View the full-size version of this graphic

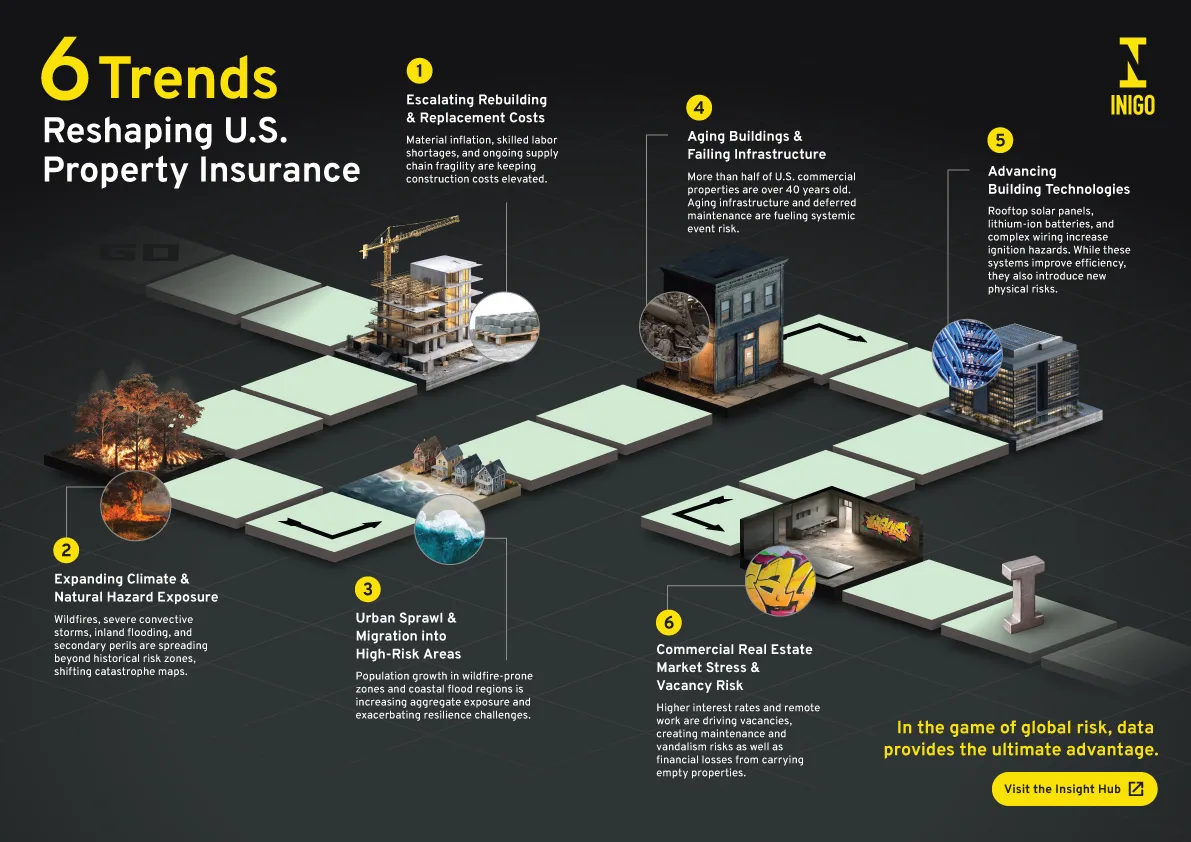

6 Trends Reshaping U.S. Property Insurance

Key Takeaways

- Property risk is becoming more widespread, as climate-driven losses expand beyond traditional catastrophe zones.

- Replacement values continue to rise, driven by construction inflation and aging building stock.

- New technologies are reshaping loss profiles, introducing emerging electrical and ignition risks.

Property risk in the U.S. is being reshaped by a perfect storm of rising replacement costs, aging buildings, and a rapidly changing climate. At the same time, growth, strained infrastructure, and new technologies are introducing fresh vulnerabilities that traditional models weren’t built to capture.

Together, these forces are setting a new baseline for insured losses and raising the stakes for resilience and smarter risk management. This visualization, created in partnership with Inigo, outlines the major trends set to shape property risk in years to come.

1. Escalating Rebuilding & Replacement Costs

Material inflation, skilled labor shortages, and ongoing supply chain fragility are keeping construction costs elevated across the United States. As a result, insured values continue to rise, increasing claim severity even for moderate loss events.

2. Expanding Climate & Natural Hazard Exposure

Wildfires, severe convective storms, inland flooding, and other secondary perils are spreading beyond historical risk zones. This shift is redrawing catastrophe maps and challenging models that rely on past loss patterns.

3. Urban Sprawl & Migration into High-Risk Areas

Population growth in wildfire prone regions and coastal flood zones is driving higher concentrations of property and infrastructure at risk. This expansion often outpaces local mitigation efforts, amplifying potential losses when disasters strike.

4. Aging Buildings & Failing Infrastructure

More than half of U.S. commercial properties are over 40 years old, many built to outdated codes and standards. Combined with aging power, water, and transportation systems, deferred maintenance on infrastructure increases the likelihood that localized damage escalates into broader systemic losses.

5. Advancing Building Technologies

Rooftop solar panels, lithium ion batteries, and increasingly complex electrical systems are altering building risk profiles. While these technologies improve efficiency and resilience, they also introduce new ignition, fire, and loss pathways that are not fully reflected in historical data.

6. Commercial Real Estate Market Stress & Vacancy Risk

Higher interest rates and persistent remote work trends are pushing vacancy rates higher, particularly in office markets. Empty or underutilized properties face greater risks from neglect, vandalism, and deterioration, compounding both physical and financial losses.

A New Baseline for Property Risk

Climate volatility, rising replacement costs, aging assets, technological change, and economic pressure are redefining property risk in the United States. Understanding how these forces interact is essential for anticipating future losses, as is identifying where resilience and smarter risk management can make the biggest impact.

Explore the data behind emerging global property risks.

-

Environment4 months ago

Environment4 months agoRanked: The 10 Most Powerful U.S. Hurricanes (1900-2025)

Hurricanes are a defining force in the U.S. climate, capable of leaving behind profound environmental, social, and economic devastation.

-

Environment5 months ago

Environment5 months agoMapped: Which U.S. Cities Saw Record-Breaking Temperatures in 2024?

Global temperatures are climbing—but how is this trend playing out across the United States, and which regions are being hit the hardest?

-

Environment6 months ago

Environment6 months agoRanked: The Most Expensive U.S. Wildfire Events, So Far

Wildfire events are growing increasingly frequent and destructive around the world as human-driven climate impacts continue to escalate.

-

Environment6 months ago

Environment6 months agoMapped: The United States of Drought

Drought grips much of the U.S., affecting over 60 million people today.

-

Healthcare6 months ago

Healthcare6 months agoThe $58B Weight Loss Drug Market in One Chart

Weight loss drugs have surged in popularity in recent years, transforming the pharmaceutical landscape. Which brands are dominating this space?

-

Healthcare7 months ago

Healthcare7 months agoRanked: Which Areas Receive the Most Pharma R&D?

The pharmaceutical industry has made enormous strides in treating—and even curing—a wide range of diseases and conditions. Which areas are seeing the most R&D in 2025?

-

Healthcare7 months ago

Healthcare7 months agoThe $5.6T Pharmaceutical Industry in One Chart

Pharma giants don’t just make medicine—they shape the future of healthcare. Who are the world’s major players?

-

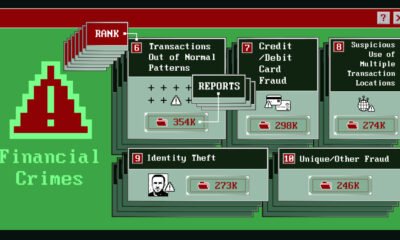

Crime7 months ago

Crime7 months ago6 Fraud Trends Reshaping Risk in 2025

The fraud and financial crime landscapes are evolving rapidly. What are the key threats shaping risk in 2025?

-

Cryptocurrency7 months ago

Cryptocurrency7 months agoRanked: The 10 Biggest Digital Heists

Some of the largest digital heists didn’t rely on brute-force hacking, they exploited the weakest link in security: human trust.

-

Crime7 months ago

Crime7 months agoThe Most Costly Financial Crimes in 2024

As cybersecurity threats escalate, which financial crimes are causing the most harm? The FBI has the data.

-

Crime7 months ago

Crime7 months agoMapped: U.S. Financial Crime Activity by State

Suspicious activity has been rising in the U.S., but is it spread evenly throughout all 50 states? Certainly not.

-

Crime7 months ago

Crime7 months agoRanked: America’s Most Common Financial Crimes

As technology and AI become more widespread, fraud and other suspicious activity are rising across America. Which types are the most common?

-

Economy8 months ago

Economy8 months agoTracking the $3.1 Trillion Financial Crime Pandemic

From money laundering to fraud, financial crime acts as a drain on the economy, totaling an incredible $3.1 trillion.

-

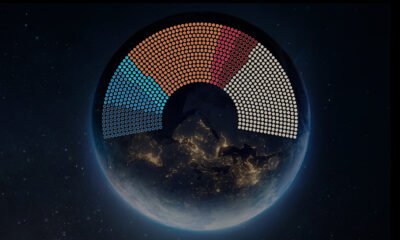

Politics9 months ago

Politics9 months agoWhich Types of Government Rule the World?

Over half the global population is ruled by non-centrist types of government, including autocracies and left or right wing parties.

-

Politics9 months ago

Politics9 months agoBreaking Down the $524 Billion Investment Needed to Rebuild Ukraine

Ukraine will require an estimated $524B over the next decade to recover from the Russia-Ukraine war. Which sectors have been most impacted?

-

Politics9 months ago

Politics9 months agoAre Tariffs Causing U.S. Inflation Fears?

Amid tariff increases, consumers’ expectations for U.S. inflation in the next five years have reached their highest level since March 1991.

-

Politics9 months ago

Politics9 months agoRanked: Executive Orders by President in the First 100 Days

In his first 100 days, President Trump has issued far more executive orders than any other president in history.