The voluntary carbon credit market (VCM) has undergone notable changes from 2021 to 2024, according to the latest Ecosystem Marketplace (EM) report. After a trading peak, total volumes dropped. Still, demand for high-quality, high-integrity carbon credits is strong. This is especially true for those providing real carbon removals and environmental co-benefits. This shift signals a maturing market focused more on impact than sheer volume.

A Price Jump in 2022, With Less Trading

After 2021, many companies renewed or launched carbon credit purchases. In 2022, the average price per carbon credit (each credit represents one ton of CO₂e removed or avoided) jumped. It rose from $4.04 per ton in 2021 to $7.37 per ton in 2022 — an increase of 82%. This was the highest price level seen in 15 years.

Despite the higher price, the total trade volume dropped from its 2021 peak. Trading slowed while buyers became more selective about what credits they bought.

Because the carbon price rose as volume dropped, the overall market value in 2022 stayed roughly stable, at just under $2 billion. This shows the market still had strong demand, but buyers favored fewer, pricier credits rather than many low‑cost ones.

2023: Market Contracts, But Credit Quality Matters

In 2023, the voluntary carbon market shrank sharply. The total reported transaction volume fell by 56% compared with 2022. At the same time, the total value of transactions dropped to $723 million.

The average credit price in 2023 settled at about $6.53 per ton CO₂e. Some project types suffered more than others.

Credits tied to forestry and land‑use (including REDD+ projects) — once among the most popular — saw a steep decline in trade, as buyers paused buying while waiting for clearer standards.

Yet, credits from projects with more robust environmental or social benefits — such as biodiversity, community support, or sustainable land use — remained in demand. The market began favouring “high‑integrity” credits or those with:

- strong verification,

- clear additionality (meaning the credit reflects real, extra emission reductions or removals), and

- co‑benefits beyond carbon.

2024: Lower Trading, But Underlying Demand Persists

According to the 2025 update from Forest Trends / EM, the VCM continued contracting in 2024. Transaction volumes dropped by about 25 % compared to 2023. Yet, credit prices fell only modestly — about 5.5%.

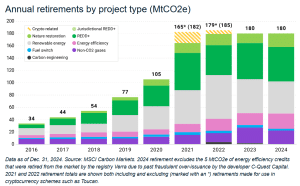

More importantly, the number of credits “retired” (i.e., used to offset emissions) remained stable. In 2024, a little over 180 million tons of CO₂e carbon credits were retired under the largest certifying standards — roughly the same as in prior years.

This suggests that while fewer credits are being traded, companies and organizations continue to use offsets to meet climate goals. In other words, the trading market is smaller, but demand for real credits has not vanished.

The EM report also notes a growing price gap between different types of credits. Credits representing actual carbon removals (e.g., from reforestation or removal technologies) were, on average, 381% more expensive than credits representing only emissions avoidance.

- This growing premium reflects buyer demand for greater assurance: they want credits that remove or permanently store carbon, not just avoid future emissions.

SEE MORE: Base Carbon: A Rising Force in the Voluntary Carbon Market

Lessons from Two Decades: Market Evolution and Maturity

In another report by EM, the VCM has grown over almost 20 years. It started as a small, experimental area and has become a more organized and advanced system.

In the early 2000s, dubbed as “The Wild West,” companies joined in mainly due to social responsibility. They wanted to “walk the talk” on climate action. Dell, Google, and Nike were among the first to make significant purchases. Verification standards were limited, and concerns over additionality and real climate impact were common.

Over time, third-party standards and transparency measures strengthened. By 2008, 96% of credits were verified, showing that buyers increasingly valued quality and integrity. The market faced tough times, especially after the 2008 financial crisis. It also struggled after early platforms, like the Chicago Climate Exchange, closed down.

Voluntary markets kept going, even with slowdowns. They highlighted co-benefits such as:

-

Protecting biodiversity

-

Supporting community livelihoods

-

Promoting sustainable land use

Recent trends show the market split into two: technological removals, like direct air capture, and nature-based solutions. Buyers now want high-integrity carbon credits. They look for permanence, co-benefits, or both.

The market has grown up from its “wild west” days. Now, quality, transparency, and long-term impact drive value. It’s not just about trading volume anymore.

What Type of Credits Now Lead the Market?

Several shifts stand out in what kinds of credits buyers prefer. The top ones include:

-

Nature‑based and high‑integrity credits lead demand. Projects in forestry, land use, agriculture, and similar areas remained important, especially when they include social or environmental co‑benefits.

-

Carbon removal credits gain higher price premiums. Credits from activities that remove CO₂ or store carbon long‑term now cost far more than reduction‑only credits. This shows buyers prioritizing permanence and long‑term impact over cheaper, short‑term reductions.

-

Lower‑integrity credits — especially older or riskier projects — lose traction. Credits from some legacy project types (like certain REDD+ or basic clean energy projects) saw steep declines. Some buyers paused new purchases while waiting for clearer integrity standards.

Thus, the market seems to be shifting away from volume-driven trading to a smaller, more focused market driven by quality, trust, and long-term climate impact.

- MUST READ: High-Quality Carbon Credit Prices Hit Record Levels, Driven by Integrity and Market Shifts

What This Means for Carbon Credit Use and Climate Efforts

These recent trends offer important signals about how voluntary carbon credits are used today:

-

Offsetting now leans toward actual carbon removals and nature‑positive projects. Buyers seem more interested in credits that make a tangible, lasting difference, not just claims of avoided emissions.

-

High‑quality verification and co‑benefits encourage trust. Credits that deliver environmental or social benefits beyond carbon — like biodiversity protection or community livelihood support — appear more desirable.

-

Strong demand remains even as trading shrinks. The fact that credit retirement stayed high in 2024 shows that many buyers still believe in carbon credits as part of their climate strategy. Trading markets may fluctuate, but the demand for real carbon offsets persists.

-

Credit markets are maturing and re‑sorting. The voluntary market seems to be evolving: less speculative or volume‑based trading, more emphasis on integrity, quality, and long‑term value.

-

Not all credits are equal. The wide price divergence between credit types underscores that buyers must look carefully at what a credit represents — removal or reduction, short-term or permanent, people‑friendly or just carbon‑focused.

The VCM Is in Transition — Not Collapse

From 2021 to 2024, the voluntary carbon credit market has undergone a major shift. After a peak in trading, volume dropped. Yet, demand did not disappear. Instead, buyers turned more toward high‑integrity, often more expensive credits that offer real carbon removals and co‑benefits beyond carbon alone.

Today’s market values quality over quantity. Market value has dropped from its peak. But companies and organizations continue to retire credits, showing that credits remain a tool for climate action.

The current state suggests the VCM is not collapsing. It is evolving, becoming more selective and — for those credits that meet higher standards — more valuable. For carbon‐credit markets to truly support climate goals, this shift toward integrity, transparency, and impact may be necessary.

The post A Recap of the Voluntary Carbon Market: Quality Over Quantity appeared first on Carbon Credits.