Dairy farmer organizations across Canada are changing how farmers will be paid for milk to help meet the burgeoning demand for protein.

Products such as cottage cheese grew by 32 per cent and yogurt by seven per cent in 2025, according to NielsenIQ, as consumers sought more protein-options.

Why it matters: Pricing changes require precise management on dairy farms to maximize profit.

The change in protein demand means the producer-run organizations that manage the pricing and flow of milk in Canada’s supply management system are having to move from a butterfat-rich payment system to one with more emphasis on protein.

Dairy farmers buy quota based on kilograms of butterfat produced per day, so if they produce less butterfat, they will have to ship more litres of milk per day to fill their quota. However, if they produce more protein, they could end up with higher pay.

Canadian butter stocks have been rising over the past year, also resulting in the need to realign the ratio between butterfat and other milk solids, including protein. The Canadian Dairy Commission reports in its November report that total butter stocks were 35,216 tonnes, which is 4,789 tonnes higher than in November 2024.

The P5, which includes the five eastern Canadian provinces other than Newfoundland and Labrador, and the Western Milk Pool, which includes the provinces west of Ontario, are taking different approaches.

In the P5, “the high protein products, fluid milk, yogurt, for sure, and cheese, have seen incredible growth,” says Kristin Benke, chief business and supply chain officer with Dairy Farmers of Ontario. “We’ve seen that sort of increase in demand from the market side, which is outpacing the increase in demand for butterfat at this point.”

When protein demand increases quickly and butterfat demand growth doesn’t match that of protein, market changes are needed at the farm.

Jason Wiebe, a dairy farmer in Chilliwack, B.C., and chair of the Western Milk Pool, says the increase in protein demand is also being seen in the western provinces, and that demand will be enhanced when a processing plant being expanded by Vitalus in British Columbia starts taking more. milk. It’s focusing on high-protein dairy products.

The two parts of the country have different approaches to milk pricing. Here’s what it means for farmer milk cheques:

The P5 approach

Farmers in the P5 get paid on two tiers, with payments in tier two generally being the most profitable, as producers are incentivized to deliver milk that meets market demands.

More value, $3 per kilogram more, is being put on protein in the second tier, encouraging farmers to produce a solids-non-fat to butterfat ratio that’s more than two. That also means that the price paid for tier one protein will decrease by 18 cents per kg.

Farmers who hit a ratio of 2.2 will be paid the highest for their milk, although on-farm factors will determine if that’s the most profitable.

Benke says the policy change on pricing brings what farmers are paid for milk back to what it was in 2023. Butterfat production has risen since then, as farmers responded to that pricing change.

She says this pricing change aims to move butterfat production down to where it was around 2023 and 2024.

There are likely more changes ahead to pricing policy, says Benke.

The new P5 pricing is in place as of Jan. 1, 2026.

The Western Milk Pool approach

Wiebe also signaled that the changes made by the Western Milk Pool could be the first step in changes emphasizing less fat and more protein.

In 2017, the milk pool changed the pricing ratio to farmers being paid 85 per cent on butterfat, 10 per cent on protein and five per cent on other solids in the milk.

“In 2017, we were actually short cream,” he said. “Now it’s nine years later and we have this huge demand for protein starting.”

Wiebe says the Western Milk Pool isn’t yet short of protein, but the Vitalus expansion Abbotsford and global trends point to more demand.

As of April 1, farmers in the west will be paid at 70 per cent for butterfat, 25 per cent for protein and five per cent for other solids.

The western milk boards have been discussing the change since their fall meetings, so farmers will have had time to manage the change.

What does this mean on farms?

Dairy farmers will have to figure out how new changes to milk pricing affect their profitability.

That becomes a complex mix of managing feed, genetics and barn capacity, but the data to inform decisions can be challenging to calculate.

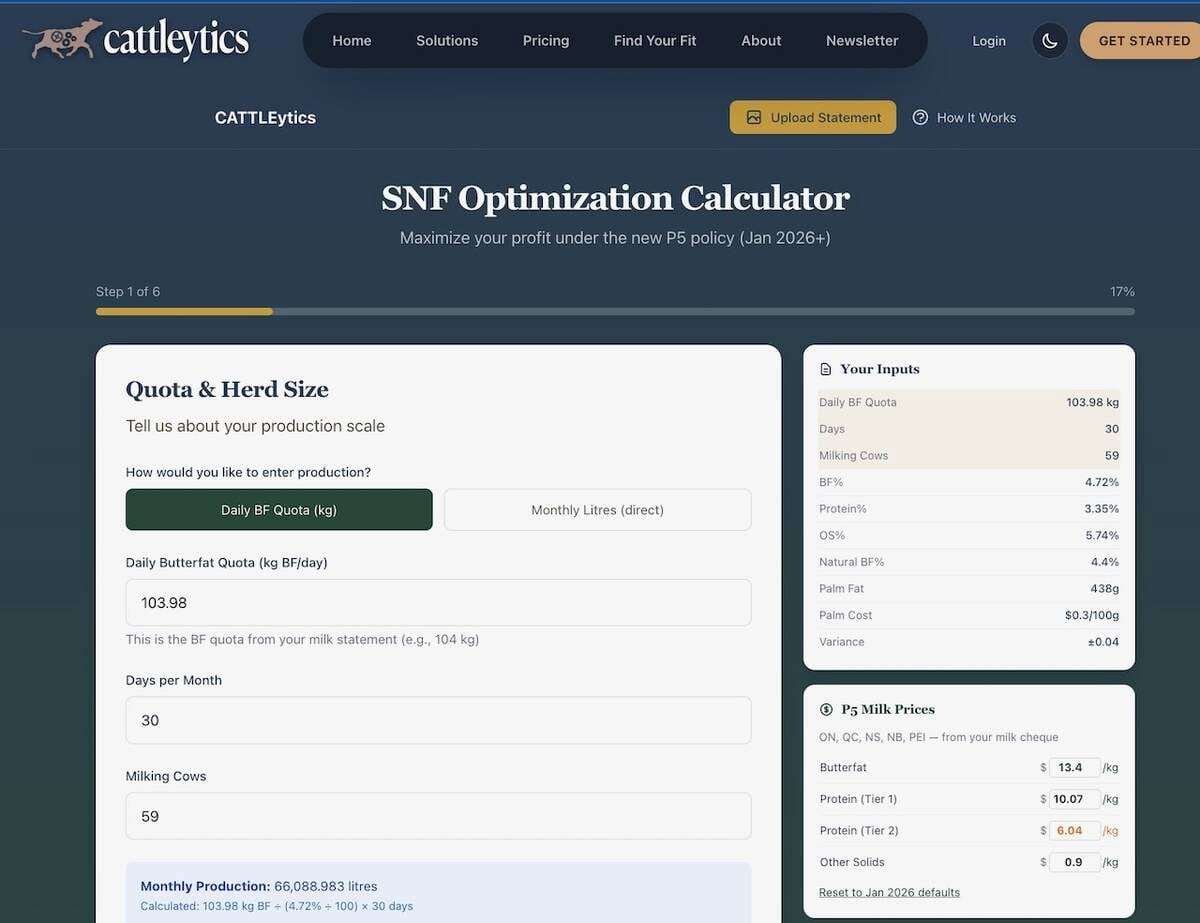

Cattleytics, a Canadian dairy software, data and analytics company, has created a free calculator for farmers in the P5. The calculator can be found on the Cattleytics website.

According to Dairy Farmers of Ontario, the sweet spot for farmers will be at a solids that aren’t fat to butterfat ratio of 2.2 to one. However, meeting that exact ratio on a farm every day is challenging.

“I think that’s a very difficult calculation for a lot of people to do,” says Shari van de Pol, CEO of Cattleytics. Farmers will see that they get paid much more for their tier one milk, but the tier two milk is where they can make extra money.

As of January milk payments to dairy farmers, protein in tier two will be worth $3 per kg more and protein in tier one will be worth 18 cents less per kg.

“The takeaway is that if you’re not making quota, you just want to fill tier one, because you get paid the most for that. But if you’re able to make your quota and you’re able to ship the milk, filling that tier two milk is just money on the table that you can get,” she says.

If a producer’s solids-not-fat ratio is around two currently, it likely means butterfat percentage is high, and that’s where there are opportunities to lower butterfat and get more for protein.

Farmers who feed palm fat, which helps cows stay healthier, especially around reproduction, and will increase butterfat percent, can save some of their feed costs by reducing the amount of palm fat in the ration.

“If you’re going quite heavy to maximize that butterfat, that’s no longer the best strategy,” says van de Pol.

She says farmers should consult with their nutritionists to determine the optimal amount of fat in their ration.

She did some figuring and saw how complex the decision will be for farmers to determine the most profitable way to meet the new payment system. To make the process easier she created that calculator which takes into account numerous variables on farms, and allows farmers to change the values of their butterfat and protein levels and the levels of fat they’re feeding to see which SNF ratio makes the most sense for their farm.

Once a farmer exceeds the 2.2 ratio, that means they will get no bonus for their protein. That means farmers are targeting closer to 2.18 or 2.16, so it gives them a buffer for the natural variation that comes with managing cows, especially through seasons.

“If you’re looking for a target, targeting 2.0 means that, for most people, there’s money left on the table.”

The post How dairy farm management can adjust to new milk pricing appeared first on Farmtario.