China has updated and expanded its carbon reporting rules to cover new sectors. The changes are part of the country’s effort to improve transparency on climate risks and emissions.

Officials have extended carbon reporting requirements to include the airline industry and major industrial sectors such as petrochemicals and copper producers. This is a major shift in how companies disclose climate data and manage emissions.

China also introduced a new national climate reporting standard in late 2025. This standard aims to align with global best practices and to make climate data clearer and more useful to investors and regulators.

The changes reflect China’s strategy to meet its climate targets and to build stronger systems for environmental data. They also show how the Chinese reporting regime is becoming more structured and consistent.

Inside China’s New Climate Disclosure Rulebook

In December 2025, China’s Ministry of Finance and eight other ministries issued the Corporate Sustainable Disclosure Standard No. 1 – Climate (Trial). This is a national framework for climate disclosures.

The standard is based on the International Sustainability Standards Board (ISSB) IFRS S2 Climate-related Disclosures. It focuses on reporting climate risks, opportunities, and impacts.

Under the new framework, companies are expected to report on their governance, strategy, risk and opportunity management, and metrics and targets.

The Chinese framework also requires more extensive emissions data, including value chain emissions in many cases. This goes beyond basic climate risk reporting.

Currently, the Chinese authorities present the standard as a trial (voluntary phase). However, they plan to expand its use and make parts mandatory over time. They will start with large companies and key sectors.

High-Emission Sectors Now Under the Spotlight

The newly announced carbon reporting expansion will affect energy-intensive and high-impact sectors, not only traditional industries:

- Airlines: This includes carriers operating domestic and international flights.

- Petrochemical firms: Companies that refine oil and produce chemical products.

- Copper producers: Firms involved in mining and processing copper.

These sectors consume large amounts of energy and generate significant greenhouse gas emissions.

The aviation sector accounts for about 2% of global energy-related CO₂ emissions, according to the International Energy Agency (IEA). In 2023, aviation emissions reached roughly 950 million tonnes of CO₂, returning close to pre-pandemic levels. China is one of the world’s largest aviation markets, and fuel combustion remains the dominant source of airline emissions.

The petrochemical industry is also highly carbon-intensive. The IEA reports that petrochemicals account for about 14% of global oil demand and 8% of global gas demand. China is the world’s largest producer and consumer of many petrochemical products, making emissions monitoring in this sector especially important.

Copper production is another energy-heavy industry. The International Copper Association states that producing refined copper needs 2 to 4 tonnes of CO₂ for each tonne of copper. This varies by ore grade and energy source.

China produces over 40% of the world’s refined copper, says the International Energy Agency and global metals stats. Smelting and refining processes consume large amounts of electricity, often generated from fossil fuels.

From Patchwork Rules to a National Framework

The new reporting requirements and standards are part of a wider shift in China’s climate disclosure regime. The country has been building a national corporate climate reporting framework since 2024. This includes guidance from stock exchanges, government agencies, and new national standards.

In January 2026, the national climate reporting standard was formally released. It follows the IFRS S2 climate disclosure framework, but it adds China-specific details. One key requirement is to report the actual business impact on the climate.

Authorities say they’re working on guidelines for industries with high emissions. These include power, steel, coal, petroleum, fertilizer, aluminum, hydrogen, cement, and automobiles, among others.

The current trial phase mainly targets listed companies. But it plans to expand to non-listed firms and small and medium-sized enterprises (SMEs) later on.

China aims to make its climate disclosure regime more comprehensive and quantitative. Companies are expected to shift from narrative statements to detailed data reporting as they develop their climate information systems.

Driving Data to Deliver on Dual-Carbon Goals

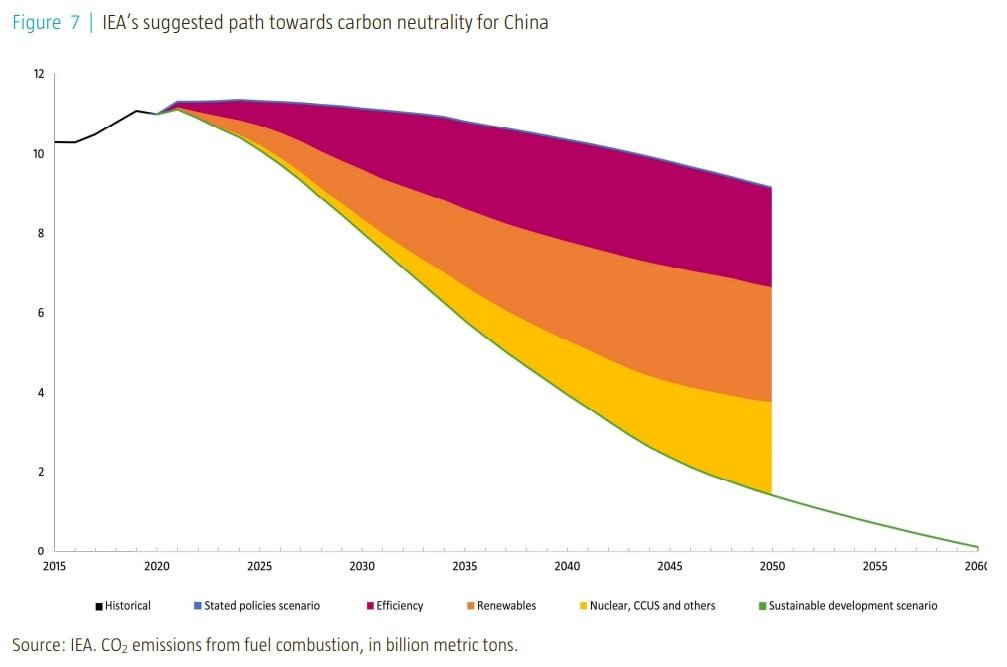

As the world’s largest greenhouse gas emitter, China aims to have its National Emissions Trading System (ETS? cover all major emitting industries by 2027 to help achieve its “dual-carbon” goals:

- peaking emissions before 2030 and reaching carbon neutrality by 2060.

Achieving these goals requires accurate, timely, and comparable emissions data from companies. Improved reporting helps regulators, investors, and the public understand corporate climate risks and progress.

Standardized disclosure can help cut down on greenwashing. This happens when companies overstate or misrepresent their climate performance. Clear rules make it harder to present incomplete or misleading data.

Those who fail to comply will face consequences. For instance, a power plant in Ningxia was recently fined 424 million yuan ($58.5 million) for missing compliance deadlines.

Better climate data also supports green finance. Investors use emissions and climate information to assess risks and make decisions about capital allocation. Reliable data can help direct funding toward low-carbon technologies and projects.

The expanded rules also fit within China’s broader strategy to build a national carbon market and improve its emissions trading system. This market already covers a growing share of the economy and underpins carbon pricing across industries.

The move also responds to global pressures. For example, the European Union’s carbon taxes on imports impact Chinese exporters in these sectors.

China’s ETS and the Use of Carbon Offsets

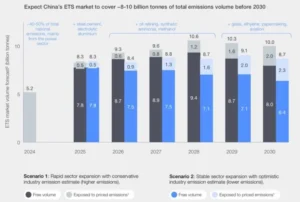

This data collection phase is a precursor to integrating the industries into China’s ETS. The system initially covers only the power sector, but it has added steel, aluminum, and cement.

The covered companies can use a limited number of carbon offsets to meet compliance requirements. Under the ETS design, entities can use China Certified Emissions Reductions (CCERs). These must come from projects not included in the national ETS. But companies can surrender CCERs for up to 5% of their verified emissions.

Also, only CCER credits from projects in the new national CCER program can be used after January 2025. This offset flexibility gives companies an option to meet part of their compliance obligations while broader reporting and reduction measures take effect.

The system currently regulates more than 5 billion tonnes of CO₂ annually from the power industry alone. Analysts estimate that once the additional sectors are fully included, the ETS could cover between 8.7 and 10.6 billion tonnes of CO₂ by the late 2020s — representing a significant share of China’s total emissions.

A Transparency Push With Global Implications

China’s expanded reporting rules represent a clear shift toward greater transparency in corporate climate data. Better reporting helps policymakers track progress toward national climate goals. It also helps businesses understand their own climate risks and opportunities.

For investors, richer data support more informed decisions about sustainable investments. This can help channel capital to cleaner technologies and low-carbon business models.

For the global climate community, China’s moves may influence reporting norms in other markets. As the world’s largest emitter, China’s reporting regime could shape climate disclosure expectations elsewhere.

- FURTHER READING: China Adds Power 8x More Than the US in 2025, with $500B Energy Build-Out in a Single Year

The post China Expands Carbon Reporting to Airlines and Heavy Industry in Major Climate Disclosure Shift appeared first on Carbon Credits.