Uranium is back in the spotlight. In 2026, uranium prices are climbing to levels not seen in years, fueled by supply constraints, policy support, and rising demand from nuclear power and AI-driven data centers. What was once a quiet energy commodity is now a strategic asset at the heart of the global energy transition.

Sprott Drives Uranium Price Rally with Strategic Accumulation

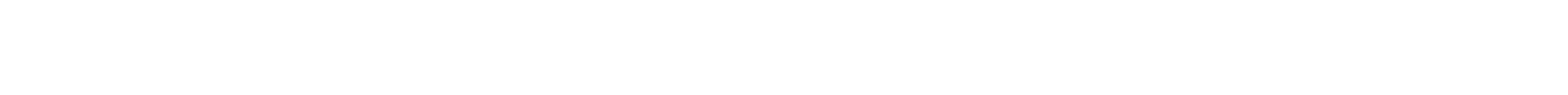

As per media reports, the global uranium market entered 2026 with strong momentum, as spot uranium prices surged by roughly 25% in January, surpassing $100 per pound for the first time in two years. This sharp rise reflects growing confidence in nuclear energy and mounting concerns about long-term supply constraints.

According to Sprott Asset Management, the rally toward 2024 peak levels indicates a stronger supportive backdrop than last year. In 2025, prices were volatile—falling in the early months before rebounding from the low $60s to the high $80s in the second half. Today, fundamentals appear more favorable.

Jacob White, Sprott’s ETF products director, noted that the January surge signals a shift in investor focus. Capital is moving away from downstream nuclear themes and returning to the upstream uranium supply chain, largely due to clearer policy signals and improving fundamentals.

Moreover, Sprott has been one of the largest buyers of physical uranium, adding around 4 million pounds to its uranium fund this year and bringing total holdings to nearly 79 million pounds. This accumulation highlights how investors increasingly view uranium as a strategic, long-term asset rather than a cyclical commodity.

Financial Buyers Are Redefining the Market

Institutional investors are transforming uranium into a financial asset class. Funds that accumulate physical uranium create additional demand beyond traditional utilities, removing supply from the spot market and amplifying price volatility.

Unlike utilities, financial buyers are less sensitive to short-term price swings. Their participation reduces downside risk and strengthens the long-term bull market thesis.

Strong Policy Support Is Driving Uranium Prices

Government policy is playing an increasingly influential role in shaping uranium prices in 2026. The U.S. government’s Section 232 framework on critical minerals explicitly designates uranium as vital for energy security and national defense, placing it alongside rare earths and lithium as a strategic resource.

At the same time, the U.S. Department of Energy (DOE) committed $2.7 billion over the next decade to expand domestic uranium enrichment. The investment aims to reduce reliance on foreign suppliers while supporting the next phase of nuclear power growth.

AI and Data Centers Boost Uranium Demand

This policy shift reflects a broader change in perception. Nuclear is now viewed as essential for meeting rising electricity demand, powering AI infrastructure, ensuring industrial resilience, and achieving long-term climate goals.

As tech companies increasingly recognize nuclear as a strategic power source, they create a new, enduring layer of uranium demand. Analysts project that the uranium market could expand to $60.5 billion by 2030, with AI-driven demand accelerating this growth.

Enrichment Bottlenecks Highlight Structural Weaknesses

Despite policy support, uranium enrichment remains a major bottleneck. Most reactors operate on low-enriched uranium (LEU), while advanced reactors—including small modular reactors (SMRs)—require high-assay low-enriched uranium (HALEU).

Currently, the U.S. produces less than 1% of global enrichment capacity and relies heavily on foreign suppliers. New restrictions on Russian uranium imports starting in 2028 further emphasize energy security risks.

Although the DOE’s investment aims to rebuild domestic enrichment capacity, new facilities will take years to become operational. Consequently, near-term enrichment constraints will continue to support higher uranium prices.

Mining Remains the Weakest Link

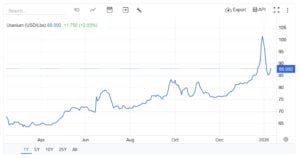

While enrichment is a challenge, upstream mining remains the weakest link in the nuclear fuel cycle. The U.S. Energy Information Administration reported that domestic uranium concentrate production fell 44% in Q3 2025, to about 329,623 pounds of U₃O₈, from only six operating facilities, mainly in Wyoming and Texas.

This decline highlights a systemic problem. The nuclear fuel cycle requires coordinated growth across mining, processing, enrichment, and fuel fabrication. Advancements in one segment without corresponding growth in the others create structural bottlenecks.

In the short term, declining production adds bullish pressure. Over the long term, decades of underinvestment in mining point to a persistent supply deficit, which could keep prices elevated.

Uranium Supply and Demand Outlook

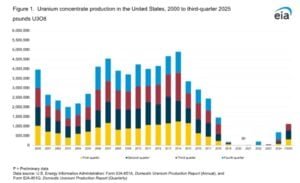

Global demand for reactor fuel continued to grow in 2025. The World Nuclear Association estimates uranium requirements at about 68,920 tonnes, or roughly 77,000 tonnes of uranium oxide, up 3% from 2024.

Looking ahead, demand is expected to rise sharply. Under the reference scenario, global uranium needs could reach 107,000 tonnes by 2040, and under a higher-growth scenario, up to 204,000 tonnes.

This growth aligns with increasing nuclear capacity, which is projected to climb to 438 gigawatts by 2030, and nearly 746 gigawatts by 2040. The trend points to a long-term, multi-decade increase in uranium demand.

The U.S. also plans to quadruple nuclear capacity by 2050 and have 10 new large reactors under construction by 2030. If achieved, this expansion would dramatically increase uranium demand.

The timing mismatch between rising demand and the slow pace of mine development creates a structural imbalance between supply and demand. Analysts also speculate that the U.S. government could take equity stakes in uranium miners in exchange for long-term offtake agreements with price floors. This move would further tighten supply and support higher prices.

Kazatomprom’s 2026 Outlook Signals Tight Margins

Recent reports tell that Kazatomprom plans to raise uranium output by about 9% in 2026, targeting 71.5–75.4 million pounds of U₃O₈, slightly below state caps but above analyst forecasts.

However, new ISR projects and brownfield expansions take time, so near-term supply remains constrained, keeping upward pressure on prices.

2026: Why the Uranium Bull Market Could Continue

Given these dynamics, uranium prices could continue trending higher throughout 2026. Government investment, supply bottlenecks, and AI-driven demand are reshaping uranium’s role in the global energy mix. Prices could approach $92 per pound or more, particularly if contracting accelerates or financial buyers continue stockpiling physical uranium.

Uranium is evolving from a traditional commodity into a strategic pillar of the global energy transition. Policy support, structural supply constraints, institutional demand, and AI-driven electricity requirements are creating a compelling long-term bull case.

For investors and utilities alike, the uranium market is signaling that big moves—and big opportunities—are on the horizon.

- SEE MORE: 2026: The Year Nuclear Power Reclaims Relevance With 15 Reactors, AI Demand, and China’s Expansion

The post Uranium Prices 2026: Supply Crunch and Rising Demand Fuel a Nuclear Bull Market appeared first on Carbon Credits.