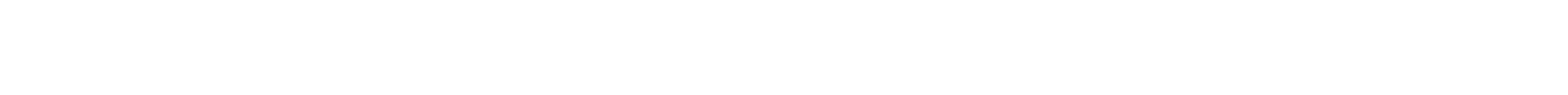

Microsoft reported strong results for the second quarter of fiscal 2026, ending December 31, 2025. The company’s total revenue was $81.3 billion, up 17% from the $69.6 billion reported in the same period last year.

Net income, the profit after expenses, was $38.5 billion. This figure rose 60% from about $24.1 billion in the second quarter of fiscal 2025. Microsoft also reported a diluted earnings per share (EPS) of $5.16. This was up 60% from $3.23 per share in the prior year. Operating income also increased by 21% year over year to was $38.3 billion.

The tech giant also reported large growth in its cloud and AI-related businesses. Revenue from Microsoft Cloud reached $51.5 billion in the quarter. This was an increase of 26% compared with the prior year.

Breaking this down:

- Intelligent Cloud revenue was $32.9 billion, up 29%.

- Productivity and Business Processes revenue was $34.1 billion, up 16%.

- More Personal Computing revenue was $14.3 billion, down 3%.

The company also reported its remaining performance obligations, future contracted revenue yet to be recognized, at $625 billion. This was up 110% compared with the same time last year.

Microsoft continued to return cash to shareholders. In the quarter, it returned about $12.7 billion through dividends and share buybacks — an increase of about 32% year over year.

These results show that Microsoft continued to grow across major business segments in Q2 FY 2026. Cloud services and AI-related products remained key drivers of revenue growth. At the same time, personal computing revenue, which includes Windows licensing, Surface devices, and search advertising, experienced a small decline.

Despite these robust results, Microsoft’s stock fell about 11% after the earnings. It dropped by $52.95 to close around $428.68 in late trading after hitting a low of $421.11. This is due to investors’ concerns about slow cloud growth and high spending on AI.

Alongside its strong financial performance, Microsoft is also taking major strides in its environmental commitments.

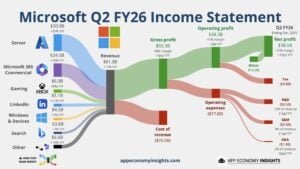

Carbon Removal Leadership: Doubling Impact in 2025

Sustainability remains central to Microsoft’s strategy. In 2025, the company more than doubled its carbon removal agreements to 45 million metric tons of CO₂, up from 22 million tons in 2024.

These purchases include a mix of nature-based solutions. They cover forestry and soil carbon projects, plus direct air capture technologies. The agreements span North America, Europe, and Africa, targeting high-quality, verified removal credits with long-term permanence.

Microsoft’s move reflects a broader trend among tech giants committing to net-zero and carbon-negative strategies. Other big buyers are Amazon, Google, and Stripe. They’re investing in carbon removal to offset emissions that can’t be cut yet.

By securing long-term offtake agreements, Microsoft ensures these projects receive funding to scale operations and deliver measurable climate impact. Analysts predict that global corporate carbon removal purchases might exceed 150 million metric tons each year by 2030. This shows a fast-growing market that mixes corporate sustainability goals with investment chances.

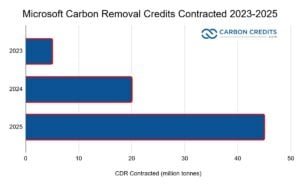

AI’s Hidden Cost: Data Centers and Water Demand

Microsoft also released projections on AI-driven data center water consumption. With AI workloads surging, water use in Microsoft’s global data centers is expected to rise 150% by 2030 compared with current levels. That’s equal to using about 18 billion liters over the said period.

The increase is mainly due to liquid cooling systems used to maintain GPU and CPU performance in AI servers. Water is essential to prevent overheating and maintain efficiency. Microsoft’s water needs are spiking hardest in dry areas.

- In Phoenix (hit by 20 years of drought), the company cut its 2030 estimate from 3.3 billion liters to 2 billion by running hotter data centers.

- Near Jakarta, Indonesia (a sinking city with drained underground water), the forecast dropped from 1.9 billion to 664 million liters.

- In Pune, India (where shortages caused protests and a “No Water, No Vote” push), it fell from 1.9 billion to just 237 million liters—Microsoft wouldn’t say why.

As AI adoption grows, data centers will consume more energy and water, especially in regions with concentrated cloud infrastructure.

In an interview, Priscilla Johnson, Microsoft’s former director of water strategy until 2020, stated:

“Water took a back seat. Energy was more the focus because it was more expensive. Water was too cheap to be prioritized.”

Microsoft is now exploring solutions such as:

- Advanced cooling technologies to reduce water intensity per compute unit

- Use of recycled water in data centers where feasible

- AI-driven energy and resource optimization to manage electricity and water demand

The company emphasizes that AI deployment must be balanced with sustainability practices, ensuring growth does not lead to unsustainable water consumption or carbon emissions.

- MUST READ: AI Drives a Transformative Wave in Global Data Centers – and Energy Is the Real Bottleneck

Where Growth Meets Responsibility

Microsoft’s Q2 results show that growth and sustainability are connected. Investments in AI, cloud, and enterprise services boost revenue while increasing resource demand. The company’s carbon removal goals and energy-efficient data center plans help reduce environmental impacts.

Key metrics illustrate this balance:

- Revenue growth of 9% year-over-year

- Cloud revenue of $30.5 billion, up 12%

- Carbon removal agreements totaling 45 million metric tons

- Projected AI data center water increase of 150% by 2030

These initiatives demonstrate that Microsoft is trying to align profitability with long-term climate goals. Investing in clean technology, energy efficiency, and carbon removal shows that big companies can grow responsibly. This approach also helps reduce environmental impacts.

What Comes Next for AI, Climate, and Capital

Microsoft expects AI adoption to boost demand for:

- Data center capacity

- Cloud computing

- Specialized hardware like GPUs

Analysts predict the global AI data center market could double by 2030, creating both financial and sustainability challenges.

The carbon removal market is also expected to expand. With 45 million tons already contracted, Microsoft’s continued leadership signals corporate influence in scaling carbon removal projects.

Forecasts show that voluntary carbon removal deals might exceed $15 billion each year by 2030. This growth is mainly due to tech companies, industrial firms, and financial institutions.

Water management in data centers is another critical area. Companies need to invest in better cooling and recycled water solutions to help meet rising demand while protecting local water resources. Microsoft’s transparency around water use provides a model for responsible AI deployment globally.

Overall, Microsoft’s earnings report not only reflects strong financial performance but also highlights the company’s sustainability leadership. Growth, carbon removal, and AI infrastructure are linked. They provide insights for companies like Microsoft trying to balance profit with environmental responsibility.

- READ MORE on Microsoft’s carbon removal deals:

- Microsoft’s Mega Move: 18 Million Carbon Credit Deal with Rubicon Carbon

- Microsoft’s $800M Carbon Removal Deal Sets Record in Climate Fight

- Microsoft Buys 2 Million Tons of Carbon from Rubicon Carbon’s Uganda Forestry Project

- Peatland Carbon Credits: Microsoft Invests in Pantheon to Restore Peatlands for Durable Carbon Removal

- Big Tech Firms Microsoft (MSFT) and Alphabet (GOOGL) Lead in Durable Carbon Removal Investments Exceeding $10 Billion

The post Microsoft Q2 FY26 Earnings: $81B Revenue, AI Momentum, and a 150% Jump in Water Use by 2030 appeared first on Carbon Credits.