The Countries Buying (and Selling) the Most Gold Since 2020

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

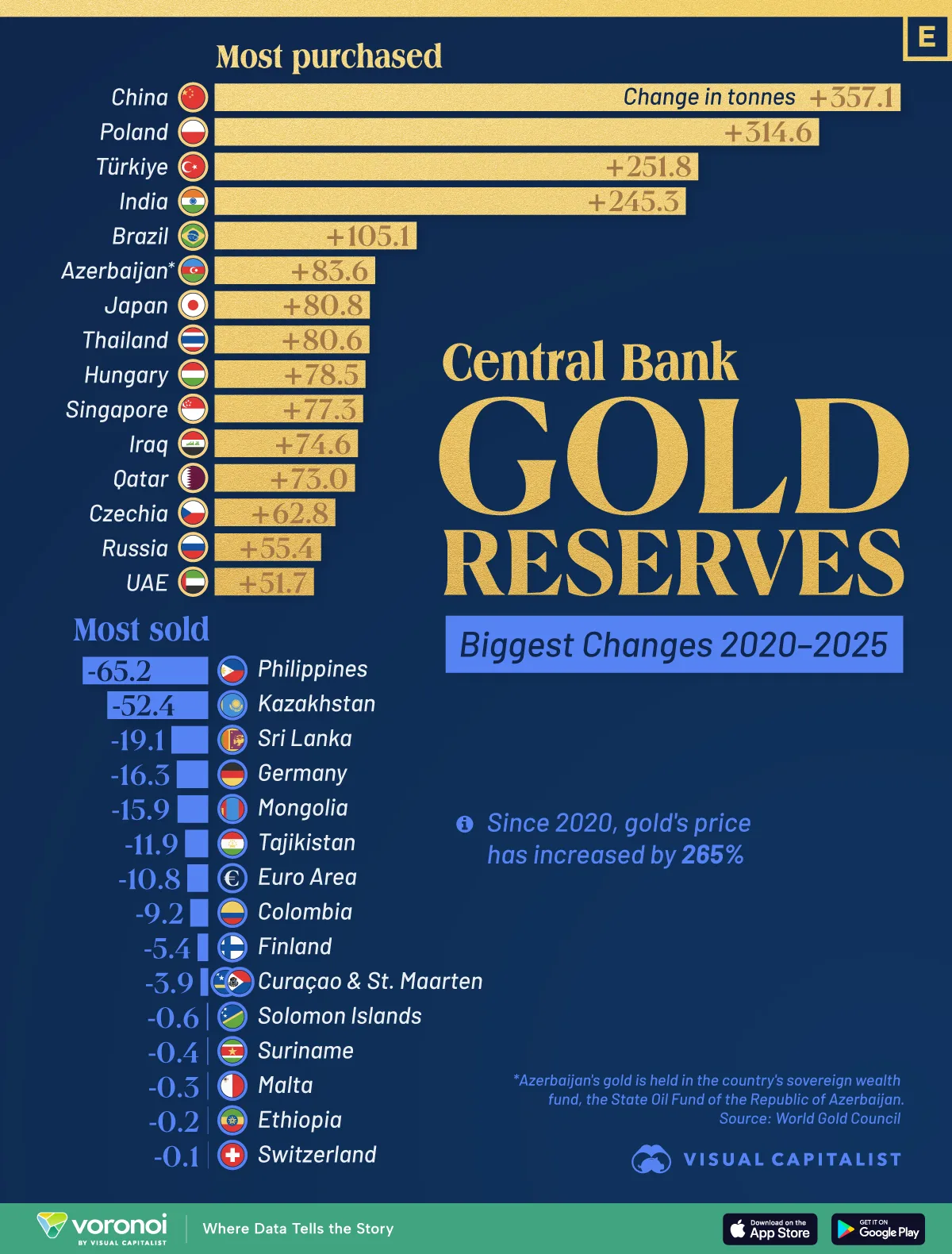

- China, Poland, and Türkiye were the largest gold buyers among central banks between 2020 and 2025.

- Gold prices surged more than 230% over the period, fueling one of the strongest official-sector buying waves in decades.

- A smaller group of countries reduced holdings, highlighting divergent reserve strategies.

As gold prices surged more than 230% since 2020, central banks around the world launched one of the largest gold-buying waves in modern history.

For many countries, bullion became more than just a hedge—it became a strategic reserve asset amid rising geopolitical tensions, currency volatility, and growing efforts to diversify away from the U.S. dollar.

Yet not every nation followed the same playbook: some were accumulating gold aggressively, while others were trimming reserves.

This chart ranks the countries that made the biggest net additions and the largest reductions in gold reserves over the past five years. The data comes from the World Gold Council.

China and Eastern Europe Lead Gold Buying

Together, the top 15 buyers added nearly 2,000 net tonnes of gold to their reserves over the period, underscoring a broad shift in official sector strategy.

China recorded the largest increase in gold reserves over the period, adding more than 350 tonnes. This move aligns with Beijing’s long-running push to diversify reserves away from the U.S. dollar and reduce exposure to Western financial systems, reinforcing gold’s role as a politically neutral anchor within global reserves.

| Rank | Country | Net change in tonnes (2020-2025) |

|---|---|---|

| 1 |  China China |

357.1 |

| 2 |  Poland Poland |

314.6 |

| 3 |  Türkiye Türkiye |

251.8 |

| 4 |  India India |

245.3 |

| 5 |  Brazil Brazil |

105.1 |

| 6 |  Azerbaijan Azerbaijan |

83.6 |

| 7 |  Japan Japan |

80.8 |

| 8 |  Thailand Thailand |

80.6 |

| 9 |  Hungary Hungary |

78.5 |

| 10 |  Singapore Singapore |

77.3 |

| 11 |  Iraq Iraq |

74.6 |

| 12 |  Qatar Qatar |

73.0 |

| 13 |  Czech Rep. Czech Rep. |

62.8 |

| 14 |  Russia Russia |

55.4 |

| 15 |  United Arab Emirates United Arab Emirates |

51.7 |

Poland followed China closely in the ranking, increasing its gold holdings by over 300 tonnes as part of a long-term push to bolster monetary security.

Türkiye and India also ranked among the top buyers. Both countries face persistent inflation pressures and currency volatility, making gold an attractive hedge within official reserves.

Emerging Markets Step Up Accumulation

Beyond the largest buyers, several emerging markets made notable additions. Brazil added more than 100 tonnes, while Azerbaijan’s increase came through its sovereign wealth fund, the State Oil Fund of the Republic of Azerbaijan.

Japan, Thailand, Hungary, and Singapore also expanded reserves, signaling broader global interest in gold as a stabilizing asset during periods of economic uncertainty.

Who Reduced Gold Holdings?

While many central banks were building gold stockpiles, a smaller group reduced exposure, highlighting sharply different reserve priorities.

The Philippines recorded the largest reduction, cutting reserves by more than 65 tonnes. Kazakhstan and Sri Lanka also posted significant declines, often reflecting domestic liquidity pressures or active reserve rebalancing during periods of economic stress.

| Rank | Country | Net change in tonnes (2020-2025) |

|---|---|---|

| 1 |  Philippines Philippines |

-65.2 |

| 2 |  Kazakhstan Kazakhstan |

-52.4 |

| 3 |  Sri Lanka Sri Lanka |

-19.1 |

| 4 |  Germany Germany |

-16.3 |

| 5 |  Mongolia Mongolia |

-15.9 |

| 6 |  Tajikistan Tajikistan |

-11.9 |

| 7 |  Euro Area (average) Euro Area (average) |

-10.8 |

| 8 |  Colombia Colombia |

-9.2 |

| 9 |  Finland Finland |

-5.4 |

| 10 |  Curaçao & St. Maarten Curaçao & St. Maarten |

-3.9 |

| 11 |  Solomon Islands Solomon Islands |

-0.6 |

| 12 |  Suriname Suriname |

-0.4 |

| 13 |  Malta Malta |

-0.3 |

| 14 |  Ethiopia Ethiopia |

-0.2 |

| 15 |  Switzerland Switzerland |

-0.1 |

Several European countries, including Germany and Finland, posted modest reductions. Switzerland’s change was minimal, underscoring its generally stable approach to gold management compared with more active buyers elsewhere.

Taken together, the data shows how gold has reasserted itself as a cornerstone of global reserves, even as countries take sharply different paths in preparing for an uncertain monetary future.

Learn More on the Voronoi App

If you enjoyed today’s post, check out The Rise of Major Currencies Against the USD in 2025 on Voronoi, the new app from Visual Capitalist.

- Source: https://www.visualcapitalist.com/ranked-the-countries-buying-and-selling-the-most-gold-since-2020/