Japan’s largest polluters are rushing to buy carbon credits ahead of the launch of the country’s mandatory emissions trading system. Trading activity on the Tokyo Stock Exchange (TSE) has surged as companies prepare for tighter climate rules and try to meet their corporate sustainability targets before the fiscal year ends.

According to Bloomberg, major Japanese companies are already purchasing credits on the TSE’s voluntary market in anticipation of the GX-ETS launch.

This buying spree highlights growing anxiety about future compliance costs. At the same time, it signals that Japan’s carbon market is shifting from a voluntary experiment to a central pillar of its climate strategy.

What Is the GX-ETS and Why Does It Matter

The Green Transformation Emissions Trading System (GX-ETS) is Japan’s national carbon trading program. The government launched it in 2023 under the GX League, a public-private platform designed to accelerate corporate decarbonization.

The GX-ETS mirrors the European Union’s emissions trading system. Companies receive or buy emissions allowances and can trade them. If they emit less than their cap, they can sell extra allowances. If they exceed limits, they must buy more or face penalties.

Timeline and Key Features

Japan is rolling out the GX-ETS in stages:

- Phase 1 (2023–2025): Voluntary participation and market testing

- Phase 2 (2026 onward): Mandatory participation for large emitters

- Future phases: Auctions, price bands, and fuel levies

Japan plans to introduce power sector auctions around 2033 and a fossil fuel importer levy by 2028. Policymakers are also considering price bands of ¥4,000 to ¥6,000 per tonne by 2027, with potential increases by 2030. Significantly, the compliance market will include a price ceiling and phased expansion with additional policy tools.

The system integrates voluntary credits into compliance trading. Companies can trade GX credits via call auctions on the TSE, with unmatched orders carried forward. This design aims to improve liquidity and price discovery.

Japan’s Path to Net-Zero by 2050

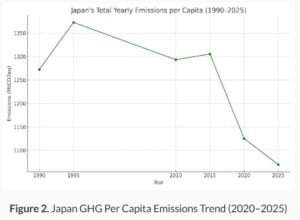

Japan made modest progress in reducing emissions in the first half of 2025. The Ministry of the Environment reported a 2.8% decline compared with the same period in 2024. For the full year, emissions are estimated at 1,070 million tonnes of CO₂ equivalent, down from about 1,272 million tonnes in 1990.

Much of this improvement came from energy efficiency gains in the industrial sector. However, Japan still relies heavily on fossil fuels, and transport emissions remain difficult to reduce. Consequently, current policies are projected to cut emissions by 31% to 37% below 2013 levels by 2030, which still falls short of the country’s 46% national climate target, excluding land-use emissions.

Heavy industries—such as steel, chemicals, cement, and power generation—account for more than 60% of national emissions, making them key GX-ETS targets. Therefore, the GX-ETS is expected to cover roughly 60% of Japan’s greenhouse gas emissions and support the country’s goal of achieving net zero by 2050.

Japan’s carbon tax remains low at about ¥289 per tonne (roughly $2.16), emphasizing the need for stronger market-based mechanisms. As a result, policymakers view the GX-ETS as a critical lever to accelerate emissions reductions and drive the nation toward net-zero.

Who Must Participate in the GX-ETS

Phase 1 of the GX-ETS was voluntary. However, Phase 2 will become mandatory in spring 2026. Companies emitting more than 100,000 tonnes of CO₂ per year must participate.

This rule affects roughly 300 to 400 companies. Together, they account for about 60% of Japan’s total emissions. Key sectors include steel, chemicals, cement, power generation, automotive manufacturing, and aviation.

Under current proposals, companies can use carbon credits to offset up to 10% of regulated emissions. Therefore, credits complement emissions cuts rather than replace them.

Pre-Compliance Buying Surge Among Big Polluters

Large Japanese companies are buying voluntary credits aggressively before the mandatory launch. TSE officials see strong demand driven by companies preparing for GX-ETS and rushing to retire credits before the fiscal year ends.

Reports also reveal that members of the GX League, such as Toshiba, Tokyo Gas, and Isuzu Motors, have already participated in voluntary trading. Analysts expect steelmakers, utilities, and other heavy industries to dominate future purchases.

This early buying strategy helps companies hedge against future allowance shortages. It also reduces the risk of penalties once compliance rules take effect.

Japan’s Carbon Credits: Demand Soars Ahead of Mandatory GX-ETS

Japan’s carbon credit market is expanding fast. It was valued at about $28.2 billion in fiscal 2023 and could reach more than $121 billion by 2031, growing at roughly 20% annually.

Trading on the TSE began in 2023 and focuses on GX credits, including:

- J-Credits from domestic renewable and efficiency projects

- JCM credits from international projects under Japan’s Joint Crediting Mechanism

However, demand already exceeds supply. J-Credit issuance averages around 1 million tonnes per year. Analysts expect demand to reach about 3 million tonnes annually once the mandatory phase begins.

Therefore, limited supply could push prices higher and increase compliance costs for heavy emitters.

Carbon Credit Prices and Market Dynamics

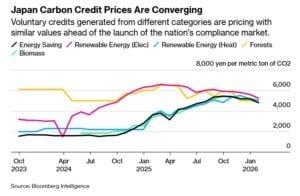

Bloomberg also highlighted that carbon credit prices on the TSE have fluctuated as the market matures. Renewable electricity credits peaked at about ¥6,600 per tonne in early 2025. Since then, prices have fallen by nearly 25%.

The Ministry of Economy, Trade and Industry has proposed a price ceiling of ¥4,300 per tonne for the compliance market. Renewable-linked credits still trade above that level, reflecting strong demand and limited supply. And the prices across voluntary credit categories are converging ahead of the mandatory phase. This trend suggests growing liquidity and market confidence.

Challenges Facing the GX-ETS

Despite strong momentum, several challenges remain. Limited credit supply could push prices higher if demand grows faster than new issuances. Credit quality also poses a risk, as regulators must ensure offsets deliver real and permanent emissions reductions to avoid greenwashing.

At the same time, Japan still depends heavily on coal, gas, and oil, meaning carbon trading alone cannot transform the energy system. Transport emissions also remain a major hurdle, especially in the road and aviation sectors, where decarbonization is progressing slowly.

Past regional trading systems, such as Tokyo’s cap-and-trade program, achieved emissions reductions of around 15% to 27%. However, scaling that success nationwide will require strict enforcement, transparent monitoring, and strong policy support.

Strategic Role of Carbon Credits in Japan’s Transition

For hard-to-abate sectors such as steel and power, carbon credits provide a temporary bridge while low-carbon technologies mature. Companies can offset a small share of emissions while investing in hydrogen, electrification, and carbon capture.

Early purchases also hedge against future price spikes. If allowance supply tightens, companies holding credits will face lower compliance costs.

Globally, Japan wants J-Credits to align with international carbon markets and potential EU carbon border rules. This strategy could strengthen Japan’s role in Article 6 carbon trading frameworks.

In conclusion, the surge in carbon credit buying shows Japanese companies are taking the GX-ETS seriously. The market is transitioning from a voluntary pilot to a compliance-driven system that will shape corporate strategies for decades.

As climate pressures mount, Japan must close the gap between current policies and its 2030 target. The GX-ETS could become one of the country’s most powerful tools to drive emissions cuts, attract investment, and accelerate clean energy deployment.

However, success depends on credit supply, price stability, and strong governance. Industry analysts and experts suggest early credit buying reflects corporate hedging strategies as Japan’s carbon market moves toward full compliance.

If Japan manages these challenges, the GX-ETS could transform its carbon market and set a model for other Asian economies.

The post Japan’s GX-ETS Sparks Carbon Credit Surge as Major Polluters Prep for Compliance appeared first on Carbon Credits.